DeltaFX Review 2025: Unregulated Broker with High Leverage Options

Abstract:DeltaFX, established in 2002, offers forex, metals, and crypto trading with leverage up to 1:1000. Discover its features, account types, and risks on WikiFX.

| DeltaFX Review Summary | |

| Founded | 2002 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Forex, energy, metals, indices and cryptocurrencies |

| Demo Account | ✅ |

| Leverage | Up to 1: 1000 |

| EUR/USD Spread | Floating around 6.4 pips (Standard account) |

| Trading Platform | MT4, MT5 |

| Copy Trading | ✅ |

| Min Deposit | $10 |

| Customer Support | 24/7 live chat, contact form |

| +44 204 547 0382, + 90 212 982 84 79 | |

| Email: info@deltafx.com, support@deltafx.com | |

| Instagram, LinkedIn, YouTube, and Twitter | |

| Head Office: Bell Yard London, WC2A 2JR | |

| Support Team Office: Kustepe Mah., Mecidiyeköy Yolu Caddesi No:12 Trump Tower Kat: 4 Ofis No: 405 Sisli /istanbul | |

| Regional Restrictions | The United States and EU/EEA/EFTA countries |

DeltaFX is an unregulated broker based in the United Kingdom, offering a range of trading services to its clients. Established in 2002, it provides access to various financial products such as Forex, CFDs, metals, energy, indices, and cryptocurrencies. The broker offers multiple account types, including Fix Spread, ECN, Standard, and Nano, with different deposit requirements starting as low as $10. DeltaFX supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, which are compatible with mobile devices, desktops, and web terminals, offering a variety of tools for traders.

While DeltaFX offers a range of trading tools and account options, it is important to note that the broker operates without regulation, which may raise concerns for some traders regarding the safety of their funds.

Pros and Cons

| Pros | Cons |

| Various trading options | Unregulated |

| Demo accounts | Wide spreads |

| Multiple account types | No popular payment options |

| No commissions for most accounts | US clients are not accepted |

| MT4 and MT5 supported | |

| Copy trading | |

| Low minimum deposit | |

| 24/7 live chat support |

Is DeltaFX Legit?

DeltaFX is not regulated by any reputable financial authority, which means it does not adhere to the regulatory standards that many trusted brokers follow. This lack of regulation raises concerns about the safety of client funds and the overall transparency of the broker's operations. While the broker offers a range of trading instruments and account types, traders should be cautious due to the absence of oversight by recognized financial bodies.

What Can I Trade on DeltaFX?

DeltaFX markets offers a variety of tradable instruments, including DeltaFX fx, energy products, metals, indices, and cryptocurrencies. Traders can access the global forex market, trade popular commodities like oil and natural gas, as well as precious metals such as gold and silver. Additionally, DeltaFX provides a selection of major stock indices and a range of cryptocurrencies. However, it does not offer stocks, bonds, or ETFs. The available instruments allow traders to diversify their portfolios, but the lack of more traditional assets like stocks may limit some traders preferences.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Energy | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

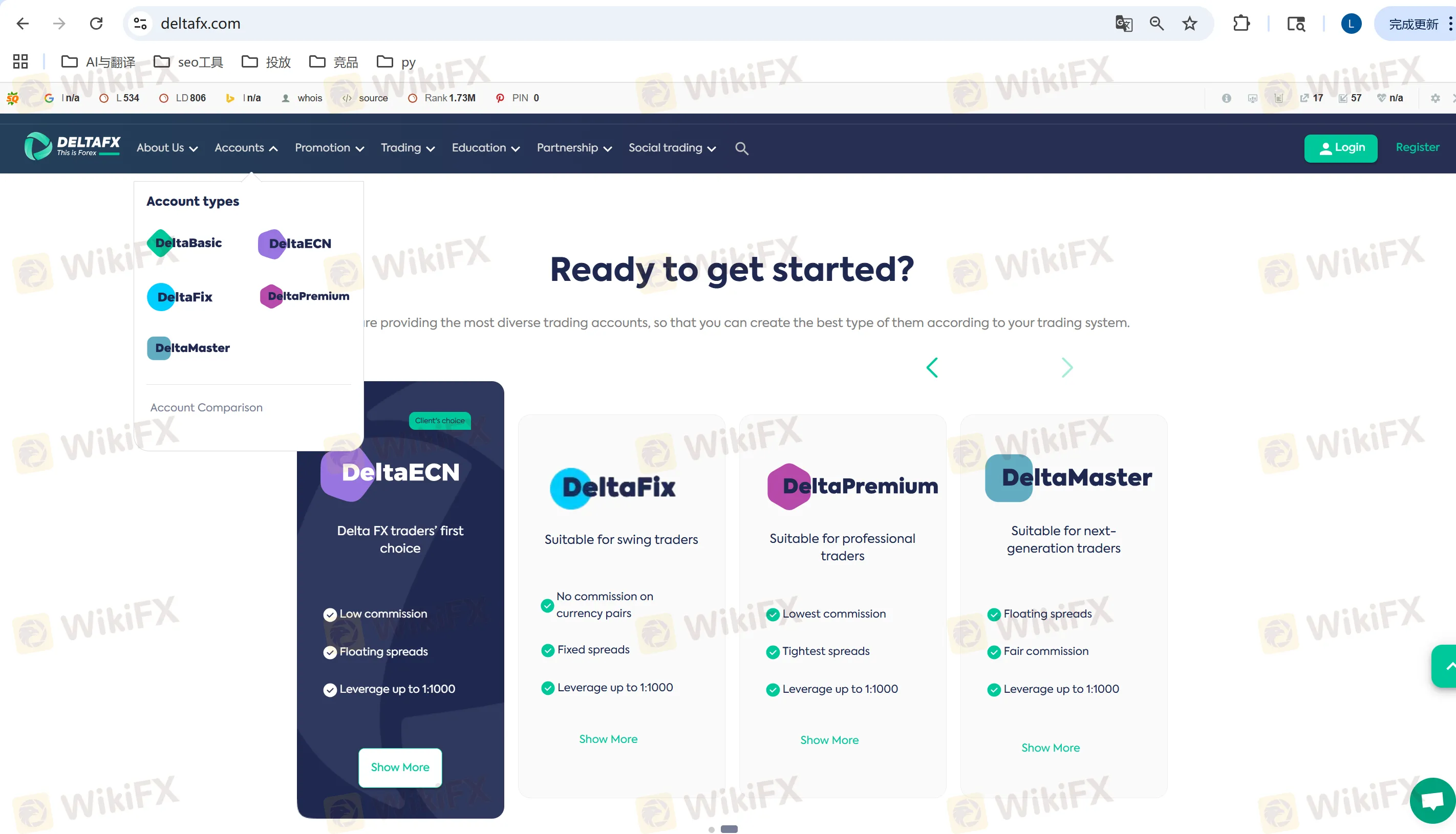

DeltaFX offers four different account types, each designed to cater to different trading needs. These include the Fix Spread, ECN, Standard, and Nano accounts, with varying deposit requirements, leverage, spreads, and commission structures.

Fix Spread Account: Requires a minimum deposit of $100 and offers fixed spreads. It includes commission fees and allows market execution.

ECN Account: With a minimum deposit of $200, this account offers floating spreads, and allows market execution. Commission is also charged.

Standard Account: Starting at $50, this account offers floating spreads, no commission, and market execution.

Nano Account: The most accessible with a minimum deposit of $10, this account offers floating spreads and allows market execution with no commission.

All accounts are compatible with both MT4 and MT5 platforms and offer trading in forex, metals, energy, indices, and cryptocurrencies. Leverage ranges from 1:33 up to 1:1000, depending on the account type. Each account has specific features like swap-free options, support availability, and expert advisor capabilities.

| Account Type | DeltaFix | DeltaECN | DeltaBasic | DeltaPremium | DeltaMaster |

| Trading Platform | MT4 & MT5 | MT4 & MT5 | MT4 & MT5 | MT4 & MT5 | MT4 & MT5 |

| Account Currency | USD | USD | USD | USD | USD |

| Leverage | 1:33 up to 1:1000 | 1:33 up to 1:1000 | 1:5 up to 1:1000 | 1:33 up to 1:1000 | 1:33 up to 1:1000 |

| Min Deposit | $200 | $50 | $50 | $10,000 | $50 |

| Max Deposit | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

| Commission | Yes | Yes | No | Yes | Yes |

| Order Execution | Market | Market | Market | Market | Market |

| Spread | Fixed (as low as 2 pips) | Floating (as low as zero) | Floating (as low as 0.6 pips) | Floating (as low as zero) | Floating (as low as 0.6 pips) |

| Stop Out | 20% | 40% | 20% | 40% | 20% |

| Swap Free | Yes | Yes | Yes | Yes | Yes |

Leverage

DeltaFX offers varying leverage options depending on the account type. Traders can access leverage up to 1:1000, with different limits for each account. Higher leverage allows traders to control larger positions with a smaller initial deposit, but it also increases the potential risk.

DeltaFX Fees

DeltaFX charges fees based on the selected account type, with costs primarily derived from spreads and commissions. The DeltaFix account offers fixed spreads starting from 2 pips, along with a commission on trades. The DeltaECN account features floating spreads starting from 0 pips and charges a commission of around USD 5 per round-turn (2.5 USD per side), making it suitable for high-frequency traders. The DeltaBasic account offers floating spreads from 0.6 pips and does not charge a commission, making it ideal for traders looking for low deposit requirements and no additional fees. The DeltaPremium and DeltaMaster accounts have floating spreads starting from zero and charge commissions, typically ranging from USD 2 to 6 per trade.

Trading Platform

DeltaFX offers two popular trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are accessible on a variety of devices to suit different trading preferences. MT4 is available for mobile devices (iOS and Android), desktops (Windows and Mac), and can be accessed through the web terminal. It is primarily focused on Forex and CFDs and allows traders to automate their strategies using expert advisors (EAs). MT4 offers 9 timeframes and 30 technical indicators. MT5, the more advanced version, is also available on mobile devices, desktops, and as a web terminal.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | PC, Mac, mobile and tablet | Beginners |

| MT5 | ✔ | PC, Mac, mobile and tablet | Experienced traders |

Deposit and Withdrawal

DeltaFX accepts deposits via trusted exchanges, local banks, Top Change payment gateway, and T Pay. The deposit process is typically fast, with a maximum processing time of 1 hour. Traders can choose from a variety of payment methods depending on their location and preferences. The minimum deposit requirement is as low as $10 for certain accounts, making it accessible for most traders to start.

For withdrawals, DeltaFX allows traders to withdraw funds using the original deposit method. The minimum withdrawal amount is $5 for all account types, and there is no maximum withdrawal limit. However, if funds are withdrawn through T Pay, a deduction of 5.5 Tether will apply. DeltaFX's withdrawal process is generally straightforward, but traders should be aware of any fees that may apply based on the chosen withdrawal method.

Read more

BlackBull Markets User Reputation: Looking at Real User Reviews and Common Problems to Judge Trust

When traders ask, "Is BlackBull Markets safe or a scam?", they want a simple answer to a hard question. The facts show two different sides. The broker began operating in 2014 and has a strong license from New Zealand's Financial Markets Authority (FMA). It also has an "Excellent" rating on review sites such as Trustpilot. But when searching for "BlackBull Markets complaints," you find many negative user stories, including withdrawal issues and poor trading conditions. This article goes beyond simple "safe" or "scam" labels. We want to carefully look at both the good reviews and common problems, comparing them with how the broker actually works and its licenses. This fact-based approach will give you the full picture of its user reputation, helping you make your own smart decision.

Is BlackBull Markets Legit? An Unbiased 2026 Review for Traders

Is BlackBull Markets legit? Are the "BlackBull Markets scam" rumors you see online actually true? These are the important questions every smart trader should ask before exposing capital to markets. The quick answer isn't just yes or no. Instead, we need to look at the facts carefully. Our goal in this review is to go beyond fancy marketing promises and do a complete legitimacy check. We will examine the broker's rules and regulations, look at its business history, break down common user complaints, and check out its trading technology. This step-by-step analysis will give you the facts you need to make your own smart decision about whether BlackBull Markets is a good and safe trading partner for you.

A Clear BlackBull Markets Review: Trading Conditions, Fees & Platforms Explained

This article gives you a detailed, fair look at BlackBull Markets for 2026. It's written for traders who have some experience and are looking for their next broker. Our goal is to break down what this broker offers and give you facts without taking sides. We'll look at the important things that serious traders care about: how well they're regulated, what trading actually costs, what types of accounts you can get, and how good their technology is. We're not here to tell you to use this broker - we want to give you the facts so that you can decide if it fits your trading style and how much risk you're comfortable with. Making a smart choice means checking things yourself. Before you pick any broker, you need to do your own research. We suggest using websites, such as WikiFX, to check if a broker is properly regulated and see what other users say about it.

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc