Valiant Markets-Overview of Minimum Deposit, Leverage, Spreads

Abstract:Valiant Markets is an offshore broker advertising trading in over 1,000 trading instruments including Forex, Stocks, Commodities, Indices, and Futures. It offers leverage up to 1:100 and requires a high minimum deposit of $250. However, its lack of regulation raises concern about asset safety.

Note: Valiant Markets's official website - https://www.valiantmarkets.com/ is currently inaccessible normally.

| Valiant Markets Review Summary | |

| Founded | 2016 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | 1,000+, Forex, Stocks, Commodities, Indices, Futures |

| Demo Account | ❌ |

| Leverage | 1:100 |

| EUR/USD Spread | From 3.2 pips |

| Trading Platform | Web |

| Min Deposit | $250 |

| Customer Support | 24/7 support |

| Contact form | |

| Tel: +44 203-318-8141 | |

| Email: support@valiantmarkets.com | |

| 23 STASINOU STREET, 2ND AND 3RD FLOOR 2404 ENGOMI, NICOSIA, CYPRUS | |

Valiant Markets is an offshore broker advertising trading in over 1,000 trading instruments including Forex, Stocks, Commodities, Indices, and Futures. It offers leverage up to 1:100 and requires a high minimum deposit of $250. However, its lack of regulation raises concern about asset safety.

Pros and Cons

| Pros | Cons |

| Multiple trading choices | Unavailable website |

| Popular payment options | No regulation |

| 24/7 customer support | Warned by MSC |

| No demo accounts | |

| Wide spreads | |

| No reliable platform | |

| High minimum deposit ($250) |

Is Valiant Markets Legit?

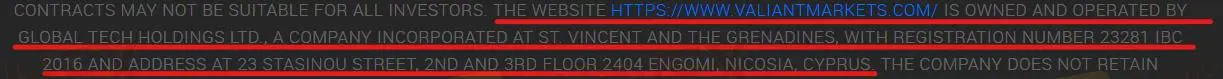

No, Valiant Markets is absolutely not a legal broker. It claims to be registered in the United Kingdom, but this is not the case. In fact, this brokerage is registered and operates in Saint Vincent and the Grenadines, an offshore haven known for not regulating its markets in any way.

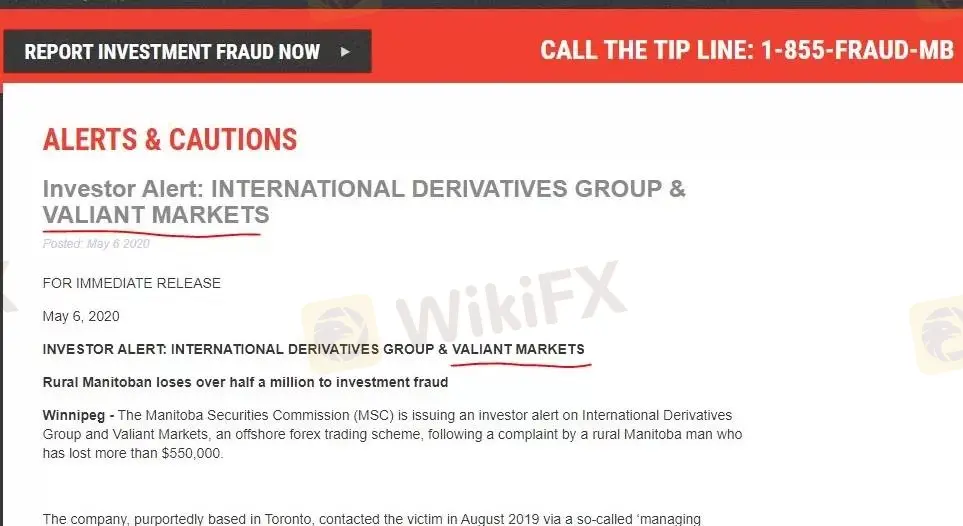

In addition, upon further investigation, we have found that as early as 2020, the Manitoba Securities Commission (MSC), a provincial regulatory agency in Canada, had already warned investors that Valiant Markets was involved in a fraudulent scheme.

What Can I Trade on Valiant Markets?

Valiant Markets advertises that it offers more than 1,000 trading assets in financial markets, including Forex, Stocks, Commodities, Indices and Futures.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Stocks | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Futures | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Leverage

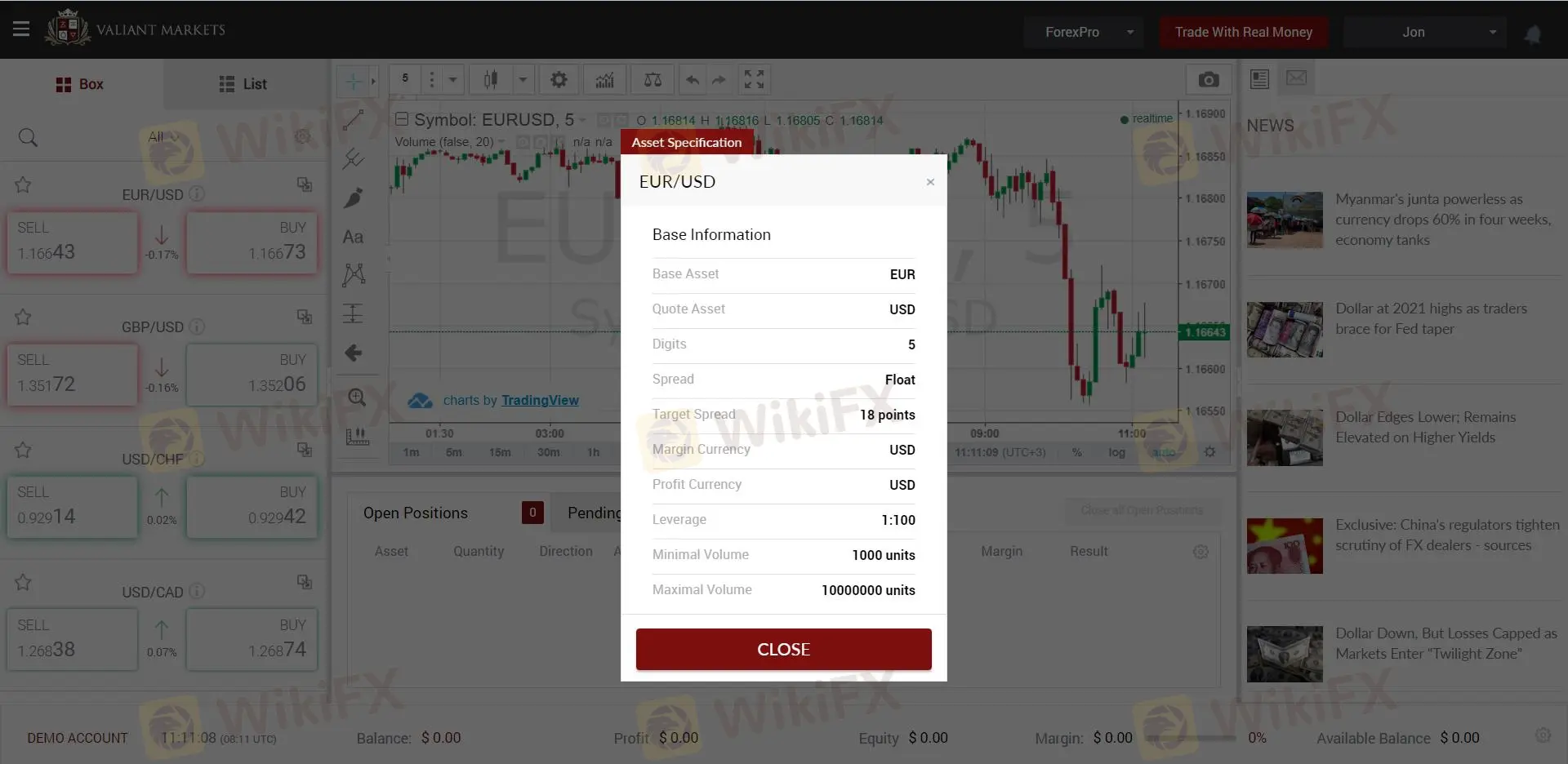

Valiant Markets offers leverage as high as 1:100. However, most regulatory jurisdictions deem such leverage levels unsuitable for retail traders. Consequently, most brokers that still offer high-leverage trading today are unlicensed – just like Valiant Markets, who are merely seeking to attract more clients and perpetrate fraud!

Spread

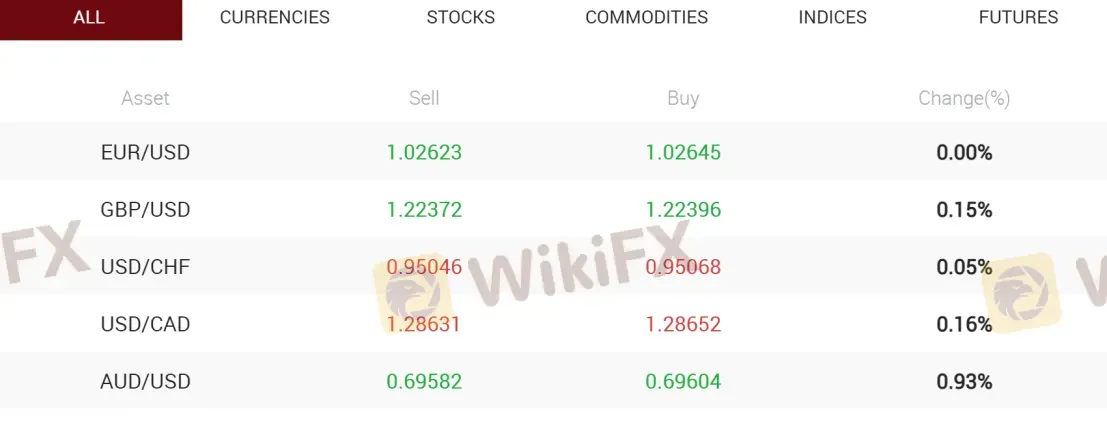

On the trading platform, the spread offered by Valiant Markets for the EUR/USD pair is 3.2 pips, which is uncompetitive. Regulated brokers typically offer spreads between 1 and 1.5 pips for this most heavily traded currency pair. Therefore, this is also a red flag.

Trading Platform

The platform available for trading at Valiant Markets is an unknown one, accessible on Web, Android, and iOS devices. Compared to the industry standard, Metatrader 5, it is quite simple, with no advanced charting and analytical tools, nor automated trading capabilities.

| Trading Platform | Supported | Available Devices | Suitable for |

| Web Trading Platform | ✔ | Web, Android, iOS | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

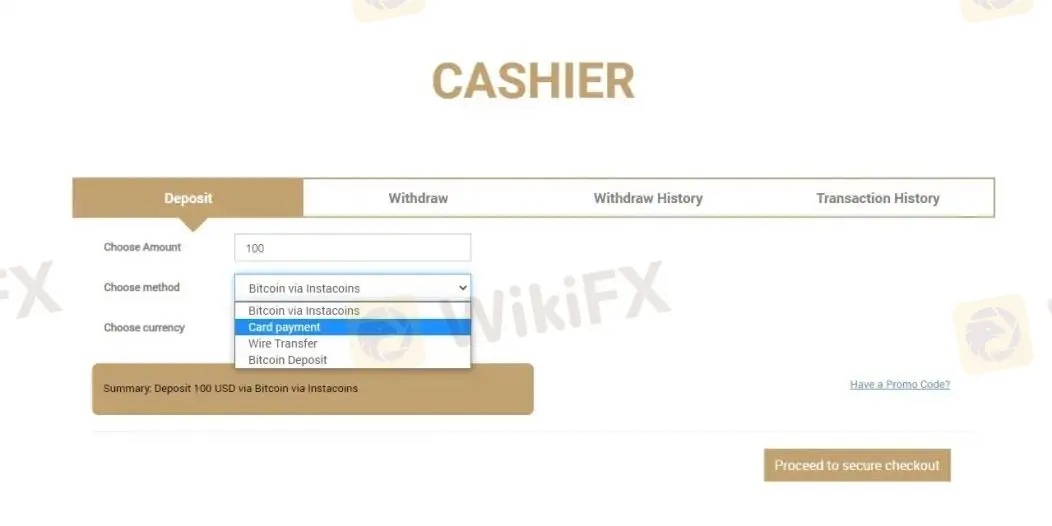

Deposit and Withdrawal

Valiant Markets accepts deposits via credit card, Bitcoin, and wire transfer. Among these, only credit card deposits are refundable, so you must exercise caution.

Valiant Markets has not provided information regarding minimum withdrawal amounts, nor whether there are any fees associated with deposits and witharawal. They claim not to charge any fees for credit card withdrawals. However, there is a clause buried in the terms and conditions stating that “additional 5% fee if investment is lower than 40% of total deposit.” Unregulated brokers often use such contradictory wording.

Promotions

Valiant Markets claims to offer some bonuses. However, only when you perform a trading volume of at least 30 times for each $1 bonus can you withdraw your bonus.

Read more

WikiFX Trending Topics Analyst Initiative

Share Your Expertise on What’s Moving the Market.

Aximtrade Exposure: Growing Allegations of Withdrawal Denials by Traders

Is your Aximtrade withdrawal application pending for months despite everything right from your end? Even after months, do you still see the withdrawal application under review while logging in to the trading platform? Or does the broker official tell you that the withdrawal is approved, but give you the excuse of the payment provider’s unavailability? These issues have allegedly become the norm at Aximtrade, a Saint Vincent and the Grenadines-based forex broker. In this Aximtrade review article, we have highlighted numerous complaints that need your attention.

Big Boss Review: Examining Withdrawal Denials & Profitable Record Deletion Claims

Did you fail to receive profits from Big Boss, a Comoros-based forex broker? Did the broker delete your profitable forex transactions so that you cannot withdraw your gains? Did you face an account freeze after making profits on the trading platform? These are some allegations we found while investigating the broker. In this Big Boss review article, we have shared some complaints traders have made against the company. Take a look!

ICM Broker Review: Scams & Alerts Exposed

Uncover ICM Broker scams and alerts: deposit delays, withdrawal blocks, and trader complaints despite regulation. WikiFX App reveals risks to help you trade more safely.

WikiFX Broker

Latest News

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

XTB Analysis Report

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Key Events This Week: PPI, Iran Talks, Nvidia Earnings, Fed Speakers Galore And State Of The Union

What Causes Stagflation?

EU Says Trump's Tariff Workaround Violates Trade Deal

Spotware Refines cTrader Infrastructure as Broker Ecosystem Expands

CME Group Moves to 24/7 Trading for Digital Asset Derivatives

Is The US Dollar About to Crash?

Is AssetsFX Safe or Scam: Looking at Real User Feedback and Complaints

Rate Calc