Bravo Markets

Abstract:Bravo Markets, a trading name of BRAVO MARKETS PTY LTD, is allegedly a financial services company registered in Australia.

Note: Bravo Markets is to operate via the website - https://www.bulawo.com.cn/, which is currently not yet functional and no information about the company was immediately available. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

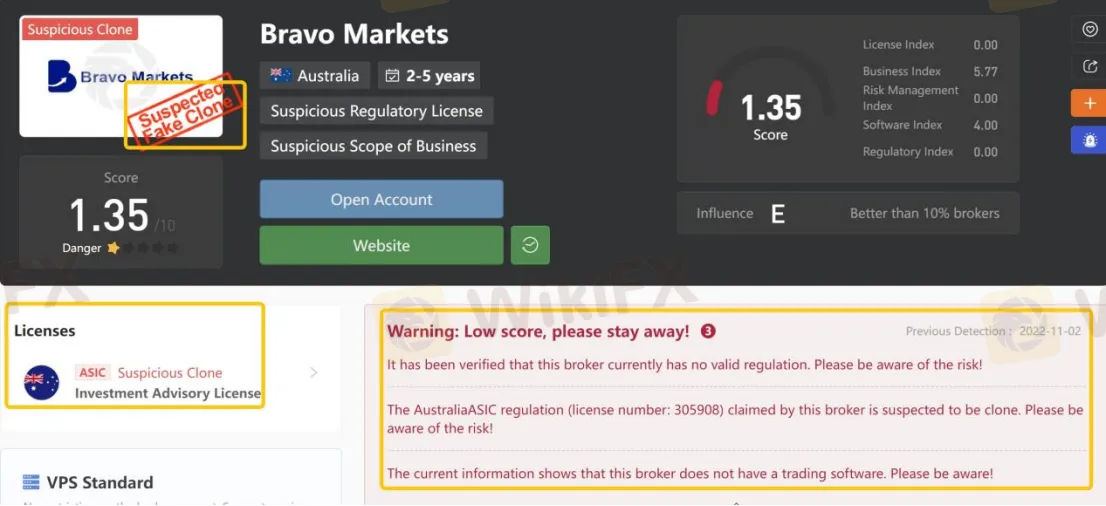

The Australia ASIC regulation (license number: 305908) claimed by Bravo Markets is suspected to be clone. Please be aware of the risk!

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

Bravo Markets, a trading name of BRAVO MARKETS PTY LTD, is allegedly a financial services company registered in Australia.

As this brokerage's website cannot be accessed, we were unable to obtain further details about its trading assets, leverage, spreads, trading platforms, minimum deposit, etc.

As for regulation, it has been verified that Bravo Markets currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.35/10. Please be aware of the risk.

Customer Support

Bravo Markets‘ customer support can be reached by telephone: +61 2 9586 3864, email: trader@bravomarkets.hk. However, this broker doesn’t disclose other more direct contact information like the company address that most transparent brokers offer.

Pros & Cons

| Pros | Cons |

| N/A | • Suspicious clone |

| • Website inaccessible |

Frequently Asked Questions (FAQs)

| Q 1: | Is Bravo Markets regulated? |

| A 1: | No. It has been verified that the AustraliaASIC regulation (license number: 305908) claimed by Bravo Markets is suspected to be a clone. |

| Q 2: | Is Bravo Markets a good broker for beginners? |

| A 2: | No. Bravo Markets is not a good choice for beginners. Not only because of its suspicious clone condition, but also because of its inaccessible website. |

Read more

IronFX Review 2025: Trusted Broker for Forex & Commodities Trading

Explore IronFX, a top-regulated broker with a 7.85 WikiFX score. Trade Forex, Metals, and more on MT4 with a $50 minimum deposit and 1:1000 leverage. Secure and reliable.

CMC Markets Just Made a Move That Could Transform CFD Trading

CMC Markets, a well-known trading company listed on the London Stock Exchange, has partnered with messaging platform Convrs.

IronFX Launches Online Trading Education to Boost Trader Education

IronFX launches a trading education blog offering in-depth market analysis, expert insights, and practical strategies for traders at all levels.

Saxo vs IronFX: In-Depth Broker Comparison for Traders in 2025

Explore a detailed 2025 comparison of Saxo and IronFX. Review platforms, fees, regulations, assets, and user feedback to choose your ideal trading broker.

WikiFX Broker

Latest News

Southeast Asia’s Trade Outlook in the Face of U.S. Tariff Adjustments

Inside the Market: Who’s Buying, Who’s Selling, and Why It Matters

Is it Safe to invest in Xtreme Markets in Malaysia?

eToro Introduces Staking for Cosmos and Polkadot

The Facebook Fraud That Stole RM649,000 | How to Avoid Being Next

CMC Markets Just Made a Move That Could Transform CFD Trading

Saxo vs IronFX: In-Depth Broker Comparison for Traders in 2025

Comparison B/W Two Renowned Brokers! Find Your Perfect Fit

Red Flags to Watch out for! CATCH THIS WARNING BEFORE IT’S TOO LATE

IronFX Launches Online Trading Education to Boost Trader Education

Rate Calc