MHMarkets:Gold surged by $72 at the opening after a dovish speech by Fed Chairman Powell.

Abstract:At the end of the Asian market on Monday (December 4), the Fed Chairman Powell said in his opening speech at Bellman College in Atlanta on December 1 local time. It is too early to confidently conclude that we have taken sufficient restrictive positions or speculate on when policies may be relaxed.

At the end of the Asian market on Monday (December 4), the Fed Chairman Powell said in his opening speech at Bellman College in Atlanta on December 1 local time. It is too early to confidently conclude that we have taken sufficient restrictive positions or speculate on when policies may be relaxed. Powell stated that the Fed is cautiously moving forward as the risks of insufficient and excessive tightening are becoming more balanced. He reiterated the Fed's intention to remain cautious, but also expressed optimistic views on the current progress in reducing inflation. Affected by Powell's speech, the US dollar index fell sharply during the sell-off period last Friday and broke through support levels downwards, ultimately closing near the intraday low. At the opening of the Asian market today, the US dollar index fluctuated slightly, with a current price around 103.29. Gold was influenced by the dovish remarks of the Fed Chairman, and the Asian market opened today with a surge of $72 to 2143, followed by market gains being hindered. If there is no fundamental change in the fundamentals of the future market, it is highly likely that the bullish trend of gold will continue in the future. US crude oil was influenced by the fundamentals of oil producing countries, and after being under pressure above last Friday, the market plummeted and broke through multiple support levels consecutively, ultimately closing near the intraday low. At the opening of the Asian market today, US crude oil continued its previous decline, with a current price of 73.60. Joachim Nagel, the President of the Bundesbank and member of the European Central Bank's governing committee, said that inflation in the Eurozone will continue to decline in the coming months, but the pace will slow down, so it is too early to declare victory now.The inflation rate in the Eurozone has dropped from 2.9% in October to 2.4% in November, far below expectations for the third consecutive month. This has increased market expectations that the European Central Bank (ECB) will lower interest rates faster than currently guided. EURUSD fell first and then rose last Friday, ultimately closing near the intraday median. At the opening of the Asian market today, there was a slight downward fluctuation, with the current price around 1.0874. USDJPY fell sharply last Friday due to the impact of the US dollar fundamentals and broke through multiple support levels, ultimately closing near the intraday low. At the opening of the Asian market today, USDJPY fell first and then rose, with a current price around 146.66.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on December 4, Beijing time.

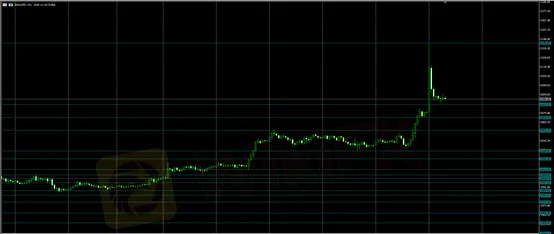

Gold XAUUSD· | |

Resistance | 2143.55 |

Support | 2079.11 – 2065.60 – 2052.19 |

The above figure shows the 30 minute chart of gold. The chart shows that the recent upward resistance of gold has been around 2143.55, and the downward support has been around 2079.11-2065.60-2052.19. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on December 4. This policy is a daytime policy. Please pay attention to the policy release time. | |

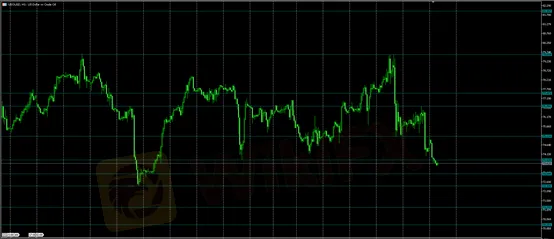

Crude Oil USOUSD· | |

Resistance | 75.11 – 76.76 – 77.47 |

Support | 73.04 – 72.37 – 71.21 |

The above chart shows the 30 minute chart of US crude oil. The chart shows that the recent upward resistance of US crude oil is around 75.11-76.76-77.47, and the downward support is around 73.04-72.37-71.21. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on December 4. This policy is a daytime policy. Please pay attention to the policy release time. | |

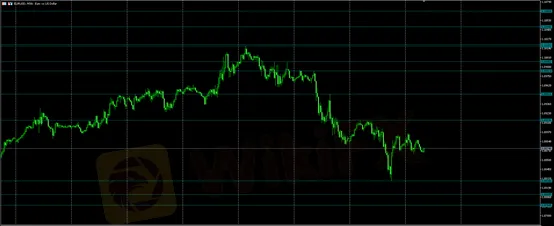

EURUSD· | |

Resistance | 1.0913 - 1.0950 - 1.0982 |

Support | 1.0828 - 1.0809 - 1.0794 |

The above figure shows the 30 minute chart of EURUSD. The chart shows that the recent upward resistance of EURUSD is around 1.0913-1.0950-1.0982, and the downward support is around 1.0828-1.0809-1.0794. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on December 4. This policy is a daytime policy. Please pay attention to the policy release time. | |

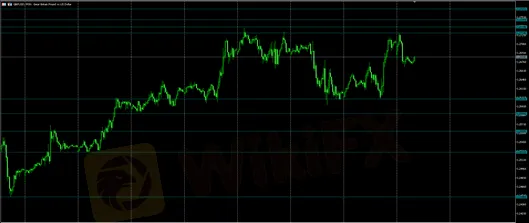

GBPUSD· | |

Resistance | 1.2724 – 1.2734 – 1.2747 |

Support | 1.2613 - 1.2589 – 1.2559 |

The above figure shows the 30 minute chart of GBPUSD. The chart shows that the recent upward resistance of GBPUSD is around 1.2724-1.2734-1.2747, and the downward support is around 1.2613-1.2589-1.2559. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on December 4. This policy is a daytime policy. Please pay attention to the policy release time. | |

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

Coinlocally Broker Review: Coinlocally Regulation & Real User Complaints Exposed

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

The "VIP" Trap: Inside the Algo-Trading Nightmare at Zenstox

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

Exposure: NAGA’s "Phantom Bonus" Trap and the $80,000 Silent Treatment

ATFX Partners with KX to Enhance Real-Time Trading Solutions

RM783,000 Gone: Restaurant Owner Fell Victim to an 85%-Return Investment Scheme

ThinkMarkets Hit By Chaos Ransomware In Major Data Breach

Complete Breakdown: MARKET-HUB Regulation & All Negative Reviews Exposed

Interactive Brokers Opens Access to Brazil’s B3 Exchange

Rate Calc