MHMarkets:The US dollar retreated after breaking the upper limit, non US currencies and precious metals were stronger within the day, and U.S. crude oil tested strong pressure at the monthly level!

Abstract:The gold market surged during Friday's trading session following the release of the non-farm payrolls report. This development provides valuable insights into underlying inflation trends. Keeping an eye on average hourly wages in the U.S. can reveal important indicators of inflation dynamics.

Market Overview

The gold market surged during Friday's trading session following the release of the non-farm payrolls report. This development provides valuable insights into underlying inflation trends. Keeping an eye on average hourly wages in the U.S. can reveal important indicators of inflation dynamics.

Falling incomes may amplify inflationary claims, especially if job creation exceeds initial expectations. This combination could strengthen the Fed's case for “soft cuts” that reduce inflation without affecting the labor market.

It is worth noting that while this approach is unprecedented, there has been significant volatility in recent economic trends. However, we saw a marked change in the final hours of the day and expect more volatility ahead.

OPEC+'s months-long efforts to reduce supply dominated the spot market, while China showed a new determination to boost its economy, which is a key engine of global crude oil consumption, and international oil prices subsequently soared. Last Friday (September 1), international oil prices soared nearly 3%, with U.S. crude standing at the $85 per barrel mark and Brent crude reaching above $88 per barrel.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on September 4, Beijing time.

·Gold XAUUSD· | |

High Probability Scenario | High throw and low suction in the 1903-1919-1931-1945-1951-1960-1977 range |

Low Probability Scenario | Chase up and kill down outside the 1903-1919-1931-1945-1951-1960-1977 range |

Intraday Oscillation Range: 1903-1919-1931-1945-1951-1960-1977 Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1892-1903-1919-1931-1945-1951-1960-1977-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100 In the subsequent period of spot gold, 1903-1919-1931-1945-1951-1960-1977 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range! Note: The above strategy was updated at 15:00 on September 4. This policy is a daytime policy. Please pay attention to the policy release time. | |

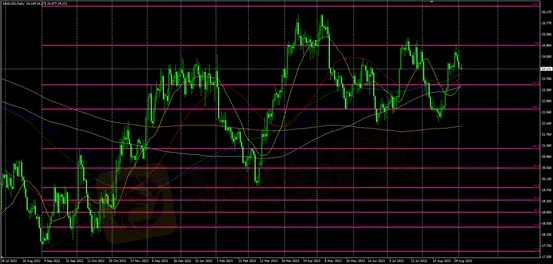

·SilverXAGUSD· | |

High Probability Scenario | High throw and low suction in the 23.1-23.9-24.5-25.3-26.1 range |

Low Probability Scenario | Chase up and kill down outside the 23.1-23.9-24.5-25.3-26.1 range |

Intraday Oscillation Range: 23.1-23.9-24.5-25.3-26.1 Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3 In the subsequent period of spot silver, 23.1-23.9-24.5-25.3-26.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range! Note: The above strategy was updated at 15:00 on September 4. This policy is a daytime policy. Please pay attention to the policy release time. | |

·Crude OilUSOUSD· | |

High Probability Scenario | High throw and low suction in the 79.9-80.7-82.3-83.5-85.3-87.3-89.1 range |

Low Probability Scenario | Chase up and kill down outside the 79.9-80.7-82.3-83.5-85.3-87.3-89.1 range |

Intraday Oscillation Range: 79.9-80.7-82.3-83.5-85.3-87.3-89.1 Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1-90.7 In the subsequent period of crude oil, 79.9-80.7-82.3-83.5-85.3-87.3-89.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range! Note: The above strategy was updated at 15:00 on September 4. This policy is a daytime policy. Please pay attention to the policy release time. | |

·EURUSD· | |

High Probability Scenario | High throw and low suction in the 1.0690-1.0755-1.0830-1.0950-1.1157 range |

Low Probability Scenario | Chase up and kill down outside the 1.0690-1.0755-1.0830-1.0950-1.1157range |

Intraday Oscillation Range:1.0690-1.0755-1.0830-1.0950-1.1157 Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303-1.13340 In the subsequent period of EURUSD, 1.0690-1.0755-1.0830-1.0950-1.1157 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range! Note: The above strategy was updated at 15:00 on September 4. This policy is a daytime policy. Please pay attention to the policy release time. | |

·GBPUSD· | |

High Probability Scenario | High throw and low suction in the 1.2470-1.25460-1.26505-1.27000-1.28200-1.29300 range |

Low Probability Scenario | Chase up and kill down outside the 1.2470-1.25460-1.26505-1.27000-1.28200-1.29300 range |

Intraday Oscillation Range:1.2470-1.25460-1.26505-1.27000-1.28200-1.29300 Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600-1.31000-1.31660-132000 In the subsequent period of GBPUSD, 1.2470-1.25460-1.26505-1.27000-1.28200-1.29300 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range! Note: The above strategy was updated at 15:00 on September 4. This policy is a daytime policy. Please pay attention to the policy release time. | |

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

Spring Rally in Chinese Equities Signals Potential Lift for AUS and NZD

Ringgit hits five-year high against US dollar in holiday trade

Commodities: Gold Targets $5,000 as Central Banks Buying Spree Meet Geopolitical Shocks

Forex vs. Stocks vs. Futures: Which Market Fits Your Wallet?

Transatlantic Rift: Visa Wars and Tech Tariffs Threaten EUR/USD

JPY Alert: Bond Yields Hit 29-Year High as Market Challenges BOJ

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

US Banking Giants Add $600B in Value as Deregulation Widens Gap with Europe

Markets Wrap: Gold and Equities Surge to Records as Holiday Liquidity Thinness Rattles Speculative A

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Rate Calc