RAC FX-Some Important Details about This Broker

Abstract:Registered in the United Kingdom, RAC FX is an online broker providing a series of trading instruments to its clients, covering Currencies, Global Indices, Metals, Commodities. With the RAC FX platform, three types of trading accounts are given, namely Standard, VIP1, VIP 2. The minimum deposit required by RAC FX is $50, and clients are provided the access to demo trading before they get familiar with this broker.

| Basic | Information |

| Registered Countries | United Kingdom |

| Regulation | No License |

| Minimum Deposit | $50 |

| Maximum Leverage | 1:500 |

| Minimum Spreads | From 0.0 pips |

| Trading Platform | MT4 |

| Demo Accounts | Available |

| Trading Assets | Forex, Commodities, Stocks, Indices, Shares, Precious Metals |

| Payment Methods | Bank Wire, VISA, MasterCard, Paysafe, Economy, Qiwi, UnionPay, Payment Asia, Tether |

| Customer Support | Phone, Email |

General Information

Registered in the United Kingdom, RAC FX is an online broker providing a series of trading instruments to its clients, covering Currencies, Global Indices, Metals, Commodities. With the RAC FX platform, three types of trading accounts are given, namely Standard, VIP1, VIP 2.

The minimum deposit required by RAC FX is $50, and clients are provided the access to demo trading before they get familiar with this broker.

Here is the screenshot of RAC FX official website:

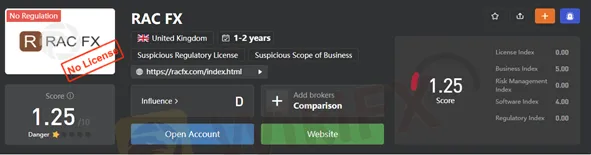

RAC FX is not regulated by any regulator to support its operation, and thats why WikiFX has given it a very low score of 1.25/10. Trading with an unregulated broker is taking a huge risk of losing your money. Please be aware of the risk.

Market Instruments

With RAC FX, a total of classes of trading assets can be traded, which covers Forex, Indices, Shares, Precious Metals, Energies, Cryptocurrencies.

Account Types

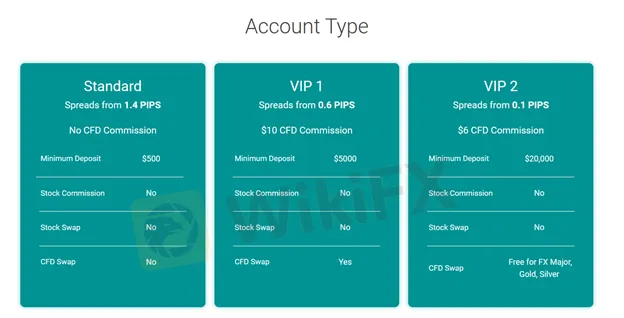

RAC FX offers three types of trading accounts to suit all clients trading needs, namely Standard, VIP1, VIP2. The minimum deposit specifies trading types. To open a Standard account, $500 is required. An initial deposit of $5,000 will set you to the VIP 1 account, and a minimum deposit of $20,000 is required for a VIP 2 account.

Besides, demo accounts are provided too. Demo accounts are an excellent tool for clients to test the trading environment and practice their trading strategies without risking their own capitals

Leverage

When it comes to leverage, RAC FX enables its clients to use the maximum trading leverage up to1:500, which is greater than the levels regarded appropriate by any regulators, with the maximum leverage for major currencies up to 1:30 in Europe and Australia, and 1:50 in the United States and Canada.

Since leverage can amplify both gains and losses, it can result in devastating losses for investors who lack experience. If you're just starting out in the trading world, it's best to stick with the lower size, no more than a 1:10.

Trading Platform

RAC FX does not disclose what trading platform it provides.

Deposits & Withdrawal

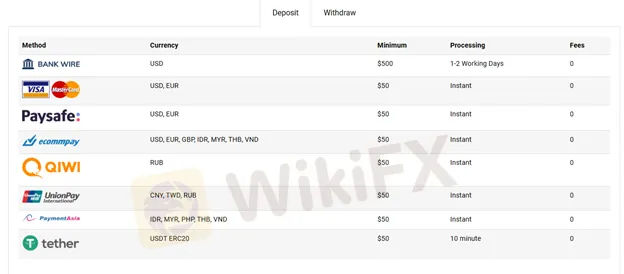

The minimum deposit varies deposit methods, mostly $50, but deposits through bank transfer requires $500. Supported payment methods include Bank Wire, VISA, MasterCard, Paysafe, Economy, Qiwi, UnionPay, Payment Asia, as well as Tether.

Withdrawal through Tether is subject to a service fee of $10. Other payment methods charge no fees. As for processing time, withdrawals through bank wire averagely take 3 to 5 working days for the money to arrive, and withdrawal through QIWI, Payment Asia, Tether, Paysafe takes up to 1 working day to process.

Customer Support

Disappointingly, RAC FX does not provide a dedicated customer support, and they can be only reached through an email: support@racforex.com.

Work Hour: Monday-Friday 24 hours

Alternatively, clients can also follow this brokerage on some social media platforms such as Facebook, Twitter, Youtube.

Restricted Countries

RAC FX does not offer services to clients from the USA, Canada, Sudan, Syria, North Korea, Iran, Iraq, Mauritius, Myanmar, Yemen, Afghanistan, Thailand, Vanuatu and EEA countries.

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that your fully understand the risks involved, taking into account your investments objectives and level of experience.

The information presented in this article is intended solely for reference purposes.

Pros & Cons

| Pros | Cons |

| Wide selection of trading instruments | No regulation |

| Multiple payment methods | Poor customer support |

| Generous leverage |

Frequently Asked Questions

What trading instruments can I trade with on RAC FX?

RAC FX allows investors to trade Forex, Indices, Shares, Precious Metals, Energies, Cryptocurrencies.

Does RAC FX offer demo accounts?

Yes, demo accounts are available on the RAC FX platform.

What is the minimum deposit required by RAC FX?

The minimum deposit to open a standard account with RAC FX is $500.

What is the maximum leverage available?

The maximum trading leverage that is available on the RAC FX is up to 1:500.

Read more

Spec Trading Blocks Withdrawals on Big Profits

Spec Trading blocks profit withdrawals and traps funds. Victims face denied payouts—avoid Spec FX, read reviews, protect money now!

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Received a withdrawal notification from GFS, but the amount could not be credited to your wallet despite numerous follow-ups with the Australia-based forex broker? Did you witness massive slippage in your stop-loss settings or pay high transaction fees charged by the broker? Did the broker delete and deactivate your trading account without any explanation? The Internet is flooded with negative GFS reviews for these and many more alleged trading activities by the broker. Let’s begin examining all of these in this article.

Multibank Group UAE & Azerbaijan Scam Case – LATEST

Multibank Group forex scam cases reveal denied $70K+ withdrawals in the UAE & Azerbaijan. Stay alert with the WikiFX App and avoid risky forex brokers.

Ingot Broker Victims: $3K/$3200 Profits Stolen LATEST

Ingot Broker scam alert: Kenya victim lost $3K profit ($600 dep); Pakistan $3,200→$179 ($250 dep); HK halted post-2018. Avoid fraud—check WikiFX cases now!

WikiFX Broker

Latest News

Kudotrade Review 2026: Is this Forex Broker Legit or a Scam?

BitPania Review 2026: Is this Broker Safe?

XTB Analysis Report

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

ALPEX TRADING Review 2025: Is This Forex Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

SOOLIKE Review 2026: Is this Forex Broker Legit or a Scam?

Macron's India Trip Exposes EU Tech Overreach And Policy Failures

Five key takeaways from the Supreme Court's landmark decision against Trump's tariffs

Rate Calc