4XC

Abstract:Founded in 2015, 4XC is a trademark of 4xCube Ltd, registered in the Cook Islands, New Zealand. It's an online trading platform operating without proper regulation. Its tradable products cover Forex, Metals, Indices, Oil, Cryptocurrencies, and Forward Contracts with flexible leverage up to 1:500 and spread from 1.0 pips on the Standard account through the MT4, MT5 and TradingView platform. 4XC offers a demo account and three types of real accounts with a minimum deposit requirement of $50.

| 4XCReview Summary | |

| Founded | 2015 |

| Registered Country/Region | New Zealand |

| Regulation | FSC (Exceeded |

| Market Instruments | Forex, Metals, Indices, Oil, Cryptocurrencies, Forward Contracts |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 1.0 pips (Standard account) |

| Trading Platform | MT4, MT5, Trading View |

| Min Deposit | $50 |

| Customer Support | 24/5 live chat |

| Tel: +44 8000 488 033 (UK) | |

| WhatsApp: +44 8000 488 033 | |

| Toll-Free: 1800 914 5011 (Colombia) | |

| Email: support@4xc.com, info@4xc.com | |

| Social Media: Facebook, YouTube, Instagram, Twitter, Telegram, Discord, Linkedin | |

| Company Address: 1st Floor, BCI House, Avarua, Rarotonga, Cook Islands | |

| Regional Restrictions | The USA, Iraq, Iran, Myanmar, North Korea, and Portugal |

Founded in 2015, 4XC is a trademark of 4xCube Ltd, registered in the Cook Islands, New Zealand. It's an online trading platform operating without proper regulation. Its tradable products cover Forex, Metals, Indices, Oil, Cryptocurrencies, and Forward Contracts with flexible leverage up to 1:500 and spread from 1.0 pips on the Standard account through the MT4, MT5 and TradingView platform. 4XC offers a demo account and three types of real accounts with a minimum deposit requirement of $50.

Pros and Cons

| Pros | Cons |

| Various tradable assets | Exceeded FSC license |

| Demo accounts | Withdrawal fee charged |

| Three account types | |

| Commission-free accounts | |

| Flexible leverage ratios | |

| MT4 and MT5 offered | |

| Low minimum deposit | |

| Multiple payment options | |

| No deposit fees | |

| 24/5 live chat |

Is 4XC Legit?

No. 4XC currently has no valid regulations. It only holds an exceeded Common Business Registration license from the Financial Supervisory Commission (FSC).

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| The Financial Supervisory Commission (FSC) | Exceeded | 4XCUBE LIMITED | Common Business Registration | MC03/2018 |

What Can I Trade on 4XC?

4XC offers a wide selection of tradable products, including forex, metals, index CFDs and oil, cryptocurrencies, and forward contracts.

| Trading Asset | Available |

| forex | ✔ |

| metals | ✔ |

| indices | ✔ |

| oil | ✔ |

| cryptocurrencies | ✔ |

| forward contracts | ✔ |

| stocks | ❌ |

| bonds | ❌ |

| options | ❌ |

| ETFs | ❌ |

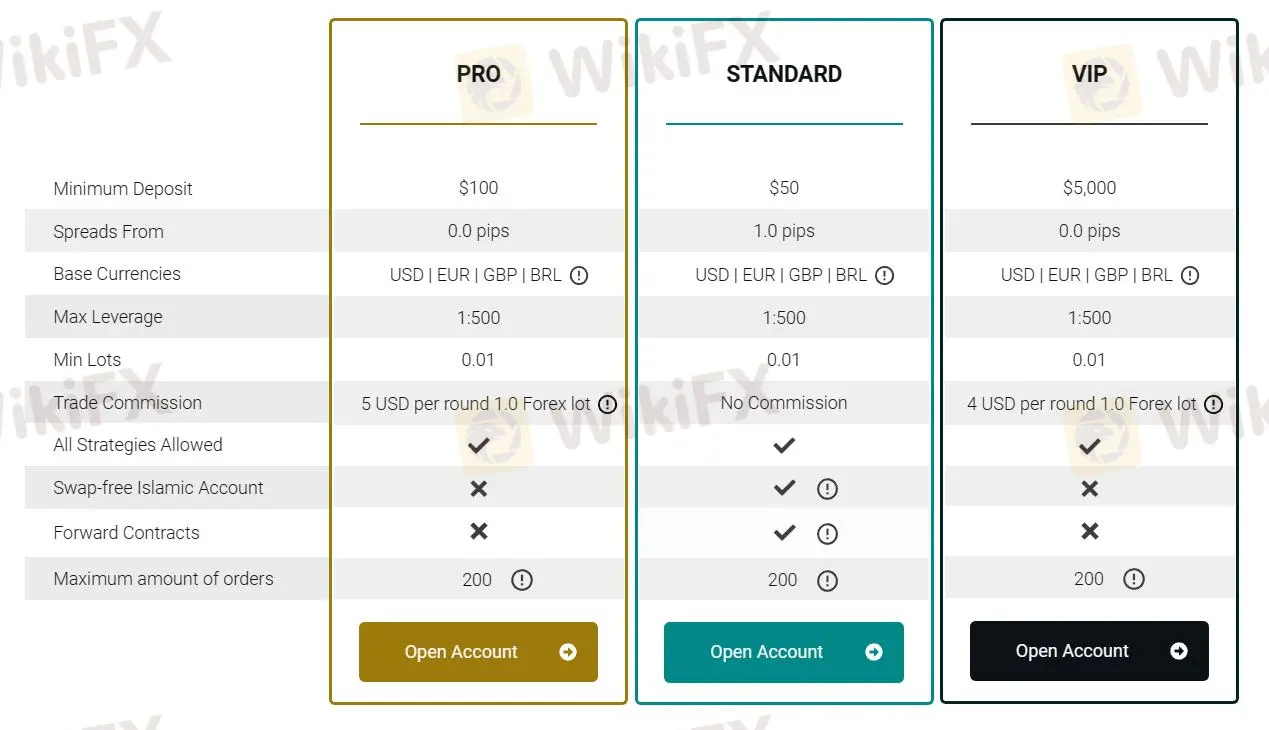

Account Type/Fees

A demo account and three types of live account are available on 4XC.

| Account Type | PRO | STANDARD | VIP |

| Base Currencies | USD | EUR | GBP |

| MinDeposit | $100 | $50 | $5,000 |

| Max Leverage | 1:500 | 1:500 | 1:500 |

| Spread | From 0.0 pips | From 1.0 pips | From 0.0 pips |

| Commission | 5 USD per round 1.0 Forex lot | ❌ | 4 USD per round 1.0 Forex lot |

| Swap-free Islamic Account | ❌ | ✔️ | ❌ |

| Forward Contracts | ❌ | ✔️ | ❌ |

Leverage

| Asset Class | Max Leverage |

| Forex | 1:500 |

| Metals | |

| Indices | 1:200 |

| Oil | |

| Cryptocurrencies | 1:20 |

| Futures Contracts | 1:200 |

Trading Platform

4XC offers both MT4 and MT5 as trading platform. Additionally, clients with Christmas Promos can access a free Trading View subscription during Christmas.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Desktop, Mobile, Web | Beginners |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| Trading View | ✔ | Desktop, Mobile, Web | Beginner |

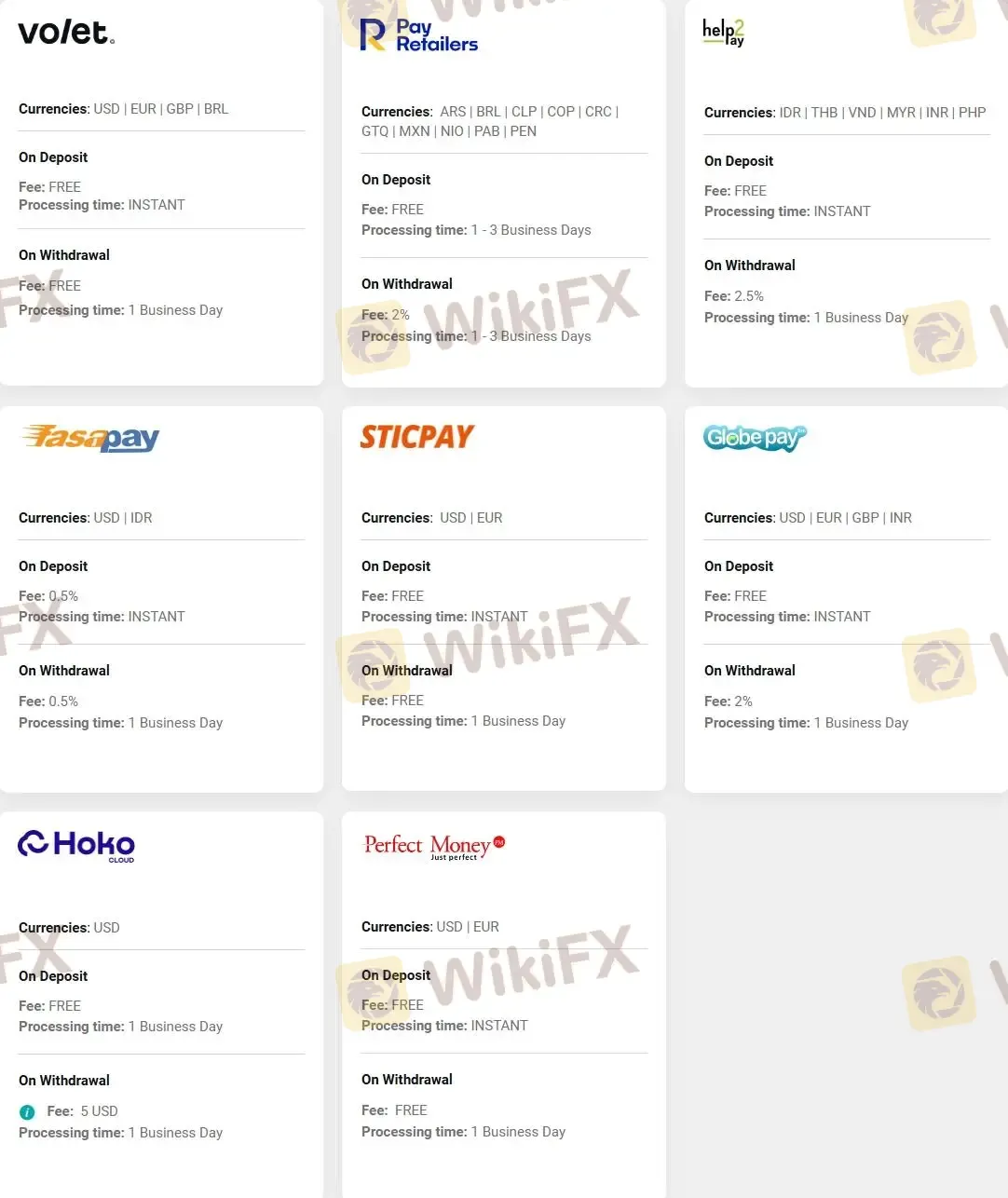

Deposit and Withdrawal

4XC accepts deposits and withdrawals via Bank transfers, CAPTEIRAX, VISA, MasterCard, American express, Crypto, Neteller, Skrill, Volet, Pay Retailers, helpay2, fasapay, Sticpay, Globepay, Hoko, and Perfect Money.

No fees for most deposits, while withdrawal fees vary on the method.

You can find more detailed info in the screenshots below.

Read more

FXPIG Exposed: Traders Report Withdrawal Denials, Fund Scams & Regulatory Flags

Do you face massive losses due to astonishing spreads at FXPIG? Have you witnessed multiple trade executions by the Georgia-based forex broker even though you wanted to execute a single order? Has this piled on losses for you? Is the FXPIG withdrawal too slow? Maybe your trading issues resonate with some of your fellow traders. In this FXPIG review article, we have shared these issues so that you can introspect them thoroughly before deciding on the best forex trader.

Does WealthFX Generate Wealth or Losses for Traders? Find Out in This Review

The name WealthFX sounds appealing for all those wishing for a rewarding forex journey. However, behind the aspiring name are multiple complaints against the Comoros-based forex broker. These trading complaints dampen the broker’s reputation in the forex community. In this WealthFX review article, we have shared some of these complaints here. Take a look!

FXPrimus Review: Is FXPrimus Regulated and Reliable for 2025?

FXPrimus is a CySEC-regulated forex broker offering MT4, MT5, and WebTrader with flexible leverage and diverse trading instruments since 2009.

IG Japan to Halt Crypto ETF CFDs as FSA Tightens Rules

IG Japan will end cryptocurrency ETF CFDs after new FSA guidance, forcing traders to close positions by January 31, 2026, under stricter crypto rules.

WikiFX Broker

Latest News

Trillium Financial Broker Exposed: Top Reasons Why Traders are Losing Trust Here

FIBO Group Ltd Review 2025: Find out whether FIBO Group Is Legit or Scam?

Amillex Withdrawal Problems

Is INGOT Brokers Safe or Scam? Critical 2025 Safety Review & Red Flags

150 Years Of Data Destroy Democrat Dogma On Tariffs: Fed Study Finds They Lower, Not Raise, Inflation

CQG Partners with Webull Singapore to Power the Broker’s New Futures Trading Offering

【WikiEXPO Global Expert Interviews】Ashish Kumar Singh: Building a Responsible and Interoperable Web3

Trump: India\s US exports jump despite 50% tariffs as trade tensions ease

IEXS Review 2025: A Complete Expert Analysis

CySEC Flags 21 Unauthorized Broker Websites in 2025 Crackdown

Rate Calc