4e

Abstract:4e is a brokerage firm headquartered in China, offering a wide array of market instruments for traders and investors. They provide access to various financial markets, including forex, stocks, cryptocurrencies, and peer-to-peer (P2P) lending.4e comes with its proprietary trading platform, offering real-time quotations, multiple asset options, price alerts, stock data, and a user-friendly experience.

| Company Name | 4e |

| Headquarters | China |

| Regulations | No license |

| Market Instruments | Forex, Stocks, Cryptocurrencies, P2P Lending |

| Leverage | N/A |

| Spread | 1.7 points for EURUSD pair |

| Commission Fee | 0.09% for spot trading and 0.05% for contract |

| Deposit/Withdraw Methods | Cryptocurrency transfer |

| Bonuses | Not disclosed |

| Trading Platforms | Proprietary platform with real-time quotations |

| Customer Support | Live chat, Telegram, Instagram, Discord, Twitter |

| Educational Resources | Tutorial Center with educational materials |

Overview of 4e

4e is a brokerage firm headquartered in China, offering a wide array of market instruments for traders and investors. They provide access to various financial markets, including forex, stocks, cryptocurrencies, and peer-to-peer (P2P) lending.

4e comes with its proprietary trading platform, offering real-time quotations, multiple asset options, price alerts, stock data, and a user-friendly experience.

Is 4e legit or a scam?

4e, as a broker lacking any licensing, operates without regulation from any financial authority. While this absence of a license does not directly label it as a scam, it does raise concerns about potential risks for traders. The absence of a valid license, as detected in 4e, can significantly impact traders. Unregulated brokers lack oversight, making them susceptible to fraudulent activities and unethical practices, like unfair trade execution or withdrawal issues. Without regulatory protection, traders may struggle to resolve disputes or seek compensation in case of wrongdoing.

Furthermore, the absence of regulation can jeopardize the safety of traders' funds. Unlike regulated brokers, unregulated ones may not segregate client funds from their own, increasing the risk of losses if the broker faces financial difficulties. In summary, trading with an unlicensed broker is riskier, and traders should conduct thorough research on a broker's regulatory status to safeguard their investments and financial security.

Pros and Cons

4e offers a diverse range of market instruments, including forex, stocks, cryptocurrencies, and P2P lending, providing traders with ample options. Their proprietary trading platform features real-time quotations, a variety of assets, and user-friendly elements like price alerts and streamlined deposits/withdrawals. The availability of educational resources in their Tutorial Center is a valuable asset for traders seeking to enhance their knowledge. Additionally, the multiple customer support channels, such as live chat, Telegram, Instagram, Discord, and Twitter, ensure accessibility for users needing assistance. Lastly, 4e caters to a global audience, extending its services to traders worldwide.

One significant concern arises from the absence of valid regulation, which can potentially expose traders to risks associated with unregulated brokers. Additionally, the lack of transparency regarding leverage or margin trading features may limit the trading strategies of users. While the platform offers a diverse array of market instruments, the complexity of managing multiple asset classes may pose challenges for some traders. Furthermore, the potential risk of borrower defaults in P2P lending, supported by 4e, should be carefully considered. Lastly, the absence of extensive information about the broker's background and history may raise questions for potential users.

| Pros | Cons |

| Diverse market instruments | Lack of valid regulation |

| User-friendly trading platform | Limited transparency on leverage |

| Accessible educational resources | Complex management of multiple assets |

| Multiple customer support channels | Risk of borrower defaults in P2P lending |

| Global reach and services | Limited information about the broker's history |

Market Instruments

4e offers a diverse range of market instruments for traders and investors. Forex trading provides access to global currency markets with competitive spreads and leverage options, although it comes with inherent volatility. Stock trading allows users to buy and sell shares in established companies, diversifying their portfolios with the potential for dividends and capital growth.

Additionally, 4e supports cryptocurrency trading, including popular assets like Bitcoin and Ethereum, available around the clock. However, crypto markets are known for their volatility. The platform also facilitates peer-to-peer (P2P) lending, enabling users to earn interest or secure loans. Nevertheless, P2P lending carries the risk of borrower defaults.

How to open an account in 4e?

Opening an account with 4e is a simple process. Here are the steps:

Open the 4e APP and go to the “My” page. Click on the “Register” button to access the registration page.

Choose to register using your email address or phone number. Enter your email or phone number with the international area code, create a password, and, if applicable, input an invitation code.

For added security, ensure your password is at least 8 characters long, containing both letters and numbers. It is also recommended to enable Google two-factor authentication.

Then, you are required to complete the KYC (Know Your Customer) verification to fully use the features of your trading account. Completing your KYC verification follows these steps:

Click on the “My” icon, go to the top account bar, and select “Identity Verification.”

Opt for “Basic Verification” and proceed to the identity verification page. Click “Continue.”

Choose your country and the country/region of your identity document's issuance. Upload the required documents and click “Document Readable” to continue.

Wait for the verification process to finalize, which typically takes about 2-3 minutes. Once verified, an authentication icon will appear in the upper left corner.

Please ensure that the document photos clearly display your full name and birthdate, and if you encounter issues uploading photos, make sure your identity document is clear and unaltered. Remember that each identity document can only be linked to one 4e account.

Spread and Commission Fees

4e charges competitive fees for trading. For spot trading pairs, the transaction fee rate is Maker 0.09% and Taker 0.09%, while for trading contracts, the fee rate is Maker 0.05% and Taker 0.05%. These fees are in line with industry standards and offer traders a reasonable cost structure for their transactions.

Regarding spreads, 4e provides relatively tight spreads for various currency pairs in the foreign exchange market. The point spreads for popular pairs like EURUSD, USDJPY, and GBPUSD range from 1.7 to 2.3 points, which can be considered favorable for traders looking to minimize the cost of entering and exiting positions. However, it's important to note that spreads may vary depending on market conditions and the specific currency pair being traded. Traders should always consider spreads as a factor when evaluating the overall cost of trading with 4e.

Leverage

The absence of disclosed information regarding leverage or margin trading on the 4e platform raises concerns about the availability of such features. This lack of transparency can affect traders significantly by leaving them uninformed about the potential risks and benefits of using leverage. Without access to leverage, traders may miss out on opportunities to amplify their positions, potentially limiting their profit potential. Conversely, it could protect them from excessive losses, reducing the risk associated with high leverage. However, the absence of leverage features should be clearly communicated to traders to ensure they can make well-informed decisions aligned with their trading strategies.

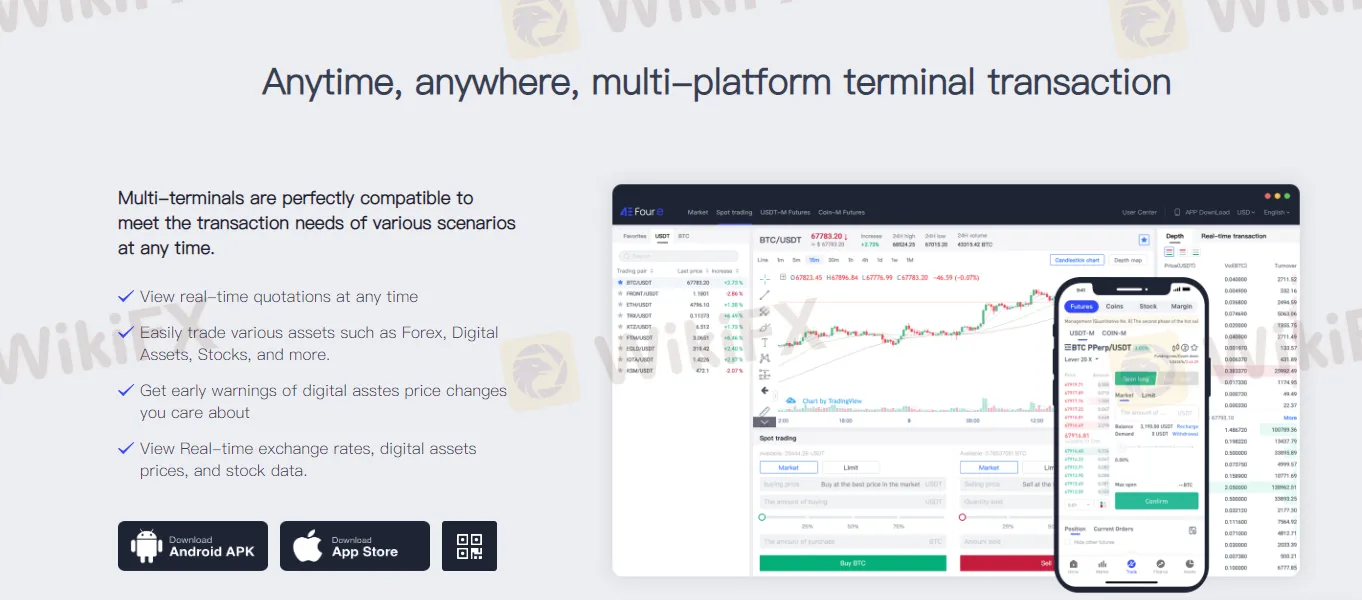

Trading Platform

4e's proprietary platform stands as a robust and versatile tool for traders and investors. One of its standout features is real-time quotation, providing users with up-to-the-minute market data, enabling them to make informed decisions swiftly. This feature is crucial for traders seeking to capitalize on price movements across various assets, including forex, digital assets, and stocks, all conveniently accessible within a single application.

Moreover, the 4e platform offers the convenience of price alerts, allowing users to set notifications for specific price changes. This feature empowers traders to stay updated on market developments without the need for constant monitoring. Additionally, the platform provides comprehensive stock data, offering insights into the performance of various stocks. Lastly, the ability to seamlessly withdraw and deposit funds within the same app streamlines the trading process, enhancing the overall user experience.

Deposit & Withdrawal

4e offers a straightforward process for cryptocurrency transfers, both for deposits and withdrawals. To initiate a transfer, users can navigate to the homepage or asset interface and select the “Withdraw/Transfer” option, specifying the desired cryptocurrency for the transaction. For instance, if transferring USDT, users will input essential details such as the “Chain Name,” “Recipient Address,” and the amount to be transferred. After confirming the accuracy of the information, a simple click on “Confirm” completes the transfer.

It's worth noting that 4e provides two types of transfers: internal and external. Internal transfers, conducted within the 4e platform, come with zero transaction fees and offer instant payment into the user's account. On the other hand, external transfers may incur fees, and the process may take approximately 5 minutes for the transfer to be successfully completed. This flexibility allows users to choose the most suitable method for their cryptocurrency transactions, considering their preferences and urgency.

Customer Support

4e offers a robust suite of customer support channels to ensure that traders have access to assistance whenever they need it. Firstly, their live chat support enables users to engage in real-time conversations with knowledgeable support agents. This immediate and direct communication channel is ideal for resolving urgent queries or seeking guidance during trading hours.

Additionally, 4e maintains an active presence on various social media platforms, including Telegram, Instagram, Discord, and Twitter. These channels not only serve as outlets for information and updates but also provide a space for users to connect with the 4e community and support team. Whether it's through informative posts, direct messages, or interactive discussions, traders can leverage these social channels to stay informed and receive prompt assistance.

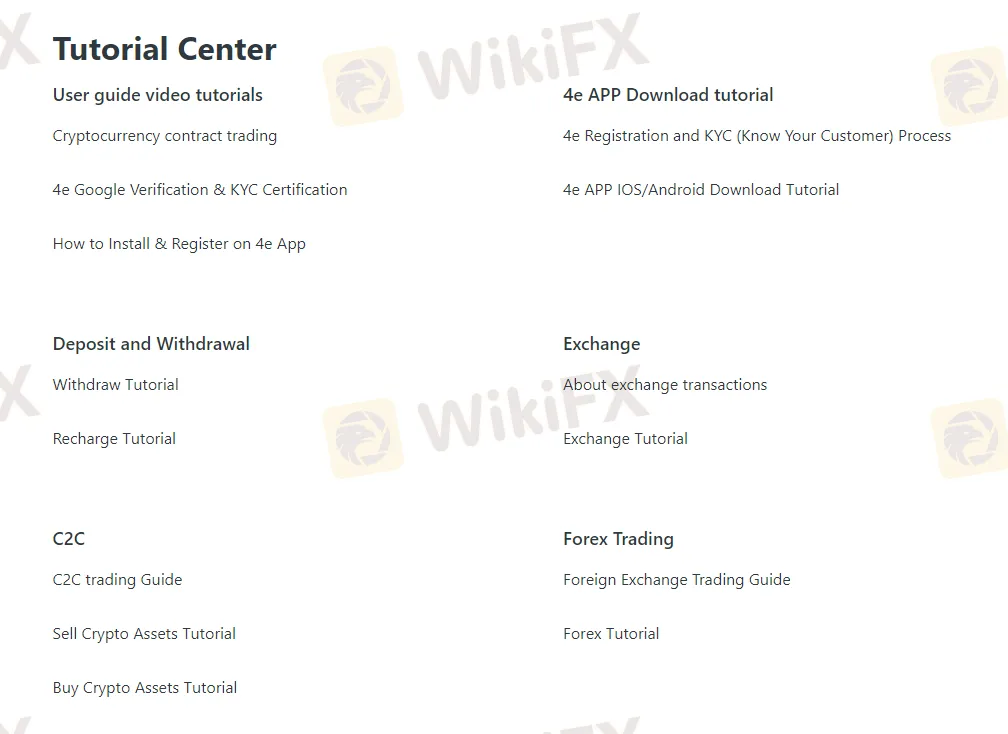

Educational Resources

4e offers an extensive Tutorial Center, providing a wealth of educational resources to empower traders. These resources cover a wide range of topics, catering to both novice and experienced traders. From comprehensive user guide video tutorials to cryptocurrency contract trading guides, 4e equips users with the knowledge and skills needed to navigate the complex world of financial markets.

Additionally, the platform offers step-by-step tutorials on essential processes like registration, KYC certification, deposits, withdrawals, and even the installation of the 4e mobile app. Whether you're interested in forex trading, stock trading, or contract transactions, 4e has you covered with detailed guides explaining the intricacies of each market. The Tutorial Center is a valuable asset for traders seeking to enhance their understanding and make informed decisions in their trading journey.

Conclusion

In summary, 4e is a China-based brokerage firm that provides a diverse range of market instruments, including forex, stocks, cryptocurrencies, and P2P lending. They offer a proprietary trading platform with features such as real-time quotations, asset variety, price alerts, stock data, and streamlined deposit and withdrawal processes.

However, it's essential to note the concern raised due to the absence of valid regulation, potentially posing risks for traders. As with any financial institution, caution and thorough research are advised when considering engagement with 4e, keeping in mind the potential benefits and risks associated with their offerings.

FAQs

Q: Is 4e a regulated broker?

A: 4e currently operates without a valid regulation, so traders should exercise caution.

Q: What types of market instruments are available on 4e?

A: 4e offers a diverse range of market instruments, including forex, stocks, cryptocurrencies, and P2P lending.

Q: How can I contact customer support at 4e?

A: You can reach 4e's customer support through various channels, including live chat, Telegram, Instagram, Discord, and Twitter.

Q: What trading platform does 4e provide?

A: 4e has its proprietary trading platform, offering real-time quotations, multiple asset options, price alerts, stock data, and seamless deposit and withdrawal within a single app.

Q: Does 4e provide educational resources?

A: Yes, 4e offers a Tutorial Center with educational materials covering various aspects of trading, including forex, stocks, cryptocurrencies, and more.

WikiFX Broker

Latest News

New AI laws to arrest deepfakes

Global Macro: Real Wage Growth Expected to Return by 2026

XAU/USD: Gold Rally Signals 'Paradigm Shift' as Middle East Tensions Simmer

BoC Preview: Macklem to Hold at 2.25% Amidst Trade Anxiety

MONAXA Review 2026: Comprehensive Safety Assessment

Fed Holds Rates as Political Storm Intensifies; Trump to Name New Chair Imminently

Gold Smashes $5,600 Record on Shutdown Fears; Analysts Flash Crash Warning for Silver

FxPro Enhances MetaTrader 5 Execution with New LD4 Cross-Connect

Meta and Samsung Fuel AI Capex Boom, Keeping Risk Sentiment Alive

Fed Holds Rates Amidst Political Siege; Dollar Sinks to Four-Year Lows

Rate Calc