Bright Smart Securities

Abstract:BRIGHT, founded in 1994, is a brokerage registered in Hong Kong. The trading instruments it provides cover Stocks, Futures, Options, Forex,Stock. It provides 3 types of accounts and MT4 platform. It is regulated by SFC.

| BRIGHTReview Summary | |

| Founded | 1994 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Stocks, Futures, Options, Forex |

| Account Type | Individual Account, Joint Account, Corporate Account |

| Trading Platform | MT4 Margin WebTrader |

| Min Deposit | $100 |

| Deposit/Withdrawal Methods | Electronic Wire, Sales Hotline, Branches |

| Customer Support | Phone: (852)25301788 |

BRIGHT Information

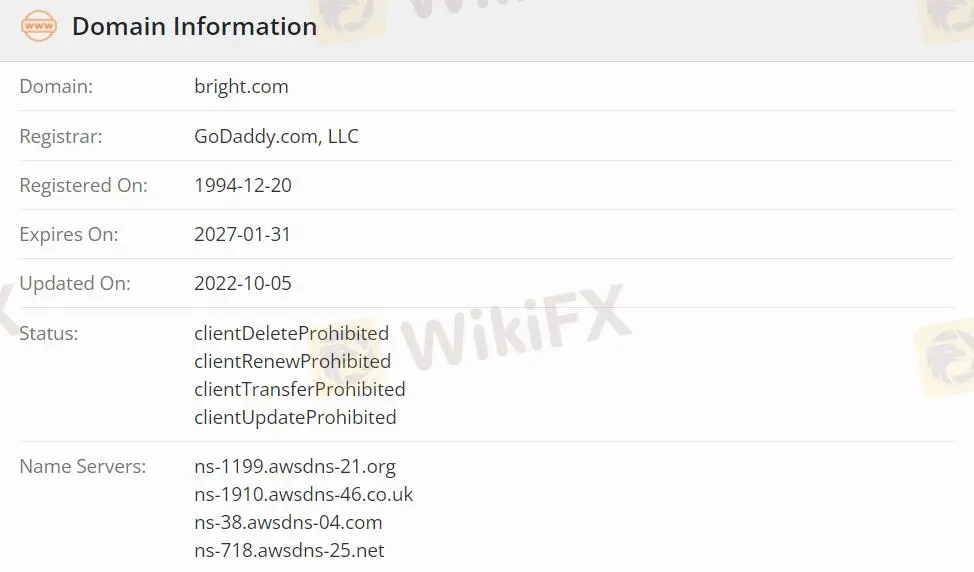

BRIGHT, founded in 1994, is a brokerage registered in Hong Kong. The trading instruments it provides cover Stocks, Futures, Options, Forex,Stock. It provides 3 types of accounts and MT4 platform. It is regulated by SFC.

Pros and Cons

| Pros | Cons |

| Regulated by SFC | Low maximum leverage |

| Wide range of trading instruments | Reliable internet connection |

| MT4 trading platform supported |

Is BRIGHT Legit?

BRIGHT is regulated by The Securities and Futures Commission (SFC).

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| Hong Kong | SFC | Bright Smart Futures & Commodities Company Limited | No Sharing | ADH427 | Regulated |

What Can I Trade on BRIGHT?

BRIGHT offers traders the opportunity to trade stocks, futures, options, forex.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Futures | ✔ |

| Stocks | ✔ |

| Options | ✔ |

| Indices | ❌ |

| Futures | ❌ |

Account Types

BRIGHT offers 3 different types of accounts to traders - Individual Account, Joint Account, Corporate Account.

| Account Type | Individual | Joint | Corporate |

| Suitable for | Individual traders | Partnerships or family members | Corporate entities |

| Features | Many instruments available | Collective management | Meet the unique needs of corporate clients |

BRIGHT Fees

BRIGHT fees contain commission, government and other related charges, account overdue interest charge and other fees.

| Fee structure | ||||

| Commission | Electronic system transaction:take the higher of the two:0.01%,a minimum of 50 RMB | Telephone transaction commission:take the higher of the two:0.15%,a minimum of 150 RMB | ||

| Government and other related charges | Transaction fee 0.0085% | Stamp Duty take the higher of the two: 0.1%, a minimum of 1 HKD | Stock transaction fee: 0.006%(more than 5HKD/5RMB/$0.65, less than 200HKD/200RMB/$26) | Italian companies listed in Hong Kong: withholding Italian financial transaction tax 0.2% |

| Account overdue interest charge | Hong Kong Account: 3%-4% | Dollar Account: 4.78% | RMB Account: 6.50% | Cash Account:HKD:10.625%RMB:10.625%Dollar: 10.625% |

| Other fees | 0.8-300HKD | |||

Trading Platform

BRIGHT's trading platform is MT4 Margin WebTrader, which supports traders on PC.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 Margin WebTrader | ✔ | Web | Beginner |

| MT5 | ❌ |

Deposit and Withdrawal

| Deposit Method | Requirement | Features |

| eDDA | Must have a Hong Kong bank account | Available for deposit and trading at any time |

| FPS | Have an e-banking account | Not supported by ICBC Asia |

| Bank Transfer | Supported by:The Hongkong and Shanghai Banking Corporation Limited, Hang Seng Bank LimitedOCBC Wing Hang Bank Limited, Bank of China (Hong Kong) Limited, Industrial and Commercial Bank of China (Asia) Limited, The Bank of East Asia, Limited |

BRIGHT offers 2 withdrawal methods: Notify the company of the withdrawal through electronic channels, Call Customer Service: (+852)25 301 788 for withdrawal instructions.

The client needs to place a withdrawal instruction through the Company's withdrawal channels on or before 1:00 pm on the same day (trading day from Monday to Friday), and the Company will deposit the funds to the client's bank account registered with the Company on the same day. All overdue withdrawal instructions will be processed on the next business day, please take note.

Read more

OctaFX Back in News: ED Attaches Assets Worth INR 134 Cr in Forex Scam Case

The Enforcement Directorate (ED) in Mumbai has attached assets worth around INR 131.45 crore. This included a luxury yacht and residential properties in Spain. Read this interesting story.

OANDA Rebrands TMS Brokers in Lithuania and Latvia Forex Markets

OANDA upgrades Baltic forex with TMS Brokers rebranding and new mobile app for enhanced trading technologies in Europe.

ActivTrades returns to profitability

London-based broker ActivTrades has released its financial results for 2024, signaling a robust turnaround following a challenging 2023. The broker recorded notable improvements in profitability, client acquisition, and capital reserves, marking a year of renewed momentum and strategic recalibration.

Admiral Markets: A Mix of Regulation and Risk

Despite multiple licenses, Admiral Markets presents potential red flags that traders should not ignore, including a suspicious clone alert and disclosure by Malaysia’s Securities Commission.

WikiFX Broker

Latest News

He Thought He Earned RM4 Million, But It Was All a Scam

CryptoCurrency Regulations in India 2025 – Key Things You Should Know

OctaFX Back in News: ED Attaches Assets Worth INR 134 Cr in Forex Scam Case

Trump inaugural impersonators scammed donors out of crypto, feds say

Ethereum is powering Wall Street's future. The crypto scene at Cannes shows how far it's come

Forex Hedging: Is It a Trader’s Safety Net or Just an Illusion?

US debt is now $37trn – should we be worried?

OPEC+ members agree larger-than-expected oil production hike in August

Top Wall Street analysts are pounding the table on these 3 stocks

US Jobs Data Out: Boom in Government Sector, Not So in Private Sector

Rate Calc