WIKIFX REPORT: Can USD/ZAR Go For A Higher High?

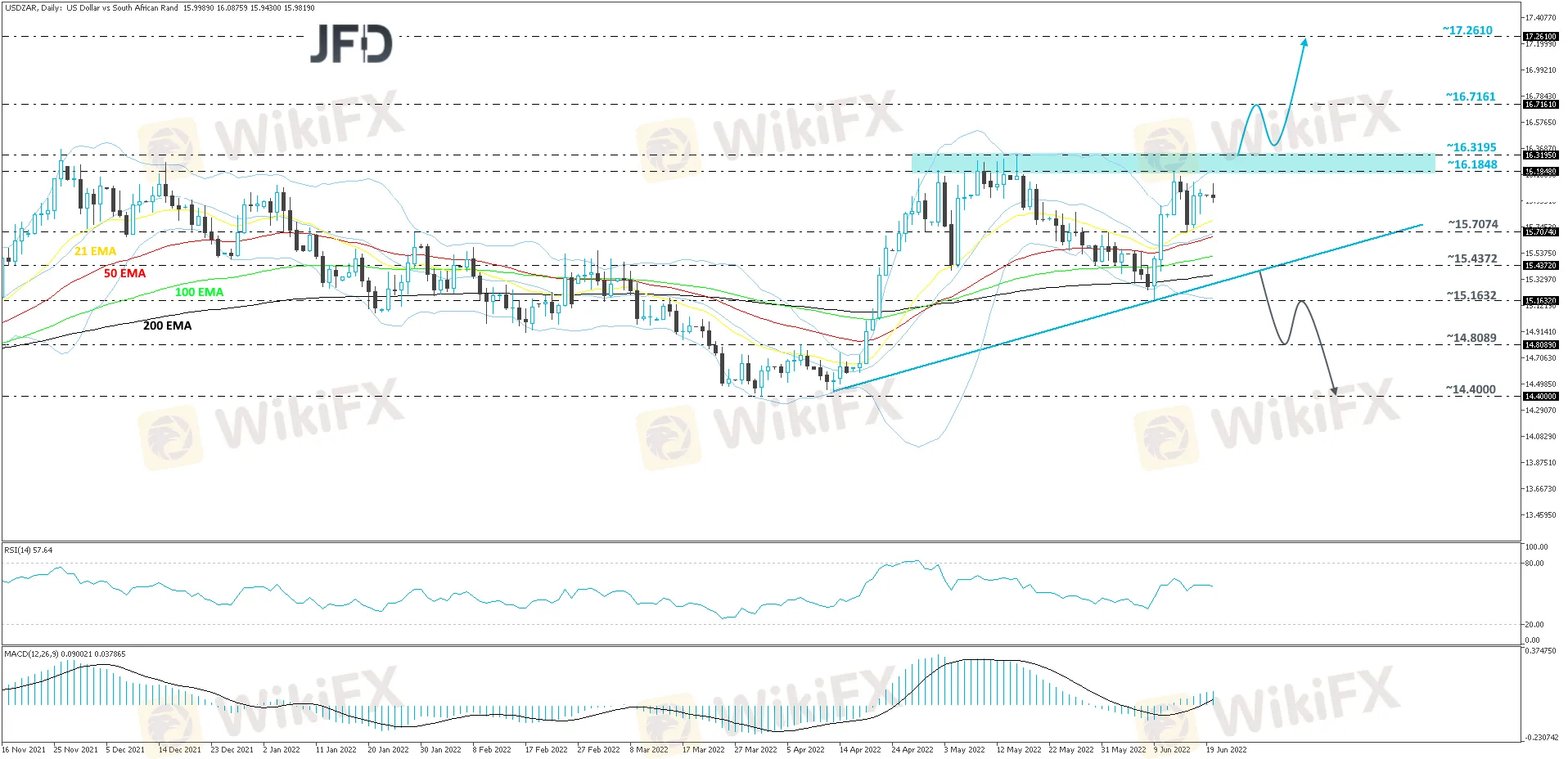

Abstract:Looking at the technical picture of USD/ZAR on our daily chart, we can see that after reversing higher at the end of March, the pair is now trading above a short-term upside support line taken from the low of April 13th. That said, the rate is currently trading below a key resistance area between the 16.1848 and 16.3195 levels, marked by the highs of June 13th and May 16th respectively. In order to aim further north, we would prefer to wait for a push above that resistance area first.

Looking at the technical picture of USD/ZAR on our daily chart, we can see that after reversing higher at the end of March, the pair is now trading above a short-term upside support line taken from the low of April 13th. That said, the rate is currently trading below a key resistance area between the 16.1848 and 16.3195 levels, marked by the highs of June 13th and May 16th respectively. In order to aim further north, we would prefer to wait for a push above that resistance area first.

Such a break will confirm a forthcoming higher high and may open the door to the 16.7161 hurdle, marked by the high of October 15th, 2020. We could see a slight hold-up around there, however, if the buyers remain strong, they might overcome that obstacle and aim for the 17.2610 zone, which is the highest point of September 2020.

The RSI is flat but continues to run above 50. The MACD is pointing higher, while running above zero and the signal line. Overall, the two oscillators show positive price momentum, which supports the upside scenario.

Alternatively, a break of the aforementioned upside line may change the direction of the current short-term trend. USD/ZAR could then drift to the current lowest point of June, at 15.1632, which was tested on the 9th of the month, a break of which might clear the way towards the 14.8089 zone. That zone marks the inside swing high of April 7th. However, if the sellers continue to apply pressure and break that zone, the next possible support area could be at 14.4000, which is the lowest point of March.

Read more

Angel Broking Review 2026: Is Angel Broking a Safe Broker or a High-Risk Platform?

When choosing a forex or CFD broker, regulation and transparency are critical factors. In this Angel Broking review, we take a close look at the broker’s background, regulatory status, trading conditions, and potential risks. According to WikiFX, Angel Broking has received a low score of 1.57/10, which raises serious concerns for traders.

BDFX Exposure: Alleged Misleading Market Advice & Poor Withdrawal Management

Do BDFX officials mislead you with poor market advice that leads to capital losses? Do you feel they themselves cannot trade the risk management analysis perfectly? Did the Comoros-based forex broker close your forex trading account and steal your funds? Did your numerous fund withdrawal requests go in vain? These are potential forex investment scams. Many traders have highlighted these trading issues on broker review platforms. Check out some of their complaints in this BDFX review article.

PURE MARKET Review: Investigating Deposit Credit Failures & Withdrawal Complaints

Did PURE MARKET stop processing payments after receiving deposits on the trading platform? Do you get a sense of a Ponzi scheme when trading with PURE MARKET? Does the broker intentionally delay your fund withdrawals? Have you faced a profit deduction on account of a wrong, arbitrary claim by the broker? Does the broker change the spread frequently to cause you losses? In this PURE MARKET review article, we have investigated these complaints against the Vanuatu-based forex broker. Keep reading!

24Five Scam Alert: No License, High Risk Trading

24Five Scam Alert exposes suspicious practices, a lack of a license broker, and hidden risks. Protect your money with key insights today.

WikiFX Broker

Latest News

China Holds Rates Steady After Hitting 5% Growth Target, Easing Expected in Q1

JPY Volatility Ahead: PM Takaichi Calls Snap Election Amid Rate Hike Speculation

Is Forex Still Worth It in 2026? Global Central Banks Are Splitting

The Fed on Trial: Markets Brace for Supreme Court Showdown Over Central Bank Independence

Trade War 2.0: Trump’s Greenland Ultimatum Rattles Transatlantic Alliance

Euro Stabilizes as France Forces 2026 Budget; Bond Spreads Narrow

JPY Volatility Spikes as PM Takaichi Calls Snap Election and Fiscal Gamble

JGB Yields Breach 4% as PM Takaichi's Fiscal Gambit Triggers 'Sell-Off'

Scrolled, Clicked, Lost RM166,000: Factory Worker Trapped by Online Investment Scam

China Macro: Liquidity Trap Signals Persist Despite Credit Bump

Rate Calc