GLORY FOREX-Some important Details about This Broker

Abstract:We do not see the company profile of GLORY FOREX on the website, but we can easily conclude that it is an online forex broker.

| Aspect | Information |

| Company Name | GLORY FOREX |

| Registered Country/Area | China |

| Founded Year | N/A |

| Regulation | Unregulatory |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:100 |

| Spreads | Starting from 0.0 pips |

| Trading Platforms | Web Trader |

| Tradable Assets | Forex |

| Account Types | Standard account and Nano account |

| Demo Account | Unavailable |

| Customer Support | Message box |

| Deposit & Withdrawal | Telegraphic transfer and cryptocurrency |

| Educational Resources | FAQ |

Overview of GLORY FROEX

GLORY FOREX, incorporated in China, specializes in Forex trading. The broker offers two account types - Standard and Nano - both tailored for Forex trading with distinct features like different spreads and commission structures. While GLORY FOREX provides a user-friendly web-based trading platform and boasts competitive spreads, its lack of regulation and limited product offerings calls into question for potential traders.

Despite claiming incorporation in China, GLORY FOREX operates without regulatory oversight from any recognized financial authority. Moreover, its limited educational resources and almost non-existent customer service may not adequately support beginner traders.

Regulatory Status

The absence of GLORY FOREXs regulatory supervision presents significant apprehensions regarding the broker's credibility and the security of client assets. Recognizing the potential risks associated with engaging in trading activities with an unregulated broker is crucial for informed decision-making by traders.

Pros & Cons

GLORY FOREX offers several attractive features for traders, including competitive spreads starting from 0.0 pips and a user-friendly web trader platform. These aspects make it an appealing option for both beginners and experienced traders looking for cost efficiency and ease of use. The tight spreads on all major currency pairs further enhance its appeal, providing opportunities for more profitable trading.

However, there are notable drawbacks to consider. The unregulated status of the broker poses serious questions regarding the security of client funds and the implementation of equitable trading practices. Additionally, GLORY FOREX offers a limited range of market instruments, focusing solely on Forex trading, which might not satisfy traders seeking diversification. The customer support is also minimal, available only through a message box on the website, lacking more direct communication channels like phone or email.

| Pros | Cons |

| Straightforward account opening process | Unregulated Broker |

| User-Friendly Web Trader Platform | Limited Market Instruments |

| Tight spreads starting from 0.0 pips | Limited Customer Support |

| Limited educational resources | |

| Limited deposit method |

Market Instruments

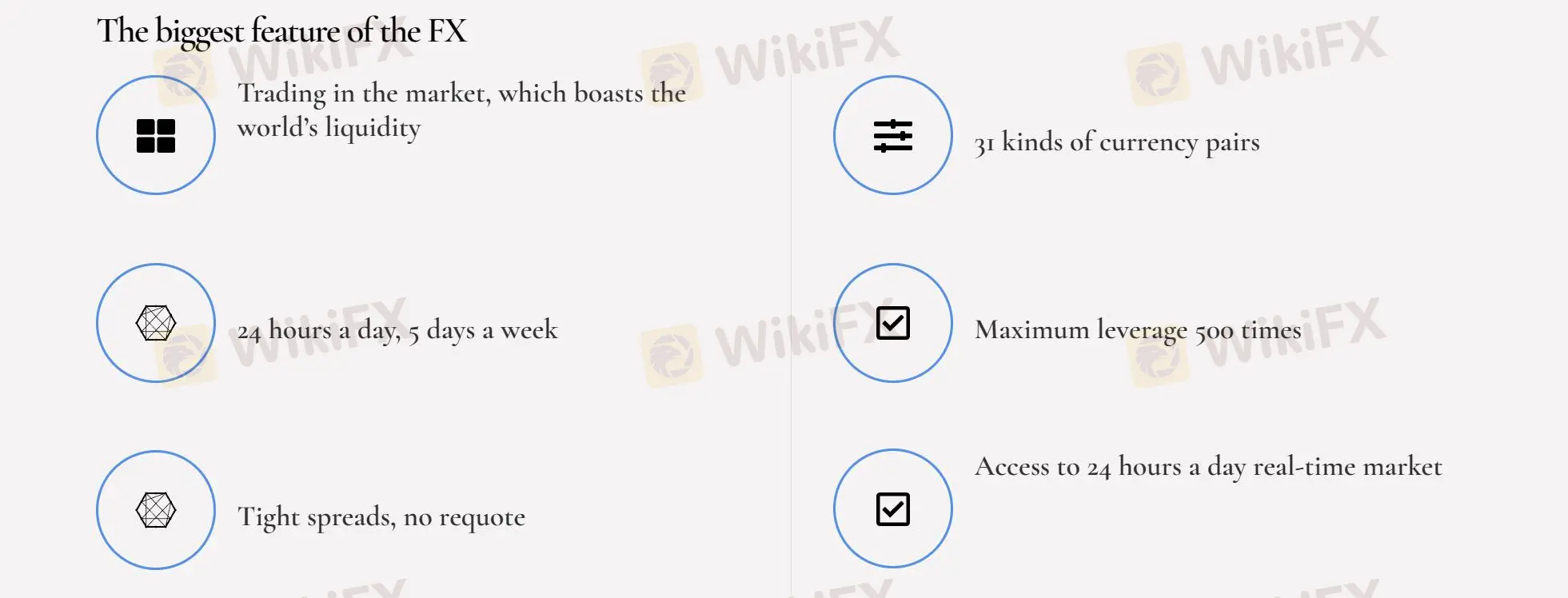

GLORY FOREX focuses solely on the Forex market, offering trading opportunities for 31 currency pairs. Forex, or foreign exchange, is the world's largest and most liquid financial market, where currencies are traded against each other. The broker does not provide access to other market instruments like stocks, commodities, or indices, limiting the diversification options for traders.

Account Types

GLORY FOREX offers two live trading account types:

Standard Account: This account type is designed for traders who prefer competitive spreads without commission fees. It offers STP (Straight Through Processing) execution, leverage up to 100 times, and a minimum deposit of USD 200 (or JPY 20,000).

Nano Account: This account type is geared towards traders seeking ultra-small spreads, even if it means paying a small commission fee per lot. It offers ECN (Electronic Communication Network) execution, leverage up to 100 times, and also a minimum deposit of USD 200 (or JPY 20,000).

Unfortunately, there is no demo account offered by this broker.

Account Opening Process

Opening an account with GLORY FOREX is a straightforward process that can be completed in a few simple steps:

Select Account Type: Choose between Standard and Nano account types.

Select Language: Choose your preferred language from the top-right corner.

Register: Fill in your personal information, including name, email, password, country, and phone number.

Confirm Registration: Review your entered information and submit.

Provide Personal and Trading Experience Information: Log in with the credentials sent to your email and provide additional details about your trading experience.

Account Opening Completed: You will receive an email confirming your account opening and providing account details.

Leverage

GLORY FOREX offers leverage up to 100 times for both Standard and Nano accounts, depending on the maximum deposit margin. Leverage allows traders to control larger positions with a smaller amount of capital, amplifying potential profits but also increasing risks.

Trading Fees

Standard accounts have no transaction fees but offer competitive spreads ranging from 1.0 to 4.0 pips. Nano accounts have a $3.00 per lot transaction fee but offer ultra-small spreads ranging from 0 to 3.0 pips. The spreads for both account types vary depending on the currency pair.

Trading Platform

GLORY FOREX provides a web-based trading platform called Web Trader. This platform is accessible through any web browser, eliminating the need for downloads or installations. The Web Trader is designed to be user-friendly and offers a range of features for analyzing charts, placing trades, and managing orders.

Deposit and Withdrawal

GLORY FOREX accepts deposits via bank transfers. The processing time usually takes 2-3 business days, but it can take up to 5 business days for some countries. Withdrawals are also processed through bank transfers and typically take 3-5 business days. The broker may require address verification documents for withdrawals.

Customer Support

GLORY FOREX offers customer support solely through a message box on their website. There is no phone or email support available, which could be inconvenient for traders seeking immediate assistance.

Educational Resources

GLORY FOREX provides a FAQ section that covers various topics like account opening, deposits and withdrawals, and document verification.

However, the broker lacks comprehensive educational resources such as webinars, tutorials, or market analysis to help traders improve their skills and knowledge.

Conclusion

GLORY FOREX can be an attractive option for Forex traders seeking competitive spreads and a user-friendly web-based trading platform. However, the lack of regulation and limited product offerings are significant drawbacks. Traders should carefully consider these factors and weigh the risks before choosing GLORY FOREX as their broker.

FAQs

Q: Is GLORY FOREX a regulated broker?

A: No, GLORY FOREX is not regulated by any recognized financial authority.

Q: What market instruments does GLORY FOREX offer?

A: GLORY FOREX exclusively offers Forex trading on 31 currency pairs.

Q: What are the account types offered by GLORY FOREX?

A: GLORY FOREX offers two account types: Standard and Nano, each with different spread and commission structures.

Q: Does GLORY FOREX offer leverage?

A: Yes, GLORY FOREX offers leverage up to 100 times, depending on the maximum deposit margin.

Q: What is the minimum deposit required to open an account with GLORY FOREX?

A: The minimum deposit for both Standard and Nano accounts is USD 200 (or JPY 20,000).

Q: How can I contact GLORY FOREX's customer support?

A: GLORY FOREX offers customer support through a message box on their website.

Read more

Apex Markets Review: Traders Outraged Over Withdrawal Denials & Other Trading Issues

Struggling to access fund withdrawals from Apex Markets for months? Does the broker remain silent on fund withdrawal issues? Does the Saint Vincent and the Grenadines-based forex broker reject your winning trades? Have you failed to get a refund into the card used for deposits? Did the broker deduct from your trading account instead? Traders have been imposing these scam allegations while sharing the Apex Markets Review online. We read the reviews and shared some of them below. Take a look!

tastyfx Exposed: Fund Losses, Trade Manipulation & Account Related Hassles Hurt Traders

Are fund losses normal for you at tastyfx? Does the US-based forex broker constantly manipulate prices to hit your trading experience? Do you fail to receive a reply from the broker on your fund withdrawal requests? Do you constantly face trading account issues with tastyfx? It’s time to read the tastyfx review shared by traders online.

Aron Groups Review: Fund Losses, High Commission & Trade Manipulation Keep Traders on Tenterhooks

Have you lost your hard-earned capital while trading via Aron Groups Broker? Has the high commission charged by the broker substantially reduced your trading profits? Does the Marshall Islands-based forex broker constantly manipulate spreads to widen your capital losses? Have you been lured into trading courtesy of Aron Groups No Deposit Bonus, only to find that you had to deposit capital to get a bonus? All these and many more trading issues have become synonymous with the experience of Aron Groups’ traders. Consequently, many traders have shared negative Aron Groups reviews online. In this article, we have shared some of their reviews.

Uniglobe Markets Bonus Review: Understanding the Offers and Uncovering the Risks

Many traders start looking for a new broker by searching for special deals and bonuses. The phrase "Uniglobe Markets no deposit bonus" is something people often search for. Let's address this question clearly and directly. Based on all the information we have, Uniglobe Markets does not currently offer a no-deposit bonus. Instead, this broker focuses on bonuses that require you to deposit your own money first. To get any bonus credits, traders must put in their own capital. Read on to learn how this entire bonus works out for traders.

WikiFX Broker

Latest News

The United States Outgrows All Its Major Peers

PINAKINE Broker India Review 2025: A Complete Guide to Safety and Services

PINAKINE Broker Review: A Complete Look at Its Services and Risks

Voices of the Golden Insight Award Jury - Simon So, Chief Experience Officer of Hantec Financial

Seychelles FSA Flags Clone Website Impersonating Admiral Markets

Canary Wharf Address Scam Resurfaces: FCA Exposes 20+ Clone Template Forex Platforms

He Thought It Was a Crypto Investment; It Cost Him RM1.2 Million

Private payrolls rose 42,000 in October, more than expected and countering labor market fears, ADP says

Yields Rise, Rate-Cut Odds Slide As ISM Services Survey Signal Inflation Fears

Op-ed: The fuel for the AI boom driving the markets is advertising. It is also an existential risk.

Rate Calc