Old trick for escape? Omega Pro allegedly transfers its members to another company.

Abstract:According to reports, OmegaPro, always with the excuse of the alleged "hacking" announces that it will transfer its members to another already established "company".

According to reports, OmegaPro, always with the excuse of the alleged “hacking,” announces that it will transfer its members to another already established “company.” We still need more information to confirm this issue, and we do not know what this “company” is yet. Thus, WikiFX welcomes investors to offer relevant evidence so that we can together air OmegaPro's dirty laundry in public.

About Omega Pro

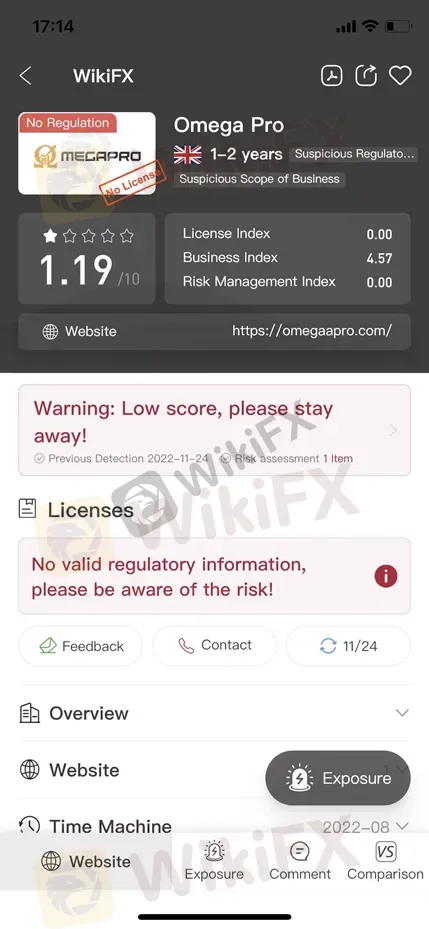

Omega Pro is a forex broker whose main target market is rooted in Africa. This broker has a special strong existence in the Spanish-speaking world. However, according to much feedback, this broker is getting involved in a Ponzi Scheme. And it is not trustworthy as you may think it is. It is not regulated and WikiFX has given it a fairly low score of 1.19/10. Please be aware of the risks.

Read more

WikiFX Trending Topics Analyst Initiative

Share Your Expertise on What’s Moving the Market.

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

Strong retail participation in 2026 is driving forex and CFD trading volumes higher, as investors expand beyond equities into macro-sensitive markets.

Aximtrade Exposure: Growing Allegations of Withdrawal Denials by Traders

Is your Aximtrade withdrawal application pending for months despite everything right from your end? Even after months, do you still see the withdrawal application under review while logging in to the trading platform? Or does the broker official tell you that the withdrawal is approved, but give you the excuse of the payment provider’s unavailability? These issues have allegedly become the norm at Aximtrade, a Saint Vincent and the Grenadines-based forex broker. In this Aximtrade review article, we have highlighted numerous complaints that need your attention.

Big Boss Review: Examining Withdrawal Denials & Profitable Record Deletion Claims

Did you fail to receive profits from Big Boss, a Comoros-based forex broker? Did the broker delete your profitable forex transactions so that you cannot withdraw your gains? Did you face an account freeze after making profits on the trading platform? These are some allegations we found while investigating the broker. In this Big Boss review article, we have shared some complaints traders have made against the company. Take a look!

WikiFX Broker

Latest News

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

XTB Analysis Report

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Key Events This Week: PPI, Iran Talks, Nvidia Earnings, Fed Speakers Galore And State Of The Union

What Causes Stagflation?

EU Says Trump's Tariff Workaround Violates Trade Deal

Spotware Refines cTrader Infrastructure as Broker Ecosystem Expands

CME Group Moves to 24/7 Trading for Digital Asset Derivatives

Is The US Dollar About to Crash?

Is AssetsFX Safe or Scam: Looking at Real User Feedback and Complaints

Rate Calc