Optiver-Some Important Details about This Broker

Abstract:Founded in 1986 and headquartered in the Netherlands, Optiver is a global trading firm that operates in Europe, Asia Pacific, and the United States. Regulated by the SFC, Optiver offers liquidity in equities, foreign exchange, fixed income, and commodities. With over 1,900 employees in offices worldwide, Optiver is a leading proprietary trading firm that strives to make markets more efficient, transparent, and stable. Their commitment to providing liquidity, competitive pricing, and reliable risk management drives their mission to benefit all market participants.

| Optiver Review Summary | |

| Founded | 1986 |

| Registered Country/Region | Netherlands |

| Regulation | SFC |

| Services & Products | Liquidity in equities, foreign exchange, fixed income, and commodities |

| Minimum Deposit | N/A |

| Customer Support | Phone, email, online messaging, Twitter, YouTube and Linkedin |

What is Optiver?

Founded in 1986 and headquartered in the Netherlands, Optiver is a global trading firm that operates in Europe, Asia Pacific, and the United States. Regulated by the SFC, Optiver offers liquidity in equities, foreign exchange, fixed income, and commodities. With over 1,900 employees in offices worldwide, Optiver is a leading proprietary trading firm that strives to make markets more efficient, transparent, and stable. Their commitment to providing liquidity, competitive pricing, and reliable risk management drives their mission to benefit all market participants.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

Pros of Optiver:

- Global presence: Optiver operates in Europe, Asia Pacific, and the United States, which allows them to access and trade in various markets worldwide. This provides them with a broader range of opportunities and potential to generate profits.

- Regulated by SFC: The fact that Optiver is regulated by the SFC (Securities and Futures Commission) demonstrates their commitment to compliance and regulatory standards. This provides a level of assurance and trust for clients and counterparties.

- Industry experience: With many years of industry experience, Optiver has developed a deep understanding of the financial markets and trading strategies. Their expertise and knowledge can be advantageous in navigating complex market dynamics.

- Liquidity provision: Optiver's role as a liquidity provider benefits the overall market by ensuring there are buyers and sellers available for securities, currencies, and commodities. This helps to enhance market efficiency and accessibility.

Cons of Optiver:

-Unclear trading conditions: The trading conditions, such as account types and funding methods, are not unclear or not readily available to the general public. Limited transparency in this regard may make it challenging for potential clients to evaluate suitability.

Is Optiver Safe or Scam?

Optiver is regulated by the Securities and Futures Commission (SFC) (License Type: Dealing in futures contracts License No. APO583).

With several years of experience in the market, Optiver has established itself as a reputable broker. Positive reviews from numerous customers further reinforce their trustworthiness. These factors, combined with their global presence and specialization in various asset classes, make Optiver an attractive option for traders and institutional clients.

However, all investments come with a certain level of risk. Traders should conduct their own research, evaluate their options, and carefully consider the potential risks and rewards before making any investment decisions. This can help ensure that they make informed choices and manage their investments effectively.

Services & Products

Optiver is a global trading firm that provides liquidity in various financial markets to institutional investors worldwide.

Equities:

Optiver offers liquidity in equity markets, which involves trading stocks and other equity instruments. They provide buying and selling opportunities for institutional investors looking to execute trades in equities efficiently and at competitive prices.

Foreign Exchange (Forex):

Optiver provides liquidity in the foreign exchange market, allowing institutional investors to trade currencies. They offer competitive bid-ask spreads, enabling clients to execute forex trades smoothly and efficiently.

Fixed Income:

Optiver offers liquidity in fixed income markets, including government bonds, corporate bonds, and other debt instruments. They provide a platform for institutional investors to buy and sell fixed income securities, optimizing execution and minimizing market impact.

Commodities:

Optiver also provides liquidity in commodity markets, including both physical and derivative contracts. They facilitate trading in commodities such as energy products (e.g., natural gas, crude oil), metals (e.g., gold, silver), agricultural products (e.g., wheat, corn), and more.

Institutional Scales

Optiver is a global trading firm that operates in Europe, Asia Pacific, and the United States.

In Europe, Optiver is a trading partner to over 600 counterparties worldwide, offering liquidity in equities (options, futures, ETFs, and cash), fixed income, and FX options. With offices in Amsterdam and London, Optiver is a leader in European equity derivatives and holds up to a 20% market share in SX5E options, ensuring competitive execution for its clients. Optiver's risk management capabilities allow them to aggregate positions across various global asset classes, enabling them to maintain tight pricing and support their counterparties during turbulent market conditions.

In the Asia Pacific region, Optiver leverages its regional specialization and significant market share in Hong Kong, Japanese, and Korean equity derivatives and ETF markets. This enables them to provide competitive, timely, and consistent pricing in all market conditions.

In the United States, Optiver serves as a trading partner to counterparties globally, offering liquidity in index, fixed income, and commodity options. With a leading market share on the screen and in the block market, Optiver is able to provide tight pricing for a variety of structures and sizes. Moreover, Optiver maintains private relationships with its counterparties, and there are no brokerage fees.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

| Amsterdam | Strawinskylaan 3095, 1077 ZX Amsterdam | +31 20 708 7000 | info@optiver.comrecruitment@optiver.com |

| London | 20 Old Bailey, London EC4M 7AN | / | office@optiver.ukrecruitment@optiver.uk |

| Chicago | 130 East Randolph, Suite 800, Chicago, Illinois 60601, U.S.A | +1 312 821 9500 | recruiting@optiver.us |

| Austin | 11501 Alterra Parkway, Suite #600, Austin, Texas 78758, U.S.A | +1 512 720 7599 | |

| Sydney | 39 Hunter Street, Sydney 2000 | +61 2 9275 6000 | careers@optiver.com.au |

| Singapore | 138 Market St, #25-01 CapitaGreen, 048946, Singapore | +65 6994 5200 | singaporecareers@optiver.com.au |

| Shanghai | 35F, China Fortune Tower, 1568 Century Avenue, Pudong, Shanghai 200122, PR China | +86 21 2082 3777 | chinacareers@optiver.com.au |

| Hong Kong | 25/F, 33 Des Voeux Road Central | +852 3607 8700 | / |

| Taipei | 8F No. 100, Songren Road, Xinyi District, Taipei City 110 Taiwan | +886 2357 0777 | taiwancareers@optiver.com.au |

Moreover, clients could get in touch with this broker through the social media, such as Twitter, YouTube and Linkedin.

Optiver offers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform. Online messaging can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

Conclusion

Overall, Optiver is a well-established trading firm with a reputation for expertise and compliance. They regulated by SFC. Optiver has a strong presence and expertise in trading various financial instruments. However, individuals should carefully evaluate their risk tolerance and investment objectives before engaging with the firm

Frequently Asked Questions (FAQs)

| Q 1: | Is Optiver regulated? |

| A 1: | Yes. It is regulated by SFC. |

| Q 2: | How can I contact the customer support team at Optiver? |

| A 2: | You can contact via phone, email, online messaging, Twitter, YouTube and Linkedin. |

| Q 3: | What services and products Optiver provides? |

| A 3: | It provides liquidity in equities, foreign exchange, fixed income, and commodities. |

| Q 4: | What is Optivers global presence? |

| A 4: | Optiver has a global presence and operates in markets across multiple regions, including Europe, the Americas, and Asia-Pacific. This global footprint allows them to leverage market opportunities worldwide and expand their trading activities. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Read more

BelleoFX Review: Allegations of Controversial Profit Cancellations & Account Closure

Have your past good experiences been marred by recent cases of profit cancellations by BelleoFX, a Mauritius-based forex broker? Has your trading account been blown away by the broker’s official upon your refusal to deposit more? Did the broker’s official tell you to deposit more, even if the earlier attempt turned unsuccessful? Did the high-return promise fall flat on the ground? In this BelleoFX review article, we have investigated these allegations. Take a look!

Is Dbinvesting Real or Fake: A Simple Check to See if This Trading Company Can be Trusted

When a trading company like Dbinvesting shows up and says it's an experienced partner with great deals like high leverage up to 1:1000 and different account types, it gets people's attention. But this appeal gets clouded by more and more serious complaints from users. This creates a big problem for people thinking about investing. The main question that needs a clear answer based on facts is: Is Dbinvesting legit, or is it a clever scam that could cause you to lose a lot of capital? This investigation wants to give you that answer. We will look past the company's marketing claims to study facts we can check. Our study will carefully look at the main worries: Is Dbinvesting watched over by a trustworthy authority? What are the real, honest experiences of people who used it? Are the many reports about withdrawal problems and Dbinvesting scam claims believable? To do this, we will use solid data from third-party checking services, such as WikiFX, including their complete regulatory check

Dbinvesting Complete Review (2026): A Detailed Look at Safety, Costs, and Customer Experiences

An Honest First Look When checking out a forex broker, the main question is always about trust: "Is Dbinvesting a safe place for my investments?" This review answers that question directly. Dbinvesting says it's an experienced broker that offers the popular MT5 platform, different account options, and access to worldwide markets. But as we look closer, we find a very different story. Our research found serious warning signs, especially its weak overseas regulation and a very low trust score from independent reviewers. This review gives you a short summary of what we found, comparing what the broker promises with the serious problems shown by real data and lots of user feedback. We want to give you a clear, fact-based answer to help you understand the major risks before investing. The difference between what it promises and what users actually report is the main focus of our investigation.

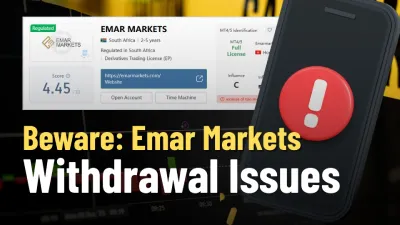

Beware: Emar Markets Withdrawal Issues—Online Trading Scam Red Flags

Beware: Emar Markets withdrawal issues may signal online trading scam red flags—delays, blocked payouts, vague excuses. Read this exposure now to protect money.

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Rate Calc