Technical Analysis & Forecast for November 2023

Abstract:EURUSD has completed a correction to 1.0633. A new fifth decline wave to 1.0125 could start now. Practically, the first structure of this wave is forming, targeting 1.0418. After the price reaches this level, it could correct to 1.0550 (a test from below) and then decline to 1.0277, from where the trend might continue to 1.0125.

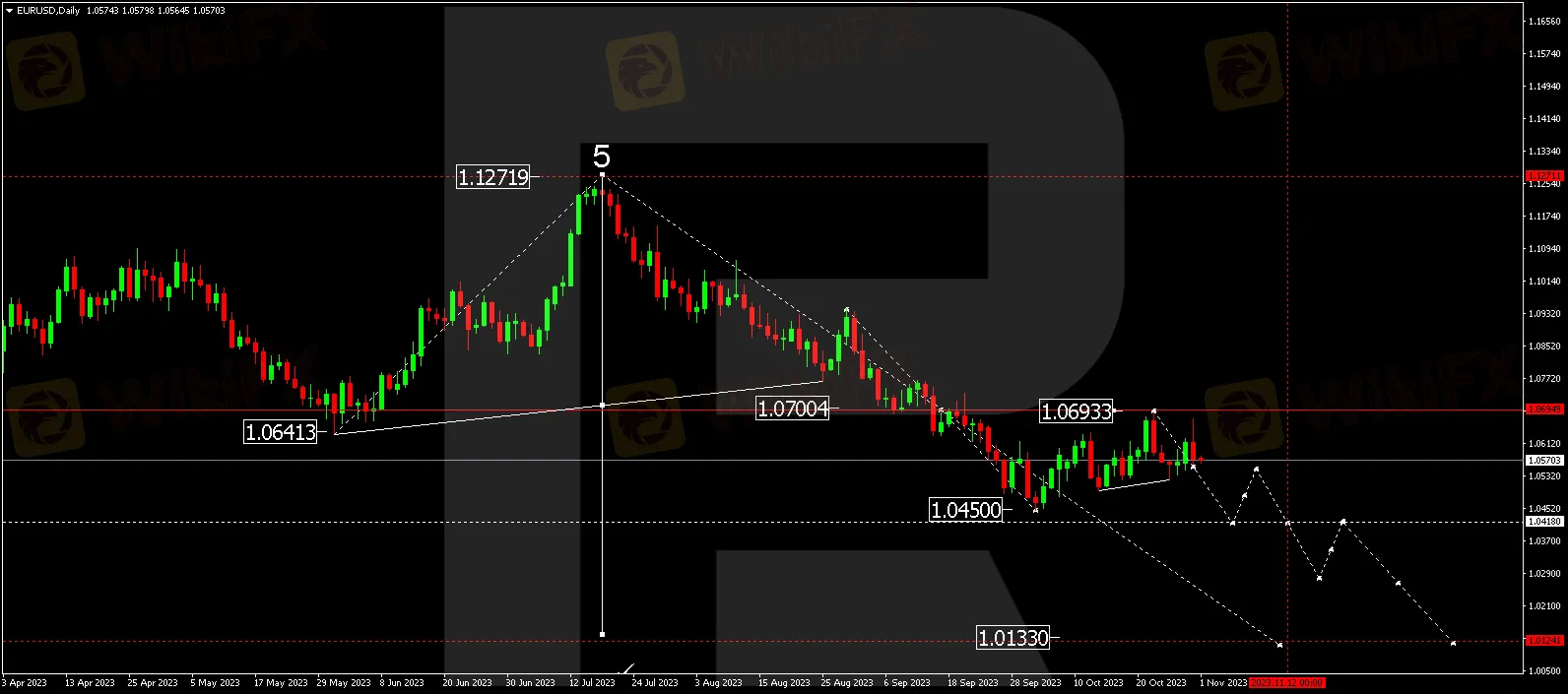

EURUSD, “Euro vs US Dollar”

EURUSD has completed a correction to 1.0633. A new fifth decline wave to 1.0125 could start now. Practically, the first structure of this wave is forming, targeting 1.0418. After the price reaches this level, it could correct to 1.0550 (a test from below) and then decline to 1.0277, from where the trend might continue to 1.0125.

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has corrected to 1.2330. By now, the market has completed a structure of decline to 1.2121. A consolidation range is now forming around this level. A downward breakout will open the potential for a decline to 1.1925. Once the price hits this level, a link of correction to 1.2330 (a test from below) could develop, followed by a decline to 1.1550.

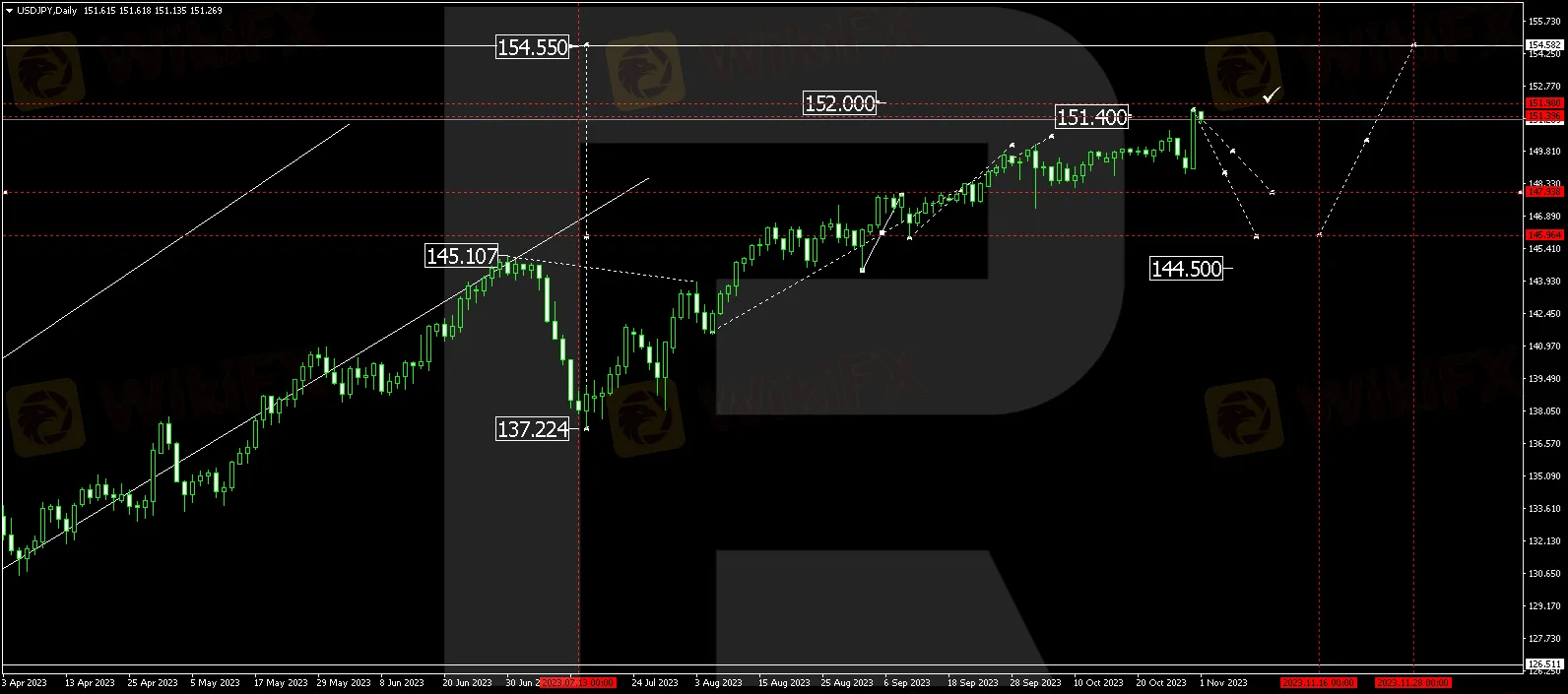

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed a growth wave, reaching 151.40. A consolidation range is expected to form below this level. Breaking it downwards, the price might correct to 147.90 (at a minimum). After the correction is over, a rise to 154.55 could follow. This is the primary target.

Read more

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Is your trading experience with MYFX markets full of fund withdrawal denials despite repeated communications with its customer support team? Has the broker deleted all your profits? Did the broker accuse you of false trading strategy implementation while deleting your profits? There have been many such instances reported by traders against these activities online. In this MYFX Markets review article, we have shared some complaints. Take a look!

Exfor Exposure: Investigating Alleged Withdrawal Denials, Illegitimate Account Closure & More

Exfor, a Malaysia-based forex broker, has allegedly been the centre of attention for all the wrong reasons. These include long-pending withdrawal denials, no communication or assistance from the broker’s customer support team, manipulated pricing upon a withdrawal request by the trader, and account blowups due to bonus-related issues. It’s the traders who allegedly bear the brunt of all these suspicious trading activities. A lot of them have criticized it on broker review platforms. We have highlighted some of their complaints in this Exfor review article. Take a look!

Understanding Xlibre's Regulation: What You Need to Know About Its License and Risk Level

When choosing a broker, the most important question is: "Is my broker properly regulated and is my capital safe?" For Xlibre, the answer is straightforward but worrying. Based on detailed research from independent global regulatory checking platforms, Xlibre is not regulated by any major financial authority. This article looks at the main issues around Xlibre Regulation status, or more correctly, the lack of it. We will examine the truth behind the claimed Xlibre License and explain why its business setup has high-risk warning signs such as a "Suspicious Regulatory License" and very low trust scores from auditors. The goal of this research is to give a clear, fact-based analysis of Xlibre's company registration, its claims, and the real risks these create for traders' capital. While this article provides a detailed analysis, regulations can change. Traders should always check the most current information before working with any broker. You can find the detailed verification report for

Is Xlibre Legit? A Complete Investigation into Scam Claims and Warning Signs

Let's answer the main question right away: Is Xlibre a safe and trustworthy broker for traders? After carefully reviewing how it operates and checking its legal status, our answer is a clear no. We strongly advise against using Xlibre for trading. Our research shows that this company operates without proper financial oversight, has multiple serious warning signs, and faces complaints from users who claim the company has acted dishonestly with their funds. This decision isn't based on personal opinions but on facts we can verify. We used information from global broker research platforms such as WikiFX. These services help protect traders by collecting information about regulations, user experiences, and expert reviews in an easy-to-understand format. Before you invest in any broker, you should always check its status on one of these platforms. You can see all the information about Xlibre yourself on the Xlibre WikiFX page.

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Rate Calc