Citadel Securities

Abstract:Registered in the United States, Citadel Securities drives markets through trading, research, and technology. The company's work is driven by the fusion of financial, mathematical, and engineering expertise to provide liquidity to important financial institutions.

| Citadel Securities Review Summary | |

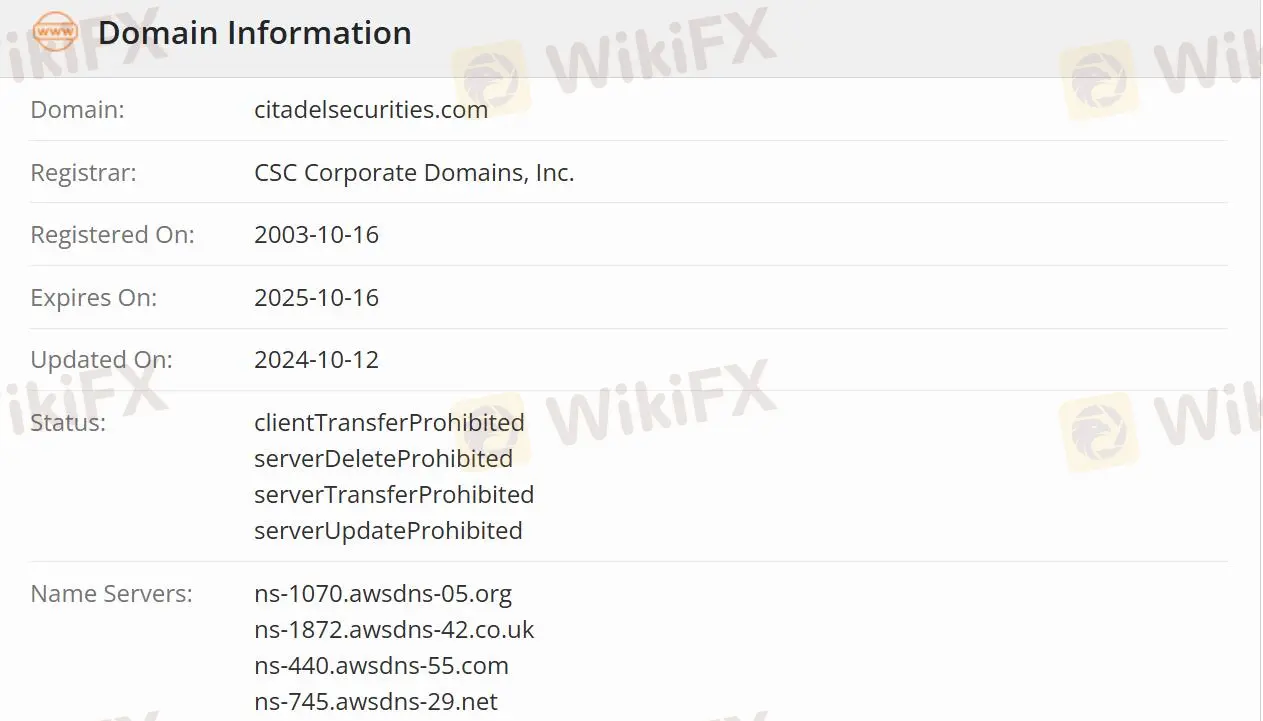

| Founded | 2003-10-16 |

| Registered Country/Region | United States |

| Regulation | Regulated |

| Services | Equities/Options/Fixed Income & FX/Corporate Solutions |

| Customer Support | LinkedIn/Facebook/Instagram/YouTube |

Citadel Securities Information

Registered in the United States, Citadel Securities drives markets through trading, research, and technology. The company's work is driven by the fusion of financial, mathematical, and engineering expertise to provide liquidity to important financial institutions.

Is Citadel Securities Legit?

Citadel Securities is authorized and regulated by the Securities and Futures Commission of Hong Kong(SFC), making it safer than an unregulated company.

What services does Citadel Securities provide?

One of Citadel Securities' functions is market making, which provides liquidity to investors by purchasing securities from sellers and selling them to buyers. Citadel Securities Enterprise Solutions also helps investors make decisions.

Bringing together financial services firms, including major banks, brokers, and even other market makers, to lead the creation of an exchange founded and operated by its members to launch the MEMX fully electronic stock exchange.

Asset-related businesses include equities, options, and fixed income & FX.

Read more

UNIGLOBEMARKET Analysis Report

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.

Mazi Finance Exposure: Do Traders Find it Hard to Place Trades and Access Withdrawals?

Did Mazi Finance deny withdrawals once you made profits? Did the Saint Lucia-based forex broker deny based on terms and conditions that did not exist while opening a trading account? Do you frequently encounter issues concerning the Mazi Finance App download? Do you fail to place trades due to the server issues on the trading app? These are some problems traders have highlighted while sharing the Mazi Finance review. Read on as we share some complaints against the forex broker.

Jetafx Review: Allegations of Fund Scams and Withdrawal Blocks Using Unfair VPS Trading Rule

Did Jetafx allow you to withdraw initially to gain your trust and later disallow you from using this privilege? Were you prevented from withdrawing funds due to a seemingly inexplicable new VPS trading rule? Have you witnessed a complete fund scam experience with the forex broker? Does the Jetafx support team fail to address your trading queries? You are not alone! Many traders have complained about these issues on broker review platforms. In this Jetafx review article, we have shared some of their complaints. Read on!

uexo Analysis Report

uexo emerges as a recommended forex broker with a solid overall rating of 6.9 out of 10, demonstrating reliable performance that appeals to both novice and experienced traders. Based on a comprehensive analysis of 21 reviews, the broker maintains an impressively low negative rate of just 9.5%, with the sentiment distribution heavily favoring positive experiences—15 traders expressed satisfaction, 4 remained neutral, and only 2 reported negative encounters. Read on for more insights.

WikiFX Broker

Latest News

Telegram Investment Scam Wiped Out RM91,000 in Days

SPEC TRADING Review 2026: Is this Forex Broker Legit or a Scam?

Gold Smashes $5,100 Barrier: Dalio Warns of 'Capital Wars'

Fiscal Policy Monitor: Authorities Tighten Tax Compliance Framework

AMBER MARKETS Review 2026 — Is AMBER MARKETS Broker Safe for Forex Trading?

Who are the “Police” Watching Your Forex Broker? (FCA, ASIC, NFA Explained)

Dollar Index Hits Four-Year Low as 'Fed Whisperer' Signals Rate Pause

PayPal Re-enters Inbound Nigerian Market via Paga Partnership

German Capital Flows Heavy into China, Defying Trade War Risks

FIBOGROUP Review: Safety, Regulation & Forex Trading Details

Rate Calc