Mai hui MHmarkets: July 17, 2023-MHM European Perspective

Abstract:On Monday (July 17), spot gold fluctuated in a narrow range during the Asian session and is currently trading near $1955.20 per ounce. Last Friday's data showed that U.S. consumer confidence jumped to the highest level in nearly two years, the dollar index rebounded from this year's 15-month low near, so that gold prices continue to be pressured by the 55-day average and 1960 mark and other multiple resistance, short-term gold prices face further retracement risk

Market Overview

On Monday (July 17), spot gold fluctuated in a narrow range during the Asian session and is currently trading near $1955.20 per ounce. Last Friday's data showed that U.S. consumer confidence jumped to the highest level in nearly two years, the dollar index rebounded from this year's 15-month low near, so that gold prices continue to be pressured by the 55-day average and 1960 mark and other multiple resistance, short-term gold prices face further retracement risk; but the market is still widely expected that the Fed is close to the end of the tightening cycle, the gold price of the retracement of the space may be limited, the market is still the opportunity for a further move higher.

In addition, China's Q2 GDP data came in weaker than market expectations, which also provided some safe-haven support for gold prices. This trading day need to pay attention to the further impact of the data fermentation.

There is no important economic data during the European and American session, focusing on the G20 finance ministers and central bankers meeting and ECB President Lagarde speech.

U.S. crude oil extended the downtrend on Friday, once refresh the four-day low to $74.31 per barrel. China's Q2 GDP is weaker than the market is expected to suppress the crude oil demand outlook is expected. In addition, Libyan oil fields resumed production over the weekend, increasing supply concerns; in the short term, pay attention to support near 73.52 near the 100 day moving average.

U.S. crude oil last week recorded gains for the third consecutive week, and touched a high since April. Because some Libyan oil fields shut down production, and Shell stopped exporting Nigerian crude oil, resulting in tightening oil market supply.

Of the three fields shut down last Thursday, the Sharara and El Feel fields, with a combined capacity of 370,000 bpd, resumed production on Saturday evening, four Libyan oil engineers and the oil ministry said. The 108 oil fields remain closed.

The scale of Russian oil exports from western ports next month will fall by about 100,000-200,000 bpd from July levels, two sources said on Friday, citing export plans, suggesting that Moscow was making good on its promise to cut production in tandem with major Organization of the Petroleum Exporting Countries (OPEC) nation Saudi Arabia.

Analysts pointed out that on the economic front, stronger-than-expected consumer confidence data released by the U.S. on Friday dampened expectations that the Federal Reserve will end its rate hike cycle at its meeting next week. A rebound in the dollar index also pressured oil prices.

This trading day needs to watch out for further market interpretations of China's economic data, and pay attention to the G20 meeting of finance ministers and central bankers.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on July 17, Beijing time.

Intraday Oscillation Range: 1929-1937-1951-1960-1978-1985-1998

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1960-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1929-1937-1951-1960-1978-1985-1998 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 17. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 23.1-23.9-24.5-25.3-26.1

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 23.1-23.9-24.5-25.3-26.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 17. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 72.3-73.1-73.8-75.1-77.9-78.5-79.9

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of crude oil, 72.3-73.1-73.8-75.1-77.9-78.5-79.9can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 17. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0830-1.0950-1.1157-1.1220-1.1303

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0830-1.0950-1.1157-1.1220-1.1303 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 17. This policy is a daytime policy. Please pay attention to the policy release time.

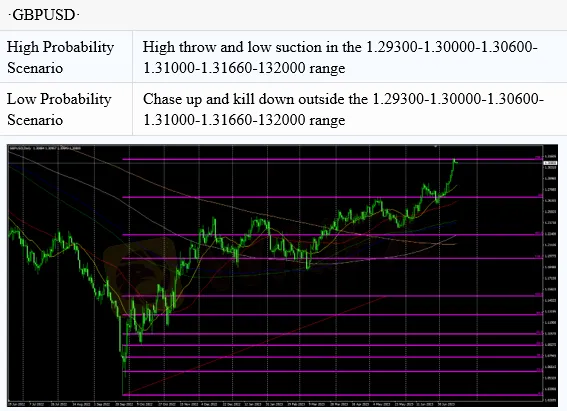

Intraday Oscillation Range: 1.29300-1.30000-1.30600-1.31000-1.31660-132000

Overall Oscillation Range:

1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600-1.31000-1.31660-132000

In the subsequent period of GBPUSD, 1.29300-1.30000-1.30600-1.31000-1.31660-132000 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on July 17. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

CySEC Withdraws CIF License of OBR Investments Ltd (OBRInvest)

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Rate Calc