Vodafone merger: VOD stock jumps on talks with Three to form telecoms giant

Abstract:Vodafone (VOD) confirmed this week that it is in conversation with rival Three for a potential merger.

Vodafone (VOD) confirmed this week that it is in conversation with rival Three for a potential merger.

The deal would involve both companies merging their UK businesses. Hong Kong-based CK Hutchison would own 49 per cent of it while Vodafone would keep 51 per cent. To avoid cash being handed over the deal would be through a transfer of debt. Three, owned by CK Hutchison Holdings limited (0001) , would own 49% of the combined business if it were to go ahead. While Vodafone will have majority control with 51%.

The aim of the merger is to control costs of rolling out 5G across the UK, says Vodafone.

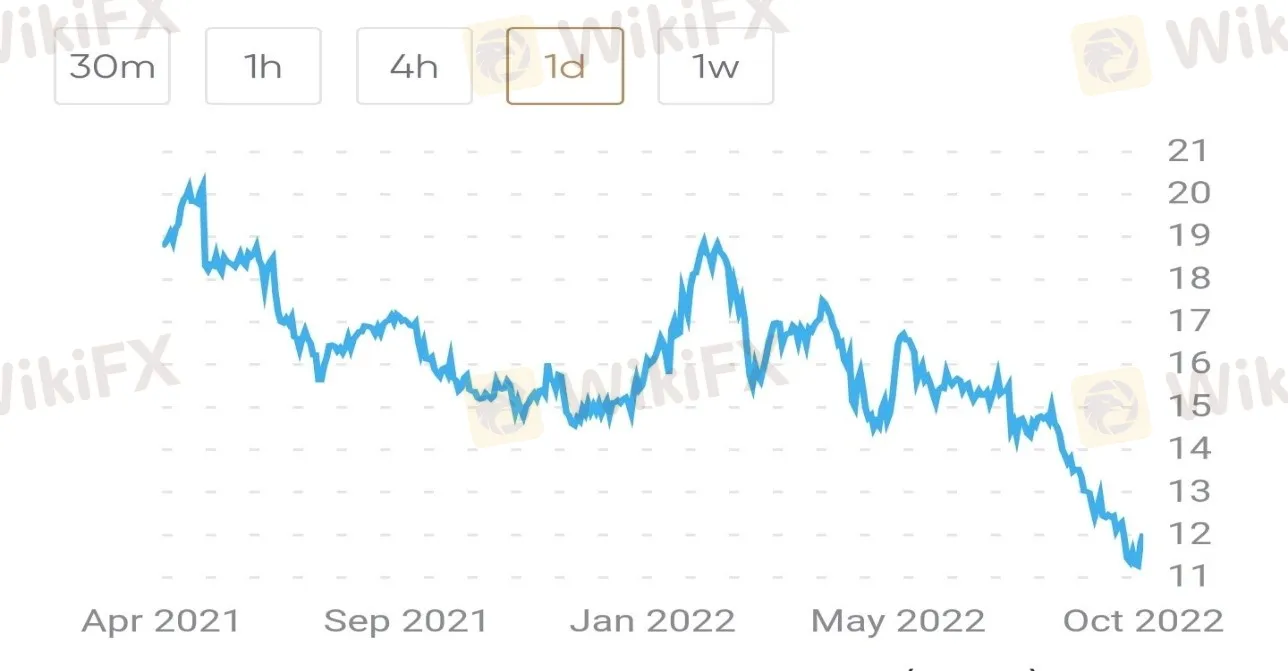

Vodafone (VOD) Price Chart

In the official statement Vodafone (VOD) said:

By combining our businesses, Vodafone UK and Three UK will gain the necessary scale to be able to accelerate the rollout of full 5G in the UK and expand broadband connectivity to rural communities and small businesses.

“The merged business would challenge the two already consolidated players for all UK customers and bring benefits through competitively priced access to a third reliable, high quality, and secure 5G network throughout the UK.”

Vodafone currently has a market capitalisation of £28.7 bn while CK Hutchison (0001) has a market capitalisation of £21bn.

Danni Hewson, AJ Bell financial analyst said in a note: “A mashup of the UKs third and fourth biggest mobile networks would give them the firepower to dominate the 5G rollout and eclipse the current market leaders.”

CK Hutchison Holdings limited (0001) Price Chart

But will the regulatory bodies approve?

This kind of a merger attempt is not the first of its kind in UK phone operator history. Three has previously tried to make a deal with O2 for £10.25bn back in 2016. At the time the deal was blocked by the European Competition Commission.

They said at the time: “We want the mobile telecoms sector to be competitive, so that consumers can enjoy innovative mobile services at fair prices and high network quality.”

And added: “Allowing Hutchison to takeover O2 at the terms they proposed would have been bad for UK consumers and bad for the UK mobile sector. We had strong concerns that consumers would have had less choice finding a mobile package that suits their needs and paid more than without the deal”

Hewson comments on this issue: “Whether it would be good news for customers is something the competition watchdog will have to consider carefully, but the technology required to keep us better connected is expensive. Pooling resources would help generate better returns for investors and unlock a better service for users.”

However, by 2020, the decision of the O2 merger was overturned. By that point the deal moved to a different combination, O2 merging with Virgin media. The European watchdog likely confirmed this deal mainly due to the timing. The slow economic growth in 2020 pushed the authority to make a lenient decision to allow the European market to keep producing.

The current deal between Vodafone and Three allows for a similar cost cutting measure, and permits for both entities to keep competing, which may tilt the regulatory decision in their favour.

Read more

OspreyFX Review: Do Traders Face High Slippage and Wide Spreads?

Are your funds stuck with OspreyFX, a Saint Vincent and the Grenadines-based forex broker? Does your trade execution price always remain far away from the requested price due to heavy slippage? Does the broker, contrary to its claims of low-cost trading experience, widen spreads to inflate your costs? Like others, do you always witness constant fund withdrawal denials by the broker? In this OspreyFX review article, we have investigated complaints against the forex broker. Read on!

Xlibre Deposit and Withdrawal Methods: A Complete 2026 Review

When choosing a broker, how you move capital in and out of your account is extremely important. Investing funds and withdrawing them out are not just simple tasks - they show whether a broker is trustworthy and works properly. It doesn't matter if putting money in is easy if you can't get your money back out. This guide explains Xlibre deposit and withdrawal methods, but we also talk about managing risks and being careful. Sometimes it's easy to deposit funds in an account, but very hard to take out your profits and original capital. Our main goal is to keep your funds safe by giving you a clear analysis of how these processes work and, more importantly, what risks they involve.

Xlibre User Reputation: Looking at Real User Feedback and Common Complaints to Check Trust

When traders want to know if a broker is safe or a scam, they want a clear answer based on facts. After carefully studying regulation data and reports from users, Xlibre appears to be a high-risk brokerage. The direct answer to "Is Xlibre Safe or Scam?" is clearly no - it's not safe. The platform works without any proper financial regulation from a trusted authority, which is absolutely necessary to keep traders’ finances safe. This lack of oversight gets worse when you add the serious user complaints saying they cannot withdraw large amounts. These two problems - no regulation and believable claims about blocked withdrawals - are major warning signs. While "scam" is a legal term, Xlibre shows a pattern that puts it clearly in the unsafe and untrustworthy category. This article will break down the evidence step by step, giving you the information you need to make a smart decision and protect your capital.

Italy’s CONSOB Orders Blocking of Three Unauthorized Investment Websites

Italy’s financial markets regulator, Commissione Nazionale per le Società e la Borsa (CONSOB), has announced the blocking of access to three websites offering unauthorized investment services as part of its ongoing efforts to combat online financial fraud.

WikiFX Broker

Latest News

TAG MARKETS Review 2026: Allegations of Withdrawal Denials & Trading Glitches

WikiFX Wishes You a Happy International Women's Day

Canadian Regulators Say More Than 7,500 Fraudulent Investment and Crypto Websites Were Taken Down

Oil prices jump above $100 for first time in four years

Retiree’s Tabung Haji Savings Gone: Elderly Retiree Loses RM277,000 After One Whatsapp Message

US NFP Preview: Markets Brace for Volatility as Employment Data Tests Fed's Patience

Crude Oil Rallies to $85 on Escalating Middle East Geopolitical Risks

Forex Brief: Dollar Dips Ahead of NFP; RBA Bets Lift AUD

HeroFx Review: Withdrawal Problems, Scam Alert & Risks

JRJR Review: Safety, Regulation & Forex Trading Details

Rate Calc