Smart FX Vest

Abstract:Smart FX Vest appears to be an unregulated online trading platform that offers 250+ trading instruments, including Forex, CFDs on Shares, Futures, Indices, Metals, and Energies. Additionally, it claims to provide its clients with leverage up to 1:1000, floating spreads from 0.5 pips, and commission-free trading via 3 different live account types.

Note: Smart FX Vest's official website - https://smartfxvest.com/ is currently inaccessible normal.

| Smart FX Vest Review Summary | |

| Founded | / |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | 250+, Forex, CFDs on Shares, Futures, Indices, Metals, Energies |

| Demo Account | / |

| Leverage | Up to 1:1000 |

| Spread | From 2 pips (Classic account) |

| Trading Platform | / |

| Min Deposit | $100 |

| Customer Support | Live chat, contact form |

| Email: support@SmartFxVest.com | |

| Regional Restrictions | The United States, Cuba, Iraq, Myanmar, North Korea, and Sudan |

Smart FX Vest appears to be an unregulated online trading platform that offers 250+ trading instruments, including Forex, CFDs onShares, Futures, Indices, Metals, and Energies. Additionally, it claims to provide its clients with leverage up to 1:1000, floating spreads from 0.5 pips, and commission-free trading via 3 different live account types.

Pros and Cons

| Pros | Cons |

| Various market instruments | Unfunctional website |

| Three account types | Unregulated status |

| No commissions | High spreads on the Classic account |

| Flexible leverage ratios | Only email support |

| Multiple payment options | Regional restrictions |

| No deposit and withdrawal fees | |

| Live chat support |

Is Smart FX Vest Legit?

No, Smart FX Vest operates without valid regulation, which means trading on this platform your fund is not safe.

What Can I Trade on Smart FX Vest?

In its advertising, Smart FX Vest claims to provide access to more than 250 trading instruments, including Forex, CFDs on shares, futures, indices, metals, and energies.

| Trading Asset | Available |

| Forex | ✔ |

| CFDs | ✔ |

| Metals | ✔ |

| Energies | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Futures | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type/Leverage/Fees

Smart FX Vest claims to offer 3 types of trading accounts - Classic, Pro and ECN, with minimum initial deposit requirements of $100, $500 and $10,000 respectively.

| Account Type | CLASSIC | PRO | ECN |

| Min Deposit | $100 | $500 | $10,000 |

| Max Deposit | $1,000 | $5,000 | Unlimited |

| Max Leverage | 1:1-1:500 | 1:1-1:400 | 1:1-1:100 |

| Spread | From 2 pips | From 1.2 pips | From 0.5 pips |

| Commission | ❌ | ||

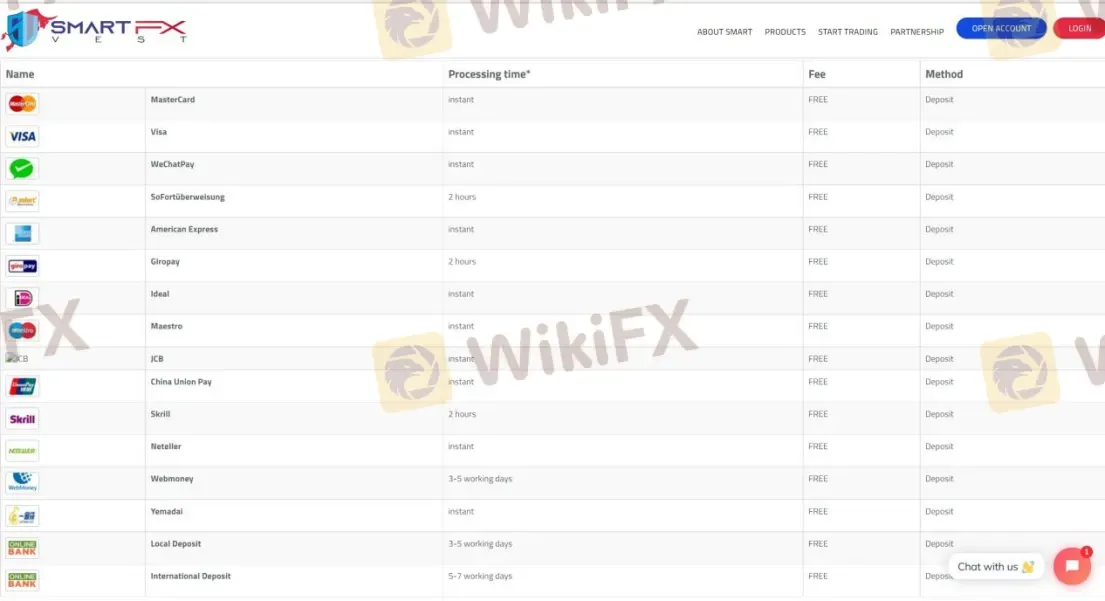

Deposit and Withdrawal

| Payment Option | Min Deposit | Deposit/Withdrawal Fee | Deposit/Withdrawal Time |

| MasterCard | $100 | ❌ | Instant |

| Visa | |||

| WeChatPay | |||

| SoFortüberweisung | 2 hours | ||

| American Express | Instant | ||

| Giropay | 2 hours | ||

| Ideal | Instant | ||

| Maestro | |||

| JCB | |||

| China Union Pay | |||

| Skrill | 2 hours | ||

| Neteller | Instant | ||

| WebMoney | 3-5 working days | ||

| Yemadai | Instant | ||

| Local Deposit and International Deposit | 5-7 working days |

Read more

Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Pemaxx Review: Fund Scams & No Withdrawals, Say Traders

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Fortune Prime Global Exposure: Withdrawal Denials & Profit Cancellations Frustrate Traders

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET Analysis Report

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.

WikiFX Broker

Latest News

New AI laws to arrest deepfakes

Global Macro: Real Wage Growth Expected to Return by 2026

XAU/USD: Gold Rally Signals 'Paradigm Shift' as Middle East Tensions Simmer

MONAXA Review 2026: Comprehensive Safety Assessment

BoC Preview: Macklem to Hold at 2.25% Amidst Trade Anxiety

Fed Holds Rates as Political Storm Intensifies; Trump to Name New Chair Imminently

Meta and Samsung Fuel AI Capex Boom, Keeping Risk Sentiment Alive

Gold Smashes $5,600 Record on Shutdown Fears; Analysts Flash Crash Warning for Silver

FxPro Enhances MetaTrader 5 Execution with New LD4 Cross-Connect

Fed Holds Rates Amidst Political Siege; Dollar Sinks to Four-Year Lows

Rate Calc