Exfor Limited

Abstract:Founded in 2004, Exfor is a Malaysian brokerage regulated by the LFSA. Exfor offers forex, metals, indices, energies, and stocks, and also provides MT4 and MT5 professional platforms for trading. It provides two types of accounts and a demo as well as an Islamic account, with a minimum deposit of $50 and leverage up to 1:500. Besides, it does not provide services for residents from the US, Israel, North Korea, and Yemen.

| Exfor Review Summary | |

| Founded | 2004 |

| Registered Country/Region | Malaysia |

| Regulation | LFSA |

| Market Instruments | Forex, metals, indices, energies, stocks |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | 0.8 pips (EUR/USD) |

| Trading Platform | MT4, MT5 |

| Minimum Deposit | $50 |

| Customer Support | Live chat, contact form |

| Tel: +60 87 416 989 | |

| Email: Info@exfor.com | |

| Social Media: LinkedIn, Facebook | |

| Address: Office Suite 1629, Level 16 (A), Main Office Tower, Financial Park Complex, Jalan Merdeka, 87000 Labuan F.T. | |

| Regional Restriction | United States, Israel, North Korea, Yemen |

Founded in 2004, Exfor is a Malaysian brokerage regulated by the LFSA. Exfor offers forex, metals, indices, energies, and stocks, and also provides MT4 and MT5 professional platforms for trading. It provides two types of accounts and a demo as well as an Islamic account, with a minimum deposit of $50 and leverage up to 1:500. Besides, it does not provide services for residents from the US, Israel, North Korea, and Yemen.

Pros and Cons

| Pros | Cons |

| LFSA regulation | Regional restriction |

| Various trading products | Limited payment options |

| MT4 and MT5 support | Only two account types |

| Demo account available | |

| Islamic accounts available | |

| Multiple channels of contact |

Is Exfor Legit?

| Regulated Authority | Labuan Financial Services Authority |

| Current Status | Regulated |

| Regulated Country | Malaysia |

| Regulated Entity | Exfor Limited |

| License Type | Straight Through Processing (STP) |

| License No. | MB/22 / 0099 |

What Can I Trade on Exfor?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Energies | ✔ |

| Stocks | ✔ |

| Bonds | ❌ |

| Cryptocurrencies | ❌ |

| ETFs | ❌ |

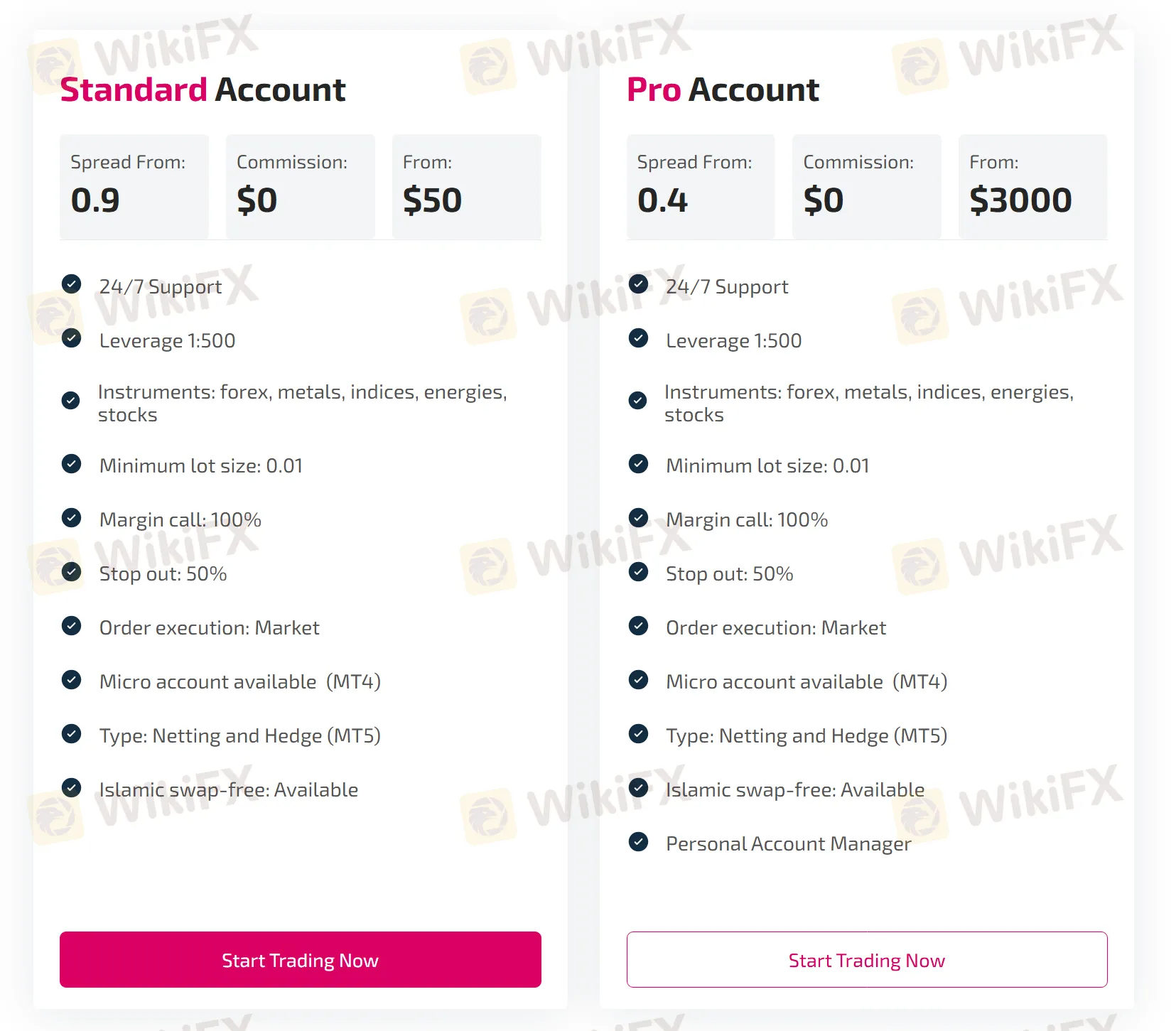

Account Type

Exfor offers two account types: Standard Account and Pro Account. Besides, a demo account and an Islamic account are also available.

| Account | Minimum Deposit |

| Standard | $50 |

| Pro | $3000 |

Leverage

For both Standard Account and Pro Account, the leverage is 1:500. The use of leverage can maximize profits and increase losses at the same time.

| Account | Leverage |

|---|---|

| Standard | 1:500 |

| Pro | 1:500 |

Exfor Fees

| Account | Spread | Commission |

| Standard | From 0.9 pips | $0 |

| Pro | From 0.4 pips | $0 |

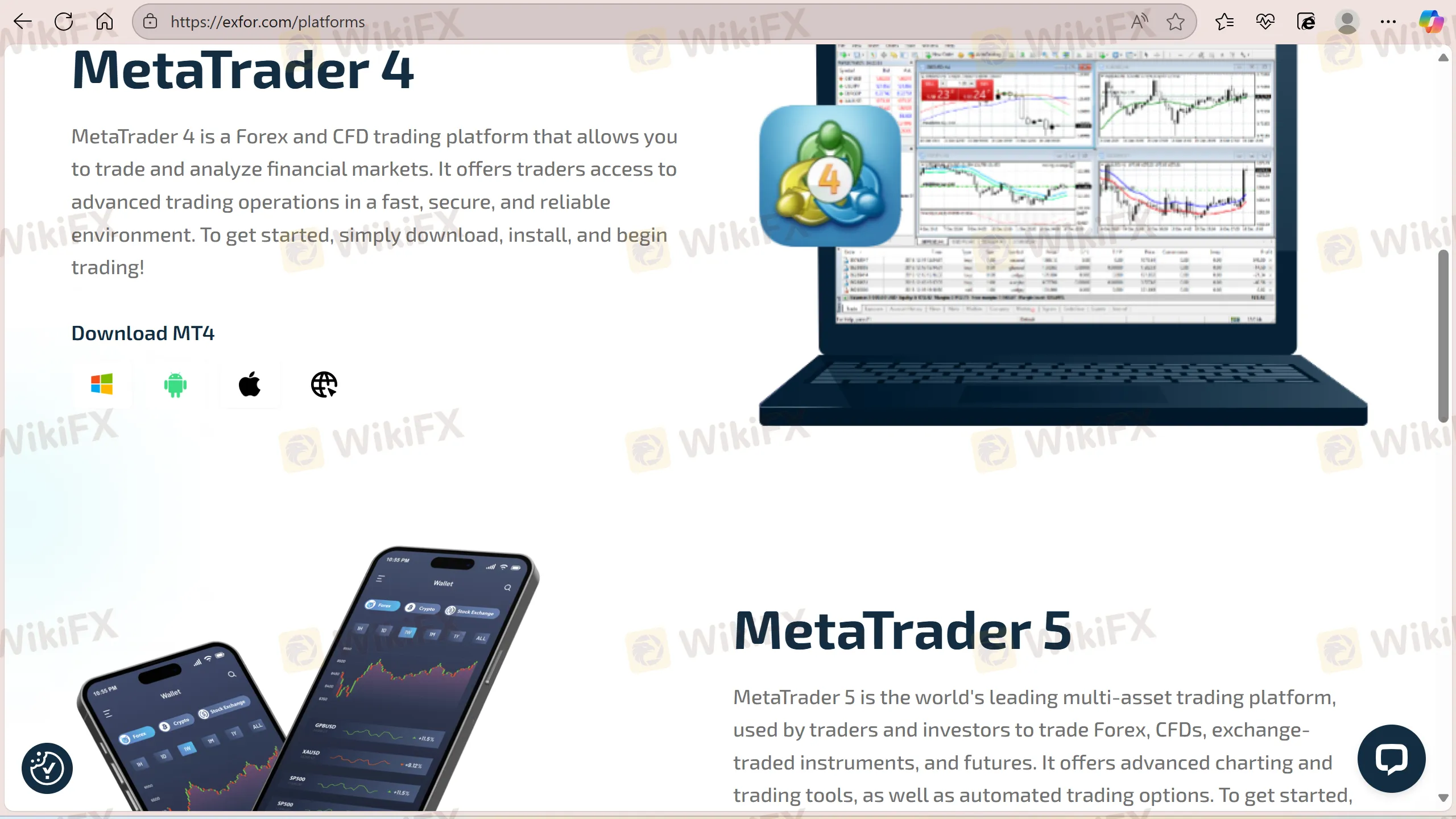

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Windows, Mobile, Web | Beginners |

| MT5 | ✔ | Windows, Mobile, Web | Experienced traders |

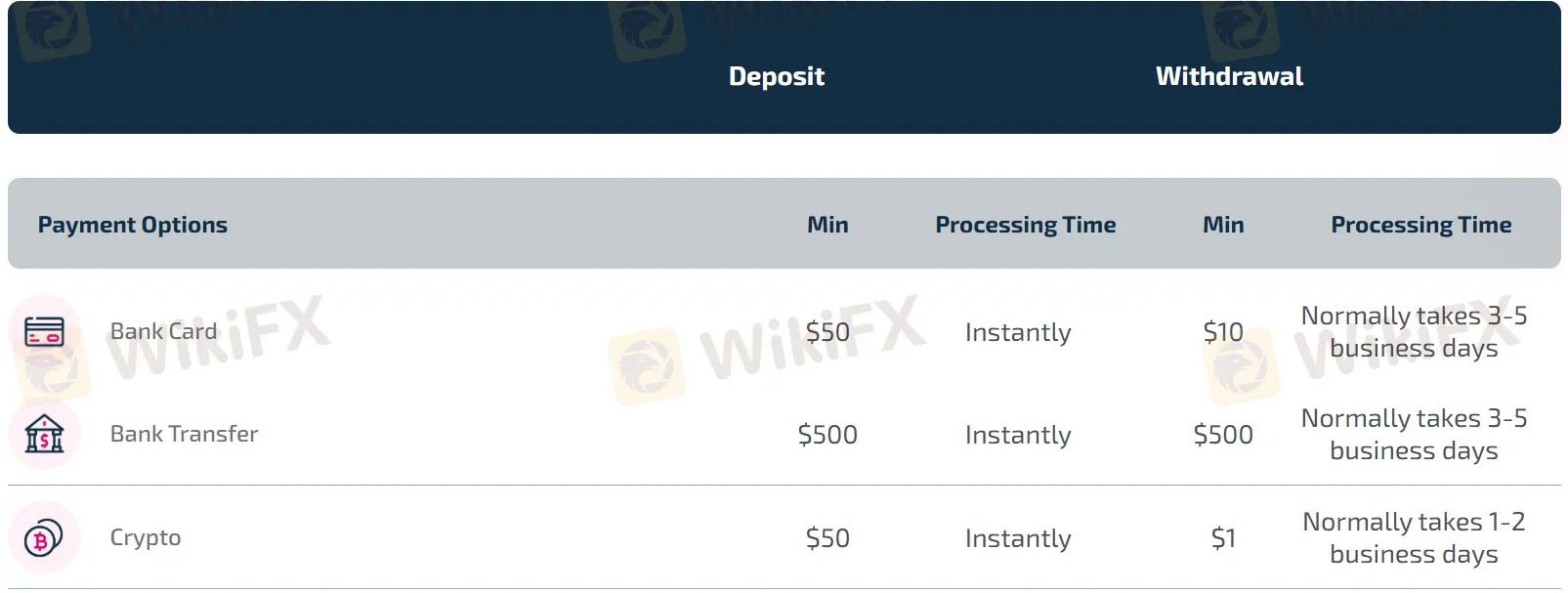

Deposit and Withdrawal

| Deposit | Withdrawal | |||

| Payment Options | Minimum Deposit | Processing Time | Minimum Withdrawal | Processing Time |

| Bank Card | $50 | Instantly | $10 | Normally takes 3-5business days |

| Bank Transfer | $500 | $500 | ||

| Crypto | $50 | $1 | 1-2 business days | |

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Rate Calc