Fidelity Has Launched CryptoCurrency Trading For Retail Investors

Abstract:Fidelity, one of the world's major financial services companies, has begun to provide consumers with bitcoin trading accounts.

This follows their earlier disclosure of a wait list earlier this month. According to The Block, select users, presumably those on the queue, got an email outlining the release with the message “The wait is gone.”

Fidelity has been involved in the bitcoin sector for some time, beginning mining bitcoin in 2014, according to the company website. In addition, in December 2021, it will offer a spot bitcoin ETF in Canada.

The financial services behemoth's involvement in bitcoin has not gone unnoticed, with US lawmakers questioning its provision of a 401k plan that enables customers to allocate to bitcoin.

The same group of senators recently revived the same concern, stating in their newest letter, “Fidelity Investments has decided to go beyond conventional finance and plunge into the very unstable and more dangerous digital asset sector.”

Despite these cautions, Fidelity looks to be jumping into bitcoin wholeheartedly, as interest in bitcoin within the conventional banking industry grows. It should be emphasized that the move comes at a very intriguing moment, considering recent events surrounding the collapse of FTX and the increased focus on volatility in the sector.

With the industry image so shaky, the acts of behemoths like Fidelity will almost surely have repercussions for bitcoin legislation in the future.

Aside from FTX, senators claim that cryptocurrency investments have only developed as a dangerous and speculative bet, and they are afraid that Fidelity would assume similar risks with millions of Americans' retirement assets.

Fidelity is the biggest retirement plan provider in the United States, with more than $10 trillion in assets under management, and its move was considered a crucial driver for making cryptocurrency even more popular. The cryptocurrency option is now accessible to the 23,000 employers that use Fidelity to manage their 401(k) retirement funds.

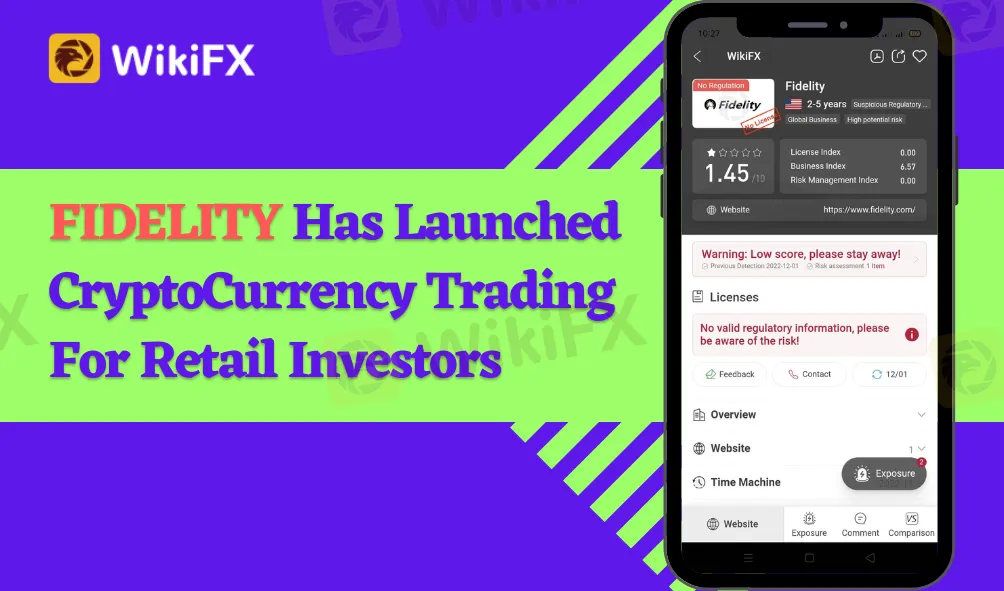

You may check out more of Fidelity news here: https://www.wikifx.com/en/dealer/5871434190.html

Always remember to check the true identity of a broker before investing. Being regulated online trading broker must be known to public to be considered as trustworthy broker.

Stay tuned for more Online Trading news.

Download the WikiFX App from the App Store or Google Play Store to stay updated on the latest news.

Read more

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

FIBO Group has grabbed attention from traders for mostly the wrong reasons, as traders have accused the broker of causing financial losses using malicious tactics. Whether it is about withdrawal access, deposit disappearance, trade manipulation, or awful customer support service, the broker is receiving flak from traders on all aspects online. Our team accumulated a list of complaints against the FIBO Group broker. Let’s screen these with us in this FIBO Group review article.

GMO-Z.com Review: Do Traders Face Unfair Tax Payment on Withdrawals?

Do you have to pay taxes or margin when seeking fund withdrawals from GMO-Z.com, a Thailand-based forex broker? Do you witness heavy slippage when trading on the broker’s platform? These are some complaints traders have made against the broker. In this GMO-Z.com review article, we have explained these complaints. Take a look!

EO Broker Review: Why You Should Avoid It

EOBroker Review shows a low WikiFX score of 1.33/10. No regulation, fake license, and unsafe trading make this broker dangerous.

Pocket Broker Review: Why Traders Should Avoid It

Pocket Broker review highlights user complaints of blocked accounts, rejected withdrawals, and fraudulent practices.

WikiFX Broker

Latest News

TEMO Review 2025: Institutional Audit & Risk Assessment

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

Is GMG Safe or a Scam? A 2026 Deep Dive

FBS Review: The "Balance Fixed" Trap and the $30,000 Ghost Candle

Pocket Broker Review: Why Traders Should Avoid It

Why Southeast Asia Can’t Stop Online Scams

Gold and Silver Buckle Under BCOM Rebalancing Weight Ahead of Critical NFP

Trump Triggers Fiscal Jitters with $1.5tn Defense Ambition Funded by Tariffs

Is Assexmarkets Legit or a Scam? 5 Key Questions Answered (2025)

TibiGlobe Review 2025: Institutional Audit & Risk Assessment

Rate Calc