Understanding Trends and Mastering Trendline Drawing

Abstract:As a dynamic and ever-changing market, forex trading relies heavily on understanding trends to make informed decisions.

Understanding Trends and Mastering Trendline Drawing

Forex trading, the world's largest financial market, involves the buying and selling of currencies with the aim of making a profit. As a dynamic and ever-changing market, forex trading relies heavily on understanding trends to make informed decisions. Trendline drawing is a powerful tool used by forex traders to identify trends and potential entry and exit points. In this article, we will explore the significance of trends in forex trading and provide valuable insights on mastering the art of trendline drawing.

The Importance of Trends in Forex Trading

Trends play a fundamental role in forex trading, as they provide crucial information about the overall market sentiment and direction of currency pairs. Identifying trends allows traders to align their strategies with the prevailing market sentiment and make more accurate predictions about future price movements. There are three primary types of trends observed in forex trading:

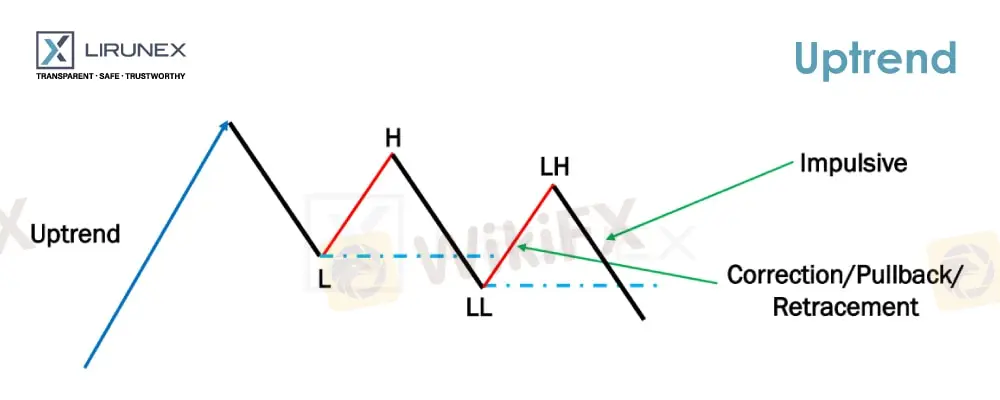

Uptrend:An uptrend occurs when the price of a currency pair forms higher highs and higher lows over time. This suggests that buyers are in control, and the currency pair's value is appreciating. Traders aim to buy during an uptrend to ride the upward momentum.

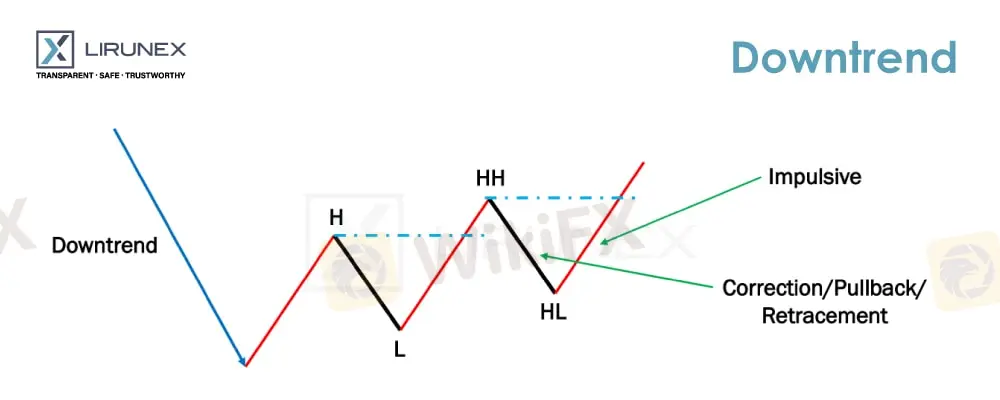

Downtrend:A downtrend is the opposite of an uptrend, where the price forms lower highs and lower lows. This indicates that sellers are dominating the market, and the currency pair's value is depreciating. Traders seek to sell during a downtrend to capitalize on falling prices.

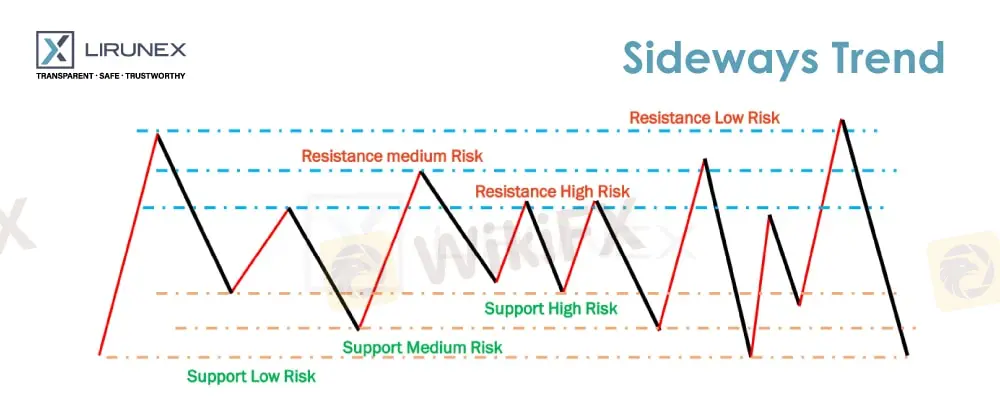

Sideways Trend (or Range):A sideways trend occurs when the price moves within a relatively narrow range, with no clear upward or downward direction. In such situations, traders may use range-trading strategies, buying at support levels and selling at resistance levels.

Mastering Trendline Drawing in Forex Trading

Trendlines are invaluable tools that help forex traders visualize trends and make informed decisions. Drawing trendlines accurately requires skill and practice. Here are some essential tips to master trendline drawing in forex trading:

Identify Swing Points:To draw trendlines, identify swing points, which are the significant highs and lows on the price chart. For uptrends, connect the higher swing lows, and for downtrends, connect the lower swing highs.

Use Multiple Timeframes:Analyzing trends across different timeframes provides a broader perspective. Long-term trends give an overall direction, while short-term trends offer entry and exit points for precise trading decisions.

Draw Valid Trendlines:Ensure that your trendlines have at least three points of contact. More points of contact increase the reliability and validity of the trendline, making it a stronger tool for analysis.

Pay Attention to Market Structure:Market structure refers to the patterns formed by highs and lows on the price chart. Understanding market structure helps traders draw trendlines accurately and identify potential trend reversals.

Adjust for Precision:To draw trendlines with precision, use the wicks (shadows) of candlesticks in addition to their bodies. This provides a more accurate representation of price movements.

Combine with Other Indicators:Trendlines work best when used in conjunction with other technical indicators, such as moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence). The convergence of signals from various indicators strengthens the reliability of your analysis.

Be Flexible:Markets are dynamic, and trends can change. Stay flexible and adjust your trendlines accordingly as new data emerges.

Conclusion

In conclusion, understanding trends and mastering trendline drawing are vital skills for successful forex trading. Trends offer valuable insights into market sentiment, and trendlines help traders visualize these trends and identify potential trading opportunities.

Lirunex helps the traders and forex community by providing weekly forex analysis and forex news to help traders to predict the market and as well to learn forex analysis and enhance their trading strategies. Remember that forex trading involves risk, and it is essential to combine trend analysis with proper risk management strategies to achieve long-term success in the forex market.

Read more

Algorithmic Trading: Demystifying the Black-Box Strategies

This article aims to unravel the intricacies of algorithmic trading, shedding light on its inner workings and exploring the advantages and challenges it presents.

Day Trading vs Swing Trading: Matching Trading Strategies to Your Lifestyle

Day trading and swing trading each offer unique opportunities and challenges.

Leverage and Risk Management: Striking the Right Balance in Trading

While leverage can amplify returns, it must be used judiciously and in conjunction with effective risk management practices.

Maximize Your Profits with Support and Resistance!

In this article, we will delve into how you can harness the power of Support and Resistance levels to enhance your forex trading strategies.

WikiFX Broker

Latest News

Spring Rally in Chinese Equities Signals Potential Lift for AUS and NZD

Ringgit hits five-year high against US dollar in holiday trade

Commodities: Gold Targets $5,000 as Central Banks Buying Spree Meet Geopolitical Shocks

Forex vs. Stocks vs. Futures: Which Market Fits Your Wallet?

Transatlantic Rift: Visa Wars and Tech Tariffs Threaten EUR/USD

JPY Alert: Bond Yields Hit 29-Year High as Market Challenges BOJ

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

US Banking Giants Add $600B in Value as Deregulation Widens Gap with Europe

Markets Wrap: Gold and Equities Surge to Records as Holiday Liquidity Thinness Rattles Speculative A

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Rate Calc