BREAKING: Inveslo Deleted the Investor’s Entire Earnings and Closed the Accounts' Trading Authority.

Abstract:Inveslo is an online forex broker that recently caught our eye. Why? One trader named Serdar told WikiFX that he started a mutual agreement with Inveslo. However, according to the victim, Inveslo deleted the investor’s profits and accused Inveslo of not complying with the contract. This article delves into the details of Serdar's case and raises questions about the practices of Inveslo.

About WikiFX

WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 45,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

About Inveslo

Inveslo is registered in Kazakhstan. According to Inveslos website, Inveslo claims to provide an extraordinary trading environment for exceptional traders. Dive into the financial world and trade – Forex, Stocks CFDs, Spot Metals, CFD Indices, Spot Energies & Cryptocurrencies.

Is it Legit?

According to WikiFX, this broker does not hold a legitimate license, which means Inveslo is an unregulated broker. Investing in an unlicensed broker is very dangerous as no one can hold it accountable if something goes wrong. In addition, WikiFX has given this broker a fairly low score of 1.36/10. Be aware of the risk!

Case Description

One trader named Serdar has come forward with claims that Inveslo not only deleted his hard-earned profits but also revoked his trading authority.

Serdar embarked on a trading journey with Inveslo under the terms of a mutual agreement. Unfortunately, his experience turned into a nightmare as his allegations suggest a breach of contract. According to this trader, he had shared the details of the agreement, which outlined specific conditions for trading and profit withdrawal. However, he claims that Inveslo deviated from these terms, leading to a cascade of distressing events.

One of the most alarming accusations leveled against Inveslo is the premature deletion of Taşdelen's profits. Contrary to the stipulations in the contract, the company allegedly wiped out his earnings before the specified date. Additionally, the company reportedly suspended the trading authority of the trader's account, preventing him from executing trades that could have helped him meet the terms of the contract.

There is More to Concern

Serdar's case takes a perplexing turn when he claims that Inveslo accused him of non-compliance with the contract. Despite his efforts to reach a resolution and his adherence to the contractual provisions, Serdar asserts that the company's communication revealed a lack of understanding and transparency. The alleged deletion of his earnings, he insists, was entirely unwarranted and not in line with the agreed-upon terms.

The heart of the issue lies in the substantial sum of $7,500 that the trader alleges was deleted from his trading account. Adding to the complexity, he claims that a $500 credit was applied against his deleted earnings. This raises significant concerns about Inveslo's practices and prompts broader questions about its treatment of traders' funds and financial transactions.

Conclusion

The allegations brought forth by Serdar shed light on the potential pitfalls that traders may encounter in the forex trading realm. The Inveslo case serves as a reminder that diligence and research are crucial when selecting a forex broker. It also emphasizes the need for the forex trading industry to maintain transparency, ethical practices, and open lines of communication between brokers and traders.

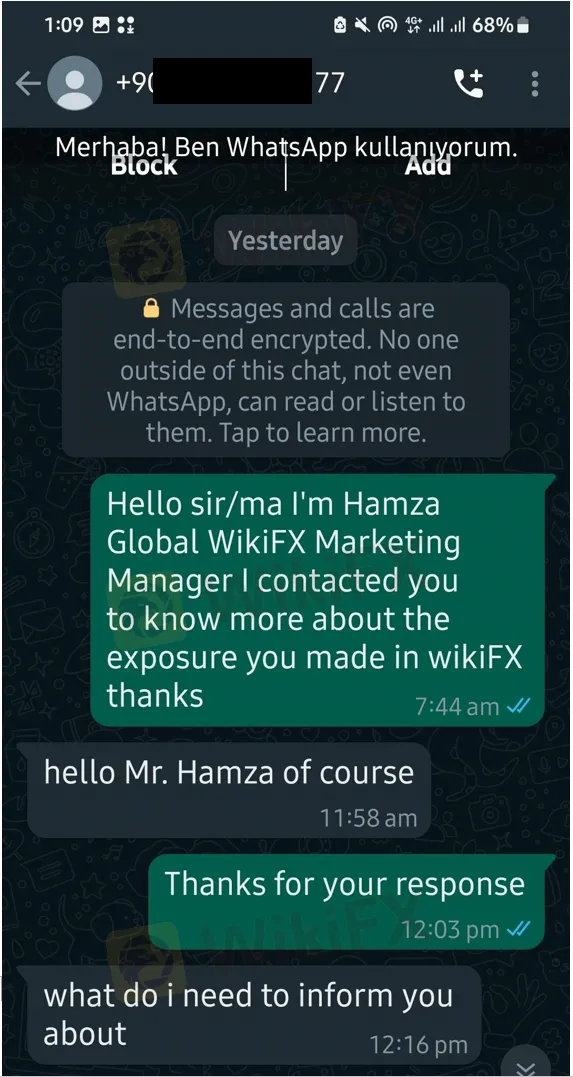

Investing in a broker with a low WikiFX score is very risky. WikiFX is actively reaching out to the victim and other traders hoping to find more evidence to help resolve the problem.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFX official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html).

Read more

Check Yourself: The Costly Trading Habits Every Trader Must Fix

Are the trading habits you barely notice the very ones quietly destroying your profits, and could a single overlooked mistake be costing you far more than you realise?

Scandinavian Capital Markets Exposed: Traders Cry Foul Play Over Trade Manipulation & Fund Scams

Does Scandinavian Capital Markets stipulate heavy margin requirements to keep you out of positions? Have you been deceived by their price manipulation tactic? Have you lost all your investments as the broker did not have risk management in place? Were you persuaded to bet on too risky and scam-ridden instruments by the broker officials? These are some burning issues traders face here. In this Scandinavian Capital Markets review guide, we have discussed these issues. Read on to explore them.

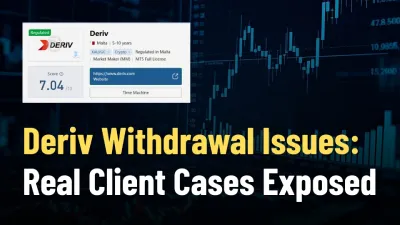

Deriv Withdrawal Issues: Real Client Cases Exposed

Deriv exposed via client cases of withdrawal issues, 13‑month refund delays, severe slippage, and disabled accounts despite multiple “regulated” licenses.

Uniglobe Markets Deposits and Withdrawals Explained: A Data-Driven Analysis for Traders

For any experienced trader, the integrity of a broker isn't just measured in pips and spreads; it's fundamentally defined by the reliability and transparency of its financial operations. The ability to deposit and, more importantly, withdraw capital seamlessly is the bedrock of trust between a trader and their brokerage. When this process is fraught with delays, ambiguity, or outright failure, it undermines the entire trading relationship. This in-depth analysis focuses on Uniglobe Markets, a broker that has been operational for 5-10 years and presents itself as a world-class trading partner. We will move beyond the marketing claims to scrutinize the realities of its funding mechanisms. By examining available data on Uniglobe Markets deposits and withdrawals, we aim to provide a clear, evidence-based picture for traders evaluating this broker for long-term engagement. Our investigation will be anchored primarily in verified records and user exposure reports to explain the Uniglobe Mar

WikiFX Broker

Latest News

Gratitude Beyond Borders: WikiFX Thank You This Thanksgiving

MH Markets Commission Fees and Spreads Analysis: A Data-Driven Breakdown for Traders

Alpha FX Allegations: Traders Claim Account Blocks, Withdrawal Denials and Security Breaches

How to Become a Profitable Forex Trader in Pakistan in 2025

CFTC Polymarket Approval Signals U.S. Relaunch 2025

Zipphy Exposed: No Valid Regulation, Risk Warning

KEY TO MARKETS Review: Are Traders Facing Withdrawal Delays, Deposit Issues & Trade Manipulation?

FCA Consumer Warning – FCA Warning List 2025

Australia’s Fraud-Intel Network Exposes $60M in Scams

RM104.9 Million Gone: Why Hundreds Are Demanding a Full MACC Investigation

Rate Calc