Mai hui MHmarkets: July 27, 2023-MHM European Perspective

Abstract:Spot gold traded near $1,976.08 an ounce in Asia on Thursday(JUL/27), as investors digested fairly balanced remarks from Fed Chair Powell and expectations that the Fed's cycle of rate hikes may be over. The dollar index briefly hit a more than one-week low. Helped gold hit a near one-week high of $1,981.91 an ounce. But fears of a U.S. recession have also cooled, with the Congressional Budget Office on Wednesday sharply raising its 2023 growth forecast, still giving gold bulls pause.

Market Overview

Spot gold traded near $1,976.08 an ounce in Asia on Thursday(JUL/27), as investors digested fairly balanced remarks from Fed Chair Powell and expectations that the Fed's cycle of rate hikes may be over. The dollar index briefly hit a more than one-week low. Helped gold hit a near one-week high of $1,981.91 an ounce. But fears of a U.S. recession have also cooled, with the Congressional Budget Office on Wednesday sharply raising its 2023 growth forecast, still giving gold bulls pause.

Us crude oil is trading around $79.26 a barrel in a volatile rally. Bulls have been buoyed by expectations of tighter supply and stronger demand from China, even as the Fed's 25 basis point rate hike, which could slow economic growth and reduce oil demand, and a smaller-than-expected drop in US crude inventories have kept prices under pressure in the round 80s. The oil market is still bullish in the short term and is expected to break resistance around the 80 mark upward.

Plus, the Congressional Budget Office on Wednesday sharply raised its 2023 U.S. economic growth forecast. This factor also tends to support oil prices.

With the Fed's move expected, market focus shifted to OPEC+, which will hold its monthly Joint Ministerial Monitoring Committee (JMMC) meeting next week, analysts noted. The committee's outlook on demand will be key to Saudi Arabia's decision on whether to extend voluntary cuts of 1 million barrels a day into September.

On alert, three industry sources said Russia would sharply increase its oil export shipments in September, ending a sharp drop in exports from June to August, as refineries are at their peak for maintenance, freeing up more crude to sell abroad. This is also shown by Reuters calculations based on refining data.

This trading day will also usher in the EUR ECB Interest Rate Decision, the USD GDP Data(Q2), as well as the USD Initial Jobless Claims change and the USD Durable Goods Orders(JUN), which are relatively influential in the market and investors need to focus on. In addition, the USD Wholesale Inventories MoM Prel(JUN) and theUSD Pending Home Sales MoM s.a(JUN)also need to be briefly noted.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on July 27, Beijing time.

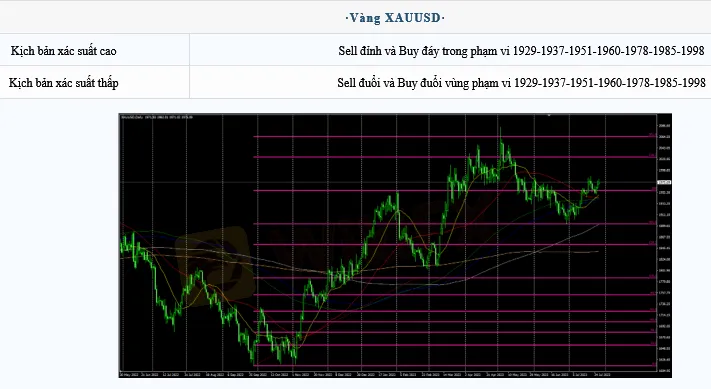

Phạm vi dao động trong ngày: 1929-1937-1951-1960-1978-1985-1998

Phạm vi dao động tổng thể: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

Trong giai đoạn tiếp theo của giá vàng giao ngay (spot gold), 1929-1937-1951-1960-1978-1985-1998 có thể có thể rơi vào vùng bò và gấu; Sell đỉnh và Buy đáy trong phạm vi, Sell đuổi và Buy đuổi vùng ngoài phạm vi!

Lưu ý: Chiến lược trên được cập nhật lúc 15:00 ngày 27/07/2023. Chiến lược này là chiến lược ngày, vui lòng chú ý đến thời gian phát hành chiến lược.

Intraday Oscillation Range: 23.1-23.9-24.5-25.3-26.1

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 23.1-23.9-24.5-25.3-26.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 27. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of crude oil, 73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 27. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0830-1.0950-1.1157-1.1220-1.1303

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303-1.13340

In the subsequent period of EURUSD, 1.0830-1.0950-1.1157-1.1220-1.1303can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 27. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.27000-1.28200-1.29300-1.30000-1.30600

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600-1.31000-1.31660-132000

In the subsequent period of GBPUSD, 1.27000-1.28200-1.29300-1.30000-1.30600 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 27. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

MultiBank Group — recent exposures, complaints, and who runs the firm

WikiEXPO Global Expert Interview Spyros Ierides:Asset management and investor resilience

US Deficit Explodes In August Despite Rising Tariff Revenues As Government Spending Soars

Dukascopy Issues Fresh Warning on Fraudulent Clone Websites

Thinking of Trading with Darwinex? Read This First!

Top Reasons Why You Should Avoid Trading with B Investor

GMZ Global Exposed: Investors Cry Foul Play as Investment Scams Take Precedence

Glancing at the Top 5 Forex Risk Management Tools

Disadvantages of Investing with Bulenox! Must Read

Malaysian Traders: Stay Away From MTrading!

Rate Calc