URUS KIYMETLI Information Revealed

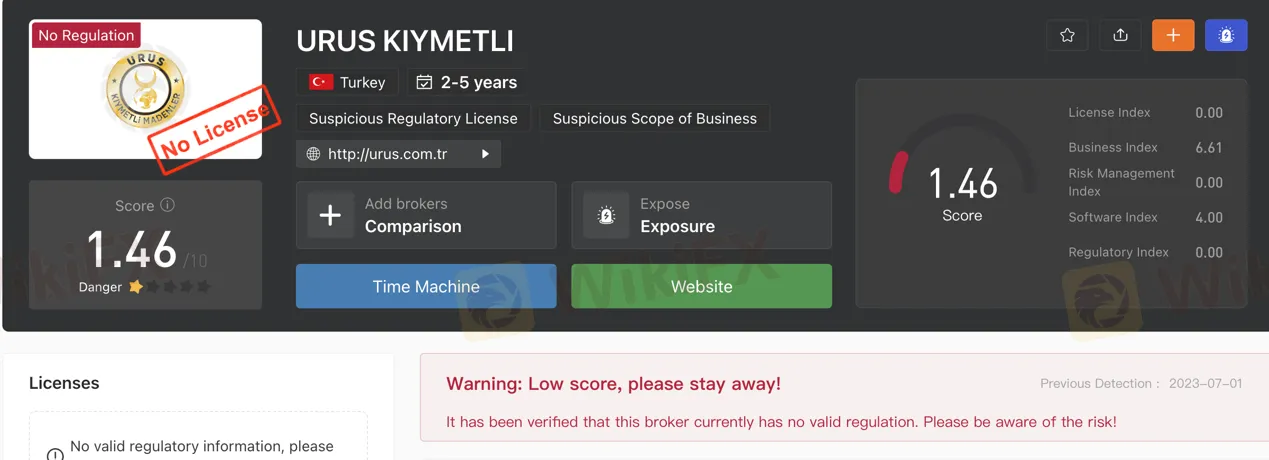

Abstract:URUS KIYMETLI is an unregulated broker based in Turkey that engages in trading precious metals such as gold, silver, platinum, and palladium. They operate without oversight from any independent regulatory body, which poses potential risks for investors. URUS KIYMETLI offers various trapping options and facilitates coal trading. The broker's pricing varies across different products, and they have committed capital of 8,000,000 TL. They provide a trading platform called the URUS Mobile App, which offers real-time prices, portfolio tracking, translation and graph features, and contact access. Customer support is available via telephone and email, but information about their presence on social media platforms is not provided. It is crucial for investors to exercise caution and consider the associated risks before engaging with this broker.

| Aspect | Information |

| Registered Country/Area | Turkey |

| Founded Year | 2-5 years ago |

| Company Name | URUS KIYMETLİ MADENLER TİCARETİ A.Ş. |

| Regulation | Suspicious Regulatory License |

| Capital | 8,000,000 TL |

| Price | Varies for different products |

| Trading Platforms | URUS Mobile App |

| Tradable Assets | Metals (gold, silver, platinum, palladium), TRAPPINGS, COAL, and more |

| Account Types | N/A |

| Customer Support | Telephone: +90 212 527 27 55, Email: info@urus.com.tr, Physical address: Beyazit Mahallesi Aynacılar Sokak No: 27/1, Fatih Istanbul |

Overview of URUS KIYMETLI

URUS KIYMETLI is a broker operating in Turkey that offers trading services for various metals such as gold, silver, platinum, and palladium. However, it is important to note that URUS KIYMETLI lacks valid regulation from any independent regulatory authority, which raises concerns about the transparency and oversight of its operations. Investors should exercise caution and thoroughly assess the associated risks before considering engaging with this broker.

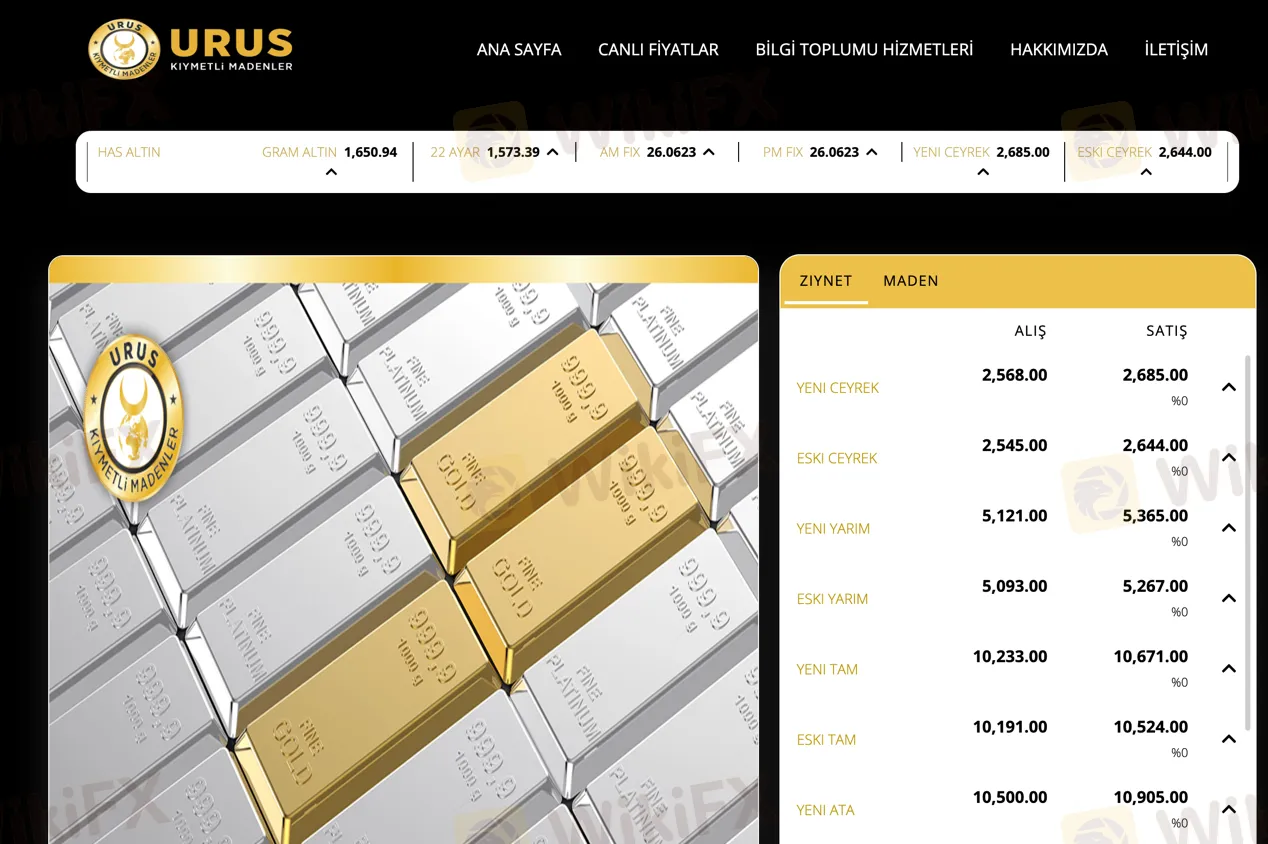

The broker provides different trading options for metals, including trapping options like “NEW QUARTER,” “OLD QUARTER,” and “NEW ATTORNEY,” among others. These options may have varying values and are subject to market fluctuations. Additionally, URUS KIYMETLI facilitates coal trading with options for buying and selling at different prices denoted by categories like “FINE GOLD,” “GRAMS GOLD,” and “22 SETTINGS.”

URUS KIYMETLI offers a trading platform called the URUS Mobile App, which provides real-time prices and portfolio tracking for gold, foreign currency, parity, and jewelry products. The app includes features like Translation for creating parities and comparing exchange rates, a Favorite feature for quick access to preferred products, and a Graph feature for visualizing market trends. However, specific details about the types of accounts offered by the broker are not available, and information about their presence on social media platforms is also limited.

In conclusion, while URUS KIYMETLI provides trading services for metals and offers a mobile app for real-time information and analysis, its lack of independent regulation raises concerns about the transparency and reliability of its operations. Potential investors should carefully evaluate the risks associated with engaging with this broker and seek additional information before making any investment decisions.

Pros and Cons

URUS KIYMETLI has both pros and cons to consider. On the positive side, the broker offers trading opportunities in various precious metals and has a committed capital amount of 8,000,000 TL, which indicates a level of financial stability. They also provide a mobile trading app that offers real-time prices, allowing users to stay updated on market trends. However, there are significant drawbacks to be aware of. The lack of valid regulation raises potential risks for investors, as the company's activities are not overseen by an independent regulatory body. Pricing details vary across products, making it difficult to determine consistent costs. Additionally, specific information about account types is not available, and there is a lack of mentioned trading tools and educational resources, which may limit the overall trading experience.

| Pros | Cons |

| Offers trading opportunities in various precious metals | Lacks valid regulation, raising potential risks for investors |

| Committed capital amount of 8,000,000 TL | Pricing details vary across products |

| Provides a mobile trading app with real-time prices | Specific information about account types is not available |

| Lack of trading tools and educational resources mentioned |

Is URUS KIYMETLI Legit?

URUS KIYMETLI, a broker that one might consider for their investment needs, lacks valid regulation from any third-party authority. This means that the activities and operations of URUS KIYMETLI are not overseen or monitored by an independent regulatory body. Such a lack of regulation poses potential risks for investors. It is essential to exercise caution and carefully consider the associated risks before engaging with this broker.

Market Instruments

URUS KIYMETLI engages in trading various metals, including gold, silver, platinum, and palladium. These metals are traded within the LBMA (London Bullion Market Association) through the Istanbul Gold Exchange (IAB). URUS KIYMETLI provides its clients with the opportunity to participate in the market for these precious metals.

1. TRAPPINGS: URUS KIYMETLI offers various trapping options, such as “NEW QUARTER,” “OLD QUARTER,” “NEW HALF,” “OLD HALF,” “NEW FULL,” “OLD FULL,” “NEW ATTORNEY,” “OLD ATTORNEY,” “NEW ATA5,” and “OLD ATA5.” These trapping options appear to have different values and may be subject to fluctuations in the market.

2. COAL: Within this category, URUS KIYMETLI facilitates the trading of coal, with “BUYING” and “SALES” options available. The coal prices are denoted for different quantities like “FINE GOLD,” “GRAMS GOLD,” “22 SETTINGS,” “AM FIX,” and “PM FIX.”

Pros and Cons

| Pros | Cons |

| Provides its clients with the opportunity to participate in the market for precious metals | Some trapping options may have different values and be subject to fluctuations in the market |

| Trades within the LBMA (London Bullion Market Association) through the Istanbul Gold Exchange (IAB) | Coal prices are denoted for different quantities, which can be confusing for some users |

| Not all trapping options are available in all countries |

Account Types

The broker's official website or other sources do not provide details about the various types of accounts, including their features, benefits, or any specific requirements.

Price

URUS KIYMETLI's pricing varies across different products. For instance, the prices for TRAPPINGS range between 2,568.00 (Buying) to 2,685.00 (Sales). For COAL, the prices stand at 1,592.95 (Buying) and 1,646.04 (Sales). Additionally, URUS KIYMETLI offers various other products like GOLD, ATA5, GREMSE, and more, each with its own respective buying and sales prices. The specific pricing details for each product are outlined in the provided data.

Pros and Cons

| Pros | Cons |

| Prices vary across different products | Prices are not always transparent |

| Specific pricing details are outlined in the provided data | Not all products are available in all countries |

Capital Amount

URUS KIYMETLI has an amount of committed capital totaling 8,000,000 TL. Additionally, the company has paid the full amount of this capital, also amounting to 8,000,000 TL.

Trading Platforms

URUS KIYMETLI offers a trading platform known as the URUS Mobile App. This mobile application provides users with real-time prices of gold, foreign currency, parity, and jewelry products offered by Aifa Global Bilişim Hizmetleri LTD. Users can access their portfolio, which represents the total value of their investment instruments such as cash, foreign currency, gold, and jewelry. This allows users to track their investments, assess profits and losses, and make informed decisions.

The Translation feature within the app enables users to create their own parities and compare current exchange rates. This feature provides accurate information and allows users to analyze different currency pairs. The Favorite feature makes it easier for users to access the currency, gold, parity, and jewelry products they follow.

The Graph feature allows users to enhance their analysis by tracking FX, gold, parity, and jewelry products using graphical representations. This feature aids in visualizing market trends and patterns, supporting users in making informed trading decisions.

The URUS Mobile App also provides contact access, enabling users to find the current location and phone numbers of relevant contacts. Additionally, users have the options to choose between dark or light themes, customizing the app's appearance according to their preferences.

Pros and Cons

| Pros | Cons |

| Real-time prices of gold, foreign currency, parity, and jewelry products | Translation feature may not be accurate for all currency pairs |

| Portfolio feature allows users to track their investments | Favorite feature may not be available for all products |

| Graph feature allows users to track market trends and patterns | Contact access may not be available for all users |

| Dark or light theme option | App may not be available in all countries |

Customer Support

URUS KIYMETLI offers various contact options for customer support. Clients can reach them via telephone at +90 212 527 27 55 or by emailing their inquiries to info@urus.com.tr. The broker's physical address is Beyazit Mahallesi Aynacılar Sokak No: 27/1, Fatih Istanbul. However, it is important to note that specific information regarding their presence on social media platforms like Twitter, Facebook, and Instagram is not available. For further details on their customer support capabilities through social media channels, it is advisable to consult with URUS KIYMETLI directly or seek additional information from independent sources.

Conclusion

In conclusion, URUS KIYMETLI is a broker operating in Turkey that lacks valid regulation from any third-party authority. This absence of oversight exposes potential risks for investors, making it crucial to exercise caution before engaging with this broker. URUS KIYMETLI offers trading opportunities in various metals within the LBMA through the Istanbul Gold Exchange. The broker provides trapping options and facilitates coal trading, but details about account types are not available. Pricing varies across different products, and URUS KIYMETLI has committed capital of 8,000,000 TL. The broker offers the URUS Mobile App as a trading platform, which provides real-time prices, portfolio tracking, analysis features, and contact access. While customer support options are available, information regarding the broker's presence on social media platforms is not provided.

FAQs

Q: Is URUS KIYMETLI a legitimate broker?

A: URUS KIYMETLI lacks valid regulation, posing potential risks for investors.

Q: What market instruments does URUS KIYMETLI trade?

A: URUS KIYMETLI trades precious metals such as gold, silver, platinum, and palladium.

Q: What are the pricing details for URUS KIYMETLI's products?

A: URUS KIYMETLI's pricing varies across different products, with specific details provided in the data.

Q: What trading platform does URUS KIYMETLI offer?

A: URUS KIYMETLI provides the URUS Mobile App for real-time trading and investment tracking.

Q: How can I contact URUS KIYMETLI for customer support?

A: You can contact URUS KIYMETLI by phone or email, but their presence on social media platforms is unclear.

Read more

T4Trade Review 2025: Live & Demo Accounts, Withdrawal to Explore

T4Trade, established in 2021 and regulated by the FSA in the Seychelles, allows trading on a modest portfolio of over 300 instruments, spanning forex, metals, indices, commodities, futures, and shares, all accessible via the popular MetaTrader 4 and their proprietary WebTrader platforms. Notably, T4Trade offers a zero-commissions pricing model where both floating and fixed spreads are offered on its MetaTrader—flexible leverage up to 1000:1 to increase trading flexibility. T4Trade also introduces a copy trading service called “TradeCopier”, which enables traders who lack experience or time to join in the markets by copying the trades of seasoned professionals.

GQFX Trading Review 2025: Read Before You Trade

GQFX Trading review 2025: Unregulated broker with poor ratings. Learn why trading with GQFX is risky and unsafe for your investments.

Oanda Shines As Frop Trading Firm After Being Acquired By FTMO

FTMO enhances prop trading with the OANDA Prop Trader Community and loyalty program, integrating CRM automation and rewards post-acquisition.

Webull: A Comprehensive Review from Accounts to Withdrawal 2025

Webull Financial stands as a digital trading platform founded in 2017, offering commission-free trading across multiple asset classes including stocks, options, ETFs, cryptocurrencies, and forex. The platform targets primarily intermediate traders seeking a balance of analytical tools and straightforward execution capabilities. While Webull provides robust charting tools and an intuitive mobile experience, its forex offering remains at industry average levels with certain limitations in currency pair selection compared to some other forex brokers.

WikiFX Broker

Latest News

2025 SkyLine Guide Thailand Opening Ceremony: Jointly Witnessing New Skyline in a New Chapter

TriumphFX: The Persistent Forex Scam Draining Millions from Malaysians

Safety Alert: FCA Discloses These 11 Unlicensed Financial Websites

Unbelievable! Trump to 'Sell US Green Cards'?

GQFX Trading Review 2025: Read Before You Trade

WikiFX Community Ramadan Charity Creator Program

Massive Crypto Scam in Philippines: Education Pioneer Wealth Society Exposed

Arab Trading Market Stunned by this Scam! Know about it & Beware

Skype announces it will close in May

DOJ Investigates LIBRA Memecoin Scam: $87M Lost by Investors

Rate Calc