USD vs CPI: Dollar dips after US inflation heat eases. Is the DXY bull trend over?

Abstract:The dollar dipped on Thursday, while other assets like equities, currencies and commodities rocket after US consumer inflation data fell more than expected in October.

The dollar dipped on Thursday, while other assets like equities, currencies and commodities rocket after US consumer inflation data fell more than expected in October.

Headline annual inflation dipped to 7.7% in October, down from 8.2% in the previous month and below the 8% expected. The core measure of inflation that strips out volatile energy and food prices eased to 6.3% from 6.6%, again below expectations (6.5%). The monthly increase in headline inflation was 0.4% instead of the predicted 0.6%, while the monthly increase in core inflation was 0.3% instead of the expected 0.5%.

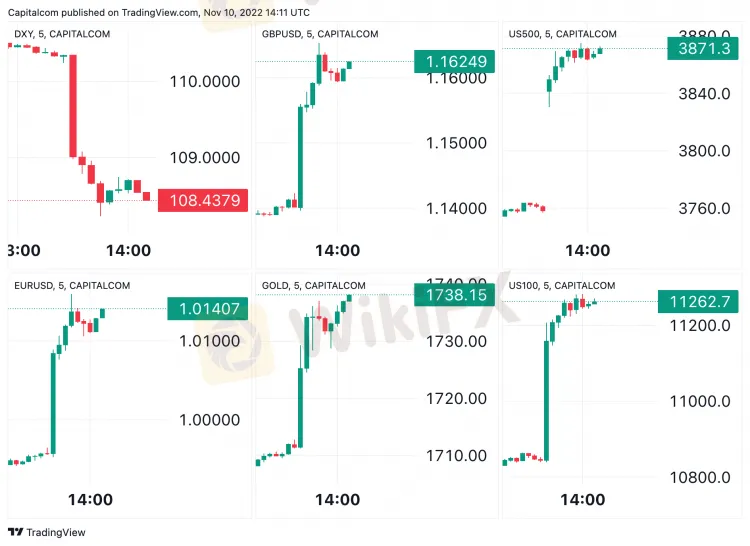

The CPI data miss fueled bearish market action on the dollar index (DXY), which fell to 108.6 at the time stamp, with EUR/USD surging 1.3% to 1.014, GBP/USD jumping 2.3% to 1.162, and gold pushing 1.8% higher to 1,735/oz. US equity indices skyrocketed with the S&P 500 (US 500) up 3.2% to 3,870 points and the tech-heavy Nasdaq 100 (US 100) up 4.3% to 11,280 points

Market reactions to the US October CPI print

Market reactions to the US October CPI data (DXY, EUR/USD, GBP/USD, Gold, S&P 500, Nasdaq 100)

Investors lower Fed hike expectations: USD and Treasury yields sink

The lower-than-expected US inflation rate has prompted investors to speculate on a slower pace of Federal Reserve interest rate hikes going forward.

The chances for the December meeting have shifted in favour of a 50 basis point raise, which is now factored in with an 80% probability, up from 50% before the CPI print.

The estimated terminal rate at which the Fed hiking cycle will conclude is now priced at 4.87% in May 2023, down from 5.07% before the inflation data. This means that markets are currently pricing in slightly more than 75 basis points of hike until May 2023.

U.S. Treasury yields, along with the value of the dollar, fell as a result of a massive reassessment in Fed interest rates by the market. The yield on the 10-year Treasury fell by 20bps on the day to 3.88%, the lower since early October.

Read more

WikiFX Alert: Three Well-Known Brokers Targeted by Impersonation Websites

WikiFX issues a warning over unlicensed trading sites posing as established brokers, highlighting the lack of regulatory safeguards and growing risks of fraud and investor losses.

Pocket Option Scam Alert: Real Trader Complaints

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Beware Weltrade: Scam Reports Surge in One Month

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

PU Prime Launches “The Grind” to Empower Traders

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

WikiFX Broker

Latest News

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Eurozone Economy Stalls as Demand Evaporates

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Nigeria Outlook: FX Stability Critical to Growth as Fiscal Revenue Surges

AUD/JPY Divergence: Aussie Service Boom Contrasts with Japan's Fiscal "Truss Moment"

ZarVista Regulatory Status: A Deep Look into Licenses and High-Risk Warnings

KODDPA Review: Safety, Regulation & Forex Trading Details

Rate Calc