Mohicans markets:Inflation worries or recession worries? Follow U.S. labor market data

Abstract:On August 4th, Beijing time, spot gold in the Asian session tested the first resistance at 1774 and failed to break through, and gave up some of the gains. The current trend remains bullish. Spot silver fluctuates up and down at 20. If it is confirmed to stand above 20, it may further open up the upside. WTI crude oil is still running below the pivot point after falling, and the primary support is 90.5. The US dollar index is hovering near the pivot point. If it is confirmed to stand on the pivo

Today's Disk

Market Overview

Fundamentals Overview

On August 4th, Beijing time, spot gold in the Asian session tested the first resistance at 1774 and failed to break through, and gave up some of the gains. The current trend remains bullish. Spot silver fluctuates up and down at 20. If it is confirmed to stand above 20, it may further open up the upside. WTI crude oil is still running below the pivot point after falling, and the primary support is 90.5. The US dollar index is hovering near the pivot point. If it is confirmed to stand on the pivot point, the first target will be 105.54. EUR/USD needs to pay attention to the direction selection. GBP/USD tested the first support in the short-term and has now rebounded.

At 19:00 tonight, the Bank of England will announce the interest rate decision and meeting minutes, followed by a press conference at 19:30 by the Governor of the Bank of England, Bailey. Markets are expecting the Bank of England to join other central banks this time around in extending the rate hike to 50 basis points, which would be the largest rate hike in 27 years.

At 19:00 on August 4, Beijing time, the Bank of England will announce its interest rate decision and meeting minutes. ING analyst James Smith said the Bank of England was concerned about the pound after the Fed, European Central Bank and other central banks raised rates sharply and did not want to be an outlier by not joining the 50 basis point hike. Fxstreet analyst Dhwani Mehta said the pound could rebound to hit 1.2500 if the Bank of England hints at aggressive policy tightening at its meeting this week, putting inflation above growth concerns.

The Mohicans Markets strategy is for reference only and not as investment advice. Please read the terms of the statement at the end of the article carefully.

The following strategy was updated at 16:30 on August 4, 2022, Beijing time.

Technical View

International Gold

High probability scenario Below 1775.72, bearish

Small probability scenario Above 1775.72, bullish

Key Point

First support 1763.44 Second support 1755.94 Third support 1742.98

First resistance 1775.72 Second resistance 1785.21 Third resistance 1795.89

1795-1800 trend bulls target, strong resistance

1783-1785 Strong resistance

1775 day key resistance

1763 Short-term support

1752-1755 Trend key support

1742 The first callback target after the break

Key Support in Week 1736

Technical Analysis

The U.S. non-manufacturing PMI for July announced yesterday unexpectedly rose. However, this did not reduce the markets worries about economic

recession. Spot gold stopped falling and rebounded after the U.S. market fell

yesterday. 1775 key resistance. From the perspective of order flow, the bulls

in the 1769-1774 range have left the market, and the bearish stock is large,

which is a rebound resistance range; if it stands in this range, it may look to the long

target of 1794, but the call options at this position have left the market for

two consecutive days, and the short-term momentum will be limited; the

second target for the bulls is 1814-1819, but there is also a loss of bulls in

this vicinity. If the price of gold falls below 1754, it may continue to impact the short target of 1744 and 1719, of which 1719 is the second target for

bearish funds to be willing to increase.

Note: The above strategy was updated at 16:00 on August 4th. This strategy is a day strategy, please pay attention to the release time of the strategy.

Spot Silver

High probability scenario Below 19.99, bearish

Small probability scenario Above 19.99, bullish

Key Point

First support 19.99 Second support 19.83 Third support 19.51

First resistance 20.18 Second resistance 20.50 Third resistance 20.80

The first key position after 19.99 broke

20.5 Strong resistance

20.18 Intraday key resistance

19.8 Short-term support

19.54 broke the first callback target

Technical Analysis

After hitting the 20.5 long target again yesterday, spot silver broke the 20 mark for support. From the perspective of option order flow, 20 is still a prominent position for bullish stock, but there are many bearish bets on 20.1 Masukura, where resistance is more critical. If silver returns to above 20.1 within the day, it may continue to challenge the previous bull target of 20.50.

Below the current price, both the long and short sides of 19.75 have increased their bets and become the key support for the day. Once it breaks, the next short fall target is at 19.5, which is also the key support for the previous upward trend.

US crude oil

High probability scenario Above 92, bullish

Small probability scenario Below 92, bearish

First support level 89.31 Second support level 87.24 Third support level 85.16 (day K)

First resistance 91.82 Second resistance 92.81 Third resistance 94.83

96.5 Early long-short boundary, strong resistance

94.8 Strong resistance 91.8-92.8

Short-term resistance 90 early bear target (touched)

The first support after 87 broke

85 short second target

Technical Analysis

Oil prices rose first and then fell on Wednesday, turning around at the 96.5 long-short dividing line. According to the news, OPEC+'s “slightly perfunctory”

increase in production is short-term bullish, but the market already has many

expectations, and the evening EIA inventory data is bearish. After the OPEC+ meeting, the focus will turn to the economic recession and the Iran nuclear

negotiation, which is still bearish overall.

In terms of options, the differences between long and short positions around

90 are more obvious. Therefore, we should pay attention to the support of this mark during the day. After breaking the position, we will test the support of 87, and the next target of the bears is 84-85. If you hold 90, the short-term

resistance will first look at 91-92, and the strength of long bets above this has weakened, which may suggest that today's rebound space may be limited, and 94.8 and 96.5 constitute strong intraday resistance.

Note: The above strategy was updated at 16:00 on August 4th. This strategy is a day strategy, please pay attention to the release time of the strategy.

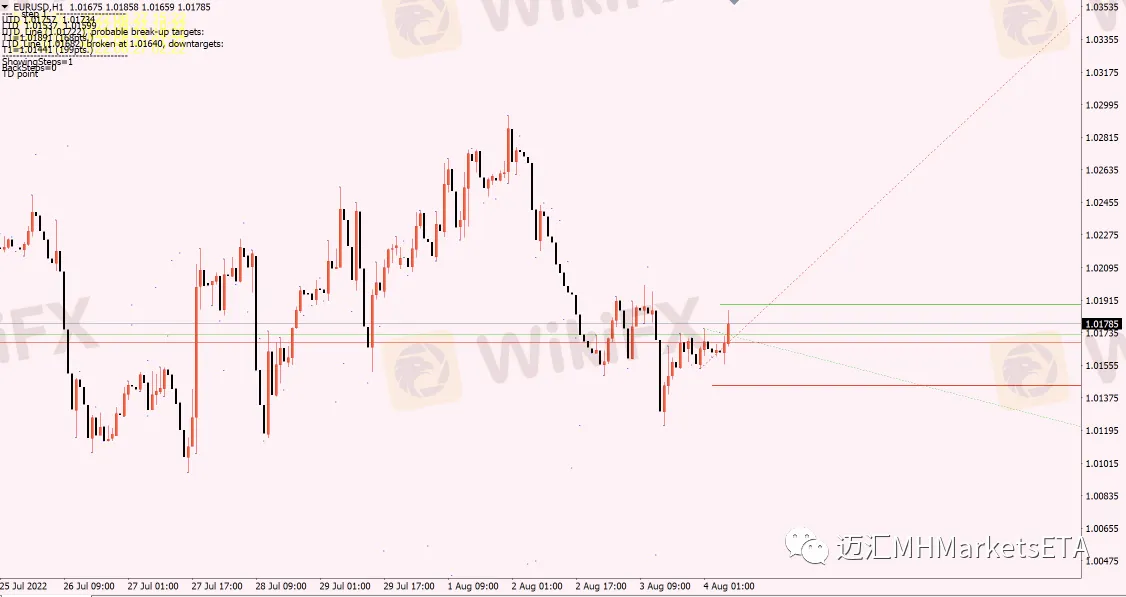

EUR/USD

High probability scenario Below 1.0160, bearish

Small probability scenario Above 1.0160, bullish

Key point

First support 1.0150 Second support 1.0125 Third support 1.0106

First resistance 1.0175 Second resistance 1.0250 Third resistance 1.0350

1.0350-1.04 slightly less bullish, less bearish but large stock, resistance area

1.03 Bullish increase, bearish decrease, long target

1.0175 Bullish increase, bearish unchanged, focus on upside momentum

1.0150 bullish increase, bearish increase slightly, support level

1.0125 bullish increase, bearish decrease, support level

1.00 bullish basically unchanged, bearish increasing, bear target

Technical Analysis

On Wednesday, the euro against the dollar failed to break through the key

resistance of 1.02, stabilized and rebounded after falling to the lowest level of 1.0123 in the US market, and recovered to around 1.0175. After the market

opened today, it continued to be under pressure at 1.0175. From the

perspective of changes in order flow, 1.0125-1.0175 added 1393 lots, which is expected to provide support for the euro. If it falls below 1.0125, you need to be alert to the risk of retesting parity. However, there are still some bullish

funds entering the market above 1.02. If they break through 1.02, they can

pay attention to the 1.0225 target level, but the exit of 1.0250 bullish funds

may weaken the upward momentum. In the case of a further breakthrough, pay attention to the 1.03 integer.

Note: The above strategy was updated at 16:00 on August 4th. This strategy is a day strategy, please pay attention to the release time of the strategy.

GBP/USD

High probability scenario Below 1.2150, bearish

Small probability scenario Above 1.2150, bullish

Key point

First support 1.2130 Second support 1.2107 Third support 1.2090

First resistance 1.2150 Second resistance 1.2170 Third resistance 1.2250

1.2250 bullish reduction, bearish unchanged, resistance level

From 1.2150 to 1.2170, both longs and shorts increased slightly and the stock was equal, and longs and shorts competed for the area

1.21 Calls increase, bears unchanged, key support level

1.2050 is bullish unchanged, bearish slightly increased and the stock is large,

short target position

Technical Analysis

On Wednesday, the pound against the US dollar was blocked at the 1.22

resistance level, and it failed to break through the two tests. After falling

below the opening low, it reached the 1.21 bearish target suggested in

yesterday's report in the US market, and rose to around 1.2150 in late trading.GBP/USD remained volatile around this level at the opening of the day.

Judging from the changes in order flow, new bullish funds were added at the overnight low of 1.21, which is expected to provide strong support. If it breaks down unexpectedly, the short target will be 1.2050 and 1.20. On the other

hand, 1.2150-1.2170 is expected to constitute a long-short competition area. Only by breaking through this range can there be a possibility of further upward movement. First, continue to pay attention to the double top area of the

previous day near 1.22, followed by 1.2250.

Note: The above strategy was updated at 16:00 on August 4th. This strategy is a day strategy, please pay attention to the release time of the strategy.

AUD/USD

High probability scenario Above 0.6950, bullish

Small probability scenario Below 0.6950, bearish

Key point

First support 0.6925 Second support 0.6907 Third support 0.6875

First resistance 0.6975 Second resistance 0.7010 Third resistance 0.7025

0.7025-0.7050 bullish decrease, bearish unchanged, upside momentum weakened

0.6975-0.70 bullish decrease, bearish increase, resistance level

0.6950 bullish increase, bearish increase, long and short fight, rebound key level

0.6925 bullish unchanged, bearish increase, short-term downside target

0.69 Bullish decrease, bearish decrease, bearish weakened

0.6850-0.6875 bullish unchanged, bearish sharply reduced, key trend support

0.58-0.5825 bullish unchanged, bearish decrease, support level

Technical Analysis

On Wednesday, the Australian dollar rebounded slightly near the support

of 0.6890, the middle rail of the daily Bollinger Band, and finally reached theshort-term key level of 0.6960.

Judging from the changes in order flow, the bearish funds below 0.69 leftthe market sharply, which weakened the further downward momentum of the Australian dollar. Continue to pay attention to the gains and losses of 0.6890 during the day. Once it falls below, it may test the key support of the

0.6850-0.6875 trend. Further support is at 0.68.

The top is concerned about the breakthrough of 0.5960. Stabilization is

expected to look at the key resistance of 0.70. Returning to the top of

0.70 means that the rally has restarted, and then the upper resistance is at 0.7025-0.7050.

Note: The above strategy was updated at 16:00 on August 4th. This strategy is a day strategy, please pay attention to the release time of the strategy.

Disclaimer: The information contained in this material is for general advice only.

It does not take into account your investment goals, financial situation or special needs. Mohicans Markets has made every effort to ensure the

accuracy of the information as of the date of publication. Mohicans Markets

makes no warranties or representations regarding this material. The examples in this material are for illustration only. To the extent permitted by law,

Mohicans Markets and its employees shall not be liable for any loss or

damage arising in any way, including negligence, from any information

provided or omitted from this material. The features of Mohicans Markets

products, including applicable fees and charges, are outlined in the Product

Disclosure Statement available on the Mohicans Markets website www.mhmmarkets.com, and you should consider before deciding to deal with these products. Derivatives can be risky; losses can exceed your initial payment. Mohicans

Markets recommends that you seek independent advice.

Mohicans Markets, (abbreviation: MHMarkets or MHM, Chinese name: Maihui), Australian Financial Services License No. 001296777.

Read more

December 9-European Perspective

On Friday, December 9, Beijing time, during the Asian and European session, spot gold shocks up, and is currently trading near $ 1795 per ounce. Market concerns about the lingering U.S. recession dragged the dollar down, approaching support for more than five-month lows, providing support for gold prices. Market expectations that the Federal Reserve will slow down some of its interest rate hikes also helped the bulls. However ……

MHM Today’s News

☆ 09:30 China publishes annual rate of CPI for November. ☆ 21:30 U.S. publishes annual rate and month rate of PPI for November. ☆23:00 U.S. releases one-year inflation rate expectations for December and preliminary of University of Michigan Consumer Confidence Index for December. ☆ The following day 02:00 U.S. releases total number of oil wells drilled for the week to Dec. 9. ☆ Next day 04:30 U.S. Commodity Futures Trading Commission publishes its weekly COT Report.

MHMarkets:Gold Bulls Bet on a Rebound, Crude Oil Spot Price Long and Short Competition

On Monday, September 27, during the Asian session and the Asia-Europe session, spot gold fluctuated and dropped, extending the decline of last Friday, reaching a minimum of $1,626.60 per ounce, the lowest since April 7, 2020.

MHMarkets:Pay Attention to the Speeches of Fed Officials

☆At 15:30, the 2023 FOMC voting committee and Chicago Fed President Evans was interviewed by CNBC. Investors will need to be on the lookout for this hawkish call after three Fed officials have said they need to keep raising interest rates and slow the economy "moderately".

WikiFX Broker

Latest News

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

FX SmartBull Regulation: Understanding Their Licenses and Company Information

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Neptune Securities Exposure: Real Forex Scam Warnings

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

Rate Calc