Paxton Trade-Overview of Minimum Deposit, Spreads & Leverage

Abstract:Paxton Trade, an international brokerage firm headquartered in Mauritius, offers a diverse range of financial instruments, including Forex and CFDs on Indices, Stocks, Commodities and Metals. However, it currently operates without valid regulatory oversight, raising concerns for traders about its legitimacy and accountability.

| Paxton Trade Review Summary in 8 Points | |

| Founded | 2020 |

| Registered Country/Region | Mauritius |

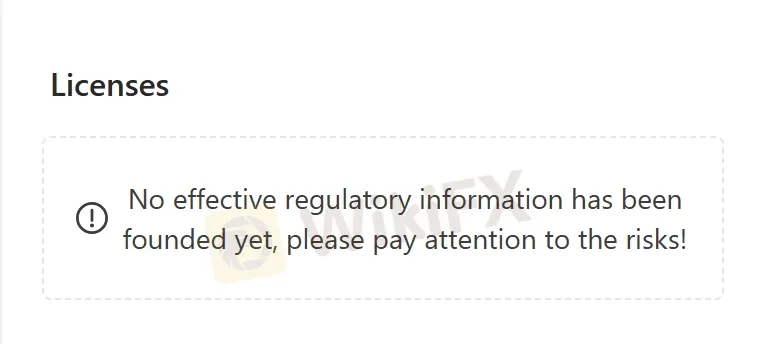

| Regulation | Unregulated |

| Market Instruments | Forex,CFDs on Indices, Stocks, Commodities and Metals |

| Leverage | Up to 1:500 |

| EUR/USD Spread | From 2.5 pips |

| Minimum Deposit | USD 1000 |

| Customer Support | Phone, email, address |

What is Paxton Trade?

Paxton Trade, an international brokerage firm headquartered in Mauritius, offers a diverse range of financial instruments, including Forex and CFDs on Indices, Stocks, Commodities and Metals. However, it currently operates without valid regulatory oversight, raising concerns for traders about its legitimacy and accountability.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the broker's services and offerings. We encourage interested readers to delve further into the article for valuable insights. In conclusion, we will provide a concise summary that highlights the distinct characteristics of the broker for a clear understanding.

Pros & Cons

| Pros | Cons |

| • Multiple trading instruments | • Unregulated |

| • High minimum deposit | |

| • Lack of transparency from its one-page website | |

| • Limited info on commissions |

Pros:

Multiple Trading Instruments: Paxton Trade offers a diverse array of trading instruments, spanning Forex, CFDs on indices, stocks, commodities and metals. This breadth of options enables traders to explore various markets, diversify their portfolios, and potentially capitalize on a wide range of market opportunities.

Cons:

Unregulated: Paxton Trade operates without valid regulatory oversight, which raises concerns about the protection of client funds and overall transparency. The lack of regulation can leave traders vulnerable to potential risks and uncertainties in the market.

High Minimum Deposit: Paxton Trade imposes a high minimum deposit requirement at $1000, which can serve as a barrier to entry for many traders, particularly those with limited capital or those who prefer to start with smaller investments.

Lack of Transparency from Its One-Page Website: Paxton Trade's one-page website provides limited info without comprehensive information about its services, trading conditions, regulatory status, and company background. The minimalistic approach to website design create doubts among potential clients regarding the platform's credibility, transparency, and commitment to providing accurate and reliable information.

Limited Info on Commissions: Paxton Trade provides limited information about its commission structure, making it challenging for traders to fully understand the costs associated with trading on the platform.

Is Paxton Trade Safe or Scam?

When considering the safety of a brokerage like Paxton Trade or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: Currently, this broker operates without any legitimate regulatory oversight, raising concerns about transparency and accountability.

User feedback: For a deeper insight into the brokerage, traders should read reviews and feedback from existing clients. These valuable inputs from users, available on trustworthy websites and discussion forums, can provide firsthand information about the company's operations.

Security measures: So far we have not found any security measures implemented from its one-page website.

In the end, choosing whether or not to engage in trading with Paxton Trade is an individual decision. It is advised that you carefully balance the risks and returns before committing to any actual trading activities.

Market Instruments

Paxton Trade offers a comprehensive array of market instruments tailored to meet the diverse needs of traders globally.

In the realm of Forex trading, clients can engage in currency pair transactions, capitalizing on the fluctuations of major, minor, and exotic currency pairs.

Additionally, Paxton Trade provides Contracts for Difference (CFDs) on indices, allowing investors to speculate on the performance of leading global indices such as the S&P 500, FTSE 100, and Nikkei 225.

Furthermore, traders can leverage CFDs on individual stocks, gaining exposure to renowned companies like Apple, Amazon, and Google.

For those interested in commodities, Paxton Trade facilitates trading in precious metals like gold and silver, as well as energy commodities such as crude oil and natural gas.

Account Types

Two distinct account types tailored to suit varying trading preferences and financial goals are available in Paxton Trade: the Micro Account and the Premium Account.

The Micro Account option requires a minimum deposit of 1,000 USD. This account type is ideal for those who are just starting their trading journey or prefer to trade with smaller amounts of capital.

On the other hand, the Premium Account is suitable for more experienced traders or those with larger investment portfolios, allowing deposits of up to 10,000 USD.

Leverage

Paxton Trade empowers traders with leverage of up to 1:500, providing significant amplification of trading power to capitalize on market opportunities. This high leverage ratio enables traders to control larger positions with a relatively small amount of capital, potentially magnifying profits.

However, it's crucial for traders to apply prudent risk management strategies since higher leverage also entails increased exposure to potential losses.

Spreads & Commissions

Paxton Trade advertises a spread of 2.5 pips without providing information about commissions. For clarity on the cost structure, interested individuals are encouraged to directly contact Paxton Trade. Understanding the complete expenses associated with trading is important for making informed decisions.

Customer Service

Paxton Trade offers several customer service channels for trader support, including phone and email assistance and a physical address for inquiries. This multi-channel approach ensures timely and accessible support for traders' queries and concerns.

Address: Suite 403, 4th Floor, The Catalyst Building, Cybercity, Ebene, Mauritius.

Phone: +230-5-297-0923.

Email: info@paxtontrade.com.

Conclusion

To sum up, Paxton Trade is an online brokerage firm located in Mauritius and offers a wide range of trading instruments, includingForex,CFDs on Indices, Stocks, Commodities and Metals. However, it's important to note that Paxton Trade currently operates without valid regulations from any authorities, raising concerns about its accountability and commitment to client safety.

Therefore, you should be cautious when deciding to trade with this broker and consider alternative brokers with established regulatory oversight to mitigate potential risks.

Frequently Asked Questions (FAQs)

| Q 1: | Is Paxton Trade regulated? |

| A 1: | No, its been confirmed that the broker is currently under no valid regulation. |

| Q 2: | Is Paxton Trade a good broker for beginners? |

| A 2: | No, it is not a good broker because its not regulated by any authorities. |

| Q 3: | Does Paxton Trade offer the industry leading MT4 & MT5? |

| A 3: | No. |

| Q 4: | Does Paxton Trade offer demo accounts? |

| A 4: | No. |

| Q 5: | What is the minimum deposit for Paxton Trade? |

| A 5: | The minimum initial deposit to open an account is $1000. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Read more

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Failing to transfer funds into or out of your Moneycorp trading account? Have you faced a sudden account closure by a United Kingdom-based forex broker? Has the broker’s customer support service failed to resolve your queries? Did their behavior remain far from good while addressing your queries? You are not alone! Many traders have questioned such alleged trading practices by the broker. In this Moneycorp review article, we have highlighted some of their complaints. Read on!

Saracen Markets Review: Regulated or Scam Alert?

Saracen Markets claims “regulated,” but serious red flags suggest scam risk—see what to verify before depositing. Read our Saracen Markets review and scam alert now.

FXRoad Exposure Review: Withdrawal & Safety Risks Explained

FXRoad exposure review: withdrawal red flags, offshore status, and safety risks explained. Learn what to watch for and how to protect your funds—read now.

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

When people who invest ask, "Is Arena Capitals safe or a scam?" the proof shows we need to be very careful. This broker works without proper rules from top financial authorities, gets very low safety scores from independent financial watchdogs, and many users have serious complaints about them. The information available to everyone suggests that giving your capital to this company could lead to losing it all. This analysis doesn't guess - it looks at these important warning signs. We will look at real facts, study actual user reviews that show big problems with taking out funds, and give a clear answer based on evidence about whether Arena Capitals can be trusted. This article gives you the facts you need to make a smart choice and keep your funds safe from an unregulated, high-risk business.

WikiFX Broker

Latest News

HFM Review 2026: Is this Forex Broker Legit or a Scam?

ESMA Tightens Derivative Rules: Crypto 'Perpetuals' Face Strict CFD Leverage Caps

INFINOX Analysis Report

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

Scope Prime Strengthens Institutional Liquidity Infrastructure with Ultency Integration

NAGA Earnings Signal Industry Stress Amid Low FX Volatility

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

Rate Calc