Trade Huze-Some Important Details about This Broker

Abstract: Registered in United Kingdom, Trade Huze Financial is a global systematic investment manager, offering a series of financial services for both retail and professional traders. With Trade Huze Financial, five investment plans are available, including Standard Plan, Master Plan, Premium Plan, Ultimate Plan and Corporate Plan, with the minimum initial capital to take part in a standard plan is $3,000.

| Basic | Information |

| Registered Countries | United Kingdom |

| Regulation | No Regulation |

| Minimum Deposit | $3,000 |

| Maximum Leverage | N/A |

| Trading Platform | N/A |

| Trading Assets | Cryptocurrency, Agriculture, NFP, Oil & Gas, Real Estate, Forex Trading Fixed Income, Renewable Power, Infrastructure |

| Payment Methods | N/A |

| Customer Support | Email, Phone Support |

General Information

Registered in United Kingdom, Trade Huze Financial is a global systematic investment manager, offering a series of financial services for both retail and professional traders. With Trade Huze Financial, five investment plans are available, including Standard Plan, Master Plan, Premium Plan, Ultimate Plan and Corporate Plan, with the minimum initial capital to take part in a standard plan is $3,000.

Here is the screenshot of Trade Huze official website:

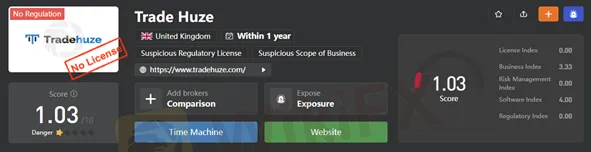

Regulation

Trade Huze is not authorized or regulated by any regulatory authority, and thats why it only gets a very low score of 1.03/10 on WikiFX. Trading with an unregulated broker contains a high level of risk. Please take care.

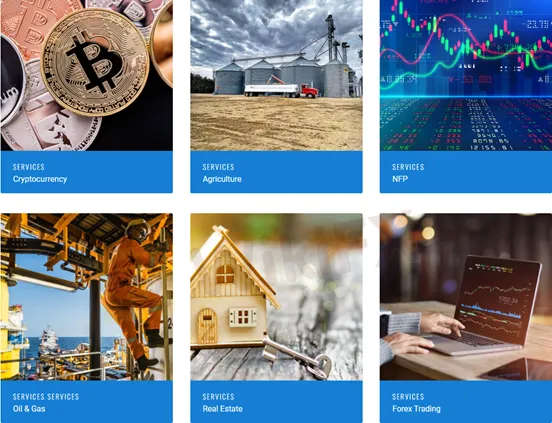

Market Instruments

Trade Huze says it provides a series of products and services for both retail and professional traders, which includes Real Estate, Stocks, Infrastructure, Forex trading, Cryptocurrency, Fixed Income, Multi Assets, Renewable Power (Oil & Gas), Agriculture, NFP.

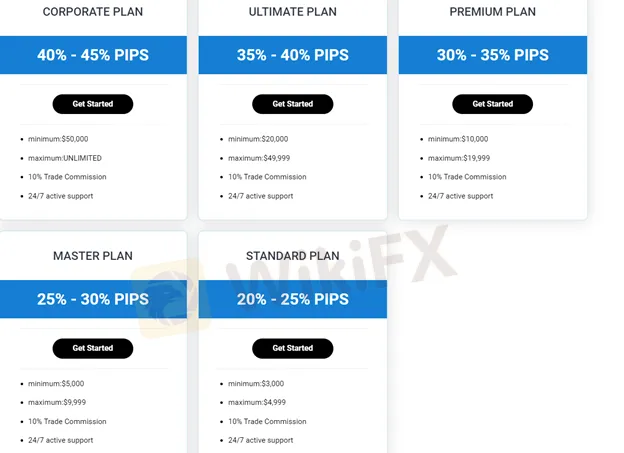

Investment Plans

A total of five investment plans are designed for both retail and professional clients, namely Standard Plan, Master Plan, Premium Plan, Ultimate Plan and Corporate Plan. It specifies what investment plan you will participate in with the minimum deposit. The entry to step into the standard plan starts from $3,000, and $5,000 will send you into the Master Plan. Premium Plans, Ultimate Plans and Corporate Plans ask for a minimum deposit of $10,000, $20,000, $30,000, respectively.

Spreads & Commissions

Spreads and commissions are significantly affected by account types. Accounts or plans with more initial capital can enjoy more discounts on spreads and commissions. For example, Standard accounts holders can enjoy a discount of 20% to 25% pips of spreads, 10% on trading commission.

While the most expensive investment plan, Corporate Plans, offer a discount of 40%-45% pips on spreads and 10% on commissions.

Trading Platform

When it comes to trading platforms available, Trade Huze does not tell us what trading platform it provides, which is quite disappointing.

Customer Support

Trade Huze provides online chat support, but when you tape your questions into the chat box, there is always an automatic answer popping up “We are busy at the moment. Leave us your email and we will contact you as soon as possible.”

Other contact channels include the following:

Telephone: +1 (606) 229-7623, +44 7888 880119

Email: support@tradehuze.com

Company Address: Flat 28 Snowman House, Abbey Road, London, England, NW6 4DN

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that your fully understand the risks involved, taking into account your investments objectives and level of experience.

The information presented in this article is intended solely for reference purposes.

Pros & Cons

| Pros | Cons |

| No regulation | |

| High minimum deposits required | |

Frequently Asked Questions

Is Trade Huze regulated?

No, Trade Huze is not regulated.

What products and services does Trade Huze offer?

Trade Huze provides diversified range of trading instruments, including Real Estate, Stocks, Infrastructure, Forex trading, Cryptocurrency, Fixed Income, Multi Assets, Renewable Power (Oil & Gas), Agriculture, NFP.

What investment plans does Trade Huze provide?

A total of five types of trading accounts are offered, namely Standard Plan, Master Plan, Premium Plan, Ultimate Plan and Corporate Plan.

Read more

NaFa Markets User Reputation: A Deep Look into Complaints and Scam Claims

Let's answer the important question right away: Is NaFa Markets safe or a scam? After carefully studying all available evidence, NaFa Markets shows all the typical signs of a fake financial company. We strongly recommend not putting any money with this company. You should avoid it completely. Read on for more revelation about the broker.

Core Prime Exposure: Traders Report Illegitimate Account Blocks & Manipulated Trade Executions

Was your Core Prime forex trading account disabled after generating profits through a scalping EA on its trading platform? Have you witnessed losses due to manipulated trades by the broker? Does the broker’s customer support team fail to clear your pending withdrawal queries? Traders label the forex broker as an expert in deceiving its clients. In this Core Prime review article, we have investigated some complaints against the Saint Lucia-based forex broker. Read on!

Inside the Elite Committee: Talk with Ahmed Hassan

WikiFX has launched the “Inside the Elite” Interview Series, featuring outstanding members of the newly formed Elite Committee. During the committee’s first offline gathering in Dubai, we conducted exclusive interviews and gained deeper insights into regional market dynamics and industry developments. Through this series, WikiFX aims to highlight the voices of professionals who are shaping the future of forex trading — from education and compliance to risk control, technology, and trader empowerment.

NaFa Markets Regulation: A Deep Dive Investigation Exposing a Major Scam

WARNING: Do not put any money into NaFa Markets. Our research shows it has all the signs of a clever financial scam. This platform lies about its legal status and uses tricks that are the same as fake investment schemes designed to steal your funds. When people search for information about NaFa Markets regulation, they need to know the truth: it is fake and made up.

WikiFX Broker

Latest News

AI Revolutionizes Modern Medicine and Diagnostics

Geopolitics meets Liquidity: EU Freezes Trade Talks as Trump 'Greenland' Gambit Rattles Alliance

De-Dollarization Reality: Gold Overtakes Treasuries in Central Bank Reserves

JGB Meltdown: Japan's Debt Crisis Deepens as Snap Election Stirs Fiscal Panic

Oil Markets Boxed In: Supply Glut Overpowers Geopolitical Floor

Markets Rally as Trump Suspends EU Tariffs on 'Greenland Framework'

JGB Market Turmoil: Volatility Spikes as BOJ Ownership Dips Below 50%

Fed Chair Race Narrows to Two as Trump Ramps Up Pressure on Powell

Sterling Rallies as Sticky Inflation Challenges BOE Outlook

He Was Promised RM1.45 Million in Return, But He Lost RM742000 Instead

Rate Calc