LOCUS MARKETS-Overview of Minimum Deposit, Leverage, Spreads

Abstract:LOCUS MARKETS, a trading name of Locus Market Int Ltd, is allegedly a forex broker registered in China that claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:800 and tight spreads from 0 pips on the industry-standard MetaTrader5 trading platforms.

Note: For some unknown reason, we cannot open LOCUS MARKETS official site (https://locusmarketsintltd.com/En) while writing this introduction, therefore, we could only gather relevant information from the Internet to present a rough picture of this broker. Traders should be careful about this issue.

General Information & Regulation

LOCUS MARKETS, a trading name of Locus Market Int Ltd, is allegedly a forex broker registered in China that claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:800 and tight spreads from 0 pips on the industry-standard MetaTrader5 trading platforms.

As for regulation, it has been verified that LOCUS MARKETS does not fall under any valid regulations. That is why its regulatory status on WikiFX is listed as “No License” and it receives a relatively low score of 1.08/10. Please be aware of the risk.

Market Instruments

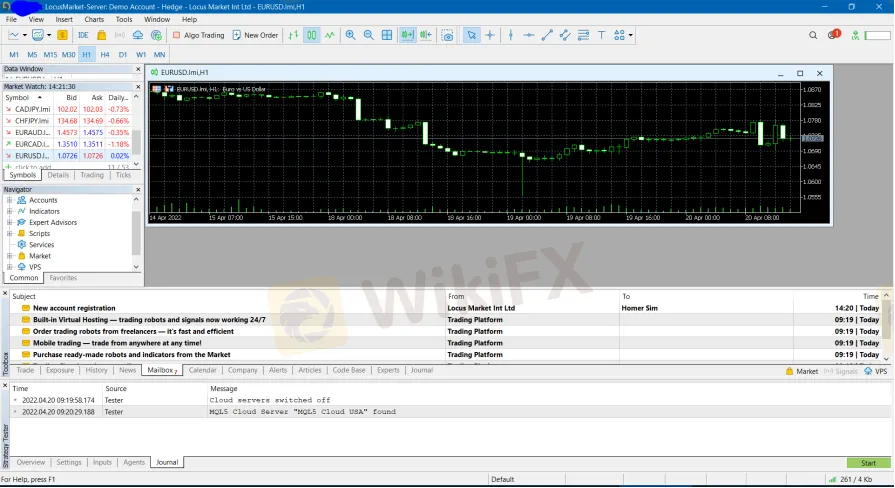

From LOCUS MARKETS demo MT5 account, the tradable assets were revealed as follows: forex currency pairs, metals, cryptocurrencies, indices and oil.

Leverage

A flexible leverage ratio ranging from 1:100 to 1:800 is offered by LOCUS MARKETS, which is much higher than that provided by most brokers. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads

As tested on the demo MT5 account, LOCUS MARKETS seems to offer the EUR/USD spread of 0 pips.

Trading Platform Available

The platform available for trading at LOCUS MARKETS is the leading MetaTrader5. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

LOCUS MARKETS appears to accept deposits and withdrawals via crypto-wallets and bank transfers only. The minimum initial deposit requirement is said to be $250.

Customer Support

LOCUS MARKETS‘ customer support can only be reached by email: info@locusmarketsintltd.com. However, this broker doesn’t disclose other more direct contact information like telephone numbers or the company address that most brokers offer.

Risk Warning

Online trading involves a significant level of risk and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Read more

IronFX Review 2025: Trusted Broker for Forex & Commodities Trading

Explore IronFX, a top-regulated broker with a 7.85 WikiFX score. Trade Forex, Metals, and more on MT4 with a $50 minimum deposit and 1:1000 leverage. Secure and reliable.

Is it Safe to invest in Xtreme Markets in Malaysia?

In the Malaysian forex market, there are a lot of brokers that draw our attention. Xtreme Markets is one of them. However, WikiFX has recently received complaints against this broker. We wonder if it is safe to invest in Xtrme Markets in Malaysia.

eToro Introduces Staking for Cosmos and Polkadot

eToro, the multi-asset brokerage platform with a robust global presence, has augmented its cryptocurrency staking programme by incorporating Cosmos ($ATOM) and Polkadot ($DOT), two of the most prominent protocols underpinning next-generation blockchain interoperability.

CMC Markets Just Made a Move That Could Transform CFD Trading

CMC Markets, a well-known trading company listed on the London Stock Exchange, has partnered with messaging platform Convrs.

WikiFX Broker

Latest News

Saxo vs IronFX: In-Depth Broker Comparison for Traders in 2025

CMC Markets Just Made a Move That Could Transform CFD Trading

eToro Introduces Staking for Cosmos and Polkadot

The Facebook Fraud That Stole RM649,000 | How to Avoid Being Next

Is it Safe to invest in Xtreme Markets in Malaysia?

Southeast Asia’s Trade Outlook in the Face of U.S. Tariff Adjustments

Inside the Market: Who’s Buying, Who’s Selling, and Why It Matters

Comparison B/W Two Renowned Brokers! Find Your Perfect Fit

Red Flags to Watch out for! CATCH THIS WARNING BEFORE IT’S TOO LATE

IronFX Launches Online Trading Education to Boost Trader Education

Rate Calc