UTrada

Abstract:Founded in 2018, UTrada is a forex broker registered in Hong Kong, China, offering more than 2100 market products, such as FX, commodities, indices, energy, shares, and cryptocurrencies, with leverage up to 1:500 and variable spreads from 0 pips via the MT4. Demo accounts are available and the minimum deposit requirement to open a live account is $50.

| UTrada | Infomation |

| Regulatory Status | LFSA |

| Tradable Assets | 2100+,Forex CFDs, Commodities CFDs, Energies CFDs, Indices CFDs, Shares CFDs, Crypto CFDs |

| Spreads | From 0.0 pips |

| Minimum Deposit | $100 |

| Leverage | 1:500 |

| Demo Account | ✅ |

| Funding Fees | From 0% |

| Micro Lot Trading | Available |

UTrada Information

Founded in 2018, UTrada is a forex broker registered in Malaysia, offering more than 2100 market products, such as FX, commodities, indices, energy, shares, and cryptocurrencies, with leverage up to 1:500 and variable spreads from 0 pips via the MT4 platform. Demo accounts are available and the minimum deposit requirement to open a live account is $100.

Regulatory Status

UTrada currently operates under the Labuan Financial Services Authority (LFSA), holding a Straight Through Processing (STP) (No.MB/19/0042).

Pros and Cons

| Pros | Cons |

| Regulated by LFSA | No info on payment methods |

| Wide range of market offerings | - |

| Demo accounts available | - |

| MT4 supported | - |

Tradable Assets

| What Can You Trade with UTrada | Assets |

| Forex CFDs | ✅ |

| Commodities CFDs | ✅ |

| Energies CFDs | ✅ |

| Indices CFDs | ✅ |

| Shares CFDs | ✅ |

| Crypto CFDs | ✅ |

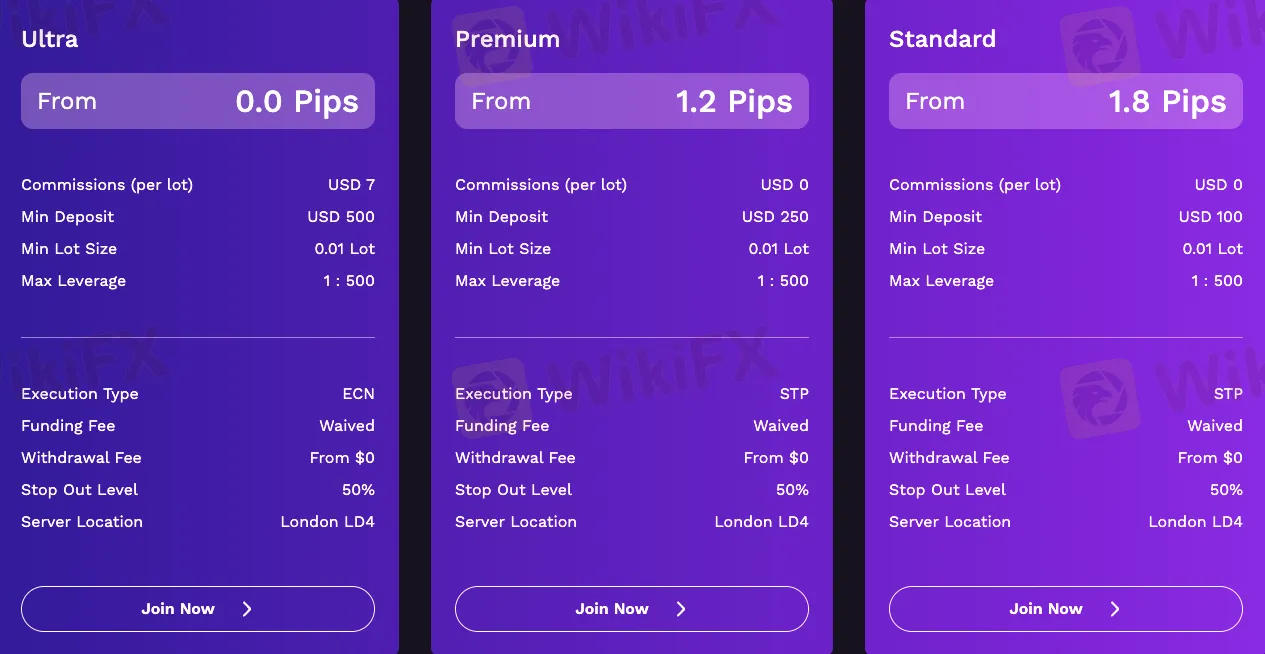

Account Types

| Account Types | Ultra | Premium | Standard |

| From (Pips) | 0.0 | 1.2 | 1.8 |

| Commissions (per lot) | USD 7 | USD 0 | USD 0 |

| Min Deposit (USD) | 500 | 250 | 100 |

| Min Lot Size | 0.01 Lot | 0.01 Lot | 0.01 Lot |

| Max Leverage | 1 : 500 | 1 : 500 | 1 : 500 |

| Execution Type | ECN | STP | STP |

| Funding Fee | Waived | Waived | Waived |

| Withdrawal Fee (From) | From $0 | From $0 | From $0 |

| Stop Out Level | 50% | 50% | 50% |

| Server Location | London LD4 | London LD4 | London LD4 |

Spreads and Commissions

UTrada offers various account types. The Ultra account has a spread of 0.0 pips but a commission of USD 7 per lot, while the Premium and Standard accounts have spreads of 1.2 and 1.8 pips respectively, with no commission per lot.

| Account Type | Point Spread (Pips) | Commissions (per lot) |

| Ultra | 0.0 | USD 7 |

| Premium | 1.2 | USD 0 |

| Standard | 1.8 | USD 0 |

Trading Platforms

| Trading Platform | Features | Status |

| MetaTrader 4 | Enhance trading experience. Trusted by many traders for MT4 trading. | Available |

| MetaTrader 5 | Supports automated trading, provides signals across sectors, enables personalized strategies & portfolio management. | Coming Soon |

| UT APP | Offers complete trading experience with diverse features for all traders. | Coming Soon |

Deposit & Withdrawal

The information about deposits and withdrawals is not clearly displayed on the official website.

Read more

Garanti BBVA Securities Exposed: Traders Report Unfair Charges & Poor Customer Service

Have you been financially ruined through chargebacks allowed by Garanti BBVA Securities? Do you have to wait for hours to get your queries resolved by the broker’s customer support official? Did the same scenario prevail when you contact the officials in-person? Failed to close your account as Garanti BBVA Securities officials remained unresponsive to your calls? Many have expressed similar concerns while sharing the Garanti BBVA Securities review online. In this article, we have shared some complaints against the broker. Take a look!

In-Depth Review of Stonefort Securities Withdrawals and Funding Methods – What Traders Should Really

For any experienced forex and CFD trader, the mechanics of moving capital are as critical as the trading strategy itself. The efficiency, security, and transparency of a broker's funding procedures form the bedrock of a trustworthy, long-term trading relationship. A broker can offer the tightest spreads and the most advanced platform, but if depositing funds is cumbersome or withdrawing profits is a battle, all other advantages become moot. This review provides a data-driven examination of Stonefort Securities withdrawals and funding methods. We will dissect the available information on payment options, processing times, associated costs, and the real-world user experience. Our analysis is anchored primarily in data from the global broker regulatory inquiry platform, WikiFX, supplemented by a critical look at publicly available information to provide a comprehensive and unbiased perspective for traders evaluating this broker.

MH Markets Deposits and Withdrawals Overview: A Data-Driven Analysis for Traders

For any experienced trader, the integrity of a broker is not just measured by its spreads or platform stability, but by the efficiency and reliability of its financial plumbing. The ability to deposit and, more importantly, withdraw capital without friction is a cornerstone of trust. This review provides an in-depth, data-driven analysis of the MH Markets deposits and withdrawals overview, examining the entire fund management lifecycle—from funding methods and processing speeds to fees and potential obstacles. MH Markets, operating for 5-10 years under the name Mohicans Markets (Ltd), has established a global footprint. With a WikiFX score of 7.08/10, it positions itself as a multi-asset broker offering a range of account types and access to the popular MetaTrader platforms. However, for a discerning trader, the real test lies in the details of its payment systems and the security of their funds. This article dissects the MH Markets funding methods withdrawal experience, leveraging pr

GAIN Capital Review: Exploring Complaints on Withdrawal Denials, Fake Return Promises & More

Is your forex trading experience with GAIN Capital full of financial scams? Does the broker disallow you from withdrawing your funds, including profits? Have you been scammed under the guise of higher return promises by an official? Does the GAIN Capital forex broker not have an effective customer support service for your trading queries? Concerned by this, many traders have shared negative GAIN Capital reviews online. In this article, we have discussed some of them. Read on!

WikiFX Broker

Latest News

The 350 Per Cent Promise That Cost Her RM604,000

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

How a Fake Moomoo Ad Led to the “New Dream Voyage 5” Scam

FXPesa Review: Are Traders Facing High Slippage, Fund Losses & Withdrawal Denials?

Trive Investigation: High Score, Hidden Risk - The Profit Paradox

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

"Just 9 More Lots": Inside the Endless Withdrawal Loop at Grand Capital

GCash Rolls Out Virtual US Account to Cut Forex Fees for Filipinos

Rate Calc