CIDT-Some important Details about This Broker

Abstract:CIDT Group is an HongKong-based broker founded in 2017, which is unregulated. It offers two types of trading products: stocks and metals. However, there is not much information revealed on its website. What is clear is that it uses MT4 platform, and it offers demo accounts.

| CIDT Group Review Summary | |

| Founded | 2017 |

| Registered Country/Region | China Hong Kong |

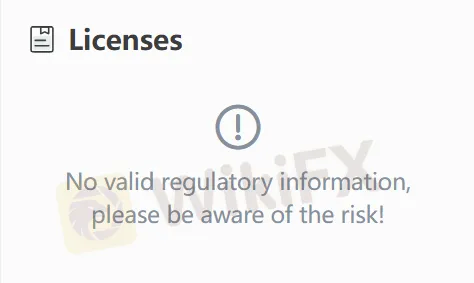

| Regulation | No regulation |

| Market Instruments | Stocks, Metals |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | MT4 |

| Minimum Deposit | / |

| Customer Support | Email: stl@dtgold.hk |

| Tel: 4000-013-202, 4000-016-202, 852-3748 8888 | |

| Address: Unit 2306-12 , 23/F Cosco Tower, no.183 Queens Road Central, Hong Kong | |

CIDT Group Information

CIDT Group is an HongKong-based broker founded in 2017, which is unregulated. It offers two types of trading products: stocks and metals. However, there is not much information revealed on its website. What is clear is that it uses MT4 platform, and it offers demo accounts.

Pros and Cons

| Pros | Cons |

| Demo Account Available | Unregulated |

| MT4 supported | Limited info on trading conditions |

| Limited trading assets |

Is CIDT Group Legit?

CIDT Group are unregulated. Please be aware of the risk!

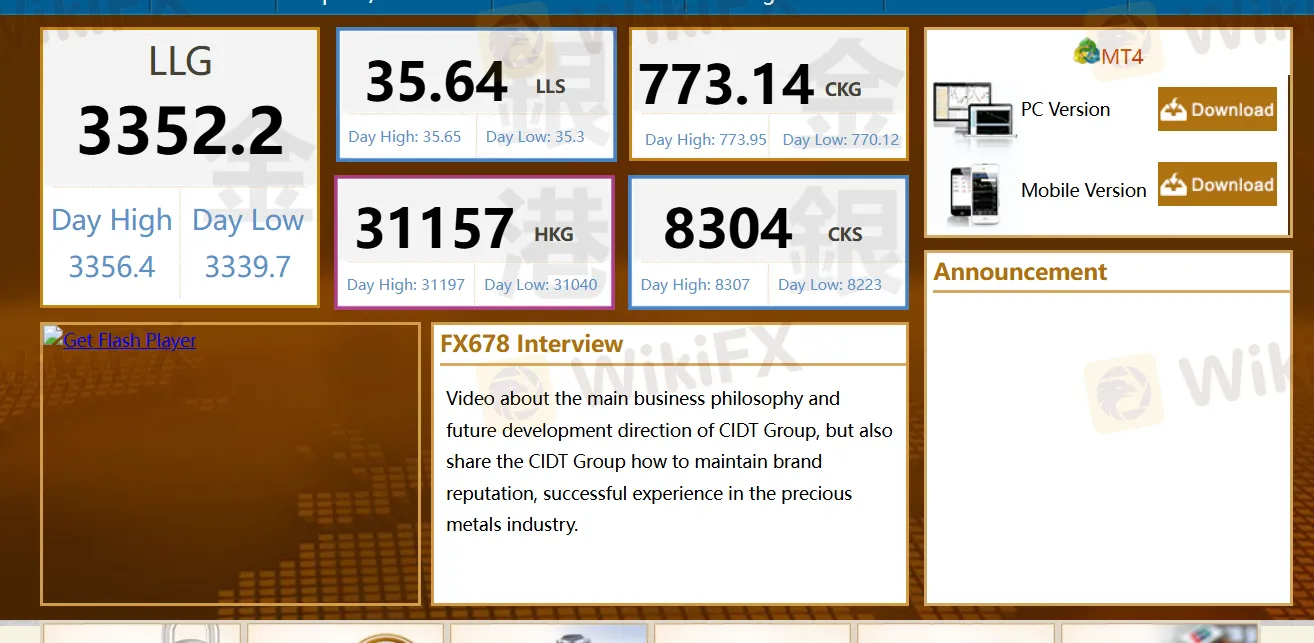

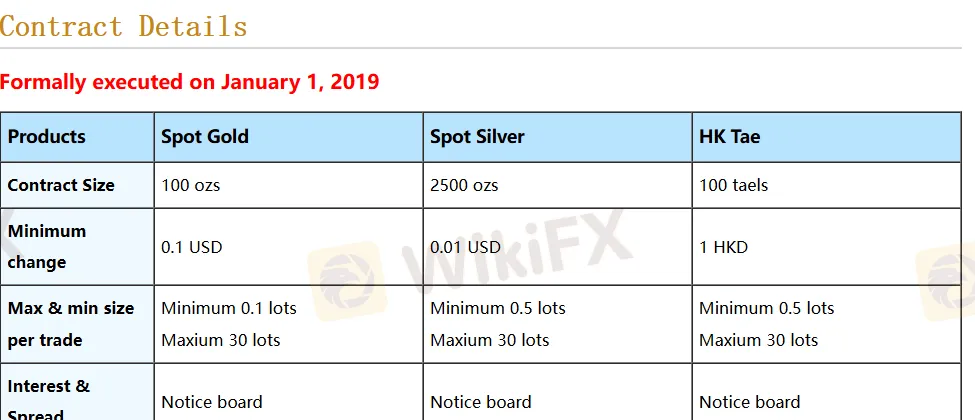

What Can I Trade on CIDT Group?

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Metals | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Bonds | ❌ |

| Cryptocurrencies | ❌ |

| Futures | ❌ |

| Options | ❌ |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web, iOS, Android, MacOS, Windows | Beginners |

| MT5 | ❌ | / | Experienced traders |

Read more

NaFa Markets Regulation: A Deep Dive Investigation Exposing a Major Scam

WARNING: Do not put any money into NaFa Markets. Our research shows it has all the signs of a clever financial scam. This platform lies about its legal status and uses tricks that are the same as fake investment schemes designed to steal your funds. When people search for information about NaFa Markets regulation, they need to know the truth: it is fake and made up.

Is NaFa Markets Legit? A Complete Investigation

Our research into NaFa Markets gives us a clear and urgent answer. For anyone asking, "Is NaFa Markets legit?", the answer is definitely no. This platform shows all the typical signs of a fake operation created to steal funds from people who don't know better. We strongly recommend that all traders stay completely away from this platform.

Capitalix Review: Revealing the Latest Fund Scam Allegations Against the Broker

Has Capitalix imposed a fine on your trading inactivity? Did you still lose your capital despite paying the fine amount? Have you had multiple instances of fund scams at Capitalix? Does your forex trading account balance often become negative? Failed to receive a response to the Capitalix withdrawal application? Did you face a prolonged drawdown issue on the broker’s trading platform? You are not alone! Many traders have reported these issues on broker review platforms such as WikiFX. We have uncovered all these alleged trading activities in this Capitalix review article. Take a look!

UFX Partners Review: Traders Allege Fund Scams and Withdrawal Issues

UFX Partners, a UK-based forex broker, has been flagged by many traders as a scam forex broker. Frequent reports of profit deletions, withdrawal blocks, and alleged fund scams are trending on several broker review platforms. Some traders reportedly lost all of their life savings due to the broker’s illegitimate trading activities. In this UFX Partners review article, we have highlighted numerous allegations against the broker. Read on!

WikiFX Broker

Latest News

China Holds Rates Steady After Hitting 5% Growth Target, Easing Expected in Q1

JPY Volatility Ahead: PM Takaichi Calls Snap Election Amid Rate Hike Speculation

Is Forex Still Worth It in 2026? Global Central Banks Are Splitting

The Fed on Trial: Markets Brace for Supreme Court Showdown Over Central Bank Independence

Trade War 2.0: Trump’s Greenland Ultimatum Rattles Transatlantic Alliance

Euro Stabilizes as France Forces 2026 Budget; Bond Spreads Narrow

JPY Volatility Spikes as PM Takaichi Calls Snap Election and Fiscal Gamble

JGB Yields Breach 4% as PM Takaichi's Fiscal Gambit Triggers 'Sell-Off'

Scrolled, Clicked, Lost RM166,000: Factory Worker Trapped by Online Investment Scam

China Macro: Liquidity Trap Signals Persist Despite Credit Bump

Rate Calc