BDSWISS

Abstract:BDSwiss is an offshore-regulated forex and CFD broker that was established in 2012 and is registered in Seychelles. The broker offers 250+ CFDs on Forex, Shares, Indices, Commodities, and Cryptos with leverage up to 1:2000 and spread from 0 pips via the MT5, BDSwiss Mobile App, and BDSwiss WebTrader platforms.

| Quick BDSWISS Review Summary | |

| Founded | 2012 |

| Registered Country/Region | Seychelles |

| Regulation | FSA (offshore) |

| Market Instruments | 250+ CFDs on Forex, Shares,Indices, Commodities & Cryptos |

| Demo Account | ✅ |

| Account Type | Cent, Classic, VIP, Zero-Spread |

| Min Deposit | $10 |

| Leverage | 1:2000 |

| Spread | From 0 pips |

| Trading Platforms | MT5, BDSwiss Mobile App, BDSwiss WebTrader |

| Copy Trading | ✅ |

| Payment Methods | Visa, MasterCard, Skrill, Neteller, korapay, OZOW, M PESA, vodafone, airtel, tiGO, GCash, PayMaya, Prompt Pay, DultNow, pix, beeteller, cryptos, wire transfer, etc. |

| Deposit & Withdrawal Fee | ❌ |

| Inactivity Fee | $30 or equivalent monthly if inactive for over 90 consecutive days |

| Customer Support | 24/5 live chat, contact form |

| Email: support@km.bdswiss.com | |

| Regional Restrictions | Algeria, Bahrain, Democratic Peoples Republic of Korea, Democratic Republic of Congo, Egypt, Eritrea, Iran, Iraq, Israel, Japan, Jordan, Kuwait, Lebanon, Libya, Mauritius, Morocco, Myanmar, Oman, Palestine, Qatar, Saudi Arabia, Seychelles, Somalia, Sudan, Syria, Tunisia, United Arab Emirates, United Kingdom, United States (and US reportable persons), Yemen and the EU |

BDSWISS Information

BDSwiss is an offshore-regulated forex and CFD broker that was established in 2012 and is registered in Seychelles. The broker offers 250+ CFDs on Forex, Shares, Indices, Commodities, and Cryptos with leverage up to 1:2000 and spread from 0 pips via the MT5, BDSwiss Mobile App, and BDSwiss WebTrader platforms.

Pros & Cons

BDSWISS offers 250+ CFDs across multiple asset classes, making it a versatile platform for traders. The absence of deposit and withdrawal fees is a definite advantage for those who prioritize low-cost trading. Additionally, the broker's extensive educational resources can be beneficial for novice traders who want to improve their trading skills.

However, some traders may find the offshore Seychelles Financial Services Authority (FSA) license to be a drawback.

| Pros | Cons |

| • Wide range of trading instruments | • Offshore FSA license |

| • Demo accounts | • Overnight charges, currency conversion, and inactivity fee |

| • Multiple payment options | • Regional restrictions |

| • Free deposits and withdrawals | • Negative reviews from their clients |

| • Copy trading | |

| • Rich educational resources for traders of all levels |

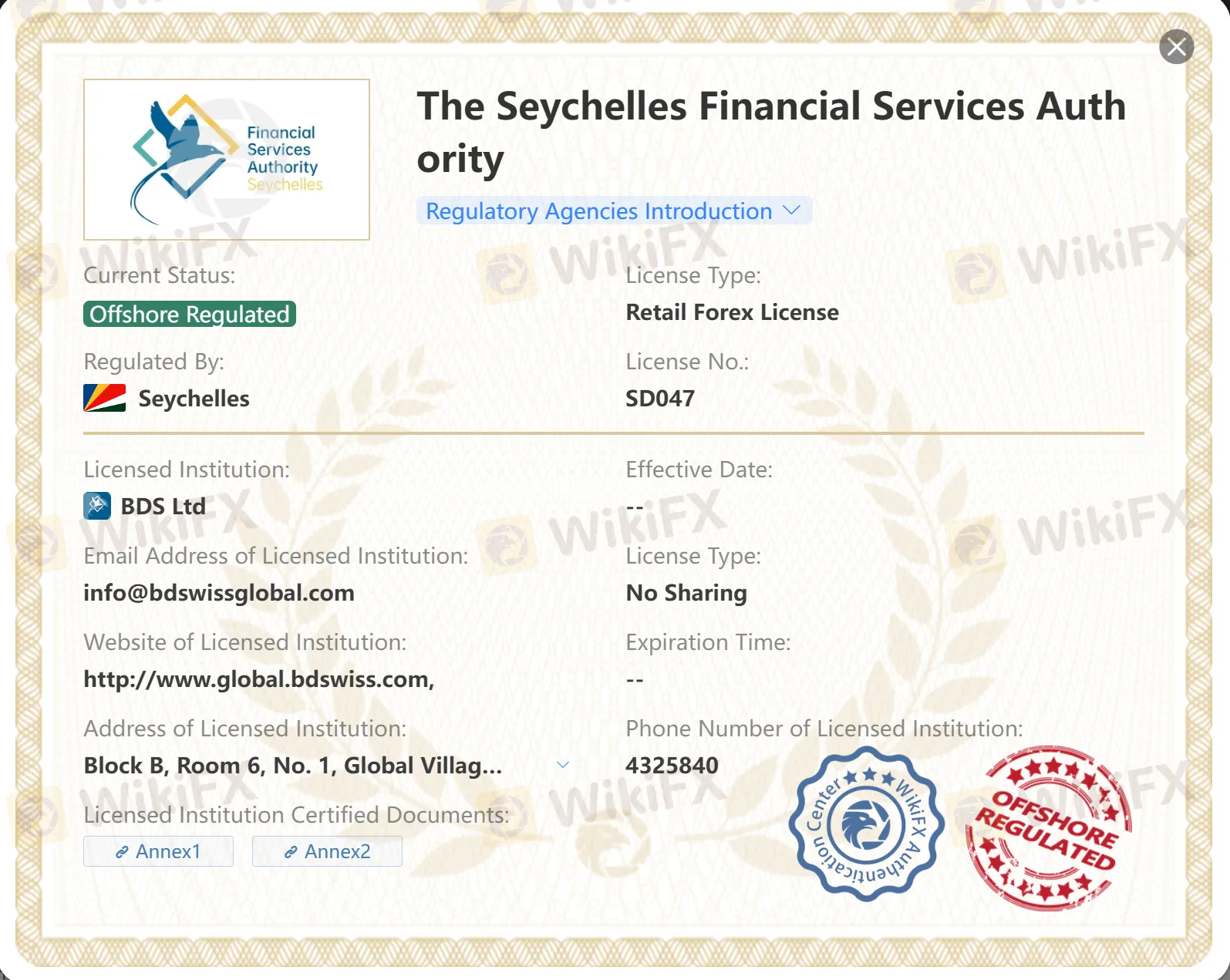

Is BDSWISS Legit?

Yes. BDSWISS is offshore regulated by Seychelles Financial Services Authority (FSA).

| Regulated Country | Regulated by | Current Status | Regulated Entity | License Type | License Number |

| FSA | Offshore Regulated | BDS Ltd | Retail Forex License | SD047 |

Market Instruments

BDSwiss offers 250+ CFDs on Forex, Shares, Indices, Commodities, and Cryptos.

| Tradable Assets | Supported |

| CFDs | ✔ |

| Forex | ✔ |

| Shares | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Cryptos | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Types/Fees

Demo Account: BDSWISS provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: BDSWISS offers four account types: Cent, Classic, VIP, and Zero-Spread. The minimum deposit to open an account is $10, $10, $250 and $100 respectively. The threshold to open an account at BDSWISS is quite low. However, we should also realize that too little capital not only reduces losses, but also reduces profitability. Therefore, you may find it “unexciting” or unprofitable. In addition, accounts with smaller initial deposits tend to have poorer trading conditions.

| Account Type | Min Deposit | Spread | Commission |

| Cent | $10 | From 1.6 pips | ❌ |

| Classic | From 1.3 pips | ❌ | |

| VIP | $250 | From 1 pip | ❌ |

| Zero-Spread | $100 | From 0.0 pips | $6 |

Leverage

BDSWISS offers a maximum leverage of up to 1:2000 for all account types, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

Trading Platforms

As for the trading platform, BDSWISS provides its clients with many options.

There is a public platform - MT5 that has served many clients worldwide, also BDSWISS's own platforms - BDSwiss Mobile App and WebTrader.

If you do not want to spend time familiarizing yourself with a new platform, you can choose MT5. But BDSWISS's own platform provides better compatibility with businesses, as they are specially developed and customized platforms. The choice is yours.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC, iOS, Android | Experienced traders |

| BDSwiss Mobile App | ✔ | iOS, Android | / |

| BDSwiss WebTrader | ✔ | Web | / |

| MT4 | ❌ | / | Beginners |

Deposits & Withdrawals

BDSWISS offers a wide range of deposit and withdrawal options, including Visa, MasterCard, Skrill, Neteller, Bank Wire, Pay Retailers, cryptocurrencies, AstroPay, Globepay, MPESA, airtel tiGo, korapay, and more.

The broker does not charge any fees for deposits or withdrawals.

BDSWISS minimum deposit vs other brokers

| BDSWISS | Most Other | |

| Minimum Deposit | $10 | $100 |

Most deposits are processed instantly. For withdrawals, BDSWISS strives to process most requests within 24 hours, although the processing time may vary depending on the payment method used and the verification requirements.

Fees

BDSWISS charges overnight fees on all positions that are held open overnight, and the rates depend on the instrument being traded.

The broker also charges a currency conversion fee for deposits made in a currency different from the account currency.

Moreover, if no trading activity occurs for over 90 days, a monthly fee of $30 will be deducted from your account balance, until the account balance is 0. This charges covers the maintenance/administration expenses of such inactive accounts.

It is important for traders to keep these fees in mind when planning their trading activities, as they can impact the overall profitability of their trades.

Education

BDSWISS provides a range of educational resources to assist traders in improving their trading knowledge and skills. They offer a variety of educational materials, including Forex eBooks, Forex Basic Lessons, Forex Glossary, and Educational Videos.

Conclusion

All in all, BDSWISS offers a diverse range of trading instruments with competitive spreads and commissions on different account types. The broker provides a variety of deposit and withdrawal options with no fees charged, and fast processing time. BDSWISS also offers various educational resources and trading tools. However, is offshore regulated by Seychelles Financial Services Authority (FSA) and there are some negative reviews from their clients saying that they have met severe slippage and unable to withdraw. Every trader should be cautious before trading or investing with a broker.

Frequently Asked Questions (FAQs)

| Q 1: | Is BDSWISS regulated? |

| A 1: | Yes. It is offshore regulated by FSA in Seychelles. |

| Q 2: | Does BDSWISS offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does BDSWISS offer the industry-standard MT4 & MT5? |

| A 3: | Yes. It supports MT5, BDSwiss Mobile APP, and BDSwiss WebTrader. |

| Q 4: | What is the minimum deposit for BDSWISS? |

| A 4: | The minimum initial deposit to open an account is only $10. |

| Q 5: | Is BDSWISS a good broker for beginners? |

| A 5: | Yes. It is a good choice for beginners because it offers demo MT5 accounts that allow traders to practice trading without risking any real money, and it also offers rich educational resources. |

WikiFX Broker

Latest News

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

FX SmartBull Regulation: Understanding Their Licenses and Company Information

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

Neptune Securities Exposure: Real Forex Scam Warnings

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Rate Calc