Gold & Silver Rocket (more) on War & Economy Double

Abstract:The combination of deteriorating economic conditions and the specter of a global war saw gold and silver prices jump the most since the banking crisis on Friday

The combination of deteriorating economic conditions and the specter of a global war saw gold and silver prices jump the most since the banking crisis on Friday – Gold was up $108 (3.6%) and Silver $1.54 (4.5%) in Aussie dollar terms and $64 & 93c in US dollars with gold spot price now $1930 (up over 5% for the week) and silver spot price $22.70 (at time of writing). Conversely the S&P500 was down and the NASDAQ down heavily.

To get the gravity of the situation from a financial markets point of view, the head of the world‘s biggest bank, J P Morgan had this to say in a statement accompanying the bank’s quarterly earnings:

“This may be the most dangerous time the world has seen in decades…….far-reaching impacts on energy and food markets, global trade and geopolitical relationships.”

At a time when increasing signs of stickier than expected inflation grew, along comes a war in the middle east adding weight to price pressures on oil and commodities (oil too rocketed Friday night), particularly as Iran weighs in warning of dire consequences.

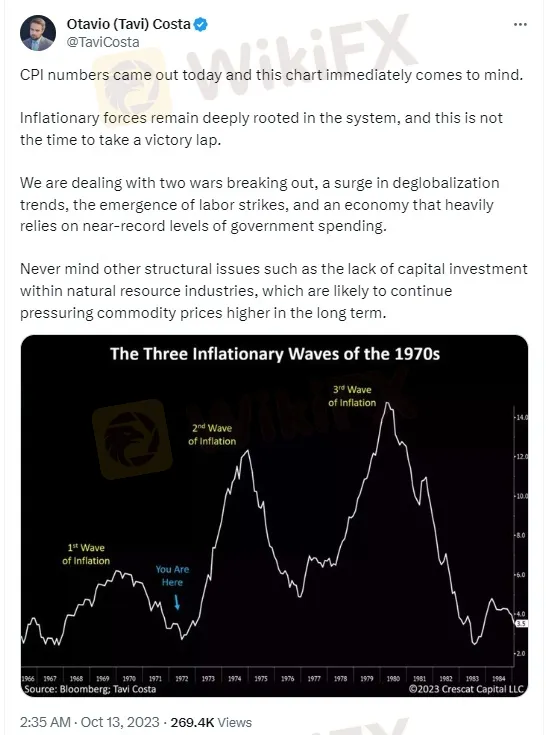

The implications for metals are profound. At a time when the US struggles to sell bonds to finance its deficits, big licks of debt are maturing in a 5% environment, and inflation stays stronger than expected putting further pressure on the situation; the pressure on the Fed to step in to buy the bonds to monetise the debt and respond to the now seemingly inevitable recession increases. The prospect then of that perversely increasing inflation again looms large. That is stagflation, negative real rates (as inflation is high and nominal rates low) – gold‘s sweet spot - and it’s happened before as Crescat‘s Tavi Costa tweeted last week (before Friday’s jump):

This spike in price aligns perfectly with that brilliant interview our Chief Economist, Chris Tipper, did last week calling the bottom in for gold.

Read more

RoboForex Exposure: Withdrawal Denials, Deposit Credit Failures & Account Blocks Frustrate Traders

Failed to withdraw funds from RoboForex despite following up with its customer support team numerous times? Did the Belize-based broker close your forex trading account when you requested a fund withdrawal? Did your deposits fail to show up in your trading account? Were you prevented from placing trades due to issues concerning the RoboForex login? These issues have become increasingly common for traders. In this RoboForex review article, we have examined these issues thoroughly to allow you to make an informed decision about the broker. Have a look!

Aximtrade Exposure: Growing Allegations of Withdrawal Denials by Traders

Is your Aximtrade withdrawal application pending for months despite everything right from your end? Even after months, do you still see the withdrawal application under review while logging in to the trading platform? Or does the broker official tell you that the withdrawal is approved, but give you the excuse of the payment provider’s unavailability? These issues have allegedly become the norm at Aximtrade, a Saint Vincent and the Grenadines-based forex broker. In this Aximtrade review article, we have highlighted numerous complaints that need your attention.

Effective Stop Loss Trading Strategies

In a forex market where fundamental and technical factors impact the currency pair prices, volatility is expected. If the price volatility acts against the speculation made by traders, it can result in significant losses for them. This is where a stop-loss order comes to their rescue. It is one of the vital investment risk management tools that traders can use to limit potential downside as markets get volatile. Read on as we share its definition and several strategies you should consider to remain calm even as markets go crazy.

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

The forex market is a happening place with currency pairs getting traded almost non-stop for five days a week. Some currencies become stronger, some become weaker, and some remain neutral or rangebound. If you talk about the Indian National Rupee (INR), it has dipped sharply against major currencies globally over the past year. The USD/INR was valued at around 85-86 in Feb 2025. As we stand in Feb 2026, the value has dipped to over 90. The dip or rise, whatever the case may be, impacts our daily lives. It determines the price of an overseas holiday and imported goods, while influencing foreign investors’ perception of a country. The foreign exchange rates change constantly, sometimes multiple times a day, amid breaking news in the economic and political spheres globally. In this article, we have uncovered details on exchange rate fluctuations and key facts that every trader should know regarding these. Read on!

WikiFX Broker

Latest News

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

UPFOREX Review 2026: Is UPFOREX Safe or Scam? A Look at User Reviews and Warning Signs

The micro-documentary "Let Trust Be Seen" is officially launched today!

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

Jane Street Under Fire: From India’s Market Ban to a $40 Billion Crypto Conspiracy

TradingMoon Review: Offshore Regulated Fraud Risk Exposed

Understanding FX SmartBull Withdrawal & Deposit: Essential Information Before You Start Trading

Understanding UPFOREX Money Transfers: Important Facts You Need to Know

Rate Calc