Digital Assets Comeback: Is the Bull Market Continuing?

Abstract:The recent surge of bullish momentum in the cryptocurrency market could potentially be attributed to the end of central banks' tightening measures and the perceived resilience of the US economy. Reviving hopes for a strengthened market sentiment from a single view.

The recent surge of bullish momentum in the cryptocurrency market could potentially be attributed to the end of central banks' tightening measures and the perceived resilience of the US economy. Reviving hopes for a strengthened market sentiment from a single view.

In this week's crypto market analysis, we explore the remarkable resurgence of Bitcoin, its growing correlation with Gold, and the evolving dynamics of Long-Term and Short-Term Holders. Delving into the nuances of investor acquisition prices and market cycles, we examine whether the bear market is finally behind us…

Bitcoin's Impressive Comeback

Bitcoin, the world's largest cryptocurrency by market capitalization, experienced a significant drop in value in 2022. While it did see a snapback in February, BTC holders continue to trade with caution.

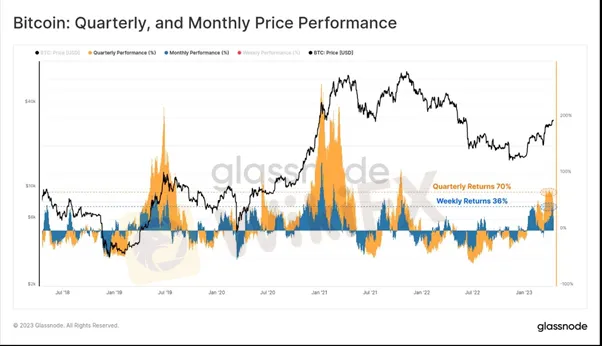

Recently bitcoin has experienced its strongest price performance since reaching its all-time high. The market has surpassed $30k, with

impressive quarterly returns of +70%. This marks the second time for weekly returns to reach +36%, making Bitcoin the best-performing asset class year-to-date (YTD). This performance presents a significant contrast between the 2023 and 2022 market performances and suggests a potential favourable regime shift. Analysing several on-chain indicators supports the hypothesis of a robust recovery. The big question remains: is the Bitcoin bear market finally behind us?

Bitcoin and Gold: A Growing Correlation

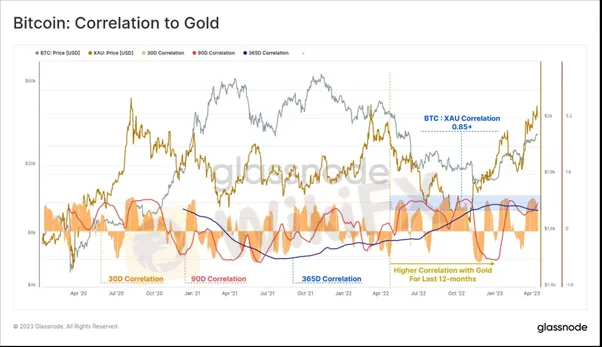

Over the last 12 months, there has been an increased correlation between Bitcoin (BTC) prices and Gold. This strongly positive correlation is observed on a 30-day, 90-day, and 365-day basis. The correlation remained elevated during the recent US banking crisis, which suggests a growing appreciation for sound money among investors. It seems that investors are becoming increasingly aware of counter-party risk.

Intriguing Market Dynamics: Long-Term vs. Short-Term Holders

The Bitcoin market is at an intriguing point with Long-Term and Short-Term Holder thresholds around the FTX implosion date. Long-Term Holders, who acquired coins before the FTX failure, hold 14.161 million BTC, which is near the all-time high. On the other hand, Short-Term Holders, who acquired coins after the FTX failure, maintain a steady supply of 2.914 million BTC in 2023.

Clustering Supply by Acquisition Prices

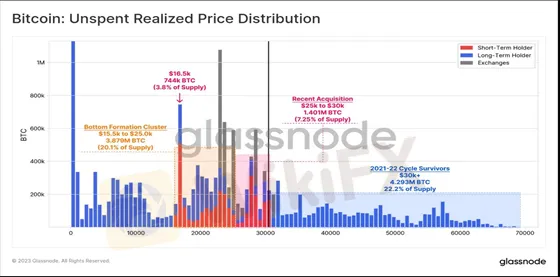

The distribution chart of investor acquisition prices reveals three distinct supply clusters. The Bottom Formation Cluster includes investors who acquired BTC at prices below $25k between June 2022 and January 2023. This cluster has a balanced mix of Long-Term Holders (pre-FTX) and Short-Term Holders (post-FTX) buyers. The Recent Acquisition cluster represents 7.25% of the supply, with acquisition prices between $25k and $30k. This cluster is mostly comprised of Short-Term Holders, indicating profit-taking and coins sold to break-out buyers. Lastly, the Cycle Survivors cluster includes Long-Term Holders from the 2021-22 cycle who acquired BTC at prices above $30k. This cluster accounts for 22.2% of the supply, indicating resilience to volatility and market chaos.

Understanding Market Cycles through Long-Term Holder Behaviour

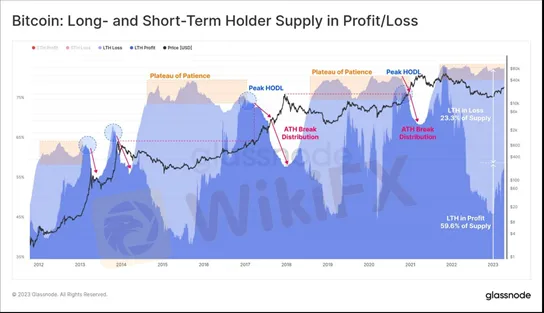

The market cycle can be analysed through Long-Term Holder (LTH) behaviour, consisting of three key phases: Plateau of Patience, Peak HODL, and Distribution upon Breaking ATH. The market is currently in the Plateau of Patience, with over 23.3% of the supply held outside exchanges owned by underwater LTHs. The current supply structure is similar to early 2016 and early 2019.

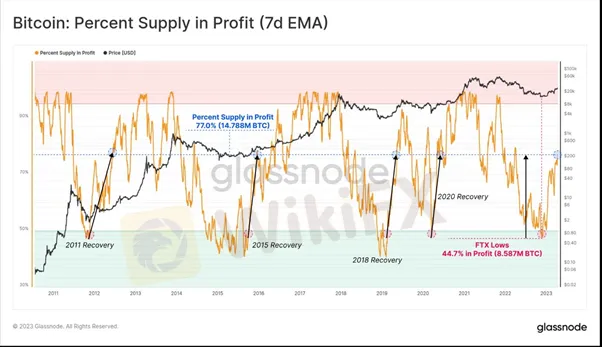

Year-to-Date Market Strength Fuelled by Coins Held at a Profit

YTD market strength is fuelled by a significant increase in coins held at a profit. Bear market floors are marked by wide-scale capitulation, balanced by equal demand inflow. Price rallies from the bottom formation zone lead to coins returning to profit. In 2023, 6.2 million BTC (32.3% of the supply) returned to profit, showcasing a strong cost basis foundation below $30k.

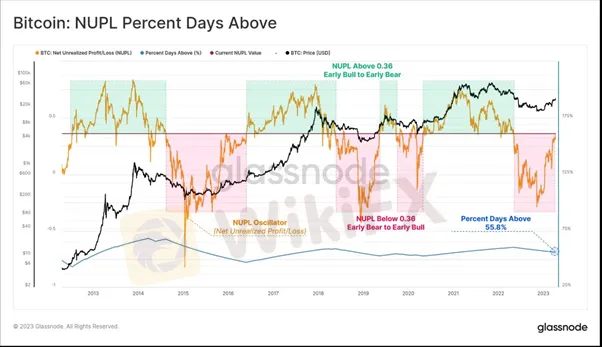

Unrealised Profit Incentivises Spending and Selling

Many coins show an unrealised profit, increasing spending and selling incentives. The Net Unrealised Profit/Loss (NUPL) metric measures the Bitcoin market cap held as unrealised profit. The current NUPL reading is 0.36, indicating a neutral market level. This reading coincides with past bear-to-bull market transitions, suggesting that the market is neither heavily discounted (e.g., $16k) nor overvalued (e.g., $60k+ peak). With 55.8% of days having higher readings and 44.2% having lower readings, the market appears to be at a turning point.

In Conclusion: A Promising Outlook for Bitcoin

Market volatility remains high for Bitcoin and other digital assets. However, on-chain indicators show consistent human decision patterns that suggest bear market conditions could be subsiding. Bitcoin is currently in neutral territory, with a strong foundation supported by a significant volume of coins trading between $16k and $25k.

As the market continues to evolve, investors should remain vigilant and adapt to changing dynamics. With a growing correlation between Bitcoin and Gold, a potential shift in market cycles, and an increase in coins held at a profit, the future of Bitcoin appears promising. While it's too early to declare the bear market officially over, the signs of a robust recovery are becoming increasingly evident.

Read more

WikiFX Trending Topics Analyst Initiative

Share Your Expertise on What’s Moving the Market.

Effective Stop Loss Trading Strategies

In a forex market where fundamental and technical factors impact the currency pair prices, volatility is expected. If the price volatility acts against the speculation made by traders, it can result in significant losses for them. This is where a stop-loss order comes to their rescue. It is one of the vital investment risk management tools that traders can use to limit potential downside as markets get volatile. Read on as we share its definition and several strategies you should consider to remain calm even as markets go crazy.

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

The forex market is a happening place with currency pairs getting traded almost non-stop for five days a week. Some currencies become stronger, some become weaker, and some remain neutral or rangebound. If you talk about the Indian National Rupee (INR), it has dipped sharply against major currencies globally over the past year. The USD/INR was valued at around 85-86 in Feb 2025. As we stand in Feb 2026, the value has dipped to over 90. The dip or rise, whatever the case may be, impacts our daily lives. It determines the price of an overseas holiday and imported goods, while influencing foreign investors’ perception of a country. The foreign exchange rates change constantly, sometimes multiple times a day, amid breaking news in the economic and political spheres globally. In this article, we have uncovered details on exchange rate fluctuations and key facts that every trader should know regarding these. Read on!

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

Understanding how to add funds to your account and, more importantly, how to take them out is essential for safe trading. For any trader thinking about ACY Securities, making an ACY SECURITIES deposit is simple, but the ACY SECURITIES withdrawal process has many serious complaints and concerns. While ACY says it is an established, regulated broker, many users have complained specifically about withdrawal problems, creating a confusing and often contradictory picture. This guide provides a complete and critical analysis. We will first explain the official steps for deposits and withdrawals, including methods, fees, and stated timelines. We will then take a deep look at patterns found in over 180 real user complaints, examining the potential warning signs and risks. By combining official information with real-world user experiences and regulatory warnings, this article aims to give you the clarity needed to make an informed decision about the safety of your funds with ACY Securities.

WikiFX Broker

Latest News

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

FX SmartBull Regulation: Understanding Their Licenses and Company Information

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

Neptune Securities Exposure: Real Forex Scam Warnings

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

Rate Calc