MHMarkets:The dollar rose slightly, the euro was significantly weak, and US crude oil continued to weaken!

Abstract:Spot gold rose slightly in Asia on Wednesday (August 23), trading near $1,902.74 / oz ahead of the Jackson Hole annual meeting. The market is in a more bearish mood, with the dollar index and Treasury yields falling, with the dollar index moving away from a near 2-1/2-month high and the 10-year Treasury yield moving away from a near 16-year high hit on Tuesday, providing support for gold. Gold was also supported by some bargain hunting after it stabilized below 1,890.

Market Overview

Spot gold rose slightly in Asia on Wednesday (August 23), trading near $1,902.74 / oz ahead of the Jackson Hole annual meeting. The market is in a more bearish mood, with the dollar index and Treasury yields falling, with the dollar index moving away from a near 2-1/2-month high and the 10-year Treasury yield moving away from a near 16-year high hit on Tuesday, providing support for gold. Gold was also supported by some bargain hunting after it stabilized below 1,890.

This trading day will usher in the PMI data of European and American countries in August, the market is expected to be generally lower than the 50 line between expansion and contraction, investors need to pay attention. Also, watch for the performance of the seasonally adjusted annualized total of new home sales in the US in July.

U.S. crude traded near $79.50 a barrel; Oil prices fell more than 1.5% on Tuesday as investors remained concerned about weakening demand and the odds the Federal Reserve will hold interest rates steady in September declined, capping gains despite a smaller-than-expected drop in U.S. inventories on the morning API.

The day focuses on the USD Building Permits MOM 2nd Est (JUL) and USD EIA Crude Oil Stocks Change (AUG/18).

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on August 23, Beijing time.

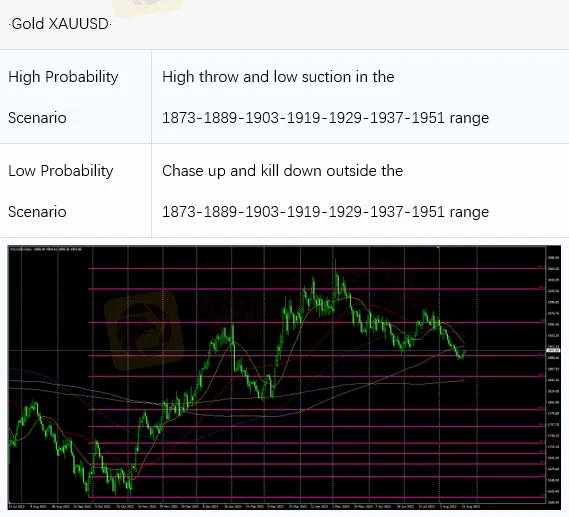

Intraday Oscillation Range: 1873-1889-1903-1919-1929-1937-1951

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1919-1929-1937-1951-1960-1977-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1873-1889-1903-1919-1929-1937-1951 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 23. This policy is a daytime policy. Please pay attention to the policy release time.

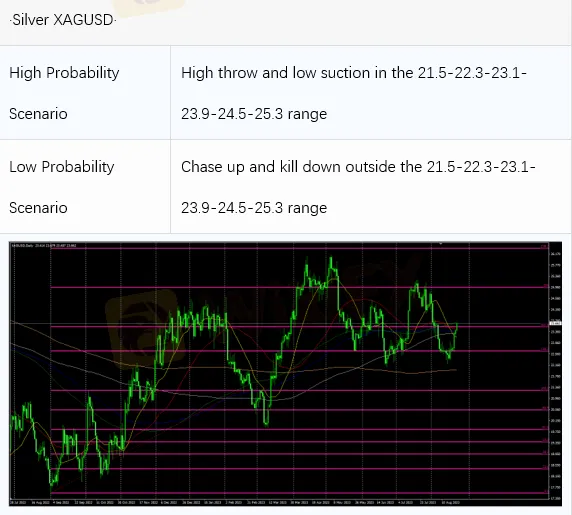

Intraday Oscillation Range: 21.5-22.3-23.1-23.9-24.5-25.3

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 21.5-22.3-23.1-23.9-24.5-25.3 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 23. This policy is a daytime policy. Please pay attention to the policy release time.

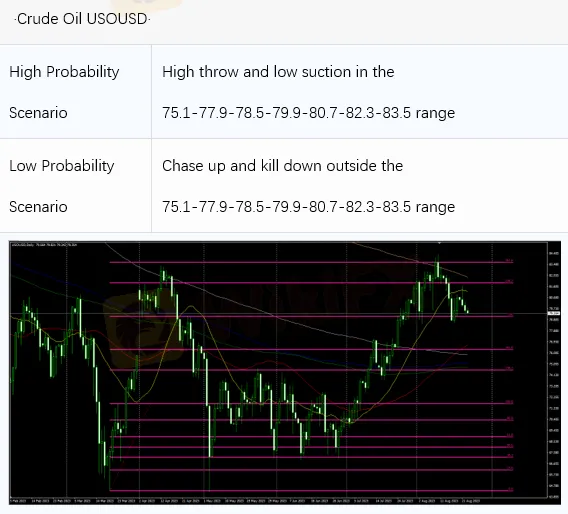

Intraday Oscillation Range: 75.1-77.9-78.5-79.9-80.7-82.3-83.5

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1-90.7

In the subsequent period of crude oil, 75.1-77.9-78.5-79.9-80.7-82.3-83.5 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 23. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.0690-1.0755-1.0830-1.0950-1.1157

Overall Oscillation Range:

1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303-1.13340

In the subsequent period of EURUSD, 1.0690-1.0755-1.0830-1.0950-1.1157can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 23. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.25460-1.26505-1.27000-1.28200-1.29300

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600-1.31000-1.31660-132000

In the subsequent period of GBPUSD, 1.25460-1.26505-1.27000-1.28200-1.29300 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 23. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

FX SmartBull Regulation: Understanding Their Licenses and Company Information

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Neptune Securities Exposure: Real Forex Scam Warnings

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

Rate Calc