Mai hui MHmarkets: June 27, 2023-MHM European Perspective

Abstract:Spot gold traded in a narrow range during Asian hours on Tuesday (June 27), currently trading near $1,925.75 an ounce.

Market Overview

Spot gold traded in a narrow range during Asian hours on Tuesday (June 27), currently trading near $1,925.75 an ounce. Concerns about the Russian mutiny have abated, but gold prices still have some chance to rebound in the short term due to the weakness of the dollar and lingering fears of a global recession.

Late in the day, markets will focus on the preliminary reading of USD Durable Goods Orders MoM Prel (MAY), which is currently expected to come in at minus 1.0 percent. If it meets expectations, it would be the worst performance in nearly three months, which tends to support gold prices. Still, the hawkish stance of most central banks around the world and the need for further rate hikes could limit gold's rebound.

Also on the watch this session are USD New Home Sales s.a (MAY), USD CB Consumer Confidence (JUN), CAD CPI (MAY), and speeches from central bankers including the BOE, ECB and BOC.

Us crude oil rose slightly to trade near $69.85 a barrel, as doubts about political unrest in Russia and potential supply disruptions offset concerns about global demand.

Heavily armed Russian mercenaries have withdrawn from the southern Russian city of Rostov under an agreement that stopped them from making a rapid advance on Moscow. But the incident has raised questions about President Vladimir Putin's grip on power and some concerns about possible disruptions to Russian oil supplies.

Lower supply is already worrying investors as Saudi Arabia has pledged to cut production starting in July. Also, markets expect US Crude Oil Stock Change fell last week; In the short term, there is a further rebound in oil prices.

Oil prices fell about 3.6% last week on concerns that further Fed rate hikes could dent oil demand and as poor economic data in Europe and the U.S. increased recession fears.

This session needs to watch API Crude Oil Stock Change series data, USD Durable Goods Orders MoM Prel (MAY), USD New Home Sales s.a (MAY), USD CB Consumer Confidence (JUN) and CAD CPI(MAY). Pay attention to the speeches from BOE, ECB, BOC and other central bank officials.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on June 27, Beijing time.

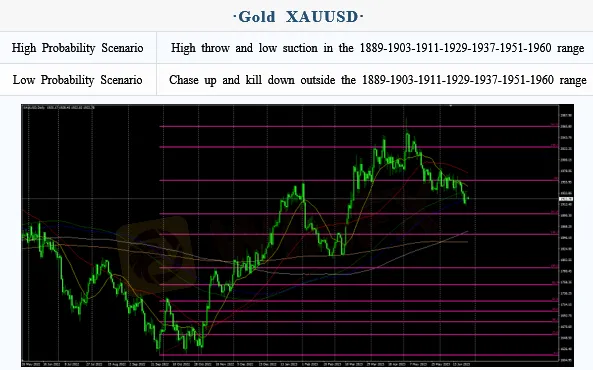

Intraday Oscillation Range: 1889-1903-1911-1929-1937-1951-1960

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1960-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1889-1903-1911-1929-1937-1951-1960 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 27. This policy is a daytime policy. Please pay attention to the policy release time.

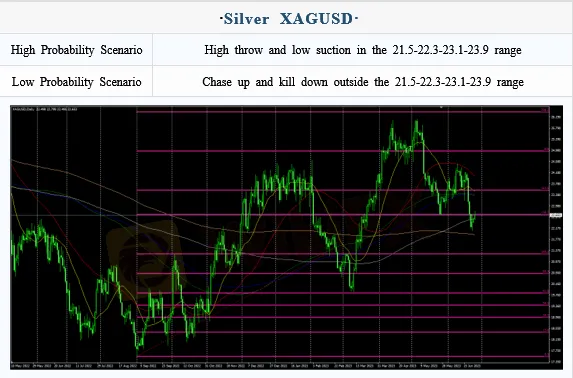

Intraday Oscillation Range: 21.5-22.3-23.1-23.9

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 21.5-22.3-23.1-23.9 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 27. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of Crude Oil, 67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 27. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0755-1.0830-1.0950-1.1157-1.1220

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0755-1.0830-1.0950-1.1157-1.1220 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 27. This policy is a daytime policy. Please pay attention to the policy release time.

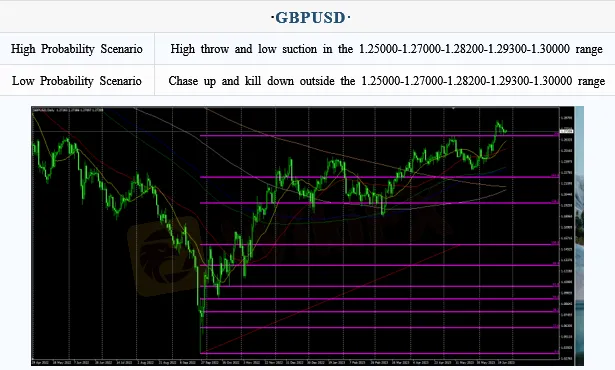

Intraday Oscillation Range: 1.25000-1.27000-1.28200-1.29300-1.30000

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25000-1.27000-1.28200-1.29300-1.30000-1.30600

In the subsequent period of GBPUSD, 1.25000-1.27000-1.28200-1.29300-1.30000 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 27. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

FX SmartBull Regulation: Understanding Their Licenses and Company Information

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

Neptune Securities Exposure: Real Forex Scam Warnings

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

Rate Calc