Global Market Index

Abstract:Global Market Index Limited is an unregulated company based in the United Kingdom, established within the past year. They offer a range of market instruments, including stocks, indices, forex, commodities, and cryptocurrencies, with leverage options of up to 1:1000 for VIP accounts and up to 1:500 for Standard and Islamic accounts. Customers can choose from three account types: Standard, VIP, and Islamic, with minimum deposits of $100 for Standard and Islamic accounts and $10,000 for VIP accounts. The company provides customer support through phone and email channels, and their trading platform is MetaTrader 4. Deposit and withdrawal methods include bank wire, credit/debit cards (for deposits only), and Skrill. It is noteworthy that Global Market Index Limited does not have a website.

| Key Information | Details |

| Company Name | Global Market Index Limited |

| Years of Establishment | Within 1 year |

| Headquarters | United Kingdom |

| Office Locations | N/A |

| Regulation | Unregulated |

| Tradable Assets | Stocks, Indices, Forex, Commodities, Cryptocurrency |

| Account Types | Standard, VIP, Islamic |

| Fees | Swap Fees |

| Minimum Deposit | $100 |

| Leverage | Up to 1:1000 |

| Spread | As low as 0.1 pips |

| Deposit/Withdrawal Methods | Bank wire, credit/debit card (deposit only), Skrill |

| Trading Platforms | MetaTrader 4 |

| Customer Support | Phone, Email |

Overview of Global Market Index

Global Market Index Limited is an unregulated company based in the United Kingdom, established within the past year. They offer a range of market instruments, including stocks, indices, forex, commodities, and cryptocurrencies, with leverage options of up to 1:1000 for VIP accounts and up to 1:500 for Standard and Islamic accounts. Customers can choose from three account types: Standard, VIP, and Islamic, with minimum deposits of $100 for Standard and Islamic accounts and $10,000 for VIP accounts. The company provides customer support through phone and email channels, and their trading platform is MetaTrader 4. Deposit and withdrawal methods include bank wire, credit/debit cards (for deposits only), and Skrill. It is noteworthy that Global Market Index Limited does not have a website.

Regulation

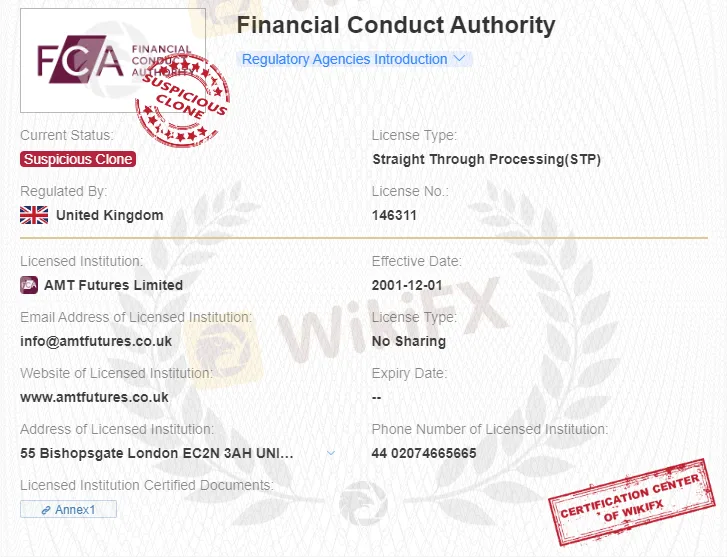

The Financial Conduct Authority (FCA) has labeled Global Market Index Limited as a suspicious clone, meaning that Global Market Index is unregulated. This designation implies that the company is suspected of being a scam or operating fraudulently. The FCA has not granted this company any license status, which raises concerns about its legitimacy and regulatory compliance.

A clone status, as defined by the FCA, refers to an unauthorized entity that imitates a legitimate financial firm, such as Global Market Index Limited, to deceive investors and gain their trust. These clones may use the names, registration numbers, and other details of genuine companies to appear credible. However, they lack proper authorization from the regulator and operate outside the oversight that licensed companies adhere to.

Pros and Cons

Global Market Index Limited offers a wide range of market instruments, including stocks, indices, forex, commodities, and cryptocurrencies, catering to diverse investment preferences. They provide competitive leverage options of up to 1:1000, allowing traders to maximize their trading potential. The absence of commissions on trades can be advantageous for cost-conscious investors. Additionally, the availability of an Islamic account with no swap fees may attract traders adhering to Sharia principles.

One significant drawback of Global Market Index Limited is its unregulated status, which raises concerns about the company's credibility and regulatory compliance. The lack of a website renders potential traders unable to access crucial information, hindering their ability to make informed decisions. Moreover, the absence of office locations and limited customer support channels may affect communication and responsiveness. The company's minimum deposit requirement of $10,000 for VIP accounts may be restrictive for some investors, limiting accessibility to premium account benefits.

| Pros | Cons |

| Diverse market instruments | Unregulated status |

| Competitive leverage | Inaccessible website |

| Commission-free trading | Limited customer support |

| Islamic account option | High minimum deposit for VIP accounts |

Inaccessible Website

Global Market Index Limited's lack of a website renders it inaccessible to potential traders. The absence of a functional website raises concerns about the company's credibility and transparency. Without a website, traders cannot access essential information about the company, its services, account types, trading conditions, or other vital details that would typically be available for review. Consequently, potential traders are unable to create a trading account with this company and may find it challenging to make informed decisions about their investments.

Market Instruments

Global Market Index Limited offers a similar set of market instruments to its competitors, including stocks, indices, forex, commodities, and cryptocurrencies. Details are as shown:

Stocks: Global Market Index Limited provides a range of stocks, including well-known companies like Facebook (FB) and Alphabet Inc. (GOOGL), enabling investors to participate in the equity markets of various companies.

Indices: Global Market Index Limited offers indices trading, allowing traders to speculate on the performance of major stock market indices.

Forex: Global Market Index Limited facilitates forex trading, allowing traders to engage in currency pairs such as EUR/USD and USD/JPY, and take advantage of currency fluctuations in the global market.

Commodities: Global Market Index Limited allows trading in commodities, including precious metals like gold, energies, and agricultural products, enabling investors to participate in the price movements of these assets.

Cryptocurrency: Global Market Index Limited includes cryptocurrencies like Bitcoin in its market instruments, giving traders the opportunity to trade digital currencies.

The following is a table that compares Global Market Index Limited to competing brokerages:

| Broker | Market Instruments |

| Global Market Index Limited | Stocks, Indices, Forex, Commodities, Cryptocurrencies |

| OctaFX | Stocks, Indices, Forex, Commodities, Cryptocurrencies |

| FXCC | Stocks, Indices, Forex, Commodities, Cryptocurrencies |

| Tickmill | Stocks, Indices, Forex, Commodities |

| FxPro | Stocks, Indices, Forex, Commodities |

Account Types

Global Market Index Limited offers three account types: Standard, VIP, and Islamic. Specifics are as follows:

Standard Account: Global Market Index Limited offers a Standard Account with a minimum deposit of $100. Traders can access leverage of up to 1:500 and benefit from spreads starting from 0.3 pips. The Standard Account has no commissions on trades but does incur swap fees.

VIP Account: Global Market Index Limited provides a VIP Account option with a higher minimum deposit requirement of $10,000. Traders under this account can access leverage of up to 1:1000 and enjoy tighter spreads starting from 0.1 pips. Similar to the Standard Account, the VIP Account also has no commissions on trades but may incur swap fees.

Islamic Account: Global Market Index Limited offers an Islamic Account for traders adhering to Sharia principles. This account requires a minimum deposit of $100 and provides leverage of up to 1:500. The spreads start from 0.3 pips, and unlike the other accounts, there are no swap fees for the Islamic Account.

The specifics of the account types are as follows:

| Account | Minimum Deposit | Leverage | Spreads | Swap Fees |

| Standard | $100 | Up to 1:500 | From 0.3 pips | Yes |

| VIP | $10,000 | Up to 1:1000 | From 0.1 pips | Yes |

| Islamic | $100 | Up to 1:500 | From 0.3 pips | No |

Swap Fees

Swap fees at Global Market Index Limited are charged for holding positions overnight, and they vary based on the asset being traded and the direction of the trade (long or short). For example, for the EUR/USD currency pair, the swap fee is -2.50 pips/day for long positions and 2.50 pips/day for short positions. For USD/JPY, the swap fee is -0.75 pips/day for long positions and 0.75 pips/day for short positions. For GBP/USD, it is -1.50 pips/day for long positions and 1.50 pips/day for short positions. And for AUD/USD, the swap fee is -1.00 pips/day for long positions and 1.00 pips/day for short positions.

| Asset | Long Swap Fee (pips/day) | Short Swap Fee (pips/day) |

| EUR/USD | -2.5 | 2.5 |

| USD/JPY | -0.75 | 0.75 |

| GBP/USD | -1.5 | 1.5 |

| AUD/USD | -1 | 1 |

Minimum Deposit

Global Market Index Limited offers different minimum deposit rates for its account types. The Standard and Islamic accounts require a minimum deposit of $100, while the VIP account has a higher minimum deposit requirement of $10,000. These varying deposit rates cater to traders with different investment preferences and risk tolerances, providing accessibility to a wider range of clients.

Leverage

Global Market Index Limited provides competitive leverage options for its traders. The maximum leverage offered by the company varies based on the account type and market instrument. Traders with a Standard or Islamic account can access leverage of up to 1:500 for forex trading and up to 1:20 for stocks. For indices, the leverage goes up to 1:200, while for commodities, it is up to 1:100. The VIP account offers higher leverage of up to 1:1000 for forex trading. It is important for traders to carefully consider their risk appetite and trading strategy when utilizing leverage, as higher leverage can amplify both potential gains and losses.

| Market Instrument | Global Market Index Limited | OctaFX | FXCC | Tickmill | FxPro |

| Forex | Up to 1:500 | 1:500 | 1:500 | 1:500 | 1:500 |

| Indices | Up to 1:200 | 1:500 | 1:500 | 1:500 | 1:500 |

| Commodities | Up to 1:100 | 1:125 | 1:500 | 1:500 | 1:125 |

| Stocks | Up to 1:20 | 1:20 | 1:500 | 1:500 | 1:10 |

| Cryptocurrencies | Up to 1:50 | 1:02 | 1:10 | 1:500 | 1:05 |

Spread

Global Market Index Limited offers varying spreads for different market instruments. For the Standard and Islamic accounts, the spreads start from 0.3 pips, while the VIP account offers tighter spreads starting from 0.1 pips. The spreads are an important factor to consider for traders as they impact the cost of trading. A lower spread can be advantageous for traders as it reduces the cost of executing trades, allowing them to retain more potential profits. However, it is essential for traders to carefully assess the spread and other trading conditions to ensure they align with their trading strategies and objectives.

Deposit & Withdrawal

Global Market Index Limited offers several deposit and withdrawal methods for its clients. Traders can fund their accounts through bank wire, credit/debit cards (for deposits only), and Skrill. Bank wire transfers provide a secure and direct way to transfer funds to and from the trading account. Credit/debit cards offer a convenient option for depositing funds, but they are limited to deposits only and cannot be used for withdrawals. Skrill, an online payment platform, allows for quick and efficient fund transfers.

Trading Platforms

Global Market Index Limited provides traders with the MetaTrader 4 trading platform. MetaTrader 4 is a widely used and well-established platform in the financial industry, known for its user-friendly interface, advanced charting tools, and customizable features. Traders can access a range of technical indicators and expert advisors to enhance their trading strategies. The platform also offers real-time market data and allows for one-click trading execution.

The following is a table that compares Global Market Index Limited to competing brokerages:

| Broker | Trading Platforms |

| Global Market Index Limited | MetaTrader 4 |

| OctaFX | MetaTrader 4, MetaTrader 5 |

| FXCC | MetaTrader 4 |

| Tickmill | MetaTrader 4, MetaTrader 5 |

| FxPro | MetaTrader 4, MetaTrader 5 |

Customer Support

Global Market Index Limited provides two main customer support options, phone support, and email support.

Phone Support: Global Market Index Limited offers phone support for its customers. Traders can reach customer support by calling the provided phone number: +44 (0) 74 8072 3851.

Email Support: Customer support can also be contacted through email. Traders can reach out to the email: support@gmigldfx.com.

Conclusion

Global Market Index Limited, an unregulated brokerage established within the past year, offers a selection of market instruments, including stocks, indices, forex, commodities, and cryptocurrencies. Traders can choose from three account types, each with different features such as leverage, spreads, and minimum deposits. With accounts offering leverages of up to 1:1000, clients can utilize the MetaTrader 4 trading platform for their transactions.

On the downside the lack of a website could limit access to crucial information and transparency. While the absence of commissions on trades is advantageous, traders should be mindful of swap fees. Additionally, the VIP account's high minimum deposit requirement of $10,000 might be restrictive for some investors.

FAQs

Q: What market instruments does Global Market Index Limited offer?

A: Global Market Index Limited offers a variety of market instruments, including stocks, indices, forex, commodities, and cryptocurrencies.

Q: How many account types are available at Global Market Index Limited?

A: Global Market Index Limited provides three account types: Standard, VIP, and Islamic.

Q: What is the leverage range for account types?

A: The leverage options vary between account types, with up to 1:1000 for VIP and up to 1:500 for Standard and Islamic.

Q: Does Global Market Index Limited have a website?

A: No, Global Market Index Limited does not have a website available.

Q: How can traders reach customer support?

A: Traders can reach customer support through phone and email channels.

Q: Is Global Market Index Limited regulated?

A: No, Global Market Index Limited is an unregulated brokerage.

WikiFX Broker

Latest News

Gold Cements Historic 66% Gain as Silver Supply Crunch Looms for 2026

2025 Global Economic Year in Review: How Tariffs and AI Rewrote the Playbook

US Dollar on Edge: Fed Minutes and Trump Attacks Rattling Central Bank Independence

Gold and Silver Plummet from Record Highs as Profit-Taking Sweeps the Market

WM Markets Review (2025): Is this Broker Safe or a Scam?

It’s a Scam, Not Romance: How This Woman Lost US$1 Million

Crude Oil Surges as US Strikes Venezuela Facility and Ukraine Talks Stall

He Thought He Was Investing BUT US$500,000 Disappeared!

Forex Daily: USD/JPY and AUD/USD Falter as Year-End Liquidity Thins

Fed Watch: Powell Sounds Alarm on "Excessive" Valuations

Rate Calc