FX SmartBull

Abstract:FX SmartBull is a broker that is registered in the United Arab Emirates. The tradable instruments with a maximum leverage of 1:500 include forex, commodities, indices, and cryptocurrencies. The broker also provides four accounts. The minimum spread is from 0.0 pips, and the minimum deposit is 25 USD. FX SmartBull is still risky due to its unregulated status.

| FX SmartBull Review Summary | |

| Founded | 2021 |

| Registered Country/Region | United Arab Emirates |

| Regulation | No regulation |

| Market Instruments | Forex/Commodities/Indices/Cryptocurrencies |

| Demo Account | ❌ |

| Leverage | Up to 1:500 |

| Spread | As low as 0.0 pips |

| Trading Platform | MT5 |

| Minimum Deposit | 25 USD |

| Customer Support | Tel: +971 554841856, +971 555332890 |

| Email: support@fxsmartbull.com | |

| Facebook/Instagram/LinkedIn/Twitter/Telegram/YouTube | |

| DUBAI OFFICE: Damac Business Tower, Office No 1407/1408, 14th Floor, Business Bay, Dubai, UAE | |

| SAINT LUCIA OFFICE: Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia | |

| Regional Restrictions | India, Australia, Belgium, Iran, Japan, North Korea and USA |

FX SmartBull Information

FX SmartBull is a broker that is registered in the United Arab Emirates. The tradable instruments with a maximum leverage of 1:500 include forex, commodities, indices, and cryptocurrencies. The broker also provides four accounts. The minimum spread is from 0.0 pips, and the minimum deposit is 25 USD. FX SmartBull is still risky due to its unregulated status.

Pros and Cons

| Pros | Cons |

| Low minimum deposit of $25 | Unregulated |

| 24/7 customer support | Demo account unavailable |

| MT5 available | Unspecific transfer time and fee information |

| Spread as low as 0.0 pips | Regional restrictions |

| Swap free | No MT4 |

| Various tradable instruments | |

| Commission free |

Is FX SmartBull Legit?

FX SmartBull is not regulated, making it less safe than regulated brokers.

What Can I Trade on FX SmartBull?

FX SmartBull offers a wide range of market instruments, including forex, commodities, indices, and cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type & Fees

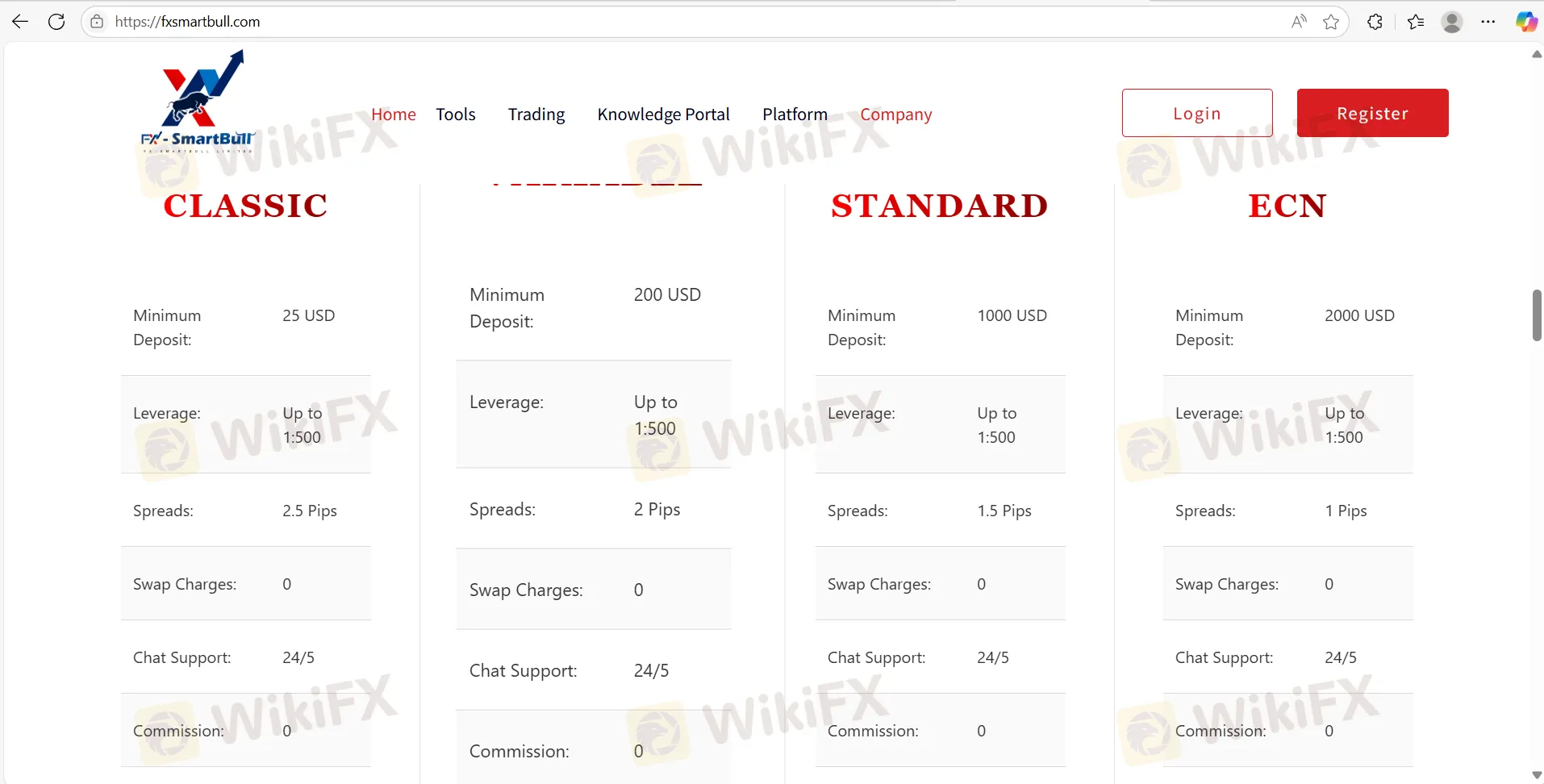

FX SmartBull has four account types: Classic, Variable, Standard, and ECN. Traders who want low spreads and low leverage can choose an ECN account, while those with a small budget can open a classic account.

| Classic | Variable | Standard | ECN | |

| Minimum Deposit | 25 USD | 200 USD | 1000 USD | 2000 USD |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Spreads | 2.5 pips | 2 pips | 1.5 pips | 1 pips |

| Swap charge | 0 | 0 | 0 | 0 |

| Commission | 0 | 0 | 0 | 0 |

Leverage

The maximum leverage is 1:500, meaning that profits and losses are magnified 500 times.

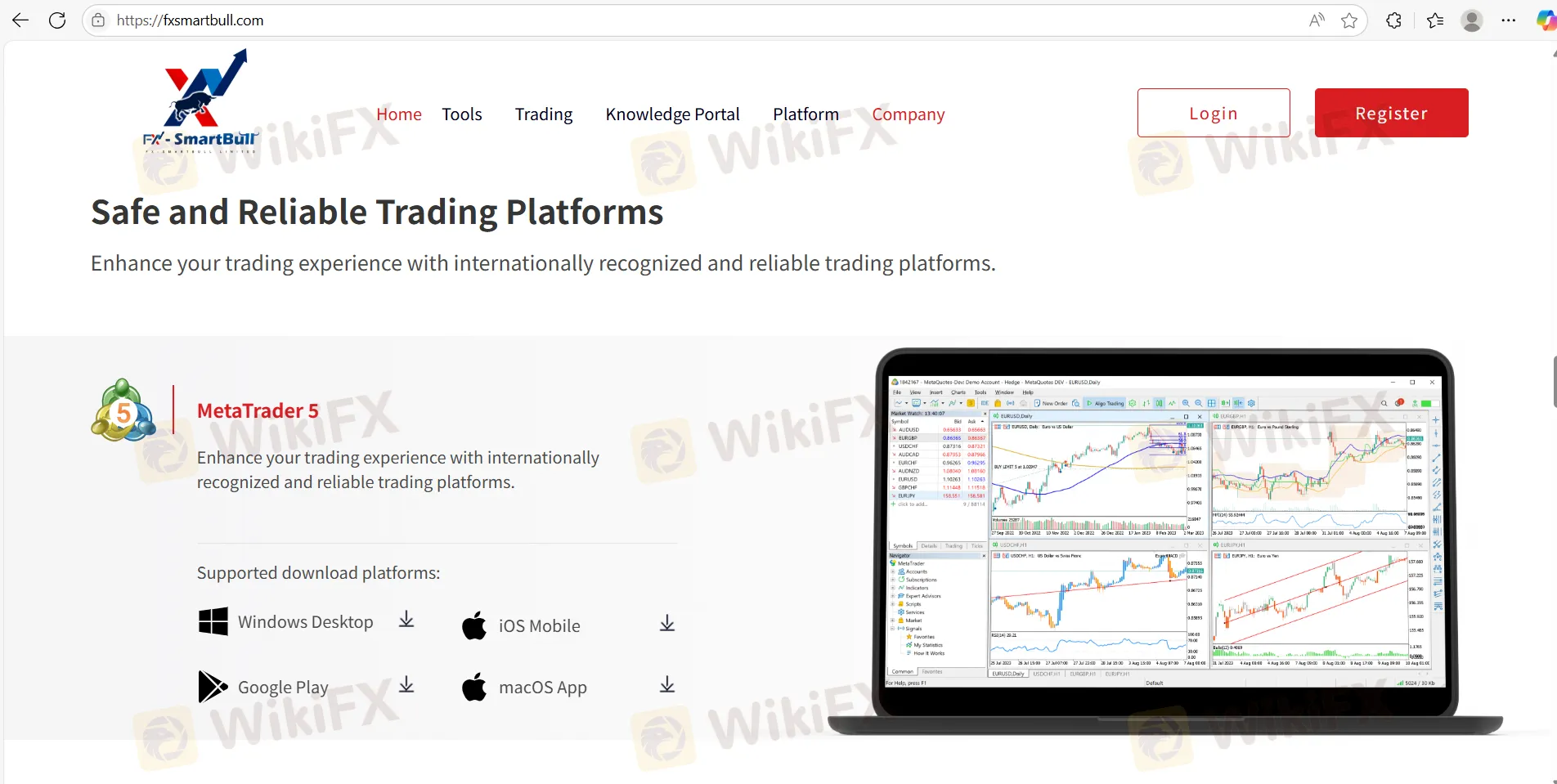

Trading Platform

FX SmartBull cooperates with the authoritative MT5 trading platform available in Windows, mobile, and macOS to trade. Traders with rich experience are more suitable for using MT5. MT4 and MT5 not only provide various trading strategies but also implement EA systems.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Windows/Mobile/MacOS | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

The minimum deposit is 25 USD. FX SmartBull accepts Visa, Mastercard, Apple Pay, Google Pay, and PhonePe for deposit and withdrawal. However, transfer processing times and associated fees are unknown.

Read more

Cabana Capital Review: Traders Report Withdrawal Issues & Account Blocks

Cabana Capital, a Saint Vincent and the Grenadines-based forex broker, has grabbed headlines for negative reasons. These include numerous complaints traders have made over withdrawal denials/delays and account blocks upon repeated attempts to contact the broker. These alleged trading activities have inevitably frustrated traders who have rightly criticized the broker online. In this Cabana Capital review article, we have mentioned a growing list of complaints against the forex broker. Keep reading!

GLOBAL GOLD & CURRENCY CORPORATION Exposure: User Complaints on Heavy Slippage & Spreads

Did you face massive slippage on the GLOBAL GOLD & CURRENCY CORPORATION trading platform and the subsequent reduction in profits? Did the broker apply a stop-loss when you were in profit? Does the high spread only add to your trading losses? Has the broker blocked your trading account and run away with your funds? You are not alone! Many traders have highlighted their painful trading experiences with the Saint Lucia-based forex broker. In this GLOBAL GOLD & CURRENCY CORPORATION review article, we have explained some of them. Read on!

Vida Markets Review: Are Traders Facing Fund Scams & Heavy Price Manipulation?

Have you witnessed illegitimate profit cancellation by Vida Markets, an Anguilla-based forex broker? Did you encounter trading losses due to inappropriate automatic stops by the broker? Were your trades closed minutes after the price changed in your favor? Did your forex trading account get blocked despite submitting the required KYC documents? Failed to get your deposit reflected in your account? These are more than just issues; they are alleged forex scams that have hit many traders. Some of them have highlighted these bad experiences while sharing the Vida Markets review. In this article, we have shared some of them. Keep reading!

LTI Legitimacy Check: Is This a Fake Broker or a Legitimate Trading Partner?

If you're wondering "Is LTI legit?" or worried about a possible "LTI scam," you're asking smart questions. Being careful is the most important skill a trader can have. To save your time, we will give you our answer right away: after carefully checking its legal status, company information, and how it operates, London Trading Index (LTI) shows serious warning signs that any potential trader needs to know about. The dangers are real and well-documented. This article won't be based on opinions. We'll show you the proof step by step, focusing on facts you can check yourself. We'll examine official warnings, look at the broker's information, and study its trading rules. By the end, you'll have a clear picture based on evidence, helping you make a smart and safe choice for your capital.

WikiFX Broker

Latest News

APAC Outlook: 'Takaichi Trade' Returns to Tokyo; RBA Hike Bets Propel Aussie Dollar

Geopolitical Risk Premium Rising: Russia Warns on Arms Treaty as Trump Pushes Ukraine Land Deal

Dollar Index Falters Near 97.00 as Washington Dysfunction Overshadows Economic Data

China Industrial Profits Turn Positive; Yen Falters on Fiscal Woes

Fed to Hold Rates Amidst Political Storm and 'Shadow QE' Speculation

Gold Breaches $5,100 as 'De-Dollarization' and Tariff Wars Crush the Greenback

APAC Outlook: 'Takaichi Trade' Returns to Tokyo; RBA Hike Bets Propel Aussie Dollar

Gold Breaches $5,100 as 'De-Dollarization' and Tariff Wars Crush the Greenback

Market Perception: 'SA Inc' Under Review

Energy Markets: Chevron and NNPCL Add 146,000 b/d to Global Supply

Rate Calc