XA Markets

Abstract:Founded in 2023, XA Markets is an Indian broker, offering trading in forex, metals, shares, indices, commodities, cryptocurrencies, and ETFs with leverage up to 1:500 and spread from 0.0 pips via the MT5 platform. Demo accounts are available and the minimum deposit requirement to open a live account is just 10 USD.

| XA Markets Review Summary | |

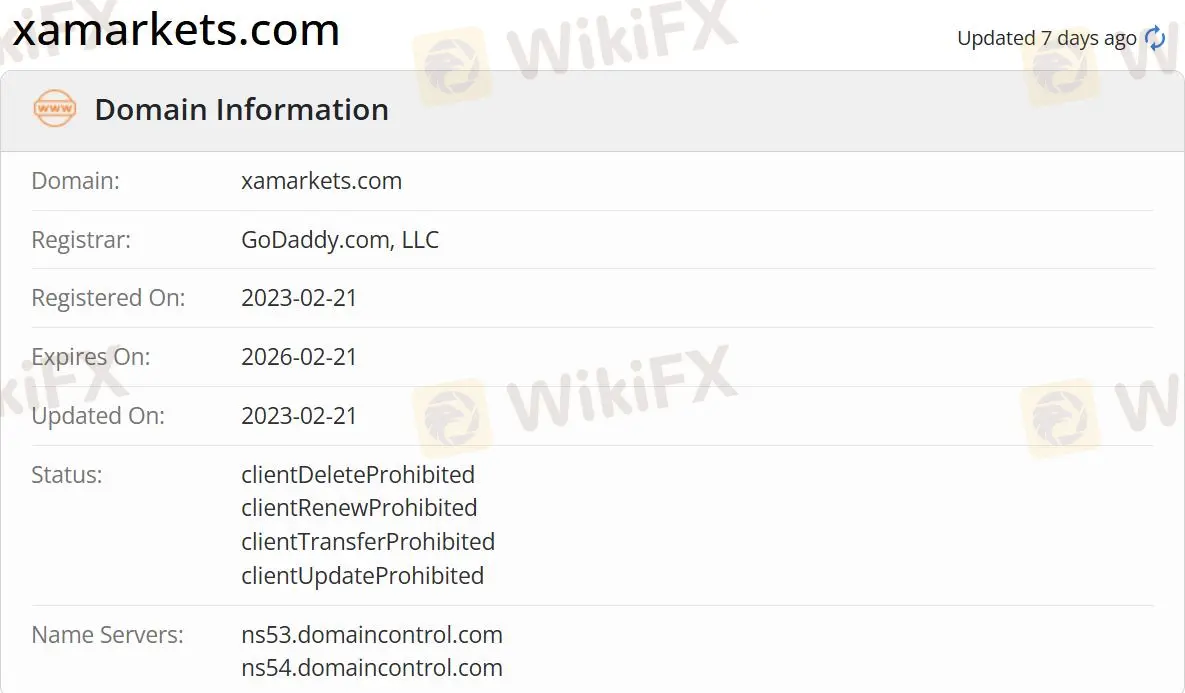

| Founded | 2023 |

| Registered Country/Region | India |

| Regulation | No regulation |

| Market Instruments | Forex, metals, shares, indices, commodities, cryptocurrencies, ETFs |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0 pips |

| Trading Platform | MT5 |

| Social Trading | ✅ |

| Min Deposit | $10 |

| Customer Support | 24/7 support |

| Tel: +914953501103 | |

| Email: info@xamarkets.com | |

| Twitter: https://twitter.com/xamarkets | |

| Facebook: https://www.facebook.com/xamarketss | |

| Instagram: https://www.instagram.com/xamarkets | |

| Office address: 1401, 2/1149-A73, 4Th Floor, Hilite Business Park, Thondayad Bypass, Kozhikode, Kerala, India | |

Founded in 2023, XA Markets is an Indian broker, offering trading in forex, metals, shares, indices, commodities, cryptocurrencies, and ETFs with leverage up to 1:500 and spread from 0.0 pips via the MT5 platform. Demo accounts are available and the minimum deposit requirement to open a live account is just 10 USD.

Pros and Cons

| Pros | Cons |

| Various trading products | New to the market |

| Demo accounts | No regulation |

| MT5 platform | |

| Social trading | |

| 24/7 support |

Is XA Markets Legit?

No, XA Markets does not have any licenses from regulatory institutions. Please be aware of the risk!

What Can I Trade on XA Markets?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Cryptocurrencies | ✔ |

| ETFs | ✔ |

| Bonds | ❌ |

| Options | ❌ |

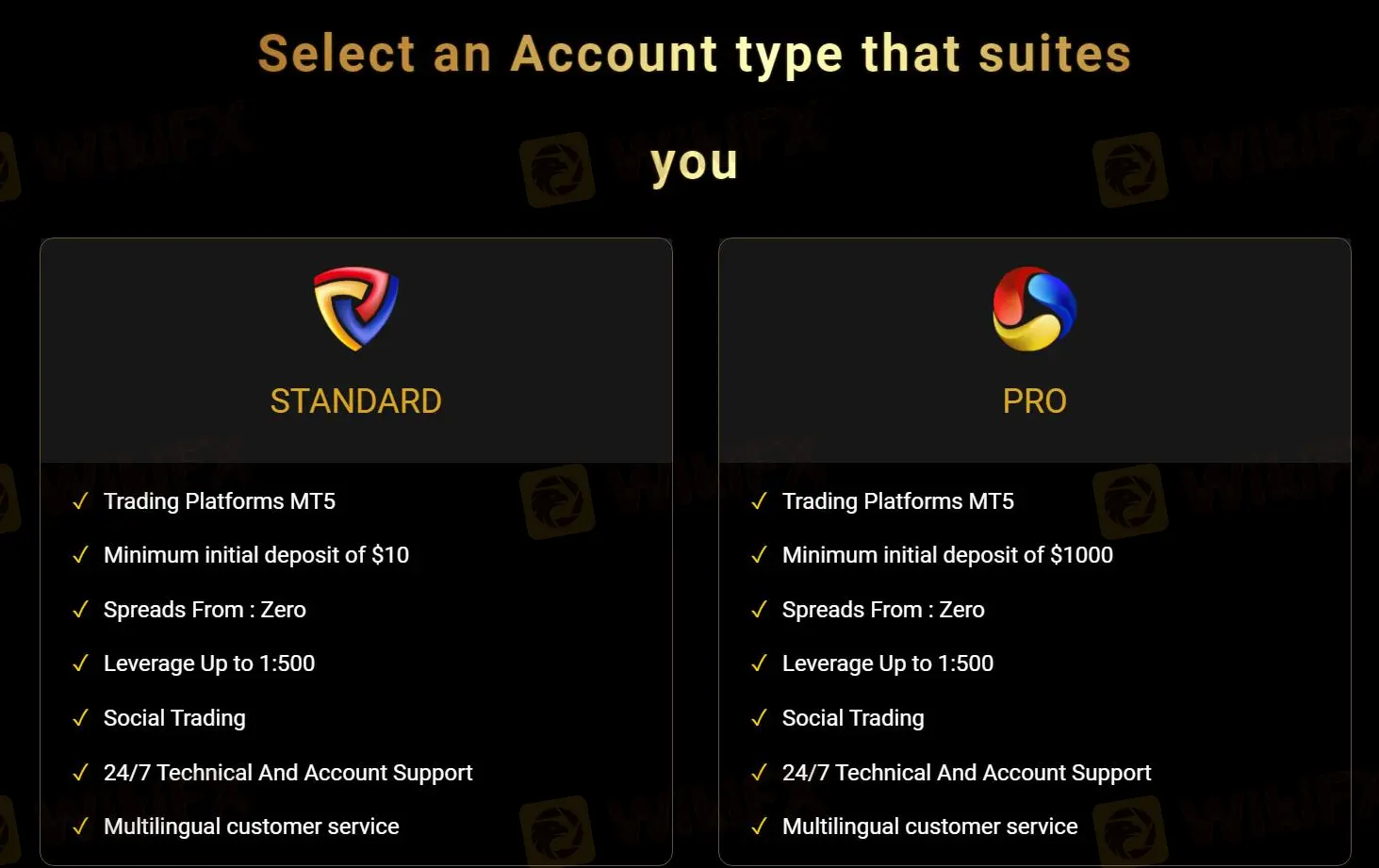

Account Type

| Account Type | Min Deposit |

| Standard | $10 |

| Pro | $1,000 |

Leverage

The leverage is capped at 1:500 for both account types. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

| Asset Class | Max Leverage |

| Forex | / |

| Metals | 1:500 |

| Shares | 1:10 |

| Indices | 1:100 |

| Commodities | / |

| Cryptocurrencies | 1:50 |

XA Markets Fees

| Asset Class | Spread | Commission | Margin | Swap |

| Forex | Tightest | ❌ | Low | ❌ |

| Metals | Tightest on gold and silver | / | / | |

| Shares | / | ❌ | ||

| Indices | Tightest on all commodities | |||

| Commodities | Tightest | ❌ | Low | |

| Cryptocurrencies | / | |||

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

XA Markets accepts payments via VISA, Mastercard, M-PESA, and Bank Transfer.

Read more

OlympTrade Review 2025: Trading Accounts, Demo Account, and Withdrawal to Explore

OlympTrade is a relatively young online broker registered in Saint Vincent and the Grenadines, a shady spot with a booming of unlicensed entities. Tradable assets on the OlymTrade are not extensive, and this broker does not tell many essential trading conditions. As for trading platforms, I found trades can only operated on a simple web-based trading platform, no Metatrader platform at all.

WNS Trade Limit Broker Review

WNS Trade Limit, established in 2023, is a forex broker incorporated in Mauritius under registration number C200345. The company operates under the jurisdiction of the Financial Services Commission (FSC) of Mauritius, holding license number GB232201953.

T4Trade Review 2025: Live & Demo Accounts, Withdrawal to Explore

T4Trade, established in 2021 and regulated by the FSA in the Seychelles, allows trading on a modest portfolio of over 300 instruments, spanning forex, metals, indices, commodities, futures, and shares, all accessible via the popular MetaTrader 4 and their proprietary WebTrader platforms. Notably, T4Trade offers a zero-commissions pricing model where both floating and fixed spreads are offered on its MetaTrader—flexible leverage up to 1000:1 to increase trading flexibility. T4Trade also introduces a copy trading service called “TradeCopier”, which enables traders who lack experience or time to join in the markets by copying the trades of seasoned professionals.

GQFX Trading Review 2025: Read Before You Trade

GQFX Trading review 2025: Unregulated broker with poor ratings. Learn why trading with GQFX is risky and unsafe for your investments.

WikiFX Broker

Latest News

DOJ Investigates LIBRA Memecoin Scam: $87M Lost by Investors

How Do You Make Money in the Forex Market in March 2025

Europe’s High-Stakes Gamble: Can It Bridge the U.S.-Ukraine Divide?

Crypto Trading: New Trend among Indian Youth

Botbro Creator, Lavish Chaudhary Unveils New Project

Beyond the Hype: The Three Pillars of a Profitable Crypto Investment

First UK Criminal Conviction for Unregistered Crypto ATMs Involves Over £2.5 Million

Consob Exercises MICAR Authority for the First Time, Shutting Down Unregistered Crypto Website

TD Bank Appoints Guidepost Solutions for AML Compliance Oversight

Malaysia’s EPF Declares Highest Dividend Since 2017 Amid Market Resilience

Rate Calc