mBank(mForex) -Overview of Minimum Deposit, Spreads & Leverage

Abstract:Founded in 2013, mBank is an unregulated broker registered in Poland, offering trading in Forex, Indices, and Commodities with leverage up to 1:30 and spread from 0.2 pips via the MT4 and mForex Web platforms.

| mBank Review Summary | |

| Founded | 2013 |

| Registered Country/Region | Poland |

| Regulation | Unregulated |

| Market Instruments | Forex, Indices, Commodities |

| Demo Account | / |

| Leverage | Up to 1:30 |

| Spread | From 0.2 pips |

| Trading Platform | MT4, mForex Web |

| Min Deposit | PLN 2,000 |

| Customer Support | Tel: 22 697 47 74 |

| Email: mforex@mbank.pl | |

| Social Media: Facebook, Twitter, YouTube | |

| Company Address: ul. Prosta 18 00-850 Warsaw | |

Founded in 2013, mBank is an unregulated broker registered in Poland, offering trading in Forex, Indices, and Commodities with leverage up to 1:30 and spread from 0.2 pips via the MT4 and mForex Web platforms.

Pros and Cons

| Pros | Cons |

| Tight spreads | No regulation |

| MT4 supported | Limited tradable assets |

| Conservative levearge | |

| Commission charged | |

| High minimum deposit | |

| Unknown payment options |

Is mBank Legit?

No, mBank currently has no valid regulations. Please be aware of the risk!

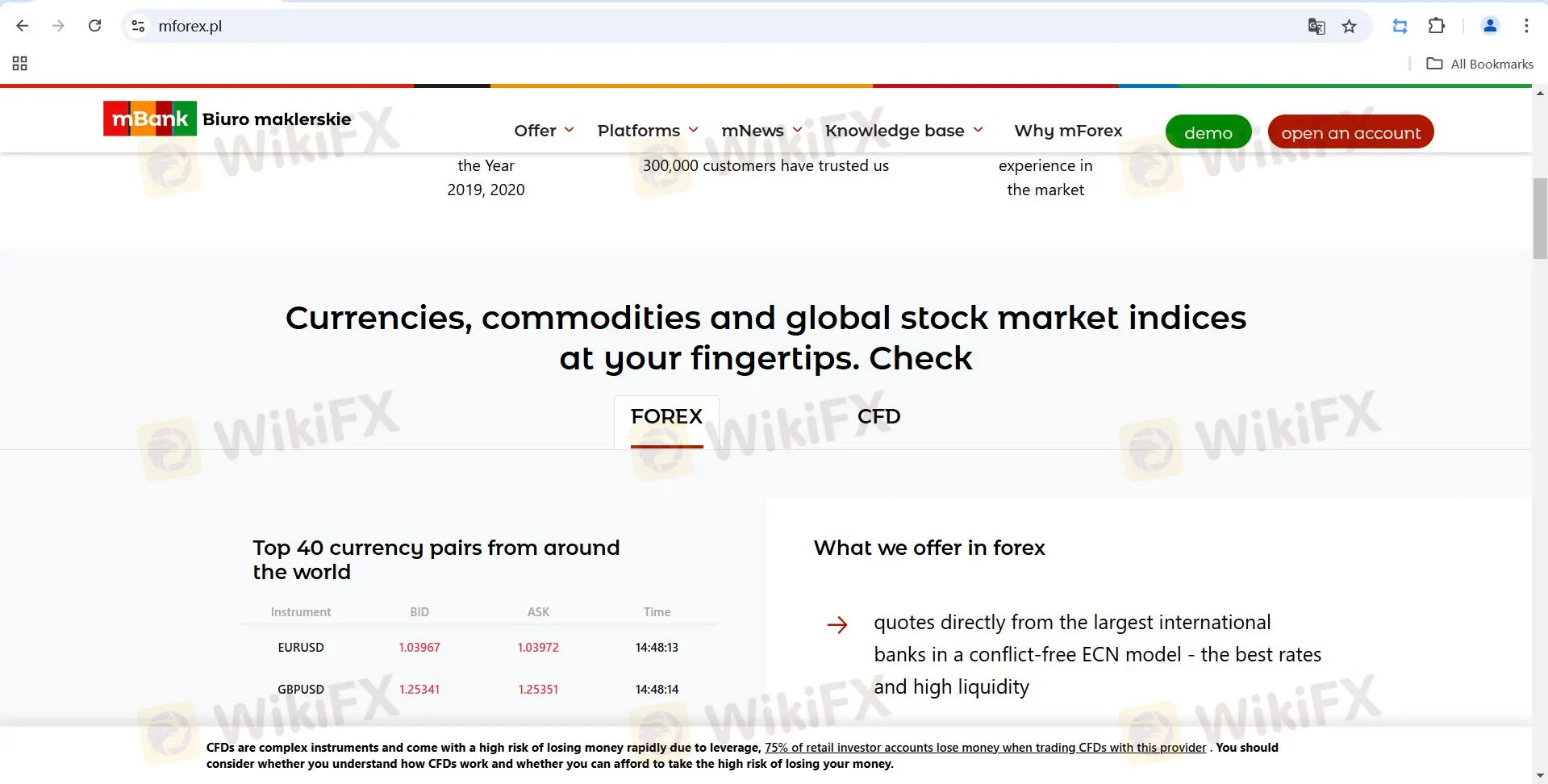

What Can I Trade on mBank?

| Trading Asset | Available |

| forex | ✔ |

| indices | ✔ |

| commodities | ✔ |

| stocks | ❌ |

| cryptocurrencies | ❌ |

| bonds | ❌ |

| options | ❌ |

| ETFs | ❌ |

Account Type/Leverage/Fees

Standard and VIP are the two account types that mForex offers. The activation fee for both accounts is PLN 2,000, or roughly 430 USD, which is seen as a large amount.

| Account Type | Standard | VIP |

| Activation Payment | Min. PLN 2,000 for individuals, PLN 10,000 for companies | |

| Leverage | Up to 1:30 (for retail customers) | |

| Spread | From 0.2 pips | |

| Commission | 0.0039% | 0.0027% |

Trading Platform

In addition to MT4, mBank also offers a mForex Web platform which is said to be available from a web browser, allows for easy and efficient adjustment of the chart appearance, the quick placing of orders, and the built-in calculator optimizes the investment process.

| Trading Platform | Supported | Available Devices | Suitable for |

| mForex | ✔ | Web | / |

| MT4 | ✔ | Desktop, Mobile, Web | Beginners |

| MT5 | ❌ | / | Experienced traders |

Read more

My Forex Funds Charts Path for 2025-2026 Revival After Legal Wins

My Forex Funds unveils 2025-2026 roadmap post-CFTC win: asset recovery, data analysis, and team rebuild.

Maven Trading Review: Traders Flag Funding Rule Issues, Stop-Loss Glitches & Wide Spreads

Are you facing funding issues with Maven Trading, a UK-based prop trading firm? Do you find Mavin trading rules concerning stop-loss and other aspects strange and loss-making? Does the funding program access come with higher spreads? Does the trading data offered on the Maven Trading login differ from what’s available on the popular TradingView platform? These are some specific issues concerning traders at Maven Trading. Upset by these untoward financial incidents, some traders shared complaints while sharing the Maven Trading Review. We have shared some of their complaints in this article. Take a look.

BTSE Review: Ponzi Scam, KYC Verification Hassles & Account Blocks Hit Traders Hard

Have you lost your capital with BTSE’s Ponzi scam? Did the forex broker onboard you by promising no KYC verification on both deposits and withdrawals, only to be proven wrong in real time? Have you been facing account blocks by the Virgin Islands-based forex broker? These complaints have become usual with traders at BTSE Exchange. In this BTSE review article, we have shared some of these complaints for you to look at. Read on!

Amillex Global Secures ASIC Licence for Expansion

Amillex Global gains ASIC AFSL licence, boosting FX and CFDs credibility. Expansion targets Asia, Australia, and institutional trading growth.

WikiFX Broker

Latest News

Is Fyntura a Regulated Broker? A Complete 2025 Broker Review

Zetradex Exposed: Withdrawal Denials, Account Freeze & Bonus Issues Hurt Traders

Is Forex Zone Trading Regulated and Licensed?

PINAKINE Broker India Review 2025: A Complete Guide to Safety and Services

Exness Restricted Countries List 2025 Explained

Is Uniglobe Markets Legit? A 2025 Simple Guide to Its Safety, Services, and User Warnings

Is Inzo Broker Safe or a Scam? An Evidence-Based Analysis for Traders

WikiEXPO Dubai 2025 “Welcome Party” Kicks Off Tonight!

He Trusted a WhatsApp Group and Lost RM659,000

Moomoo Singapore Opens Investor Boutiques to Strengthen Community

Rate Calc