List of FMA Warned Firms to Be Aware Of - Month of December 2022

Abstract:The list of unauthorized firms was released by the Financial Markets Authority (FMA) to warn the public not to invest due to a lack of necessary authorization to conduct financial transactions or investments.

The Financial Markets Authority (FMA) is the government body in charge of regulating New Zealand's securities markets and financial service providers. Its main objectives are to safeguard consumers while also promoting fair, efficient, and transparent financial markets. The FMA is a separate Crown institution that reports to the Minister of Commerce and Consumer Affairs. It has broad powers and functions, including the authority to register and license financial service providers, undertake financial market monitoring, enforce compliance with laws and regulations, and take enforcement action against persons or organizations that violate the law.

How the FMA protects the public against fraudulent businesses

The Financial Markets Authority (FMA) safeguards the public against fraudulent internet trading brokers by using a number of procedures and technologies to identify and penalize those who participate in it.

One method is to regulate and license financial service companies, such as internet trading brokers. This helps to guarantee that only genuine and trustworthy businesses may function in the market. The FMA also monitors financial markets on a regular basis in order to detect and investigate any fraud or other criminal behavior.

The FMA also maintains a public record of financial service providers on its website, where customers may check to see whether a company is licensed and in good standing with the FMA. Furthermore, FMA published warnings against unlicensed entities known as “scammers” on their websites and via other public announcements.

The following is a list of fraudulent businesses that have been banned by the FMA for the whole month of December:

REO FUNDS NZ LIMITED

MACQUARIE

KRYPTO SECURITY

BAY EXCHANGE

CTRLEX

IKICI

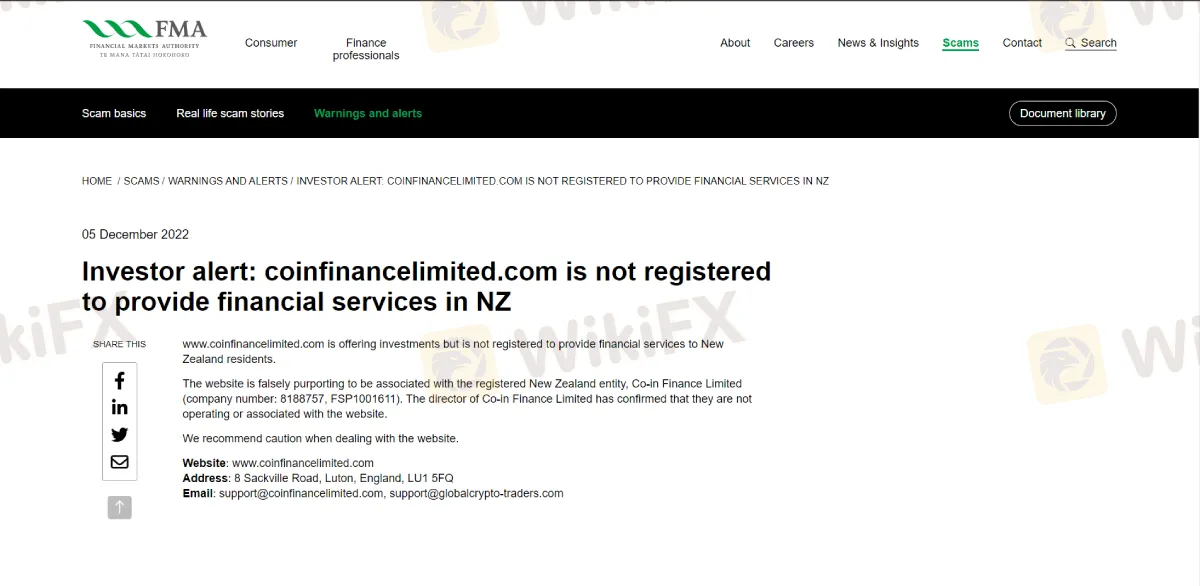

COIN FINANCE LIMITED

The FMA together with WikiFX also urges customers to report any unusual behavior or suspected fraud to them so that necessary action may be taken. They also operate public education initiatives to teach customers how to spot and avoid fraudulent online trading brokers, as well as how to protect themselves from fraud.

It is crucial to highlight that the FMA has a role in safeguarding the public, but it is not a guarantee. Consumers should also do their own research and due diligence before investing with any financial service providers.

Stay tuned for more lists of fraudulent firms.

Download and install the WikiFX App from the download link below to stay updated on the latest news, even on the go. You can also download the app from the App Store or Google Play Store.

Download link: https://www.wikifx.com/en/download.html

Related broker

Read more

WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

datian Review: Examining Slippage and Forced Liquidation Allegations Against the Broker

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

TopstepFX Review: Investigating Fund Withdrawal Denial Claims & Other Trading Issues

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

Mazi Finance Regulatory Status: A Complete Guide to Its Licenses and High-Risk Warnings

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.

WikiFX Broker

Latest News

CBN Bolsters Forex Liquidity: Resumes BDC Sales as Reserves Hit $47 Billion

China’s "Deposit Migration" Myth Debunked: A Gradual Shift, Not a Flood

Theos Markets Review 2026: Is this Forex Broker Legit or a Scam?

INVESTIZO Review: Profit Cancellation Claims, Withdrawal Denials & Poor Customer Support

AssetsFX Review : Read This Before You Put Money In it

DeltaFX Broker: No Regulation Exposed

Is Stonefort Legit Company? Understanding the Risks

Mazi Finance Regulatory Status: A Complete Guide to Its Licenses and High-Risk Warnings

Warsh Likes It Hot, And Will Move The Fed's Inflation Target To 2.5-3.5%

datian Review: Examining Slippage and Forced Liquidation Allegations Against the Broker

Rate Calc