24ProfitMarket

Abstract:Designed in 2017, 24Profit Market is an unregulated internet trading platform. Among the several financial tools it provides are forex, indices, equities, commodities, and cryptocurrencies.

| 24ProfitMarket Review Summary | |

| Founded | 2017 |

| Registered Country/Region | Not mentioned |

| Regulation | Unregulated |

| Market Instruments | Forex, Commodities, Indices, Shares, Cryptocurrencies |

| Demo Account | × |

| Spread | From 0.0 pips (claimed) |

| Trading Platform | MetaTrader 4 web platform, MetaTrader 4 mobile platform |

| Min Deposit | €250 |

24ProfitMarket Information

Designed in 2017, 24Profit Market is an unregulated internet trading platform. Among the several financial tools it provides are forex, indices, equities, commodities, and cryptocurrencies.

Pros and Cons

| Pros | Cons |

| Offers a range of financial instruments | Unregulated |

| Provide MT4 | High withdrawal fees |

| Multiple account types |

Is 24ProfitMarket Legit?

24ProfitMarket operates without any regulations.

What Can I Trade on 24ProfitMarket?

24ProfitMarket offers trading in MANY financial instruments.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Cryptocurrencies | ✔ |

| ETFs | ❌ |

| Bonds | ❌ |

Account Types

24ProfitMarket provides 3 types of live trading accounts but does not offer demo or Islamic accounts.

| Account Name | Minimum Deposit | Bonus | Suitable For |

| Bronze | €250 | 20% | Beginners |

| Platinum 1 | €750 | 30% | Intermediate traders |

| Platinum 2 | €1,000 | 50% | Advanced traders |

24ProfitMarket Fees

24ProfitMarket's fee structure is high compared to standards.

Trading Fees

The broker offers competitive spreads starting from 0.0 pips. But it doesn't mention other trading fees.

Trading Platform

24ProfitMarket offers the MetaTrader 4 (MT4) platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 | ✔ | Web, Android, iOS | Both novice and experienced traders |

Deposit and Withdrawal

Deposit fees

24ProfitMarket charges fees for withdrawals and has a minimum deposit requirement of at least €250.

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Credit/Debit Cards | €250 | Not specified | Not specified |

| Wire Transfer | €250 | Not specified | Not specified |

| E-Wallets | €250 | Not specified | Not specified |

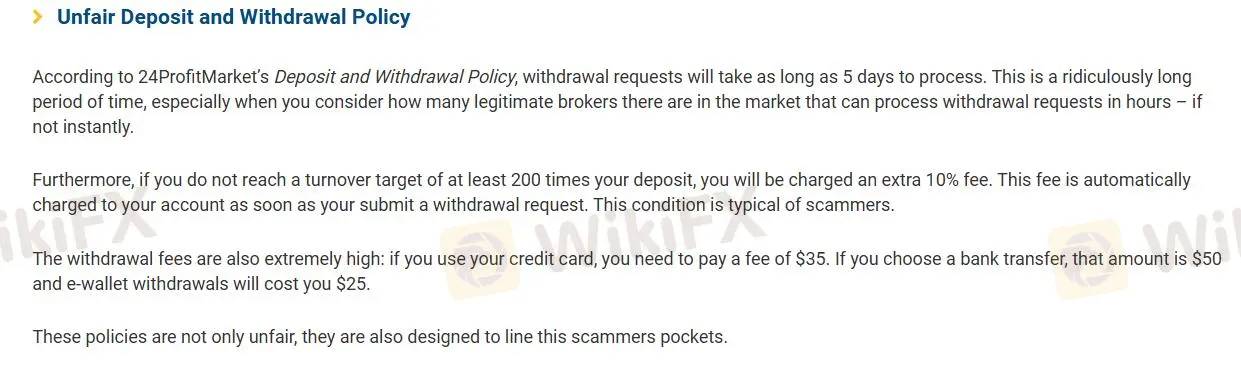

Withdrawal fees

The broker imposes high withdrawal fees of $35, and charges additional charges for not meeting certain trading volume requirements.

| Fee Type | Amount |

| Credit Card Withdrawal | $35 |

| Bank Transfer Withdrawal | $50 |

| E-wallet Withdrawal | $25 |

| Additional Fee for Not Meeting 200x Turnover | 10% of withdrawal amount |

Read more

WikiFX Alert: Three Well-Known Brokers Targeted by Impersonation Websites

WikiFX issues a warning over unlicensed trading sites posing as established brokers, highlighting the lack of regulatory safeguards and growing risks of fraud and investor losses.

Pocket Option Scam Alert: Real Trader Complaints

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Beware Weltrade: Scam Reports Surge in One Month

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

PU Prime Launches “The Grind” to Empower Traders

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

WikiFX Broker

Latest News

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Eurozone Economy Stalls as Demand Evaporates

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Nigeria Outlook: FX Stability Critical to Growth as Fiscal Revenue Surges

AUD/JPY Divergence: Aussie Service Boom Contrasts with Japan's Fiscal "Truss Moment"

ZarVista Regulatory Status: A Deep Look into Licenses and High-Risk Warnings

KODDPA Review: Safety, Regulation & Forex Trading Details

Rate Calc