Mohicans markets:November 9, 2022--MHM European Perspective

Abstract:On Wednesday, November 9, Beijing time, spot gold shock slightly down in early trading of Asian market, and is currently trading at $ 1668.80 per ounce; the dollar rebounded mildly, putting gold prices under slight pressure; in the U.S. mid-term election results are about to be released, the market wait-and-see sentiment is strong, the overall trading is not large.

Market Overview

On Wednesday, November 9, Beijing time, spot gold shock slightly down in early trading of Asian market, and is currently trading at $ 1668.80 per ounce; the dollar rebounded mildly, putting gold prices under slight pressure; in the U.S. mid-term election results are about to be released, the market wait-and-see sentiment is strong, the overall trading is not large.

U.S. crude oil narrowly oscillated, and is currently trading at $ 91.37 per barrel; The Group of Seven (G7) plan to set a price cap on Russian oil, which could cause disruptions to Russian oil exports. Coupled with OPEC+ production cuts, it is encouraging more hedge funds to establish bullish positions in the crude oil market. Rising U.S. stocks overnight also slightly supported oil prices.

However, this week will also usher in the U.S. CPI data for October; the market is expected to be slightly lower than the September performance, but it is still very strong; some investors worry that if the U.S. CPI data is higher than expected, it will lead to a hawkish shift in Fed expectations, which in turn is not good for gold prices.

In addition, according to the usual, the Fed interest rate resolution after a week, the Fed officials will be one after another public speech; the market is expected to Fed officials may further strengthen the December slowdown part of the expectations of interest rate hikes, so the investors need to be concerned.

This trading day, we need to pay attention to the U.S. midterm elections, and also need to pay attention to the Bank of England and the European Central Bank officials' speeches. At the same time, we also need to pay attention to the changes in the API crude oil inventory data. At present, the market expects the mid-term elections to be positive for the stock market, which is expected to provide support to oil prices; the market expects the US crude oil inventories to increase, but gasoline and refined oil inventories will decline.

Mohicans Markets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on November 9, 2022 Beijing time.

Technical Analysis

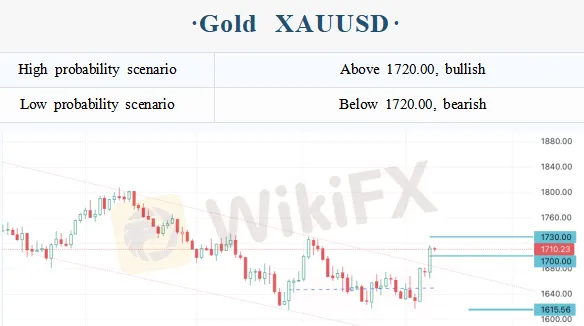

CME Group options layout changes (Futures Price in December):

1750 Bullish increased sharply, bearish decreased slightly, long target

1740-1745 Bullish increased, bearish unchanged, long target area

1725 Bullish increased sharply, bearish increased, long target

1710 Bullish increased sharply, bearish increased sharply, long and short struggle, key level

1700 Bullish decreased sharply, bearish increased sharply, support weakened

1695 Bullish increased sharply, bearish increased, weakening support

1670-1680 Bullish increased sharply, bearish increased sharply, short target area

Order flow key point marking (Spot Price):

1745 The first target after the break

1730-1733 Long target level, trend key strong resistance

1717 The formation of a small double-top resistance overnight U.S. trading

1707 The first support level, Asian and European markets can first focus on the support force here

1698-1700 The first key support area, the range is not broken but it is still expected to maintain the upside

1675 The round of multiple key level

1652 Non-farm payrolls starting level, support is strong

Note: The above strategy was updated at 15:00 on November 9. The strategy is a daytime strategy, please note the strategy release time.

CME Group options layout changes (Futures Price in December ):

23 Bullish increased significantly, bearish unchanged, long target

22-22.50 Bullish increased, bearish unchanged, long target

21.75 Bullish slightly increased, bearish slightly increased, resistance level

21.6 Bullish increased, bearish slightly increased, long target

21.5 Bullish increased, bearish slightly increased, resistance level

21.25 Bullish slightly increased, bearish increased, short target, support level

Order flow key point marking (Spot Price):

22.5-22.6 Strong resistance area composed of early rebound highs, and long targets in technical

22 Long target (option bet)

21.5 Call option in focus, 200 days average line, the first key resistance

21.3 First support position, Asian and European market focuses on the support force here firstly

21 US market is an important support for starting point

20.38 Key support position of this round of bulls

20 Platform support, integer support position

Note: The above strategy was updated at 15:00 on November 9. This policy is a daytime policy. Please pay attention to the policy release time.

Order flow key point marking (Spot Price):

92.8-93.5 Strong resistance area

91.7 The starting point and falling point of US market volume, key resistance

90.8 Strong resistance for the day

89.6-90.1 The first resistance area for the day, long and short boundaries

87.5-87.8 Key support of this round of bulls

86.7 Trend line support since the end of September

Note: The above strategy was updated at 15:00 on November 9. This policy is a daytime policy. Please pay attention to the policy release time.

Statement|Disclaimer

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. We have made every effort to ensure the accuracy of the information as of the date of publication. MHMarkets makes no warranties or representations about this material. The examples in this material are for illustration only. To the extent permitted by law, MHMarkets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material. The features of MHMarkets products, including applicable fees and charges, are outlined in the product disclosure statements available on the MHMarkets website. Derivatives can be risky and losses can exceed your initial payment. MHMarkets recommends that you seek independent advice.

Mohicans Markets, (Abbreviation: MHMarkets or MHM, Chinese name: Maihui), Australian Financial Services License No. 001296777.

Read more

Mohicans markets:MHM European Market

Spot gold weakened slightly during the Asian session on Thursday (April 6), hitting a two-day low of $2007.89 per ounce and now trading near $2014.15. A series of weak economic data has fueled fears of an impending recession in the US, giving safe-haven support to the dollar. And some dollar shorts took profits, and gold bulls also took profits ahead of Good Friday and the non-farm payrolls data, putting pressure on gold prices.

Mohicans markets:MHM Today News

On Wednesday, as the less-than-expected March "ADP" data and non-manufacturing PMI data fueled market concerns about an economic slowdown and spurred bets that the Federal Reserve could slow interest rate hikes. Spot gold continued to brush a new high since March last year, which was the highest intraday to $2032.13 per ounce, and then retracted most of the day's gains, finally closing up 0.01% at $2020.82 per ounce; spot silver hovered around $25 during the day, finally closing down 0.21% at $2

Mohicans markets:MHM European Market

Spot gold oscillated slightly lower during the Asian session on Tuesday (April 4) and is currently trading around $1980.13 per ounce. The dollar index rebounded mildly after a big drop overnight, putting pressure on gold prices. However, this week will see the non-farm payrolls report, there is no important economic data out on Tuesday, and the market wait-and-see sentiment is getting stronger.

Mohicans markets :MHM Today News

On Monday, in OPEC + members unexpectedly cut production reignited market concerns about long-term inflation and sparked uncertainty about the Fed's response, the dollar index once up to the 103 mark, and then on a "vertical roller coaster", giving back all the gains of the day and once lost 102 mark, finally closed down 0.53% at 102.04; U.S. 10-year Treasury yields rose and then fell, as data showed that the U.S. economy continues to slow, it fell sharply in the U.S. session, and once to a low

WikiFX Broker

Latest News

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Eurozone Economy Stalls as Demand Evaporates

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Nigeria Outlook: FX Stability Critical to Growth as Fiscal Revenue Surges

AUD/JPY Divergence: Aussie Service Boom Contrasts with Japan's Fiscal "Truss Moment"

ZarVista Regulatory Status: A Deep Look into Licenses and High-Risk Warnings

KODDPA Review: Safety, Regulation & Forex Trading Details

Rate Calc