Future Management Systems-Overview of Minimum Deposit, Leverage, Spreads

Abstract:Future Management Systems, a trading name of Future Management Systems LIMITED., is allegedly an unregulated STP broker registered in Saint Lucia with registration number 2018-00208 and provides brokerage services to clients in the forex and CFD markets since 1997. The broker says to provide its clients with leverage up to 1:100, spread from 1 pip and zero commission on the PAMM and MetaTrader5 trading platforms, as well as a choice of four different account types and 24/7 customer support service.

General Information & Regulation

Future Management Systems, a trading name of Future Management Systems LIMITED., is allegedly an unregulated STP broker registered in Saint Lucia with registration number 2018-00208 and provides brokerage services to clients in the forex and CFD markets since 1997. The broker says to provide its clients with leverage up to 1:100, spread from 1 pip and zero commission on the PAMM and MetaTrader5 trading platforms, as well as a choice of four different account types and 24/7 customer support service.

Market Instruments

Future Management Systems advertises that it offers more than 300 trading instruments in financial markets, including 100 forex currency pairs, shares CFD, cryptocurrencies, as well as for gold (XAUUSD), silver (XAGUSD), Brent oil (XBRUSD) and WTI (XTIUSD) and natural gas ( XNGUSD).

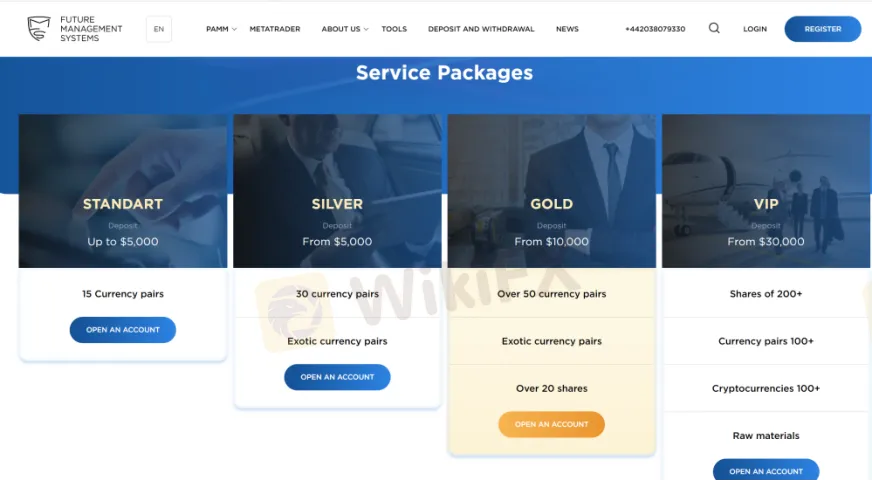

Account Types

There are four live trading accounts offered by Future Management Systems, namely Standard, Silver, Gold and VIP. The deposit amount on the Standard account is up to $5,000, while on the Silver account is from $5,000, on the Gold account is from $10,000 and on the VIP account is from $30,000.

Leverage

A leverage ratio of up to 1:100 is offered by Future Management Systems, which is much higher than that provided by most brokers. Inexperienced traders are advised not to use too much leverage since leverage magnifies gains and losses.

Spreads & Commissions

Future Management Systems claims that clients on the VIP account can enjoy spread from 1 pip with zero commission, while other account types have no more information involved.

Trading Platform Available

Platforms available for trading at Future Management Systems are PAMM and MetaTrader5, compatible with Android, iOS, Windows and Web terminals. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Trading Tools

Future Management Systems also provides its clients with a profit calculator as its trading tool to help them calculate the profits more easily, whose interface is clear and easy to use, just as the below screenshot shows.

Deposit & Withdrawal

Future Management Systems states to work with Visa, MasterCard, Maestro and Wire Transfer. Both deposits and withdrawals have a 3% commission from the bank and require 1-3 working days to be processed.

Customer Support

Future Management Systems customer support can be reached by telephone: +44 20-3807-9330, email: info@future-fx.org or send messages online to get in touch. Company address: Handelsbank Elsenheimer Str. 41 München 80687 Germany.

Read more

Malaysia’s EPF Declares Highest Dividend Since 2017 Amid Market Resilience

Malaysia’s Employees Provident Fund (EPF) has announced a 6.3 per cent dividend for both its conventional and syariah savings accounts for 2024. This marks the fund’s highest payout since 2017 and the first time both accounts have recorded the same rate. The unexpected increase is expected to encourage more voluntary contributions from members.

Succedo Markets Broker Review

Succedo Markets is a relatively new player in the forex and CFD brokerage arena, with approximately 1–2 years of trading experience. Registered in Saint Lucia and operating in the UAE, this broker has quickly made headlines for its unconventional approach and risk profile.

OlympTrade Review 2025: Trading Accounts, Demo Account, and Withdrawal to Explore

OlympTrade is a relatively young online broker registered in Saint Vincent and the Grenadines, a shady spot with a booming of unlicensed entities. Tradable assets on the OlymTrade are not extensive, and this broker does not tell many essential trading conditions. As for trading platforms, I found trades can only operated on a simple web-based trading platform, no Metatrader platform at all.

How Do You Make Money in the Forex Market in March 2025

March 2025 has arrived with a mix of opportunity and volatility in the forex market. With central banks actively adjusting policies, geopolitical events shaking market sentiment, and key economic data on the horizon, traders are presented with a dynamic landscape. To profit in such an environment, you need a robust strategy that combines technical and fundamental analysis, disciplined risk management, and the ability to adapt quickly to market shifts.

WikiFX Broker

Latest News

DOJ Investigates LIBRA Memecoin Scam: $87M Lost by Investors

Crypto Trading: New Trend among Indian Youth

How Do You Make Money in the Forex Market in March 2025

Beyond the Hype: The Three Pillars of a Profitable Crypto Investment

First UK Criminal Conviction for Unregistered Crypto ATMs Involves Over £2.5 Million

Consob Exercises MICAR Authority for the First Time, Shutting Down Unregistered Crypto Website

TD Bank Appoints Guidepost Solutions for AML Compliance Oversight

Malaysia’s EPF Declares Highest Dividend Since 2017 Amid Market Resilience

Tether’s USDT Hits $1.4 Billion on TON in Record Time

Revealed: How Investors Made 4.43 Trillion Naira in the Market

Rate Calc