CP Markets

Abstract:CP Markets is a Forex and CFD broker registered in 2021 with its headquarters in London. It offers trading services for Forex, Commodities, Shares, Futures and Indices. CP Markets claims to provide access to over 500 assets on the MetaTrader5 platform, along with four account types. However, this broker does not hold a legal regulatory license.

Note: CP Markets's official website - https://cp-markets.com/ is currently inaccessible normally.

| CP Markets Review Summary | |

| Founded | 2021 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | 500+, Forex, Commodities, Shares, Futures and Indices |

| Demo Account | ❌ |

| Leverage | 1:100 |

| EUR/USD Spread | 0.6 pips (Standard account) |

| Trading Platform | MT5 |

| Min Deposit | $50 |

| Customer Support | Contact form |

| Email: cs@cp-markets.com | |

| Physical address: Unit 1804 South Bank Tower, 55 Upper Ground, London, England, SE1 9EY | |

CP Markets is a Forex and CFD broker registered in 2021 with its headquarters in London. It offers trading services for Forex, Commodities, Shares, Futures and Indices. CP Markets claims to provide access to over 500 assets on the MetaTrader5 platform, along with four account types. However, this broker does not hold a legal regulatory license.

Pros and Cons

| Pros | Cons |

| Diverse tradable assets | Unavailable website |

| Multiple account types | No regulation |

| Commission-free accounts offered | No demo accounts |

| Micro account | Unknown payment methods |

| MT5 trading platform | Only email support |

| Low minimum deposit |

Is CP Markets Legit?

No, CP Markets is not a legitimate broker as it holds no license from any legal authorities. Furthermore, our investigation has revealed that the company's physical address is fake, and no office was found at that location.

What Can I Trade on CP Markets?

CP Markets claims to offer more than 500 trading instruments across three classes, including 70+ Forex, Commodities (Spot metals), Shares, Futures and Indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Shares | ✔ |

| Futures | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

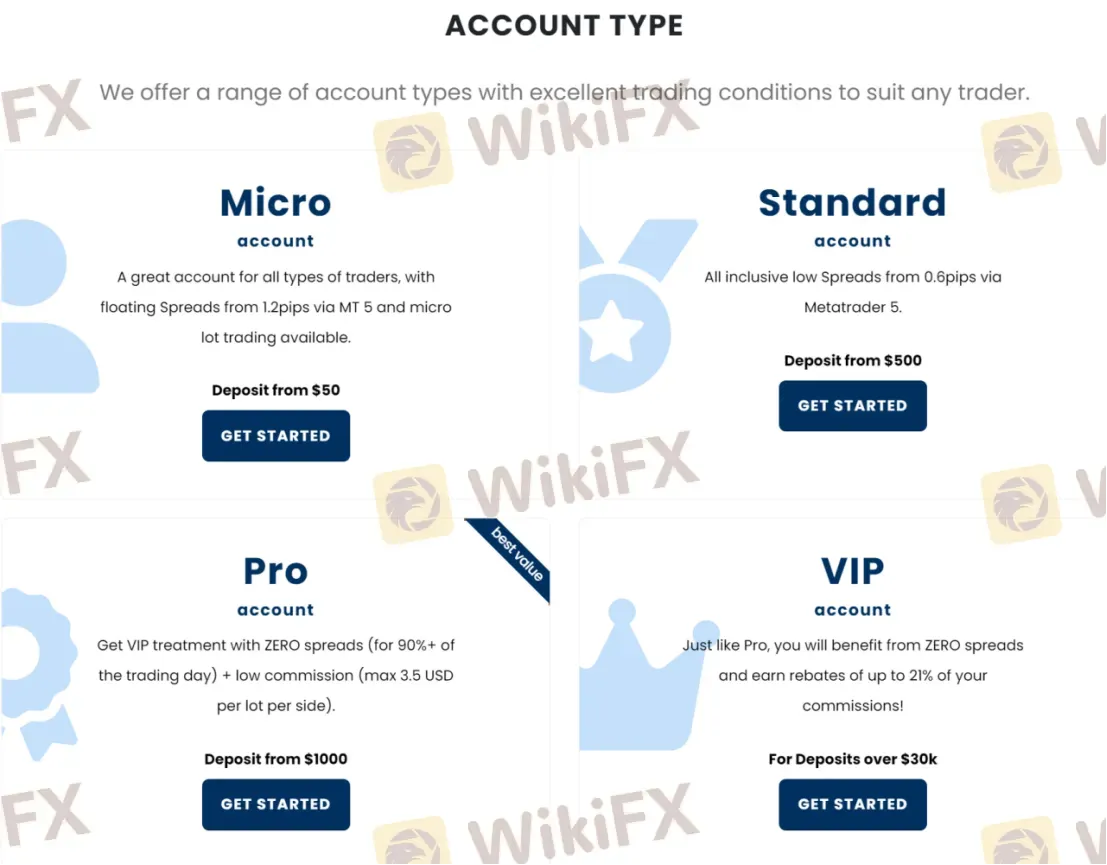

Account Type

| Account Type | Min Deposit |

| Micro | $50 |

| Standard | $500 |

| PRO | $1,000 |

| VIP | $30,000 |

Leverage

CP Markets offers leverage up to 1:100. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spread and Commission

| Account Type | Spread | Commission |

| Micro | 1.2 pips | ❌ |

| Standard | 0.6 pips | ❌ |

| PRO | 0 pips | $3.5 per lot per side |

| VIP | 0 pips | Earn rebates of up to 21% of commissions |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Web and Mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

Read more

T4Trade Review 2025: Live & Demo Accounts, Withdrawal to Explore

T4Trade, established in 2021 and regulated by the FSA in the Seychelles, allows trading on a modest portfolio of over 300 instruments, spanning forex, metals, indices, commodities, futures, and shares, all accessible via the popular MetaTrader 4 and their proprietary WebTrader platforms. Notably, T4Trade offers a zero-commissions pricing model where both floating and fixed spreads are offered on its MetaTrader—flexible leverage up to 1000:1 to increase trading flexibility. T4Trade also introduces a copy trading service called “TradeCopier”, which enables traders who lack experience or time to join in the markets by copying the trades of seasoned professionals.

GQFX Trading Review 2025: Read Before You Trade

GQFX Trading review 2025: Unregulated broker with poor ratings. Learn why trading with GQFX is risky and unsafe for your investments.

Swissquote Review 2025: Live and Demo Account to Explore

Swissquote is a unique online broker with a solid banking background in Switzerland. As a forex-focused platform, it provides one of the most respective range in the industry, over 80 currency pairs in major, minor and exotic. Notably, Swissquote offers different trading conditions for traders from Switzerland, Europe, Middle East, Hong Kong, South Africa, and other regions, and traders at Swissquote can enjoy the benefit of trading with its well-regulated brand and entities. Besides, Swissquote offers excellent research offerings along with its product offerings.

Oanda Shines As Frop Trading Firm After Being Acquired By FTMO

FTMO enhances prop trading with the OANDA Prop Trader Community and loyalty program, integrating CRM automation and rewards post-acquisition.

WikiFX Broker

Latest News

2025 SkyLine Guide Thailand Opening Ceremony: Jointly Witnessing New Skyline in a New Chapter

TriumphFX: The Persistent Forex Scam Draining Millions from Malaysians

Safety Alert: FCA Discloses These 11 Unlicensed Financial Websites

Unbelievable! Trump to 'Sell US Green Cards'?

GQFX Trading Review 2025: Read Before You Trade

WikiFX Community Ramadan Charity Creator Program

Massive Crypto Scam in Philippines: Education Pioneer Wealth Society Exposed

Arab Trading Market Stunned by this Scam! Know about it & Beware

Skype announces it will close in May

DOJ Investigates LIBRA Memecoin Scam: $87M Lost by Investors

Rate Calc