Some weakness for the dollar as the Fed holds rates

Abstract:The Federal Open Market Committee left its funds rate on hold at 5.25-5.5% on Wednesday 1 November, as widely expected.

The Federal Open Market Committee left its funds rate on hold at 5.25-5.5% on Wednesday 1 November, as widely expected. However, Jerome Powell also signaled that another hike in December is not currently planned. The dollars reaction has been cautiously negative on the whole, but now traders are looking ahead to the job report on Friday 3 November for more hints on upcoming movements.

This article summarises the latest news and data affecting the US dollar and linked instruments before giving a brief overview of the situation on two key charts, XAUUSD and EURUSD.

The main new information coming to traders on Wednesday night from Jerome Powell‘s comments was the possible inaccuracy of September’s dot plot, which indicated one more hike this year. For the moment, the Fed does seem to have inflation more or less under control.

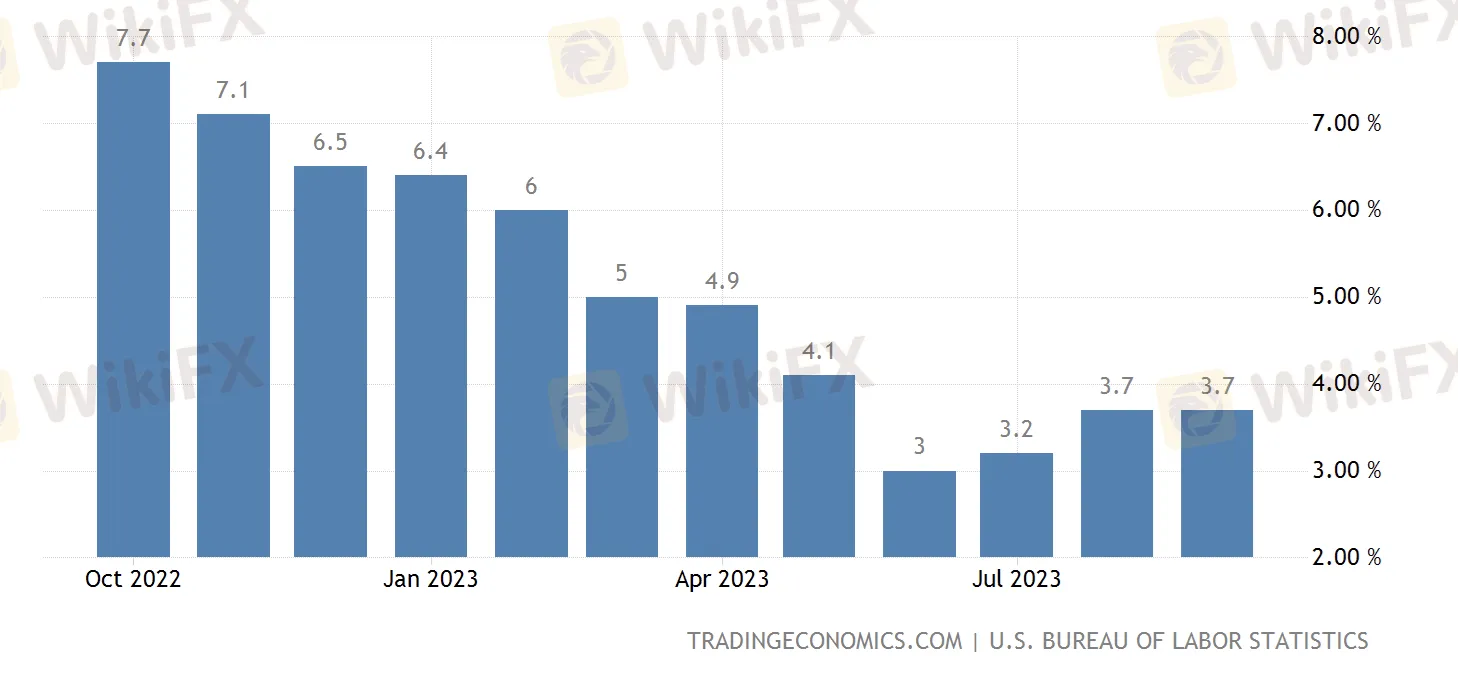

American annual headline inflation

Although headline inflation has gone back up from the low of 3% in June, this is partially related to instability in the price of oil over the last few months. Its worth comparing core inflation, which excludes food and energy: this reached a low of more than two years last month at 4.1%.

The Fed stressed at this weeks meeting that it has to keep analyzing the speed at which restrictive policy drives inflation down in different sectors. This combined with the headline figure having improved, but remaining nearly double the usual target, means that rates are likely to stay high into the end of next year: the majority of participants expect the first cut in June 2024.

Meanwhile, the job market in the US remains strong considering the circumstances of restrictive monetary policy. Unemployment is close to historic lows although it has edged up since the beginning of the year.

American unemployment

Rising unemployment is often a relatively early indicator of recession or economic slowdown, but various recession indicators have flashed since the first half of last year, and expectations based on these have been unfounded so far. The participation rate in the US job market has remained essentially unchanged in the last few months, slightly below 63%, close to the pre-Covid high. Last months total nonfarm was the strongest in several months.

Total non-farm payrolls

The American economy needs to add approximately 70,000 to 100,000 new jobs every month to keep up with the growth of the population of working age. An NFP lower than 70,000 then indicates at least a small contraction in employment, which hasn‘t happened since December 2020, although June’s release was quite close to the upper part of that range.

On the whole, employment seems to be consistently resilient in the face of the Fed‘s tight policy. There’s no clear indication of this changing in the near future, but if that does appear from this or next months NFP, sentiment could shift quickly.

Gold-dollar, daily

Gold‘s strong recovery since early last month, amid geopolitical issues, seems to have paused for now, which is normal from a technical point of view: sooner or later, trends usually need to pause. The Fed’s position and somewhat ambiguous comments this week might support positive sentiment and cut this consolidation short, but the NFP is likely to be a critical driver over the next few days.

It‘s usually challenging for the price to move significantly higher immediately from the current zone. $2,000 is an important psychological area and the slow stochastic signals definite buying saturation. If the gains continue after the NFP and into next week, $2,045 would probably be the next medium-term resistance as the area of highs from around six months ago. However, if the result from the NFP is mixed, it might be worth seeking possible clarity from next week’s preliminary GDP.

Euro-dollar, daily

Euro-dollar was locked quite firmly into a sideways trend last month, showing reluctance to push much below $1.05 and retest $1.07. Thats basically the default situation for a major forex pair in the absence of clear new information. Both the Fed and the ECB seem to be making good progress on inflation. This week, the flash figure for eurozone-wide headline inflation showed a larger decline than expected, reaching 2.9%, the lowest since summer 2021.

Unless theres a huge surprise from the NFP, EURUSD will probably maintain the range, at least into the middle of next week. That might make it a better candidate for short-term trading around the NFP, since finding stops and targets could be easier than for gold in the circumstances. Trying to find and trade a potential new trend here – either up or down – could be especially risky because fakeouts are usually more common around major releases like the NFP.

Read more

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Is your trading experience with MYFX markets full of fund withdrawal denials despite repeated communications with its customer support team? Has the broker deleted all your profits? Did the broker accuse you of false trading strategy implementation while deleting your profits? There have been many such instances reported by traders against these activities online. In this MYFX Markets review article, we have shared some complaints. Take a look!

Exfor Exposure: Investigating Alleged Withdrawal Denials, Illegitimate Account Closure & More

Exfor, a Malaysia-based forex broker, has allegedly been the centre of attention for all the wrong reasons. These include long-pending withdrawal denials, no communication or assistance from the broker’s customer support team, manipulated pricing upon a withdrawal request by the trader, and account blowups due to bonus-related issues. It’s the traders who allegedly bear the brunt of all these suspicious trading activities. A lot of them have criticized it on broker review platforms. We have highlighted some of their complaints in this Exfor review article. Take a look!

Axiory Exposed: Low WikiFX Score & Trader Complaints!

Axiory WikiFX score 1.5: Active Belize FSC license (no FX authorization), multiple complaints. Reports show withdrawal/support issues. Traders beware.

RCG Markets Exposed: License Verification & Trader Complaints

RCG Markets holds a valid FSCA license. Reports show withdrawal rejections & stop‑loss issues. Traders urged to verify details and exercise caution.

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Rate Calc