MaximusFX-Overview of Minimum Deposit, Spreads & Leverage

Abstract:MaximusFX is a broker that is registered in Saint Vincent and the Grenadines. The tradable instruments with a maximum leverage of 1:1000 include CFDs, commodities, primary products, equities, indices, and futures. The broker also provides four accounts. The minimum spread is from 0.0 pips, and the minimum deposit is $200. MaximusFX is still risky due to its unregulated status and high leverage.

| MaximusFXReview Summary | |

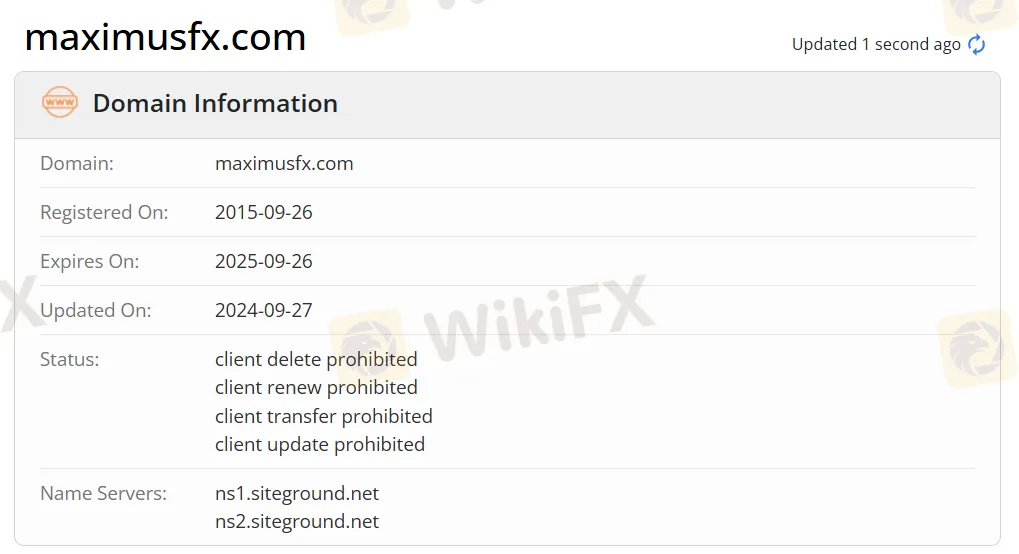

| Founded | 2015 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No regulation |

| Market Instruments | CFDs, commodities, primary products, equities, indices, and futures |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | As low as 0.0 pips |

| Trading Platform | MT4 |

| Minimum Deposit | $200 |

| Customer Support | Email: finance@MaximusFX.com |

| Facebook/Twitter/Instagram | |

MaximusFX Information

MaximusFX is a broker that is registered in Saint Vincent and the Grenadines. The tradable instruments with a maximum leverage of 1:1000 include CFDs, commodities, primary products, equities, indices, and futures. The broker also provides four accounts. The minimum spread is from 0.0 pips, and the minimum deposit is $200. MaximusFX is still risky due to its unregulated status and high leverage.

Pros and Cons

| Pros | Cons |

| MT4 available | Unregulated |

| 24/5 customer support | No MT5 |

| Demo account available | Withdrawal fees charged |

| Various tradable instruments | Only email support |

| Four types of accounts | |

| Free deposit | |

| Various payment options |

Is MaximusFX Legit?

MaximusFX is not regulated, making it less safe than regulated brokers.

What Can I Trade on MaximusFX?

MaximusFX offers a wide range of market instruments, including CFDs, commodities, primary products, equities, indices, and futures.

| Tradable Instruments | Supported |

| CFDs | ✔ |

| Primary Products | ✔ |

| Equities | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Futures | ✔ |

| Forex | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type & Fees

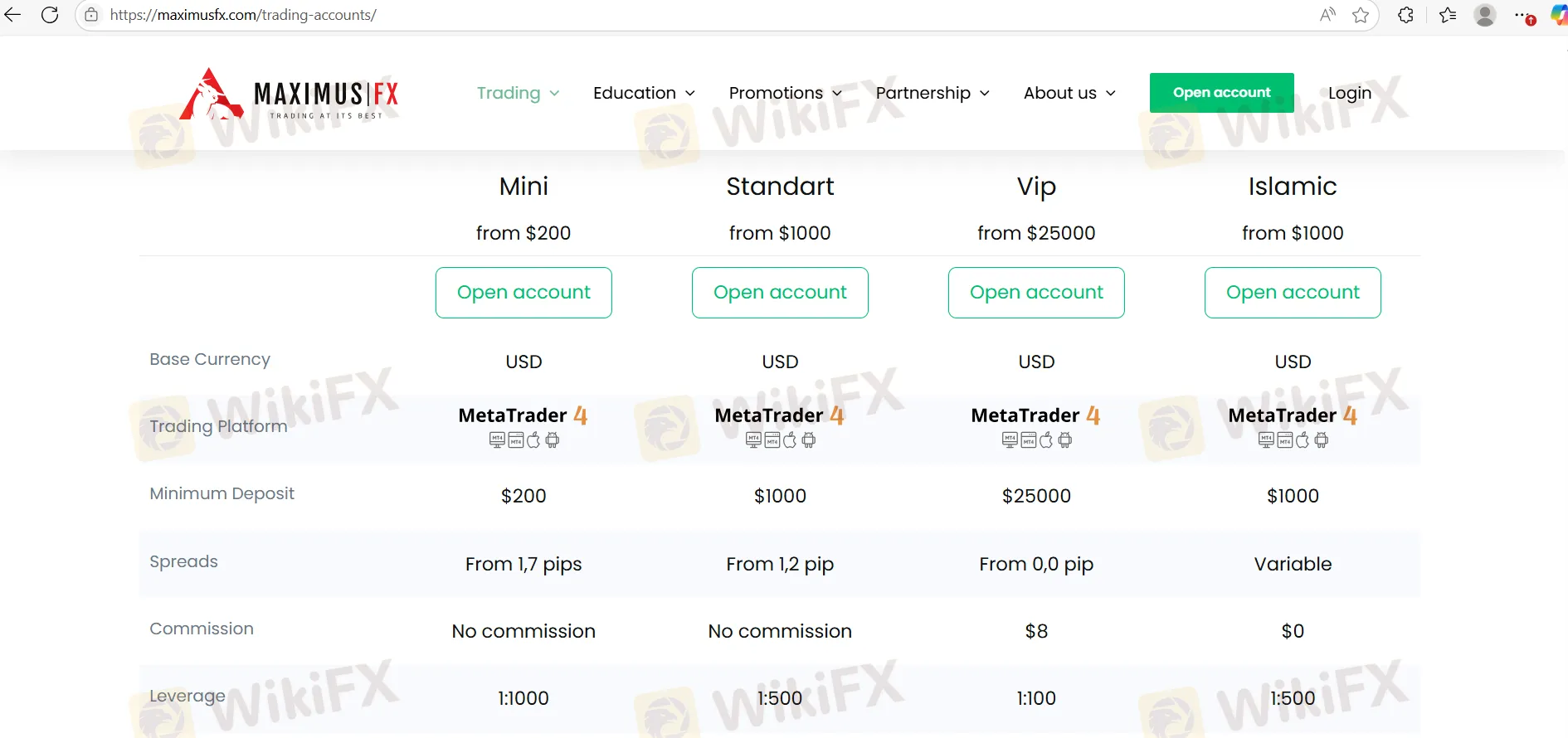

MaximusFX has four account types: Mini, Standard, Vip, and Islamic. Traders who want low spreads and low leverage can choose a Vip account, while those with a small budget can open a mini account. In addition, the demo account is predominantly used to familiarize traders with the trading platform and for educational purposes only.

| Account Type | Mini | Standard | Vip | Islamic |

| Minimum Deposit | $200 | $1000 | $25000 | $1000 |

| Spreads | From 1.7 pips | From 1.2 pips | From 0.0 pips | Variable |

| Commission | No | No | $8 | $0 |

| Leverage | 1:1000 | 1:500 | 1:100 | 1:500 |

| Swap | ✔ | ✔ | ✔ | ✔ |

Leverage

The maximum leverage is 1:1000, meaning that profits and losses are magnified 1000 times.

Trading Platform

MaximusFX cooperates with the authoritative MT4 trading platform. Junior traders prefer MT4 over MT5. MT4 and MT5 not only provide various trading strategies but also implement EA systems.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Windows/iPad/Mobile | Beginners |

| MT5 | ❌ | / | Experienced traders |

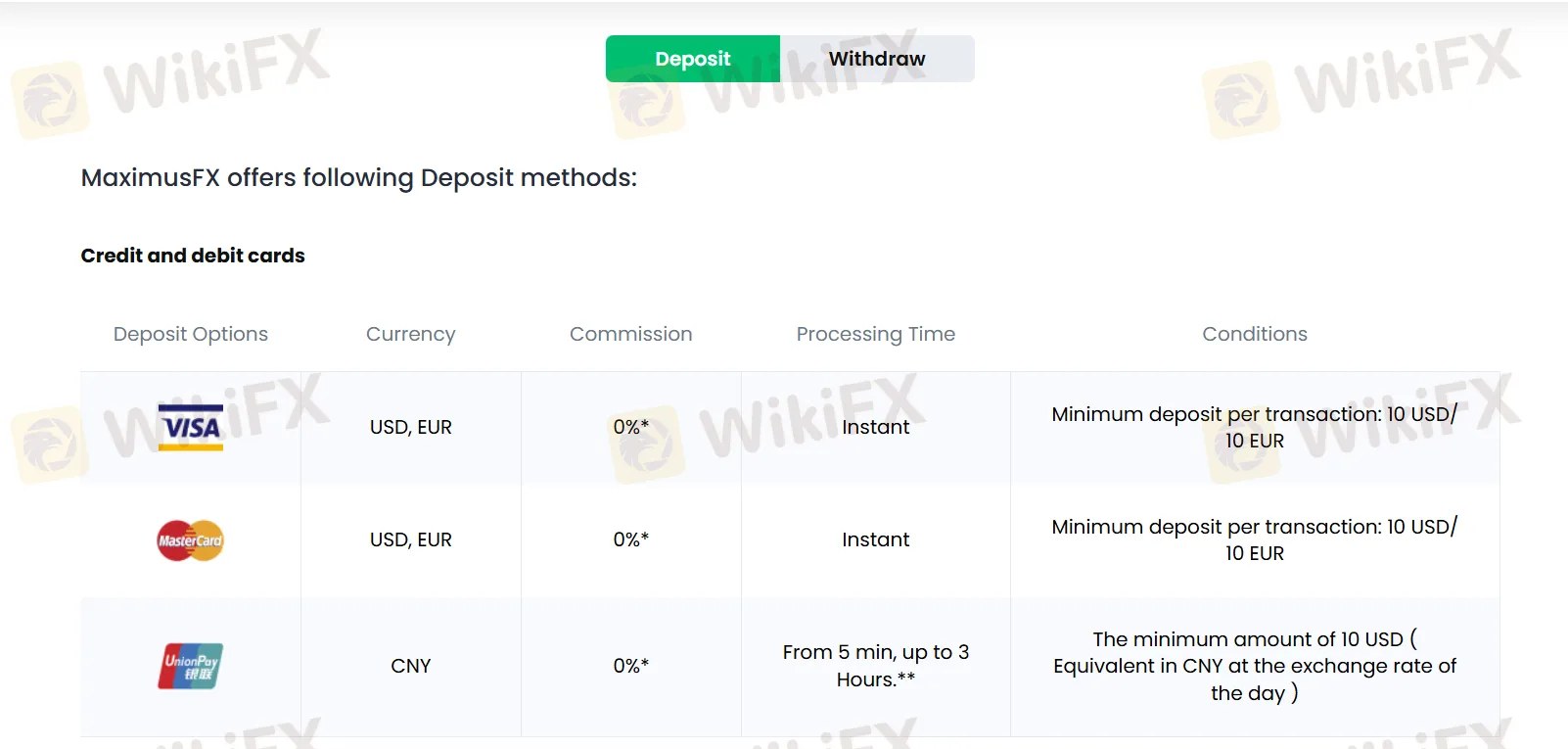

Deposit and Withdrawal

The minimum deposit is $200. MaximusFX accepts Visa, MasterCard, UnionPay, Bank transfer, PerfectMoney, WebMoney, Bitcoin, Ethereum, Tether, and more for deposits and withdrawals.

| Deposit Methods | Commission | Processing Time |

| Visa | 0% | Instant |

| MasterCard | 0% | Instant |

| UnionPay | 0% | From 5 minutes to 3 hours. |

| Bank Transfer | 0% | 1 Up to 5 bank days |

| WebMoney | 0% | From 5 minutes to 3 hours. |

| PerfectMoney | 0% | From 5 minutes to 3 hours. |

| Bitcoin | 0% | Instant |

| Ethereum | 0% | Instant |

| Tether | 0% | Instant |

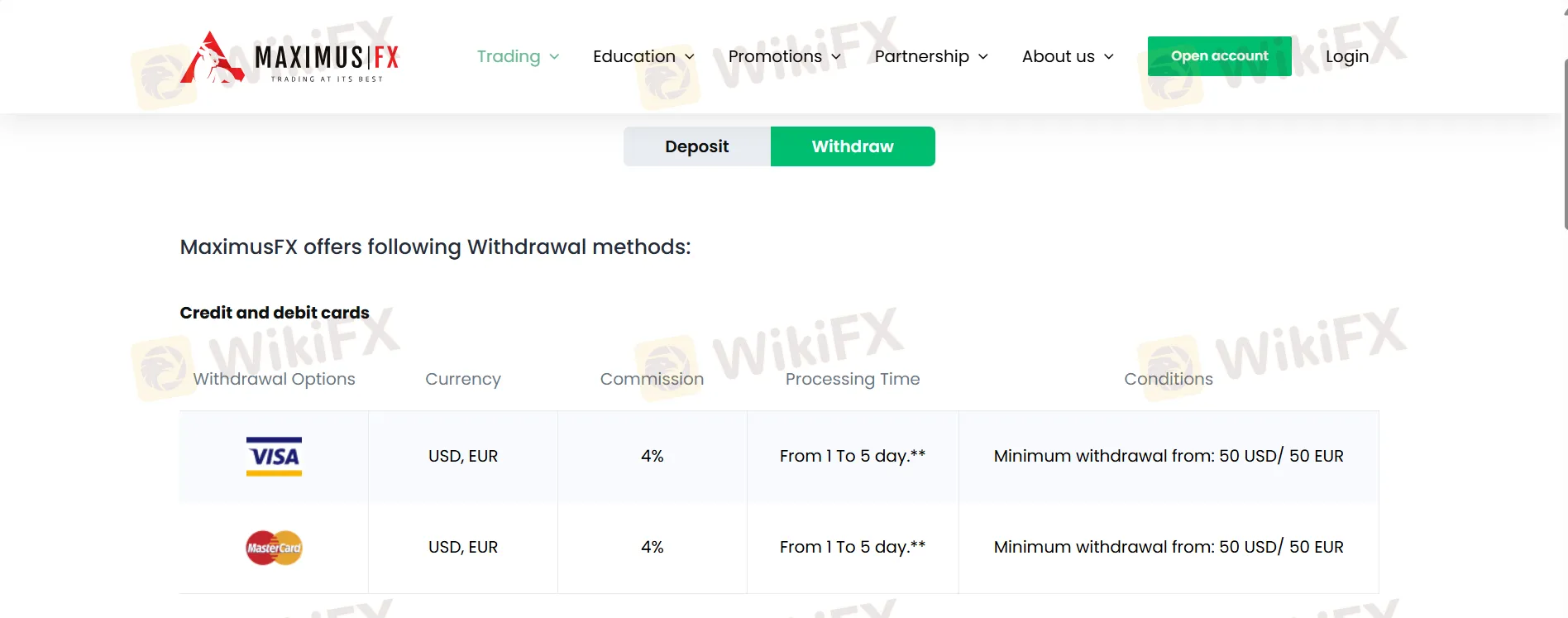

| Withdrawal Methods | Commission | Processing Time |

| Visa | 4% | From 1 to 5 days |

| MasterCard | 4% | From 1 to 5 days |

| Bank Transfer | Bank commission depends on the withdrawal amount | From 1 to 5 days |

| WebMoney | 2% | 1 day |

| PerfectMoney | 2% | 1 day |

| Bitcoin | 0.5% | Up to 1 hour |

| Ethereum | 0.5% | Up to 1 hour |

| Tether | 0.5% | Up to 1 hour |

Read more

InterTrader Exposed: Traders Report Unfair Account Blocks, Profit Removal & Additional Fee for Withd

Does InterTrader block your forex trading account, giving inexplicable reasons? Does the broker flag you with latency trading and cancel all your profits? Do you have to pay additional fees for withdrawals? Did the UK-based forex broker fail to recognize the deposit you made? Does the customer service fail to address your trading queries? In this InterTrader review article, we have shared such complaints. Read them out.

Grand Capital Doesn’t Feel GRAND for Traders with Withdrawal Denials & Long Processing Times

The trading environment does not seem that rosy for traders at Grand Capital, a Seychelles-based forex broker. Traders’ requests for withdrawals are alleged to be in the review process for months, making them frustrated and helpless. Despite meeting the guidelines, traders find it hard to withdraw funds, as suggested by their complaints online. What’s also troubling traders are long processing times concerning Grand Capital withdrawals. In this Grand Capital review segment, we have shared some complaints for you to look at. Read on!

EmiraX Markets Withdrawal Issues Exposed

EmiraX Markets Review reveals unregulated status, fake license claims, and withdrawal issues. Stay safe and avoid this broker.

ADSS Review: Traders Say NO to Trading B’coz of Withdrawal Blocks, Account Freeze & Trade Issues

Does ADSS give you plenty of excuses to deny you access to withdrawals? Is your withdrawal request pending for months or years? Do you witness account freezes from the United Arab Emirates-based forex broker? Do you struggle to open and close your forex positions on the ADSS app? Does the customer support service fail to respond to your trading queries? All these issues have become a rage online. In this ADSS Broker review article, we have highlighted actual trader wordings on these issues. Keep reading!

WikiFX Broker

Latest News

Consob Targets Political Deepfake “Clone Sites” and Unlicensed Platforms in Latest Enforcement Round

WikiEXPO Global Expert Interviews: Gustavo Antonio Montero: ESG in Finance

Mitrade Arabic Platform Targets MENA Gold Trading Boom

Israeli Arrested in Rome Over €50M Forex Scam

Scam Alert: GINKGO-my.com is Draining Millions from Malaysians!

New FCA Consumer Alert 2025: Important Warning for All Consumers

EmiraX Markets Withdrawal Issues Exposed

INGOT Brokers Regulation 2025: ASIC vs Offshore License - What Traders Must Know

Is Upforex Safe or a Scam? A 2025 Safety Review Based on Facts

Polymarket Onboards First US Users Since 2022 Shutdown: Beta Relaunch Signals Major Comeback

Rate Calc