SwissFS -Some Important Details about This Broker

Abstract:SwissFS, founded in 2004, is a brokerage registered in Kuwait. The trading instruments it provides cover Forex, indices, equities, ETFs, commodities. It is unregulated.

| SwissFS Review Summary | |

| Founded | 2004 |

| Registered Country/Region | Kuwait |

| Regulation | No regulation |

| Market Instruments | Forex, indices, equities, ETFs, commodities |

| Account Type | Live Account, Demo Account |

| Demo Account | ✔ |

| Leverage | Up to 1:200 |

| Trading Platform | MT4 |

| Customer Support | Phone: +965-22020490 |

| Email: admin@swissfs.com | |

| Physical Address: City Tower ( Al Madina Tower) Floor 16 Khalid Ibn Al Waleed Street Sharq Kuwait P.O.BOX 26635, SAFAT 13127 | |

SwissFS Information

SwissFS, founded in 2004, is a brokerage registered in Kuwait. The trading instruments it provides cover Forex, indices, equities, ETFs, commodities. It is unregulated.

Pros and Cons

| Pros | Cons |

| Wide range of trading instruments | Unregulated |

| Generous leverage up to 1:200 | No clear information about accounts |

| MT4 supported | Limited account types offered |

| Demo account available | No commission information |

| No Islamic account | |

| No payment methods information offered |

Is SwissFS Legit?

It is clear that SwissFS is currently unregulated.

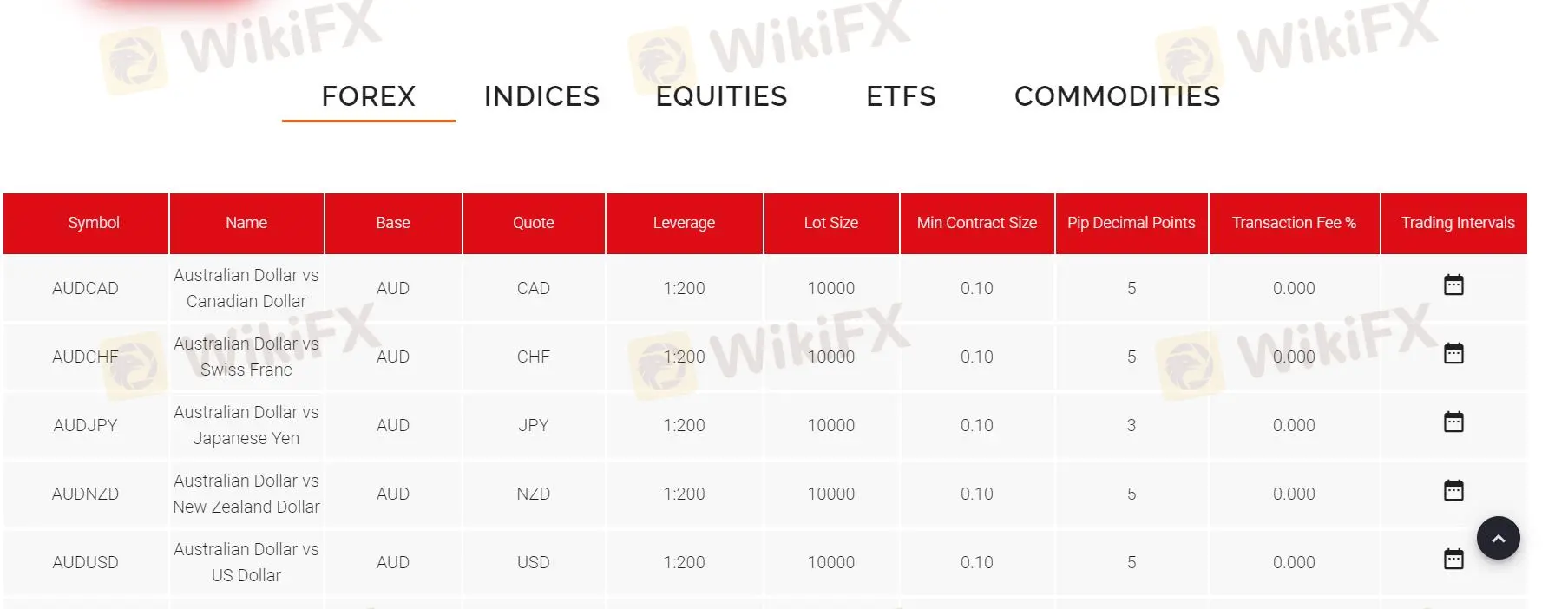

What Can I Trade on SwissFS?

SwissFS offers traders forex, indices, equities, ETFs, commodities to trade.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Equities | ✔ |

| ETFs | ✔ |

| Indices | ✔ |

| Metals | ❌ |

| Futures | ❌ |

| Options | ❌ |

Account Types

SwissFS offers 2 different types of accounts to traders - Live Account, Demo Account. But there is no more account information on its official website.

Trading Platform

SwissFS's trading platform is MT4, which supports traders on PC, Mac, iPhone and Android.

| Trading Platform | Supported | Available Devices |

| MT4 Margin WebTrader | ✔ | Web, Mobile |

| MT5 | ❌ |

Read more

Fake FP Markets Exposure: Allegations of Fund Withdrawal Denials & Trade Manipulation

Did you experience a surprise cancellation of the profits made on the Fake FP Markets trading platform? Did you face more losses than what’s mentioned on your stop-loss order? Did you lose all your capital invested through a supposedly introducing broker? Failed to receive access to the FP Markets withdrawal despite a long delay from the application date? You are not alone! In this Fake FP Markets review article, we have investigated some complaints concerning withdrawal denials and trade manipulation. Read on as we share updates below.

CMTrading Review: Is It Legit or a Scam? Check It Out Now!

Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

Sheer Markets Review: Broker Legit or Not?

CySEC #395/20 regulates Sheer Markets as a Market Maker for MT5 CFDs, but 1:30 leverage, inactivity fees, and the lack of e-wallets raise questions about reliability. Read a neutral review before depositing $/€200.

NinjaTrader Review: Platforms & Risks (2026)

NinjaTrader offers strong futures/forex platforms but faced a $250K NFA fine for AML lapses. Regulated status holds. Read the full 2026 review.

WikiFX Broker

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Rate Calc