Bitcoin to reach $45,000? Bitcoin ETF anticipation growing

Abstract:Yesterday, Bitcoin exhibited robust momentum, demonstrating a noteworthy surge of more than 10% and coming close to achieving a gain of 15% within the span of a day.

Yesterday, Bitcoin exhibited robust momentum, demonstrating a noteworthy surge of more than 10% and coming close to achieving a gain of 15% within the span of a day. Notably, the price witnessed a considerable boost and successfully surpassed the previous resistance level of 31,000. This level has previously been recognized as a substantial hurdle, often resulting in the price retracing to approximately 25,000 after several unsuccessful attempts to overcome it.

However, the markets future movements are uncertain due to upcoming events such as the release of unemployment claims reports and a scheduled speech by Federal Reserve Chair Jerome Powell later this week. These events are expected to introduce volatility, potentially leading to significant market fluctuations.

Since price has surpassed the 31,000 range we will wait and see if it does undergo a support test, the next significant resistance level to watch out for is at 40,000. Conversely, there is a possibility that the price could face rejection at 31,000, leading to a decline back to the 25,000 support. Its crucial to acknowledge that in the unpredictable realm of financial markets, no movement is guaranteed. This unpredictability underscores the importance of effective risk management strategies.

You may be asking but whats the sudden surge?

What‘s driving the sudden surge in BTC’s value, breaking the markets prolonged stagnation since the collapse of Terra in May and the subsequent crash of the crypto empire FTX? One potential catalyst for this uptrend could be the optimistic market sentiment revolving around the possible approval of spot Bitcoin ETF applications by the U.S. Securities and Exchange Commission (SEC).

The promoters of Spot Bitcoin ETF tout it as a game-changer, poised to inject a significant influx of funds into the crypto market. Additionally, it aims to facilitate mainstream adoption and provide easier access for purchasing BTC, thereby broadening the pool of crypto investors.

BlackRocks Spot Bitcoin ETF, known as the iShares Bitcoin Trust, recently made an appearance on a list maintained by the Depository Trust and Clearing Corporation (DTCC). According to Nasdaq, DTCC offers post-trade clearance, settlement, information services, and custody. Despite awaiting approval from the U.S. financial regulator, the DTCC has already listed the BlackRock fund under the ticker IBTC.

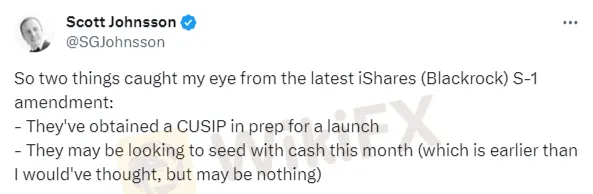

Finance lawyer Scott Johnsson shared these developments, highlighting that BlackRock has “secured a CUSIP in preparation for a launch” and suggesting that they might be considering seeding it with cash this month, an earlier timeline than anticipated.

What is seeding you may ask?

Before the launch of an ETF, an initial investment, commonly referred to as “seed capital,” is essential. This pioneering investor typically contributes around $2.5 million, giving this capital to the ETF issuer in exchange for an equivalent value in ETF shares. This process, known as “seeding the ETF,” is fundamental for the ETFs inception.

Market makers play a crucial role in providing this seed capital to ETF issuers. By participating in this initial investment, market makers are accorded special privileges. They earn the of “lead market maker” for that specific security, entitling them to specific benefits such as cash rebates and payments. These privileges are granted in return for the market makers commitment to maintaining a tightly regulated quoting level for the security in question.

Managing risk is paramount, especially during periods of high market volatility driven by news and reports. Traders should implement a robust risk management plan to safeguard their investments and navigate the market uncertainties successfully. Staying vigilant, being informed about market news, and having a well-thought-out risk management strategy are essential elements for traders aiming to thrive in such dynamic market conditions.

Read more

T4Trade Review 2025: Live & Demo Accounts, Withdrawal to Explore

T4Trade, established in 2021 and regulated by the FSA in the Seychelles, allows trading on a modest portfolio of over 300 instruments, spanning forex, metals, indices, commodities, futures, and shares, all accessible via the popular MetaTrader 4 and their proprietary WebTrader platforms. Notably, T4Trade offers a zero-commissions pricing model where both floating and fixed spreads are offered on its MetaTrader—flexible leverage up to 1000:1 to increase trading flexibility. T4Trade also introduces a copy trading service called “TradeCopier”, which enables traders who lack experience or time to join in the markets by copying the trades of seasoned professionals.

GQFX Trading Review 2025: Read Before You Trade

GQFX Trading review 2025: Unregulated broker with poor ratings. Learn why trading with GQFX is risky and unsafe for your investments.

Oanda Shines As Frop Trading Firm After Being Acquired By FTMO

FTMO enhances prop trading with the OANDA Prop Trader Community and loyalty program, integrating CRM automation and rewards post-acquisition.

Webull: A Comprehensive Review from Accounts to Withdrawal 2025

Webull Financial stands as a digital trading platform founded in 2017, offering commission-free trading across multiple asset classes including stocks, options, ETFs, cryptocurrencies, and forex. The platform targets primarily intermediate traders seeking a balance of analytical tools and straightforward execution capabilities. While Webull provides robust charting tools and an intuitive mobile experience, its forex offering remains at industry average levels with certain limitations in currency pair selection compared to some other forex brokers.

WikiFX Broker

Latest News

Lawmakers Push New Crypto ATM Rules to Fight Fraud

2025 WikiFX Forex Rights Protection Day Preview

PH Senator Probes Love Scams Tied to POGOs

Mastering Calm: How to Stay Cool in Forex Trading?

The End of Costly USDT Transfers: Tron Reshapes Stablecoin Transactions

BP\s shareholders want it to make money, not climate policy

2025 SkyLine Guide Thailand Opening Ceremony: Jointly Witnessing New Skyline in a New Chapter

TriumphFX: The Persistent Forex Scam Draining Millions from Malaysians

Safety Alert: FCA Discloses These 11 Unlicensed Financial Websites

Why does Botbro change the domain name?

Rate Calc