CAPITALFX

Abstract:CAPITALFX, a trading name of Aegion Group Ltd, is allegedly a forex broker registered in Saint Vincent and the Grenadines that claims to provide its clients with four different live account types.

Note: CAPITALFX is to operate via the website - https://www.capital-fx.info/, which is currently not yet functional and no information about the company was immediately available. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Regulation | No regulation |

| Market Instrument | forex |

| Account Type | Bronze, Silver, Gold and Black |

| Demo Account | N/A |

| Maximum Leverage | N/A |

| Spread | N/A |

| Commission | N/A |

| Trading Platform | N/A |

| Minimum Deposit | $500 |

| Deposit & Withdrawal Method | N/A |

CAPITALFX, a trading name of Aegion Group Ltd, is allegedly a forex broker registered in Saint Vincent and the Grenadines that claims to provide its clients with four different live account types.

As this brokerage's website cannot be accessed, we were unable to obtain further details about its trading assets, leverage, spreads, trading platforms, etc.

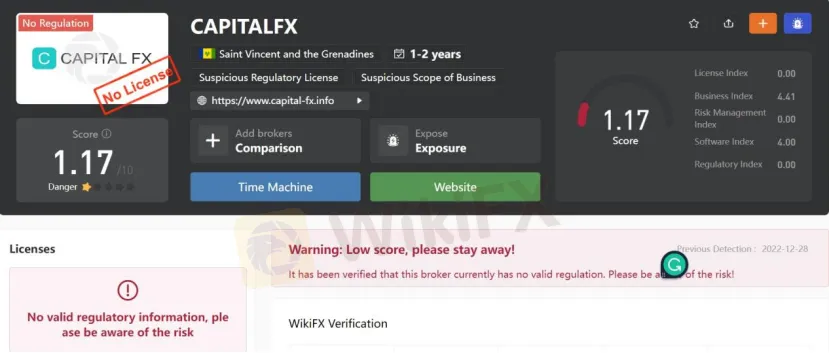

As for regulation, it has been verified that CAPITALFX currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.17/10. Please be aware of the risk.

Market Instruments

CAPITALFX advertises that it is a forex broker that mainly offers forex trading. However, more specific information about tradable assets cannot be found on the Internet.

Account Types

CAPITALFX claims to offer four types of trading accounts, namely Bronze, Silver, Gold and Black, with minimum initial deposit requirements of $500, $3,000, $7,000 and $50,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of c100 or even less.

Deposit & Withdrawal

The minimum initial deposit requirement at CAPITALFX is said to be $5000. However, the broker says nothing about the deposit and withdrawal methods.

Customer Support

The only way you can approach CAPITALFX is via email: info@capital-fx.info. However, this broker doesnt disclose other more direct contact information like telephone numbers or the company address that most transparent brokers offer.

Pros & Cons

| Pros | Cons |

| • Multiple account types can be chosen from | • No regulation |

| • Website inaccessible | |

| • High minimum deposit (500) | |

| • Lack of transparency |

Frequently Asked Questions (FAQs)

| Q 1: | Is CAPITALFX regulated? |

| A 1: | No. It has been verified that CAPITALFX currently has no valid regulation. |

| Q 2: | What is the minimum deposit for CAPITALFX? |

| A 2: | The minimum initial deposit at CAPITALFX to open an account is as high as $500. |

| Q 3: | Is CAPITALFXa good broker for beginners? |

| A 3: | No. CAPITALFX is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website and high initial deposit. |

Read more

Vault Markets Review 2025: Live & Demo Accounts, Withdrawal to Explore

Vault Markets, a South African-based broker, has attracted much attention in recent days, particularly within its region. This online broker only offers access to focused trading opportunities on Indices, Currencies, Energies, and Metals, yet it shines on low minimum deposits plus various bonus programmes, which would encourage more investors, especially beginners, to trade with a small budget. However, Vault Markets operates outside of the authorized scope, so we don't consider it solid to trade with.

Australian Dollar Surges as Trade Surplus Hits 11-Month High: A Golden Opportunity for Forex Traders

Australia's trade surplus has surged to an 11-month high, reaching $5.62 billion in January 2025. The unexpected boost in trade surplus was primarily driven by a 1.3% month-over-month increase in exports, with non-monetary gold playing a starring role.

ECB Set to Cut Rates, But Future Path Uncertain Amid Global Tensions

- ECB expected to cut interest rates on March 6 - Future rate decisions unclear due to ongoing inflation and global trade issues - Markets expect more cuts, but some ECB officials urge caution

T&D vs AvaTrade: Which Broker Suits Your Trading Needs in 2025?

In this article, we compare these brokers based on basic information, regulatory status, leverage, trading platforms, account types, spreads and commissions, customer service, AI tools, and recent updates. Our goal is to provide an objective overview so you can decide which broker aligns better with your trading style and requirements.

WikiFX Broker

Latest News

$13M Pig Butchering Scam: Three Arrested for Money Laundering

FINMA Opens Bankruptcy Proceedings

FCA Issues Warning Against 14 Unregistered Financial Firms

Crypto Scam Exposed: 3 Arrested for Defrauding Investors

Nifty 50 Index Futures Now Available at Interactive Brokers

Grand Unveiling: The Core Reasons Behind the Yen’s Rise

Ethereum’s Shock Drop: What’s The Real Reason?

Famous Olympic Breakdancer’s Brother Faces Crypto Fraud Charges

Gold Surge News: Central Banks Expand Gold Reserves—Will Prices Rise?

Denmark\s postal service to stop delivering letters

Rate Calc